|

|

|

Welcome back to Dry Powder. I’m Bill Cohan.

It’s been a busy couple days, and that’s reflected in a chockablock email. The meat of today’s issue focuses on Donald Trump’s raving, largely nonsensical, hour-plus-long monologue at the Economic Club of New York on Thursday. How a roomful of seemingly intelligent people sat there and applauded his drivel is beyond me.

But first…

|

|

|

- An (alleged) affair to forget: On September 5, James Franey of the New York Post dropped a hand grenade on Wall Street. He wrote a somewhat speculative story—with the requisite allegedlys and strong denials—suggesting that Adam Taetle, a 55-year-old Wall Street M&A banker, had left Evercore, where he was a senior managing director in the consumer banking group, back in June because he allegedly “had an affair with a younger co-worker on his team.” His last day at Evercore, after more than six years at the firm, was June 24. Despite this allegedly ignominious and radioactive exit, just two days later, on June 26, Lazard, my old firm, hired Taetle as a managing director and the global head of consumer, retail, and leisure banking. Something didn’t add up.

I get why Evercore would dismiss Taetle if he had an affair with a junior banker in his group. But, if that were the case, why would Lazard hire him—and 48 hours later, no less—to head up a major banking group? In the summer of 2023, then-incoming Lazard C.E.O. Peter Orszag wasted little time defenestrating Reid Snellenbarger, the firm’s co-head of restructuring and capital solutions, for behaving “in a manner both inappropriate and incompatible with our values” at a party that Snellenbarger himself hosted. Orszag, who’s coming up on his one-year anniversary as C.E.O., during which time Lazard’s stock is up more than 40 percent, had no trouble taking a page out of Candide and metaphorically executing Snellenbarger pour faire un example pour les autres.

How could Orszag zotz Snellenbarger so quickly and yet turn around and hire the allegedly compromised Taetle? I looked at Taetle’s FINRA broker-check report, which the self-regulatory agency requires of everyone who works on Wall Street. The publicly available reports reveal where people have worked, whether they have passed the requisite exams, and if there have been any disciplinary actions against them. Anyway, Taetle’s report was clean—not so much as a scintilla of wrongdoing. Then I got a hold of Taetle’s U-5 form, which Wall Street firms are required to file when someone leaves, and which have to include the reason for his or her departure, and are not public. Disclaimer: U-5s can be manipulated, sadly, to disguise the actual reason for someone’s exit. For example, a “communications” problem with a colleague can actually be something darker, perhaps closer to sexual assault. In other words, even though the U-5 is supposed to depict accurately why someone left a firm, the forms don’t always tell the real story.

But Taetle’s U-5 was also clean. Evercore reported he left the firm voluntarily on June 24—period, tout court. Evercore filed the U-5 on June 26, and it was reviewed by Lazard H.R. on June 27. So then why would the Post report that an alleged affair with a co-worker was behind Taetle’s departure, when nothing showed up on his U-5? Some further digging revealed that Taetle and his wife, Andrea West Taetle, a civil rights attorney and former Skadden Arps associate, began divorce proceedings last October. The divorce was resolved, according to court filings, on June 20, a few days before Taetle made his plummy career move. I won’t get into Taetle’s personal and/or love life, but I was told by sources familiar with the matter that he never had an affair with a colleague at Evercore or with anyone who ever worked at Evercore. And that he would be remaining at Lazard, as planned. Glad we got that sorted!

|

|

A MESSAGE FROM OUR SPONSOR

|

|

| An unprecedented $1.2 trillion in private equity dry powder coupled with macro drivers could create robust M&A and financing opportunities.

Goldman Sachs’ latest white paper dives into how private equity activity could continue to catalyze opportunity in 2024.

