|

|

Welcome back to Dry Powder. I’m Bill Cohan.

Tonight, my deep dive into the second installment of FTX examiner Robert Cleary’s incisive (if meandering) analysis of the internal dysfunction at Sam Bankman-Fried’s crypto empire, which reinforces the widely accepted notion that it was a freewheeling operation, run by a group of kids who had no idea what they were doing most of the time. But the report also offered a new level of salacious detail about the bedlam that enveloped the company during the three days leading up to the November 11 bankruptcy. My analysis of Cleary’s latest tome, below the fold.

But first…

- A Sydney Holland update: Trouble always seems to find Sydney Holland, one of the two women who were known around Beverly Hills, a decade ago, as the much younger “girlfriends” of Sumner Redstone, then the octogenarian media mogul behind CBS and Viacom, and what is now known as Paramount Global. As I detailed in a May 2015 Vanity Fair article, Holland was introduced to Sumner in 2010 by Patti Stanger, of Millionaire Matchmaker fame, after Sumner divorced his second wife.

A year after Sydney and Sumner met, she asked to move in with him. Her money problems suddenly disappeared. She started a few ventures that later failed, including Rich Hippo Productions, an independent film company, and UnSpoken, a lingerie company. She shifted to L.A. real-estate, buying, renovating, and selling high-end homes. Mainly, though, she managed access to Redstone, alongside Manuela Herzer, his other girlfriend—seeing how much they could get out of him and changing his will to make sure they were included in it. They each took $45 million from him on a single day in 2014; in total, Sydney walked away with some $75 million of Sumner’s money. But it all ended after one of my subsequent stories about Sydney noted that she was having an affair with George Pilgrim, a former actor who lived in Sedona, Arizona. Sumner kicked Sydney out of his Beverly Park mansion, and then, of course, Sumner’s daughter, Shari, returned to the picture, making sure the two women were gone for good and installing herself as her father’s rightful heir.

I lost track of Sydney Holland until a few days ago. It turns out that for the last year or so, she has been dating Marc Alan Chase, a luxury car dealer in La Jolla who in 2014 pleaded guilty to eight misdemeanor counts of campaign finance crimes, including conspiring with four foreign nationals to make illegal campaign contributions to candidates for elected office in Southern California. (Chase funneled some $180,000 from the foreign nationals to the political candidates.) He faced eight years in prison and $800,000 in fines. Because of his cooperation, though, Chase received three years of probation instead of a prison sentence.

As the Paramount deal saga was coming to its conclusion, this summer, Holland resurfaced via an interview in Modern Luxury San Diego magazine, which described her as an entrepreneur and a “jill of all trades.” She was photographed near the Eiffel Tower wearing a frilly white skirt with a big furry white dog by her side. The article noted she was co-founder of The Urban and The Mystic, “a wellness-focused gifting company.” She described her “aesthetic” as “effortlessly chic and feminine with a French girl twist.” She was photographed with a mini Hermès Kelly bag, of course, while her “current obsession” is “[a]ll the new Celine by Hedi Slimane handbags and ready-to-wear apparel by Chloe.” Her last supper, she said, would be an In-N-Out Burger. She made no mention of her previous life with Sumner Redstone.

|

| Now, on to the main show… |

|

| The Final Days of S.B.F. & FTX |

| A new report from FTX’s court-appointed examiner reveals, in new and sordid details, the gruesome internal dynamics inside the House of S.B.F. |

|

|

|

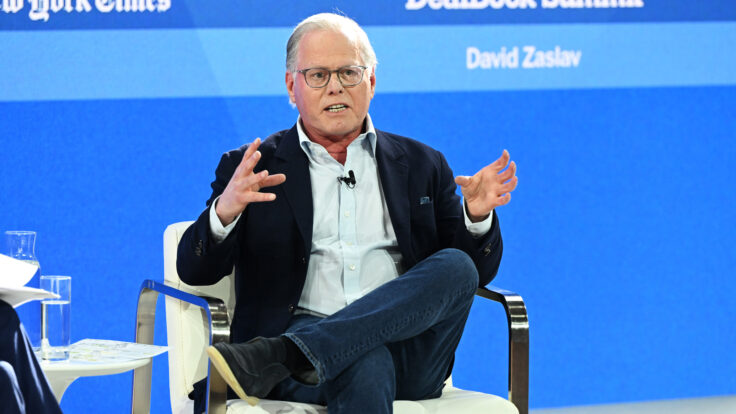

| Sam Bankman-Fried, the convicted crypto mogul who is serving the first year of his 25-year prison sentence at the Metropolitan Detention Center in Brooklyn—and who now shares accommodations with P. Diddy—has long argued that his former lawyers at Sullivan & Cromwell screwed him over. Namely, according to the S.B.F. worldview, S&C, now the counsel for the FTX debtors, urged him to file for bankruptcy and then worked too closely with both the debtors and federal prosecutors in the ongoing case against him, enriching themselves with exorbitant fees in the process. Was it duplicitous? Ass-covering? Or perfectly legal and righteous, as Judge Lewis Kaplan has suggested? S&C denies all of Sam’s allegations against the firm, of course, a position also affirmed by FTX’s court-appointed examiner, Robert Cleary. Regardless, the Sullivan & Cromwell argument is perhaps S.B.F.’s meatiest bone to pick in his ongoing effort to overturn his conviction and/or to get a new trial.

