|

|

|

Hi, welcome back to Line Sheet, back in L.A. after two and a half weeks in

Europe. Usually, this is the issue where I zonk out because we’re all so tired. Sorry, not this season. For today’s main event, I dig into the situation at Off-White: why LVMH is selling Virgil Abloh’s label and what happens next. I’m also sharing more designer switcheroo speculation—it never ends, truly—and a fashion industry plea about the timing of the Oscars. And yes, of course, I’ve sprinkled in some luxury conglomerate news and notes for good measure.

🚨🚨 Programming note: Tomorrow on Fashion People, Interview editor-in-chief Mel Ottenberg joins me to talk Fashion Month’s best shows and biggest stories. Mel also has a new jeans collab with Re/done (I’m buying them) and we get into that as well. For a good time, live from the Hotel Regina, subscribe here and here.

Mentioned in this issue: Off-White, Virgil Abloh, Bluestar Alliance, LVMH, Missoni, beach towels, Simone Bellotti, Bally, Nicolas Girotto, Cheryl Hines, Formula One, the Oscars, Michael Rubin, Bottega Veneta, perfume, Zendaya, and many more…

|

|

A MESSAGE FROM OUR SPONSOR

|

|

| Considered fashion with a luxury sensibility — made versatile, accessible, and modern.

Modern Citizen’s new flagship store is now open in New York at 251 Centre St. between Broome and Grand. Enjoy 15% off online or in-store with code LINESHEET.

|

|

|

| Six Things You Should Know |

|

- On the subject of Bally: The other day, WWD scooped that the Swiss brand’s C.E.O., Nicolas Girotto, is out. I heard as much in Milan. But I was also told that Regent, the new owner, plans to close all Bally stores in the U.S. (I’m counting 14 on the site, mostly outlets.) Regent has hired RCS Real Estate Advisors to help them get out of the leases, many of which are in prime locations like New York and Costa Mesa. (There was no comment from Bally.) The news of the closures seems unfortunate, given the momentum of the brand—particularly the popularity of those gently sculpted leather jackets and jingly boat shoes—and the desirability of those leases. But Regent, which owns everything from Intermix to Drybar, doesn’t operate anything else in the world of luxury, and you have to wonder whether they understand what they have with creative director Simone Bellotti and his gaggle of fashion-industry admirers in navy v-neck sweaters. That said, new C.E.O. Michael A. Reinstein did go to the show, and trot out Cheryl Hines, so maybe there’s good intention there.

- A Missoni makeunder: Not that I’m keeping track or anything, but I told you that Missoni creative director Filippo Grazioli was out, and that September would be his last show, in July. The company denied it at the time. (Not good to deny things that are true!) Anyway, Grazioli’s departure was officially announced today. He’s being replaced by a longtime Missoni designer, Alberto Caliri. My understanding is that C.E.O. Livio Proli, is in cost-cutting mode, prepping the business for a possible sale. (Its banker is Rothschild, who is also working with Dolce & Gabbana, according to my own reporting.)

As I’ve said many times: Missoni is, to me, the easiest brand to scale. Sure, it’s rooted in textiles, not leather goods, but they’ve got worldwide name recognition, a distinct visual language, and the ability to sell high-margin products like towels and blankets to swarms of people. Also, it’s a very fun brand. Here’s hoping a savvy buyer scoops it up.

- On LVMH’s 10-year Formula One sponsorship: I heard the deal was around $100 million per year, knocking out Rolex as the top sponsor. Here’s why it was a good idea: Much like at the Olympics, LVMH will be omnipresent in Formula One. For instance, Tag Heuer can be the official timekeeper, they can serve Moët in pretty flutes, Tiffany can design the trophies, Cheval Blanc can be the official hospitality partner. “It’s like a brand overload Pinterest board of a single group sponsorship,” a person who mixes between the two worlds told me. “It’s endless.”