Read more

|

|

|

- The Bank of Ellison: It’s hardly a surprise that Larry Ellison, with a fortune estimated at $155 billion, will be the largest shareholder in National Amusements Inc. after the Ellisons and RedBird Capital take it over from the Redstone family, even though the financial press is treating it as some big revelation. Dry Powder readers have known for months now that Larry was backing his son David’s deal for NAI and Paramount Global, to the tune of $6 billion or so, and that RedBird Capital was putting up at least $1 billion—but not what Larry was investing. The 448-page Federal Communications Commission filing has merely allowed us to see in black and white that Ellison/RedBird will own 100 percent of the equity and voting interests of NAI, with Larry’s Pinnacle Media owning 77.5 percent, and Gerry Cardinale’s RedBird Capital owning the balance of 22.5 percent.

Recall that NAI owns 77 percent of the voting stock of Paramount Global, and around 10 percent of the economic interest. So if I figured this right, Larry will own 77.5 percent of 77 percent, or 60 percent of the voting stock of Paramount Global, while Gerry will own around 17 percent of the voting stock, with the rest being held by the other owners of Paramount Global’s voting stock, such as Mario Gabelli and John Rogers Jr., assuming they choose to roll over and not sell into the Ellison/RedBird tender offer. According to the F.C.C. filing, Paramount’s existing public shareholders, those other than the Redstones, will own approximately 28.3 percent of the Class B (non-voting) shares of so-called New Paramount, assuming full participation in the cash election by Class B stockholders in the Ellison/RedBird cash tender offer, which is still to be determined, of course. The Ellisons and RedBird Capital will hold the remaining Class B shares in New Paramount.

The F.C.C. filing also confirms that while Larry Ellison will be the largest voting shareholder of New Paramount, David will be the company’s chairman and C.E.O. Jeff Shell, the former C.E.O. of NBCUniversal, will be the president of New Paramount. (The filing makes no mention of Jeff Zucker or whether he will have a role at CBS now or at sometime in the future.)

Buried in pages and pages of legal documents were some additional items that caught my eye. The first—hat tip to my partner Matt Belloni—is the fact that Ellison/RedBird (probably via Larry) have agreed to make a loan of up to $277 million to NAI, if requested, to be used “solely for working capital and other operational expenses of the [c]ompany and its [s]ubsidiaries,” according to the contract. I have to say, that is a pretty unusual provision. You don’t often see a buyer providing working capital financing to a seller prior to closing. I suspect this speaks to the ongoing financial obligations of NAI, which the Redstones would otherwise have trouble meeting, as they did when they turned to BDT & MSD Partner for what is now a $175 million PIK preferred investment. Could this looming financial obligation at NAI, as Matt wondered, have been the impetus, at least in part, for the sale of NAI and the conveyance of control in Paramount? It’s a good question that maybe Shari will answer one day.

Speaking of Shari, something called the “Shari E. Redstone Termination Agreement” appears six times in the purchase and sale agreement. It’s described as a “certain letter agreement” between Shari and the buyers, but the F.C.C. filing does not include the actual letter agreement. There’s also reference to “Transaction Bonuses” and “Specified Severance Liability” related to the termination agreement. What’s this all about, you may wonder? We get a little help from our friends at the Financial Times, who report that in addition to the $350 million Shari will personally get in exchange for her stake in NAI, she’s also receiving an additional $180 million in severance and pension benefits. Half a billion dollars is not tin, of course, and her children will get their share of the other $1.4 billion in cash that the Ellisons and RedBird are paying for NAI. But it does make you wonder what Sumner Redstone would have thought of this outcome.

- Disney War, revisited: I have to share a few thoughts about the James Stewart and Brooks Barnes tome in the Times about the failed succession process at Disney that led to Bob Iger’s return and Bob Chapek’s defenestration. Does anyone else think it’s just a longer rehash of what CNBC’s Alex Sherman wrote last year? In any event, the piece does no favors for Iger, who comes across as a conniving, backstabbing, narcissistic egomaniac, with horrible judgment to boot. Who hand-picks a successor he’s known for years and then works to undermine him at every turn, almost from the start? That’s the Iger portrayed by Stewart and Barnes. And for that, the Disney board rewards him with a return five-year engagement and over $30 million a year in compensation? I don’t get it.

