Hi, and welcome back to Line Sheet. I did an unadvisable, if ultimately rewarding, thing last night under

jet-lag duress—I stopped by designer Danielle Frankel’s dinner at her new store on Melrose. I’ve got more on the store and Danielle’s business ambitions below (she recently raised a round), plus intel on a tide-changing J.Crew exit, and some pretty significant personnel moves at LuxExperience that somehow got swept under the rug by the rest of the media. (See what happens when I go on vacation?) Finally, we’re going to talk about what’s happening at Kering and

beyond amid this painful crisis. Today’s scoop-studded email is for Inner Circle members only, so please don’t hesitate to upgrade. I will make it worth your while!

I have a long list of topics to address in the coming weeks, but if you have any thoughts, suggestions, or ideas, feel free to respond to this email—or text me!

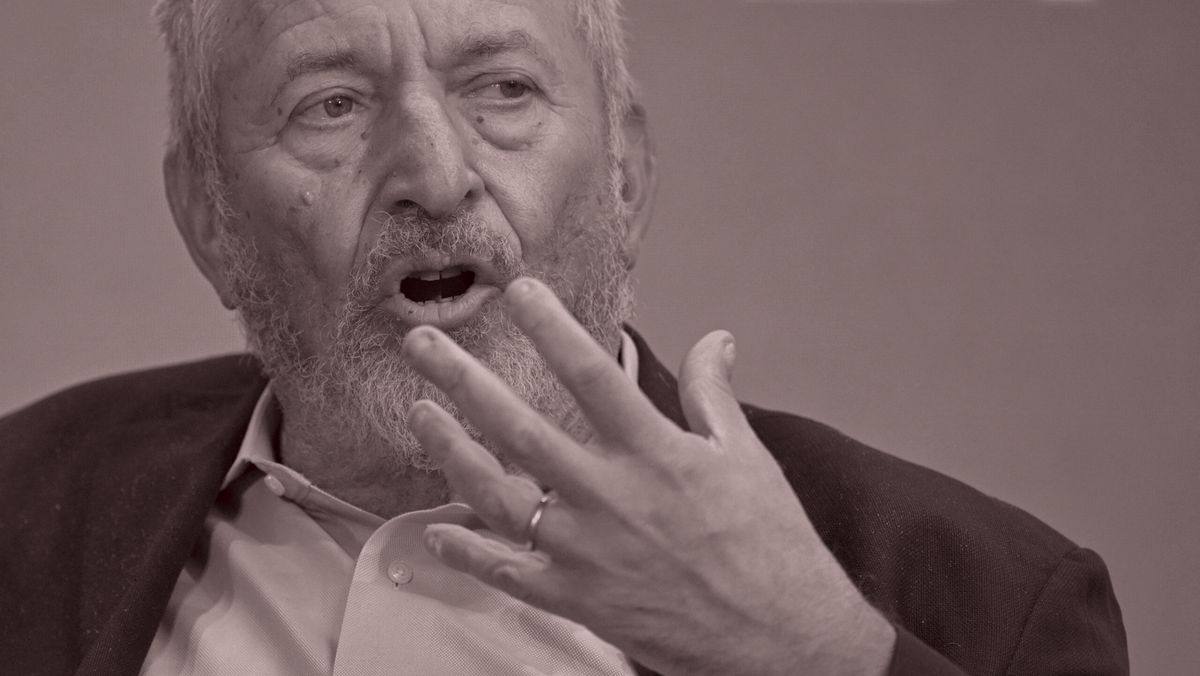

🚨 Programming note: Tomorrow on Fashion

People, I’m joined by one of the chief architects of the “accessible luxury” movement: Reed Krakoff. Reed is best known for his (actually groundbreaking) work at Coach, Tiffany, Ralph Lauren, Tommy Hilfiger, and, of course, his very own namesake label. These days, he’s a strategic advisor at L Catterton, keeping an eye on John Hardy and several other brands. I learned so much talking to Reed, and I hope you enjoy our conversation. Listen

here and here.

🛍️ Also, here are all the products we discussed, including the Coach Ergo bag, which I feel strongly that everyone should own: Coach Ergo

Bag, Coach Hamptons Bag, Coach Soho Bag, Tiffany’s Sterling Silver Bamboo Flatware Set, Tiffany’s Sterling Silver Tin Can,

Tiffany’s Blackberry Basket, Tiffany’s Sterling Silver Pencil Sharpener, Uniqlo Down Jackets, and Uniqlo Cashmere Sweaters.

Mentioned in this issue: Kering, LVMH, Bernard Arnault, Gucci, Demna, Saint Laurent, François-Henri Pinault, Francesca Bellettini, Armelle Poulou, Matthieu

Blazy, Mytheresa, Yoox Net-a-Porter Group, Michael Kliger, Lisa Greenwald, J.Crew, Saks Global, and many more…

|

|

|

A MESSAGE FROM OUR SPONSOR

|

GET NOTICED

Every detail of the Range Rover Sport has been engineered for exhilarating driving dynamics and spirited

performance.

EXPLORE

|

|

|

Four Things You

Should Know…

|

- The

next Vera Wang, but different: Danielle Frankel, who makes wedding gowns like nothing you’ve ever seen from a bridal designer, recently opened a store on Melrose Place. I’m not great at describing spaces, so I will only say that interior designer Augusta Hoffman’s gentle color palette and expertly sourced vintage improve the experience of trying on Frankel’s sculptural, borderline conceptual,

just-the-right-amount-of-artisanal dresses.