- It’s raining deals: Speaking of LVMH, I wouldn’t be surprised if there are even more announcements from the group in the coming weeks, or even days. Succession planning appears to be in full swing, and the always cost-cutting company is pruning its portfolio while also taking advantage of opportunity in a soft market. Remember, there was speculation this past summer that some of the group’s brands were on the block, including Kenzo. An acquisition could also be on the short-term horizon. Then there are all the executive moves to come…

- Can the Oscars consult fashion next time?: This year’s Academy Awards take place on March 2 (technically March 3 in Europe), which means the ceremony falls right at the end of Milan Fashion Week, and just as Paris begins. I mentioned the crowded schedule last week, and now I’m hearing that people are frustrated by this development. If you’re one of the big red-carpet brands that show in Milan (Gucci, Prada, Versace) or at the top of Paris Fashion Week (Dior, Saint Laurent), it’s going to make it difficult to simultaneously manage the runway and red carpet. (And it’ll still be annoying for Miu Miu, Louis Vuitton, and Chanel, which show at the end.) Yes, larger companies typically have separate teams devoted to maintaining celebrity relationships and red-carpet dressing, but it’s a lot to coordinate—you can’t be in two places at once, and they’ll need to manage all the looks for all the Los Angeles events, including the typical Saint Laurent and Chanel dinners, plus still attract celebrities to the show.

A humble plea: Can whoever liaises between fashion and Hollywood—the Dan Constable types—talk to someone at the Academy about making sure this doesn’t happen again? The entertainment industry really needs the fashion industry these days—not only to pay their stars for endorsement deals, but even to occasionally fund their movies as well. (See: Saint Laurent Productions.) Let’s not make it harder than it has to be.

- The reason that you are probably getting more Paris Match videos in your Instagram feed these days: Okay, one more LVMH note. This week, the group also announced it had completed the acquisition of Paris Match, which, on its Wikipedia page, likens itself to a French version of Life magazine. (I think of it as more akin to Hello!) This means yet another media property is controlled by LVMH, which has already dug its talons into Le Parisien and Les Echos and owns a small, fairly insignificant stake in my old haunt, The Business of Fashion. What’s perhaps more interesting is that the company decided to announce the acquisition in between the Off-White offloading and the Celine change-up.