Clearly, Chapek was the wrong guy for the job. And Iger had to know that. Was Iger so desperate to get out before the Covid disaster that he sloughed Disney off to someone who couldn’t handle the job, thinking that he’d return triumphantly when the dust settled? Seems unlikely, even for a Hollywood plot, and yet that’s exactly what happened. So if you’ve got an extra hour today, go to the Times for the corporate dysfunction, but stay for the delicious and crucial cameo by my friend Ben Smith—some of which was also conveyed, yes, in the CNBC piece.

|

|

| The Ineptitude of Trumponomics |

| Yes, Trump’s insane, rambling, nonsensical dissembling at the Economic Club of New York was the latest evidence of his declining acuity. But it was also yet another example of his terrible understanding of simple business concepts. |

|

|

|

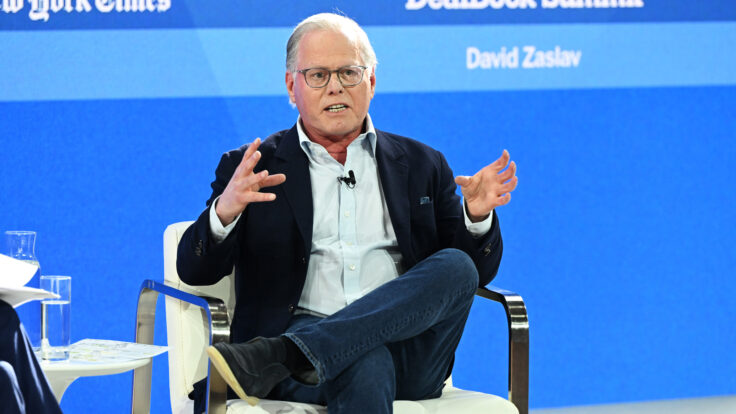

| I wasn’t allowed in the room for Donald Trump’s hour-plus monologue at the Economic Club of New York on Thursday (“space limitations,” I was told), but I watched the highly scripted proceedings on Zoom, much to my regret. There will be no “sanewashing” here. It was appalling, to say the least, as Trump delivered assertion after assertion that could only be described as abject lies—all adding up to a “word salad,” as my friend Stephanie Ruhle tweeted—to a fawning crowd. “Despite the audience knowing it was a plate full of empty calories that may cause food poisoning,” Stephanie noted, “they ate it up.”

Much of the reporting on Trump’s talk focused on a question posed by Reshma Saujani, the founder of Girls Who Code, about what specific legislation Trump would propose to make childcare more affordable. Absurdly, Trump said that he “was sitting down” with his daughter Ivanka and Sen. Marco Rubio—hold your laughter—to work on the issue, and then launched into a deranged, incoherent diatribe about how increased tariffs on foreign imports will free up funds to solve the country’s childcare problems, ending with this bon mot: “We’re going to make this into an incredible country that can afford to take care of its people, and then we’ll worry about the rest of the world.” Of course, it should go without saying, increased tariffs are a form of taxation that would be paid by U.S. consumers—especially lower-income consumers, as a percentage of their income—rather than by exporters.

He also attacked Kamala Harris for “an economy in crisis” and rattled off a list of his version of truths about the economy, including that 1.3 million workers have become unemployed in the last year. (The real number, according to the Bureau of Labor Statistics, is closer to 800,000.) What Trump didn’t mention, of course, is that the Biden administration created something like 16 million new jobs after the Trump administration lost 2.7 million jobs, according to FactCheck.org. Instead he claimed, incorrectly, that his administration created 7 million new jobs, “260 percent more than projected when I took office.” He plowed right on, claiming that the “invasion at our border” has taken jobs away from Black and Hispanic Americans “and nobody talks about it.” (In fact, the unemployment rate for both groups is near historic, multi-decade lows.)

