Hi, and welcome back to Line Sheet. The other day, a friend of mine suggested that it’s

“punk to like Nike now.” That may be a tad hyperbolic, but there’s no denying that Nike—one of the most significant brands in the world—is navigating a still-active business crisis. In today’s email, accessible only to Inner Circle members (sign up or trade up here), BMO Capital Markets managing director Simeon Siegel and I discuss the problems that still-new C.E.O. Elliott Hill has already solved, and outline the unresolved challenges ahead.

🚨Programming note: Tomorrow on Fashion People, I’m joined by The

Ringer’s Amanda Dobbins, co-host of Jam Session and The Big Picture, to discuss one of our shared interests: Sofia Coppola. We interrogate Coppola’s relationship with fashion, on- and off-screen: her incredible influence on modern aesthetics, her impact on the industry, and why she’s personally important to us. (As true professionals, we also tried not to be too sycophantic. To wit: I have zero plans to stop by

Coppola Square on my Tokyo trip.)

🛍️ Also, here are all the products we discussed: Meghan Markle’s (sold out!) jams, a Charvet shirt, a Sofia-recommended pair of Noah

pants, the Noah x Barbour jacket, Sofia Coppola x Augustinus Bader tinted lip balm, the Sofia Coppola x Barrie puffer jacket, and a lavender dress from Ulla Johnson.

Mentioned in this issue: Jonathan Anderson, Dior, Elliott Hill, Nike, Hoka, On, Michael Jordan, Bernard Arnault, Caastle, Christine Hunsicker, Kim Kardashian, LeBron, the Gredes, and many more…

|

|

|

A MESSAGE FROM OUR SPONSOR

|

GET NOTICED

Every detail of this iconic performance SUV has been labored over to communicate poise and

presence.

EXPLORE

|

|

|

Three Things You Should Know…

|

Just accept it, Bernard is never leaving: As you all know, these are heady days for LVMH, which finds itself in the middle of a generational executive shift, a trade war, and a longitudinal succession plan. And then there are the daily whims of the market. The company’s stock has dropped about 8 percent in recent days amid disappointing first-quarter results. On the bright side, chairman and C.E.O. Bernard Arnault finally announced at Thursday’s annual

shareholder meeting that Jonathan Anderson would officially become head menswear designer at Dior. Everyone who reads Line Sheet has known this for months, of course, and apparently so have market analysts and institutional investors. The stock ticked up ever so slightly before closing more or less flat.

Meanwhile, here’s hoping Anderson will revert the brand’s name from Dior Men back to Dior Homme. Also worth noting, LVMH shareholders officially

approved the resolution to increase the age limit for the C.E.O. from 80 to 85, securing the 76-year-old Arnault’s position and postponing the succession question.

- Hermès saddles up: In its own call with analysts on Thursday, Hermès previewed one of the

predictable tactics it will deploy amid the steepening trade war: price increases on goods in the U.S. market. “We are going to fully offset the impact of these new duties by increasing our selling prices in the United States from May 1, across all our business lines,” C.F.O. Eric du Halgouët told analysts. Obviously Hermès has more pricing authority than just about anyone in the industry. The company has already adjusted prices upward by around 6 percent, according to

Reuters.

Otherwise, Hermès reported total sales of around $4.7 billion in the first quarter of the year, outperforming the luxury sector with 7

percent growth, but those numbers fell just short of analyst expectations of 10 percent. The U.S., Europe, Middle East, and Japan markets were all up double digits, while China proved more challenging. (Overall, the Asian market grew by 1 percent.) Leather goods and ready-to-wear are the stronger businesses, while watches are down 10 percent. Hermès has invested in three new French production facilities, suggesting confidence in the company’s heritage craftsmanship approach. Notably, Hermès

still has untapped pricing power that they’ve yet to leverage.

- Caastle hangs on: Caastle has secured a $2.75 million bridge loan from an investor affiliated with former director Scott Callon, which will provide temporary relief for the embattled fashion rental platform. As

Lauren recently reported, the company has been engulfed by chaos—C.E.O Christine Hunsicker resigned amid allegations of sharing falsified financial statements with investors. Caastle is also facing a lawsuit from EXP Topco—a subsidiary of Express Inc.—alleging breach of contract and trademark infringement related to their

Express Style Trial services. The Caastle board told shareholders that the new funds will be used for critical operations, and advised that Chapter 11 still remains a possibility.