Sam has argued that his FTX empire was not insolvent at the time of the bankruptcy filing, per se, but was rather facing a liquidity crisis that he was trying to address by attempting to raise an additional $4 billion in fresh capital. A distinction without a difference, perhaps, in the case of a bank run. But according to S.B.F., he was unable to raise more money not because the market had frozen him out, but due to other pressures. He has asserted repeatedly that the rug was pulled out from under him in the early morning hours of November 10, 2022, when John J. Ray III, the bankruptcy specialist who famously salvaged Enron, urged him—in concert with S&C and Sam’s own attorneys at Paul Weiss—in the strongest possible terms to sign documentation that would make Ray the new C.E.O. of FTX. “They also called many of my friends, coworkers, and family members, pressuring them to pressure me to file, some of whom were emotionally damaged by the pressure,” Sam explained in a draft of testimony he planned to give to Congress on December 12, 2022. (He was arrested instead.) “Some of them came to me, crying.”

At around 4:30 a.m., “against my better judgment,” Sam signed the paperwork to turn FTX over to Ray, who filed FTX and many of its subsidiaries, including FTX.US, for bankruptcy the very next day. Sam maintained that this was unnecessary, and that it exacerbated his financial and legal problems. He also asserted that FTX.US, the U.S. crypto exchange where Americans could trade, should not have been included in the bankruptcy filing because it, too, was solvent. Ray, the bankruptcy specialist who famously salvaged Enron, disagreed.

Whether FTX.us was solvent or not has been a point of contention since the start of the bankruptcy process nearly two years ago. On September 20, Cleary published the second (and I believe final) volume of his report on what happened at FTX. The document, which runs to 126 pages—many of them quite unnecessary—addressed several open questions in this saga. First, Cleary tackled the issue of whether a “fraudulent conveyance” had occurred in 2021 when Sam acquired derivatives exchange LedgerX for FTX.us at a cost of about $300 million. (In some 50 pages of word salad, the answer was a resounding no.) Second, Cleary assessed whether Sullivan & Cromwell had a conflict in its representation of Sam and his hedge fund, Alameda, in its acquisition of shares in online trading platform Robinhood, which S&C represented in an unrelated matter. Cleary found that S&C did not have a conflict in that assignment, although I’ll note the irony that the documentation Cleary examined came from S&C.

Then, of course, there was the crucial question of whether FTX.US was rightly included in the overall FTX bankruptcy, and whether FTX.US had engaged in the same financial shenanigans that occurred at FTX.com, the international branch where $8 billion of customer funds were illegally funneled into Alameda for Sam’s personal use. In short, Cleary found no evidence that customer assets at FTX.US were “misappropriated” in the “same manner” as FTX.com’s customer assets.

But he did find an operation utterly out of control and ripe for financial disaster when the November 2022 liquidity crisis hit the company. “FTX.US, like other components of the FTX Group, maintained an egregiously poor internal control environment, including with regard to the maintenance, management, and reconciliation of customer assets,” Cleary wrote, adding that because of these “fundamentally deficient practices,” he was unable to determine “the specific causes that gave rise to the discrepancy in customer assets in November 2022 [at FTX.US], or whether shortfalls existed prior to November 2022.” But, he continued, because of the utter disorganization of the enterprise, “customer assets were at grave risk of loss and misuse and the business was wholly unprepared to confirm that customer assets were sufficient to satisfy customer liabilities in a time of crisis.”

|

|

|

| According to Cleary’s second report, Sullivan & Cromwell disagreed with Sam about FTX.US and concluded that it was, in fact, insolvent as of the bankruptcy filing date. Cleary also conveyed, in a level of detail not previously appreciated, a picture of the chaos at FTX.US in the three days leading up to the November 11 bankruptcy.

On November 8, 2022, Ryne Miller, the general counsel of FTX.US, who is about to start serving his own seven and a half year prison sentence, began to receive inquiries from U.S. regulators about the status of FTX.US. He contacted Zach Dexter, the C.E.O. of LedgerX, to tell him about a “shortfall” and to enlist his help with U.S. regulators at the Commodity Futures Trading Commission. In the early hours of November 9, Miller and Dexter told Nishad Singh, the director of engineering at FTX, that they “need[ed] to see right now … the explanation of where U.S. customer crypto is.” Singh responded, “you got it, adding in [G]ary [Wang], he’s been digging into it.” Sam offered to “start pasting what we have here,” but cautioned that more work needed to be done to “go through and confirm all the bank accounts etc.” Then, Sam shared a “prospective list of bank accounts, with fairly recent (i.e. last hour) snapped values,” adding the caveat that “it’s possible there are bank accounts not included there.” About an hour later, Sam wrote that he “think[s] we have everything.”