He then launched into the now-familiar lies about Harris—that she’s a Marxist, is promising “price controls, wealth confiscation, energy annihilation, reparations, the largest tax increase ever imposed, and mass amnesty and citizenship for tens of millions of migrants who will consume trillions of dollars in federal benefits and destroy Social Security and Medicare.” He apocryphally noted that he had saved the auto industry “from obliteration” during his administration by imposing a 27.5 percent tariff on the import of Chinese cars into the country. I have absolutely no clue what he’s talking about—Trump never placed tariffs specifically on cars—but the funniest lines of the night were that he “fought for American workers like I would fight for my own family. I took care of our economy like I would take care of my own company.” (We all know what he did to his own company.) Alas, these were just the assertions he made in the first 15 minutes.

|

|

|

|

|

| Standing before a crowd of people who ostensibly know better, Trump went on to say he intended to cut the corporate tax rate even further than he already did—to 15 percent, from 21 percent—and that America would be the leader in A.I. as well as “every other form of technology.” He also said that we would be the “world capital” in Bitcoin and crypto, whatever the hell that means, and that Elon Musk will lead a commission to excise trillions of dollars in waste in the federal budget. In addition to all of these tax cuts, including eliminating the tax on tips and Social Security payments, and extending the so-called Trump tax cuts, he’s also apparently going to reduce the federal deficits and the federal debt—an impossibility, really. Trump, however, seems to subscribe to the notion that every tax cut pays for itself. “Every business on Earth will flock to America, from Europe, Asia, the Middle East, and all over the world,” he said. “By contrast, Comrade Kamala Harris wants to sacrifice our wealth, kill the economy, and drive jobs overseas to punish businesses.” This is all nonsense, obviously.

Trump then spoke about creating a sovereign wealth fund, like many oil-rich nations have, to make investments directed by a central authority. We are also an oil-rich nation—as my friend Dan Yergin and I discussed a few weeks ago—but we are decidedly not a centrally governed nation, and individual investors are free to invest however they like. Comrade Trump, apparently, wants to change that, and to use this new fund—without specifying the source of the money for that fund—to pay down our national debt, which is nearing $36 trillion these days.

Under his watch, of course, he increased the national debt from $24 trillion to $31 trillion, a fact that he conveniently overlooked. He also had no good answer for how he was going to cut taxes while somehow eliminating the annual budget deficit and paying down the national debt. “We’re going to work on the national debt very strongly,” he said. “By the way, we’re going to have so much money coming in. We’re going to work on national debt. We’re close to $36 trillion right now. We’re going to work on getting it down. And it is many of the people in this room who will be helping to advise and recommend investments for this fund.” Oh, well if he’s going to work on it…

Why do so many seemingly intelligent people—the people in that very room—support another four years of this nonsense? My good friend Bob Steel, with the world’s greatest résumé—a successful longtime investment banker, the former C.E.O. of Wachovia before and during its sale to Wells Fargo, ex-Treasury official, ex-NYC deputy mayor under Mike Bloomberg, and a current partner at Perella Weinberg (after serving as its C.E.O.)—is the new chairman of the board of the Economic Club of New York. In fact, I believe hosting Trump was his first official act as the board chairman. I could see the pained expression on Bob’s face as Trump prattled on, vomiting up lie after lie.

I wondered what Bob was feeling up there on the dais, introducing Trump and then overseeing the four interlocutors, Rog Cohen, of Sullivan & Cromwell fame; the hedge fund billionaire (and potential Trump Treasury secretary) John Paulson; Sander Gerber, the C.E.O. of Hudson Bay Capital; and Reshma Saujani. I wrote Bob an email and asked him what it was like to watch Trump in action. Bless his heart, Bob was smart enough not to respond.

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|