|

And now on to the main event…

|

|

|

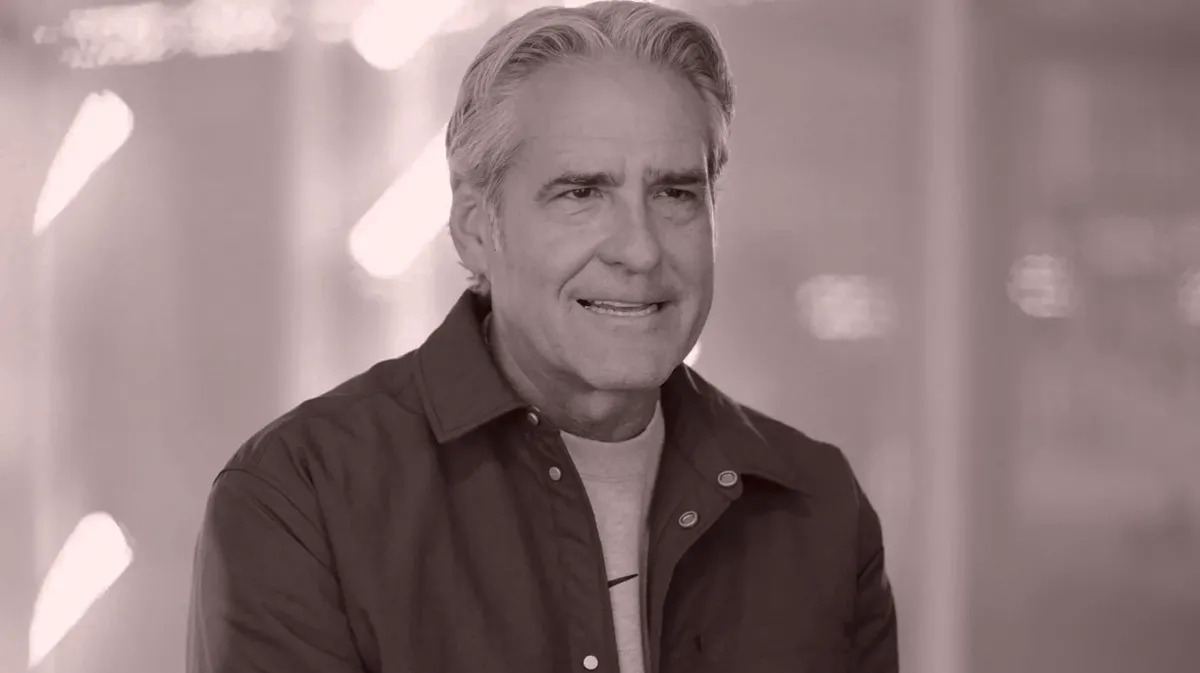

A frank conversation with retail analyst Simeon Siegel about the current anxiety and

uncertain future of Nike, as the storied sneaker brand works to win back mindshare within our disintegrating monoculture.

|

|

|

On Sunday, minutes after the long-suffering golfer Rory McIlroy finally won the Masters,

Nike released an ad featuring a pimento cheese sandwich, that famous green jacket, and the tagline, “This was always waiting for you.” On some level, this wasn’t all that different from the zillions of other coital bliss ads that Nike has created for its other star athletes following a big win or surpassed milestone. Eagles quarterback Jalen Hurts got his own spot after winning Super Bowl MVP. The pimento cheese sandwich bit was corny, sure, but it’s a thing at Augusta

National, where the Masters is played.

Anyway, the ad was… fine. But I’m a tough critic of such things. According to a golf-literate friend, the golf bros were into it. And perhaps that’s all that matters. You see, much of Nike’s success during the past 50 years has to do with market segmentation: making the right stuff for golfers, and basketball players, and runners, and people who shop at both DSW and DSM (as in, Dover Street Market), alike. As

still-new C.E.O. Elliott Hill works on getting the company back on track—from repairing retail relationships to improving employee morale and managing the tariff war—I sat down with Simeon Siegel, a retail analyst at BMO Capital Markets, to get a temperature check on one of the last remnants of our disintegrating monoculture. The conversation has been edited and condensed for clarity.

|

Lauren Sherman: Break

down the current situation for me.

Simeon Siegel: We know that Nike diluted their brand. And now we know they’re trying to reverse course. This also happened to Nike 10 years ago: Adidas had their moment in the sun, and it came at Nike’s expense. It was very similar to what’s happening now.

When Nike finds themselves at odds against a new competitor, they combat it by trying to find an already established product that will be able to compete until

they come up with something new. The problem is, when they go back to their archives, they’re selling their logo more than they’re selling their brand. That’s a cheap dollar today that ultimately hurts you tomorrow. We are in the tomorrow.

What does Nike need to do?

|

|

|

A MESSAGE FROM OUR SPONSOR

|

GET NOTICED

Every detail of this iconic performance SUV has been labored over to communicate poise and

presence.

EXPLORE

|

|

|

When a brand overstretches, it needs to pull back. Nike needs to retrench, then amplify with product and

storytelling—what makes them special. For the last five years, everyone has thought, Nike is losing a ton of share; On and Hoka are taking over. But incrementally, [Nike] actually was selling more. The growth rate may have favored the new up-comers, but in terms of actual dollars, people were choosing to buy more and more Nikes. The brand was losing mind share, but they weren’t actually losing market share.