The next day, after some more back and forth, Dexter circulated an analysis that showed FTX.US had a shortfall, or “hole,” of $45.7 million. Dexter shared the information with Sam and other FTX senior executives. Sam explained to Dexter that the discrepancy might have to do with “laziness” and could have resulted from the failure to account for “still missing bank accounts.” According to the examiner, Dexter asked Sam to account for the missing money before he spoke with the C.F.T.C. regulators. “Throughout the day, a group of senior FTX Group executives continued to discuss efforts to resolve the company’s crisis via securing a capital injection or by selling FTX Group assets,” Cleary wrote. “Dexter continued to raise concerns regarding the discrepancy at FTX.US, writing at one point that he saw ‘a $45M deficit in customer assets based on Gary’s spreadsheet, which could be, but has not been, plugged with operating cash.’” He urged Sam and the other FTX executives to “determine where that $45M is, and if it doesn’t exist, clearly effectuate a transfer of the same amount of operating cash to the [customer] accounts and record that in the accounting system.”

Sam then told the group that he had “transferred” $46 million from an Alameda account to FTX.US, although, according to Cleary, that “did not resolve the problem,” because no additional cryptocurrency or U.S. dollars were transferred into the customer accounts. Instead, the transfer extinguished a liability that FTX.US owed to Alameda, rather than filling the “hole” in the customer accounts. Although Sam “claimed to have resolved the hole in FTX.US’s balance sheet by reducing FTX.US’s liability to Alameda, other FTX.US executives were not comfortable with Bankman-Fried’s actions,” Cleary wrote. “Given that the FTX Group was, at this point, under significant regulatory scrutiny, some FTX.US executives had concerns about how regulators would respond to this database transaction.” On the afternoon of November 9, Miller informed the regulators at the C.F.T.C. that executives at FTX.US had discovered that “customer assets actually held are not immediately reconcilable with the customer assets reported,” according to Cleary’s report.

In the subsequent hours, Wang produced another analysis that showed a surplus of customer assets over liabilities at FTX.US. But that turned out to be more fiction. According to an analysis prepared by AlixPartners and Alvarez & Marsal—forensic financial advisors hired by the debtor—and completed in May, the final tally of the shortfall at the FTX.US as of the petition date was $141 million.

In summary, Clearly was appalled by the lack of controls throughout FTX. “Witnesses across the FTX.US organization expressed uncertainty as to whether the business would be viable absent the support (financial and otherwise) from other FTX Group entities,” Cleary wrote. “As with the other FTX Group entities, FTX.US relied heavily on capital infusions from its founders, Bankman-Fried, Wang, and Singh,” including at least one intercompany transfer of $195 million between Alameda and FTX.US. “As established by evidence presented at the trial of Bankman-Fried, Alameda had been misappropriating FTX.com customer assets through special privileges afforded to it on the FTX.com platform and its access to customer funds in Alameda bank accounts. To be clear, the Examiner’s investigation has not revealed evidence that Alameda took advantage of similar special privileges on FTX.US. However, given FTX.US’s reliance on funds from the founders and Alameda, it is likely that FTX.US was at least indirectly propped up through FTX Group’s misappropriation of FTX.com customer assets.”

|

|

|

| The more I read about the chaos at FTX, the more I got the sense that it was a freewheeling operation run by a group of kids who pretty much had no idea what they were doing most of the time. Certainly, in Sam’s view, and in the view of the lawyers working on his appeal, stupidity and poor judgment in the running of a business that had millions of customers should not be a crime. At the moment, though, Sam is still facing his 25 years, having been convicted earlier this year of felonies. After pleading guilty, Miller is about to begin his own years-long sentence, and even Caroline Ellison, Alameda’s former C.E.O. and Sam’s erstwhile girlfriend—despite being described by the prosecution as the most cooperative cooperating witness ever—will spend the next two years in prison after her own guilty plea. Other FTX executives, including Wang and Singh, who also pleaded guilty and testified against Sam, are awaiting their sentences.

Sam, of course, remains defiant. His appeal has been filed and he’s lining up support for his legal arguments. I have to say, Trump aside, it’s not often you see the same set of facts being interpreted in two diametrically opposed ways. In the meantime, rumors are swirling in cryptoland that the FTX debtors will soon begin distributing $16 billion in accumulated cash and assets to customers and creditors, in many cases returning to them their money in full, plus accrued interest. The confirmation hearing for the FTX plan of reorganization is scheduled for October 7.

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

|

|

| Netflix Comp Wars |

| Digging into the standoff between Netflix and talent agents. |

| MATTHEW BELLONI |

|

|

| Delphine Streets |

| Illuminating the pressure on the new C.E.O. at Dior. |

| LAUREN SHERMAN |

|

|

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|