|

| And, now, the Off-White news… |

|

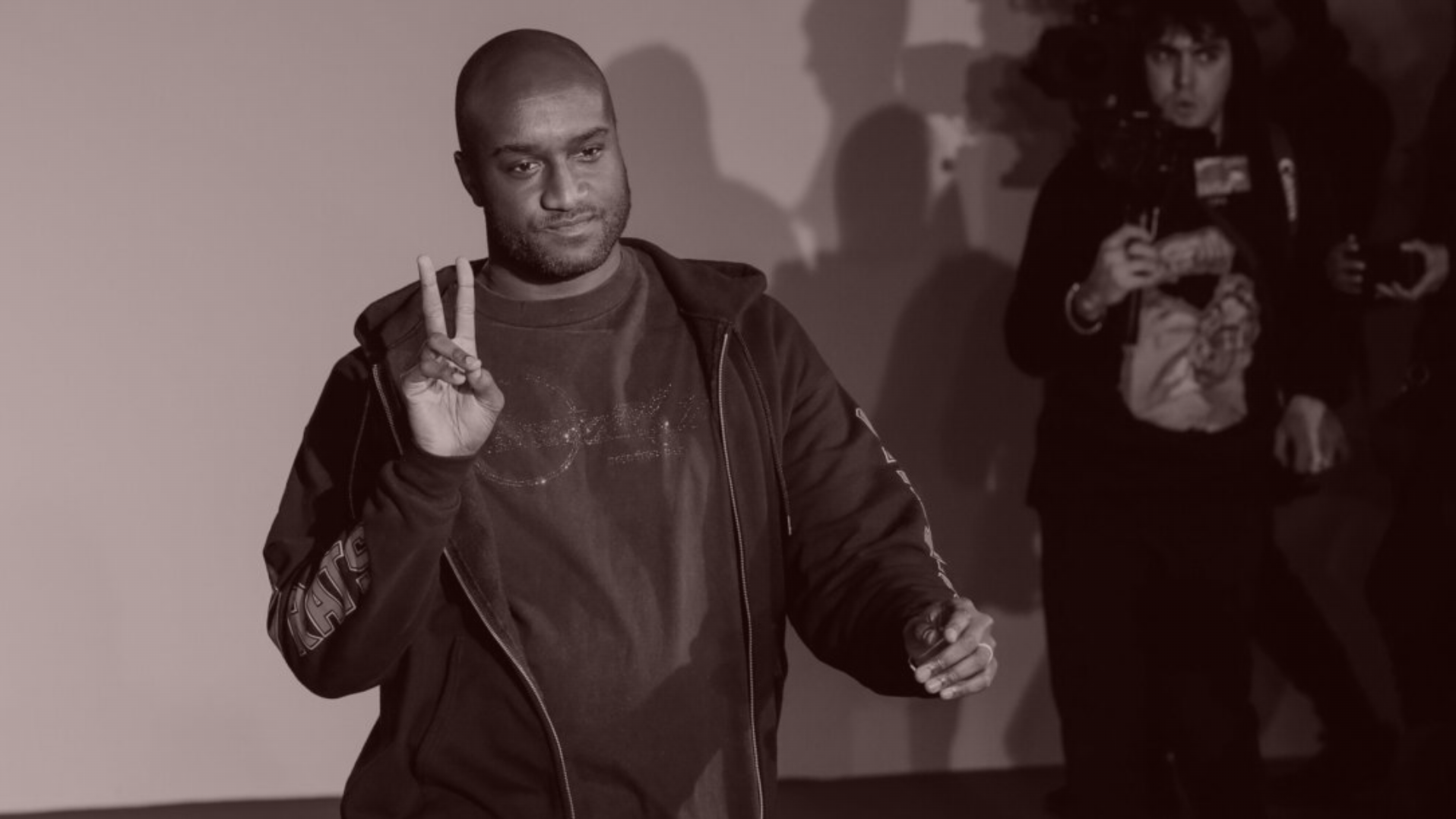

| Reciting Virgil |

| LVMH’s unsentimental decision to sell Virgil Abloh’s Off-White to a brand management chop shop, only years after his death, is the latest evidence of the economic pressures on an industry in transition. |

|

|

|

| Soon after I sent the Monday edition of Line Sheet, an American fashion industry executive who tends to play Switzerland in most scenarios replied with an unusually blunt note regarding the news that LVMH was selling Off-White to Bluestar Alliance, a brand-management firm, just three years after taking a majority stake in the late Virgil Abloh’s company. “Bluestar is a bottom fisher,” this person said. “They buy up bankrupt brands, or license dying brands, then they re-license them to every product maker they can think of.”

LVMH’s initial stake was viewed as an investment in Abloh, who was installed at Louis Vuitton in 2018, as much as a bet on his business. But Abloh died in 2019, of a rare form of cancer. Now, merely three years after his passing, here was LVMH offloading it to the sort of licensing firm known for sucking struggling brands dry. “Off-White will end up a mass-market, cheap product in a million categories,” the executive predicted.

|

|

A MESSAGE FROM OUR SPONSOR

|

|

| Considered fashion with a luxury sensibility — made versatile, accessible, and modern.

Modern Citizen’s new flagship store is now open in New York at 251 Centre St. between Broome and Grand. Enjoy 15% off online or in-store with code LINESHEET.

|

|

|

| There’s little evidence to suggest my reply guy was overstating things. Bluestar’s has-been brand portfolio—including Bebe and Limited Too, but also Catherine Malandrino—is organized, for the most part, just as he described it. For decades, licensing firms have profited from the misfortunes of mismanaged fashion businesses, taking fading household names and squeezing them for all their remnant value. (Even many of the now-mega luxury brands, including Dior and Gucci, were victims of over-licensing in the ’70s and ’80s. Those two were saved by Bernard Arnault and François Pinault, respectively.)

There has been a proliferation of these licensing firms in recent years as increased competition and consolidation, and the decay of the wholesale model, have made it more difficult to profitably operate a traditional apparel business. Unlike the unabashed bottom-fisher firms of the past, the new entrants—including Outdoor Voices owner Consortium Brand Partners, Anti-Social Social Club backer Marquee, and Authentic Brands Group, which owns Barneys New York, Sports Illustrated, and Reebok—claim to be working in favor of the brand, not to its detriment. (Authentic Brands, the most famous among them, raised $500 million at a $20 billion valuation in 2023.) What else are they going to say, though?

I’m told that Marquee also put in a bid for Off-White, but that LVMH went with Bluestar because they moved faster. There was the matter of price, too. Off-White is still a pretty decent-sized business—around $200 million, with $10 million in EBITDA—so it’s likely Bluestar paid something like $100 million for the trademark. A good amount for a firm like that, a nominal paycheck for LVMH. Marquee might have been a better steward of the brand, but apparently its bid was under $100 million. Regardless, it wasn’t supposed to end like this.

|

|

|

| Selling Off-White to a subprime brand chop shop will almost certainly damage the legacy of Abloh, whose foundation is managed by his wife, Shannon. Abloh, after all, was a pioneer in more ways than one. Off-White’s extensive archives, which date back to its founding in 2012, depict a new, meticulous design system that inspired a whole new generation of creative directors. As a trained architect, Abloh was a true product designer, rather than a fashion designer, creating concepts rather than clothes.