The exact same thing happened 10 years ago. Nike spent about two years

creating a product called the Epic React. It looked like the [Adidas] UltraBoost. It had the word “react” in the [name]. It was a reaction to Adidas. They need that new product that really gives them an edge against what exists now. Once they have that, then we get really compelling storytelling.

How hard is it going to be to find the next Epic React?

It may already be in the works. There’s a product, the Zoom Fly 6, which has a giant foam sole. It looks just like

some of the Hoka products. There’s a new Pegasus Premium, which is selling out. There’s a Vomero 18, which all of a sudden looks a lot thicker. And so, you wonder, are they starting to get there? And if that is the case, the next thing that follows is marketing.

Could NikeSkims become a giant sub-brand of Nike, à la Jordan?

This is intended to be Jordan-esque, rather than a collaboration, because there’s no X in the

middle. It’s not a collaboration. It is a brand. Nike has never given their [name] to another brand before. And so here, you’re taking a brand that you have built over decades of blood, sweat, tears, and a lot of cash, but you are sharing that line with a company that, to their credit, has earned that space in a very short amount of time.

Will it succeed?

It has to succeed, right? You have the budget, you’ve got the power of Oregon. Then, you’ve got

Kim. But you don’t just have Kim—you have the Gredes. Jens and Emma have shown a phenomenal ability to drive this as well. The question is: What does it mean to succeed? I don’t know if it’s going to speak to everyone. It may not become a business the size of Jordan, with $7 billion in annual sales.

|

How important is it for Nike to maintain legitimacy in individual sports categories in

order to also win at the lifestyle element? Nike started in running, but then became convincing in basketball (because of Jordan), but also golf, skate, etcetera. Not easy communities to infiltrate.

They need to make sure they are speaking to different people. The run-club person is very different than the DSW back-to-school shopper, who is very different than the person who’s lacing up to go play some hoops. That’s what they did so well. Fusing the product, marketing, and

segmentation.

|

|

|

How do they get back to that?

My gut is that Elliott’s mandate is to go back to the

future. They used to focus maniacally on what they were selling rather than where they were selling. He needs to repair wholesale relationships, which he’s doing. He needs to repair employee morale, which he did. And now, he needs to start repairing the customer relationship. That’s the hard one. If he does that, the flow-through should be a lot better. And a lot of that will come through selling full-priced product.

Does Nike need to let go of the idea that they

will regain mindshare? We no longer live in a monoculture.

No one says Kleenex anymore. They say tissues. Just because you owned that level of brand association doesn’t mean you get to keep it. There are still people who love Nike; they sell $50 billion worth of product a year. It’s just that people aren’t saying, Okay, this is my automatic purchase, as much. They need to make sure they never become a need-based purchase. The magic of Nike is they have fused

need and want. If you become a just replenishment staple for back-to-school, then you lose all that; then you’re a regular shoe. They still have the license to be something special. We’re seeing it in the dollars. We need to see it in the story.

|

The business is sneakers. Yes, apparel matters, they sell billions of dollars’ worth, but

this is a sneakers business. How much of their focus needs to be about sneakers versus the whole kit?

In North America last year, Nike sold just under $15 billion of footwear, and just under $6 billion of apparel. Nike is a footwear business. And if you can create a very compelling footwear model, not only do people replenish, not only do people fall in love, not only do people collect, it’s also arguably less competitive.

It’s harder to do. Nike sold a crazy amount of

running shoes last year. But people weren’t in love with them. The historical magic of Nike is they’ve been able to sell these drops that sell out for several hundred dollars and yet sell $50 running shoes to kids that are going to school in September.

Can they keep the magic for another 20 years, Simeon?

They’ve got the budget. They will find the next LeBron and no one will be able to outspend them. There’s a beautiful thing when you’re in a

variable-expense world when everyone needs to spend 10 percent on marketing—the larger your sales, the bigger your marketing. So when Nike decides they want someone, you just can’t compete against them. They might not get a hit every time, but they will get the dollars.

Maybe Kim is the next LeBron.

|

Until tomorrow,

Lauren

P.S.: We are using affiliate links because we are a business. We

may make a couple bucks off them.

|

|

|

Puck’s daily art market email, anchored by industry expert Marion Maneker, offers unparalleled access to the mega-auctions and galleries,

elite buyers and sellers, and the power players who run this opaque world. Wall Power also features Julie Brener Davich, a veteran of Christie’s and Sotheby’s, who provides unique insights into how the business really works.

|

|

|

Puck founding partner Matt Belloni takes you inside the business of Hollywood, using exclusive reporting and insight to explain the

backstories on everything from Marvel movies to the streaming wars.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|