The structure of his business was novel, too. New Guards Group, a truly newfangled licensing firm—they called themselves a “brand accelerator”—managed Abloh’s operations and profited handsomely from the relationship. At one point, Off-White was generating more than $225 million a year, helping to make New Guards Group (NGG) an attractive acquisition target for Farfetch in 2019. It also made NGG far too reliant on Off-White’s hockey-stick growth. Abloh’s belief that his shares in Farfetch would be worth very little, given the way that business was being managed, may be one of the reasons he sold part of his stake to LVMH. He was also enticed by the notion that he would take on a broader creative role across the LVMH portfolio, according to multiple people familiar with the business.

|

|

|

| LVMH, for its part, also seems to have viewed its investment in Off-White as an acqui-hire. (It was less about the product itself and more about his way of working that interested them.) So it’s perhaps no surprise LVMH was happy to offload Off-White now that Louis Vuitton has Pharrell and everyone has moved on. (Robin Givhan’s forthcoming book on Abloh’s tenure at Louis Vuitton promises to shed more light on the nuances of the relationship.) Also remember that Michael Burke, Abloh’s C.E.O. and his greatest champion within the business, has also stepped away from running the Fashion Group.

Despite its diminutive contribution to LVMH’s topline, the shedding of Off-White marks an end of an era at LVMH, and also foreshadows more changes. Not only is Bernard Arnault prepping the business for a time when his children are running the show, he is also taking advantage of being the best-positioned player in a challenged market—and doing it with surgical precision. “If there was a moment when divestments and restructuring aren’t signs of weaknesses, but of strength, it’s now,” is how one luxury executive put it to me.

As for Off-White, it’s likely to remain in a state of limbo for now. This past season, creative director Ib Kamara, an Abloh collaborator and stylist, received his first rave reviews—and perhaps he’ll get another season or two, although I’m doubtful. It’s possible that Bluestar will maintain the status quo until 2026, when the deal with New Guards Group is up, but given the fragility of that business, it’s more likely that the licensing firm will get right down to work.

|

| What I’m Reading… And Listening To… |

|

| Another thing I told you about a long time ago that happened: Steven Alan’s new store is open. Yay, Steven! [NY Times]

A Line Sheet reader-slash-influencer wrote in to let me know that, at pretty much every Fashion Week show, influencers are now required to wear the brand, regardless of whether they’re getting paid. Even if they’re sitting in the fourth row! [Inbox]

I lol’d when Naomi Fry described Michael Rubin’s eyes as “wet-looking” in this podcast from a few months back. [How Long Gone]

Bottega Veneta launched fragrances and they look fabulous. They also hosted an achingly chic dinner at a 15th century palazzo in Venice last night. Notably, it was co-hosted by Kering’s beauty C.E.O., Raffaella Cornaggia, one of the first big pushes the group has done into owned beauty. [WSJ and Vogue Biz]

The appeal of Josh O’Connor (in Loewe) is undeniable. [Just Jared]

Did you buy anything from the Stefano Pilati-Zara collab? I loved his ode to his pervy-strawberries collection at YSL. I also loved that he and Gisele are the models lmao. Also, have you ever bought anything on Zara? I didn’t know what size blazer to get, and was asked a series of very detailed questions that spit out a choice for me. It’s worth going through the process if you are interested in shopping behavior and technology-driven mechanisms that convince people to buy. [Zara]

Loved Zendaya’s look at the LV show. [Go Fug Yourself]

Bill on Ron Perelman, the guy who once owned Revlon. [Puck]

To be honest, I didn’t find this interview very satisfying (maybe I know too much), but if you are interested in why GQ is successful, or at least successful by modern Condé Nast standards, Will Welch gives you a clear sense of how he thinks. [Too Tired to Make a Joke About the Name of the Podcast]

|

|

|

| And finally… There’s a real Kim Jones-for-Burberry campaign brewing.

Until next week,

Lauren

P.S.: [Insert affiliate marketing disclosure that explains we might make a commission if we sell anything through our links here.]

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

|

|

|

|

| Balmain Drain |

| Dissecting Estée Lauder’s ambitions in the beauty category. |

| RACHEL STRUGATZ |

|

|

| Vance’s Crucible |

| A can’t-miss post-debate mini-roundtable. |

| JOHN HEILEMANN, PETER HAMBY & DYLAN BYERS |

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|