To celebrate her opening, Frankel hosted a dinner organized by party planner extraordinaire Marcy Blum and cooked by Lilia chef Missy Robbins, who flew in from New York and grilled steaks. Erin Foster and plenty of other Los Angeles types, as well as bridal scene folks, showed up, as did Andrew Rosen and

Imaginary Ventures’ Nick Brown, who are new investors in the company.

|

I may have more on Frankel’s recent funding round and business model in a future issue, but here are some quick observations for right now. Many chic bridal designers shy away from the actual “bridal” moniker, hoping to position themselves in the ready-to-wear world. Perhaps Frankel will design ready-to-wear someday, but it was clear to me that she has no desire to be anything but in service of the bride. And there’s definitely no hint at going down the licensing route, as profitable as

that may be. I wish she’d been around when I got married 14 years ago. (By the way: Happy anniversary, Dan.)

|

- Heather!:

Everyone’s been so focused on this week’s extensive layoffs at Saks Global that the frenzied reorganization of LuxExperience—the combining of Mytheresa and Yoox Net-a-Porter Group—somehow went virtually unnoticed. About two weeks ago, the company announced a new C-suite structure, with a few major changes. Michael Kliger, C.E.O. of Mytheresa and all-around responsible guy, is understandably remaining in the top spot, but he’s made some tweaks to his reporting

structure. Most notably, YNAP C.E.O. Alison Loehnis is exiting the group in June after 18 years, to be replaced at Net-a-Porter by her former colleague Heather Kaminetsky, who was most recently the C.E.O. of Mytheresa’s U.S. division. The long-suffering Toby Bateman, who had a tragic-if-short run at Hodinkee during the pandemic (it was no one’s fault, at least not his) will become C.E.O. of Mr. Porter, where he

was a founding team member. In other news, Mirko Nobili has been promoted to C.E.O. of Yoox (guess they’re not closing that, wild stuff), while Sabah Naqushbandi will remain managing director of The Outnet.

All told, Kaminetsky is the story here. A real smarty, she started in internet marketing at Barneys New York in 2006 and quietly worked her way up the ranks, eventually landing at Net-a-Porter, where she was,

by all accounts, a neutral party in the Natalie Massenet–Federico Marchetti battle. (She left right after it all went down.) Years later, she pitched the regional Mytheresa C.E.O. gig to Kliger, and has managed to position that business in the States as a leading V.I.C. retailer. And she’s a pretty under-the-radar exec, attending events only when there is a business purpose—incredibly sensible and driven by

efficiency.

She also understands that there needs to be a sense of fun in marketing and private client pushes. The company’s note announcing the move mentions Kaminetsky’s “wealth of customer-centered digital experience globally and particularly in North America,” and that “this will be an invaluable asset for her role” since Net-a-Porter “conducts a majority of its business in the United States.” That said, Kaminetsky will be based in London, where NAP is headquartered.

As for

Loehnis, who told her team a few months ago that she’d be exiting: Kudos to her for navigating—and surviving—a truly torturous 10 years at Net-a-Porter, which was acquired by Richemont a decade ago and has been in trouble ever since. Net-a-Porter still pays on time, and consumers still revere the brand. Now, it’s Kaminetsky’s job to get Net-a-Porter into the black.

- Lisa Greenwald!: Yes, Loehnis’s Net-a-Porter exit is a big deal, but it’s an equally big

deal that Lisa Greenwald, J.Crew’s longtime top merchant, has left the business after nearly 20 years. Lisa is one of those people whom I never really knew but who has come up in dozens of conversations while covering J.Crew. Interestingly, she was always referenced by her full name, Lisa Greenwald—never just Lisa.

She was a force—feared, even—and wielded a lot of power, especially between the tenures of Mickey Drexler and Libby Wadle, both merchants themselves. She was, for instance, instrumental in hiring Chris Benz as the brand’s womenswear creative director for a spell. Some people are saying Greenwald was fired; others say she left on her own accord. (I reached out to both Greenwald and J.Crew about this. Greenwald did not immediately respond, and J.Crew had no comment.) Either way, she was Lisa Greenwald! I

hope she takes a break.

- A Saks clarification: I’d like to have one day free of Saks Global (and I’m sure they’d like to have a day free of me), but I don’t think that’s going to be the case for a while. In today’s news, I wanted to note that the 3.5 percent surcharge that is being added by Hilldun, the factoring firm, to all Saks invoices is an increase from the previous surcharge of 2.5 percent. Some invoices to retailers

are paid by Hilldun with zero surcharge; some always have a surcharge attached. (There are typically additional fees that apply to these deals, but I am talking only about the surcharge here.) It just depends on the risk involved. On Wednesday, Sak Global’s bond dropped to an all-time low. (Although that may improve if Trump adjusts this China-tariff situation.)

On the bright side, things have been worse. Last fall, for instance, there was a time when Hilldun was not even willing

to approve invoices from Saks Global.

|

And now, on to the main event…

|

|

|

The luxury behemoths LVMH and Kering may be able to weather Trump’s tariffs—the ultra-rich

aren’t going anywhere—but more pressing challenges, including a glut of stores, Gucci’s uncertain future, and luxury no longer being cool, are complicating the picture.

|

|

|

On Wednesday night, I was catching up with a C.E.O. friend, comparing notes about the Saks situation and

John Arlidge’s recent piece for The Times about “luxury falling out of fashion.” While we were on the phone, he checked the Dow Jones Industrial Average, which was up more than 400 points after Trump softened his tone on his trade war with China.

Of

course Trump was gesturing at an off-ramp for the tariffs, we agreed. “He’s a coward,” my friend declared. I asked him how worried he was about the situation, really. I assumed, as a person who’d seen it all, as they say, he’d respond unfazed. This too shall pass, right? “Oh no,” he said, “I’m not sleeping at night.”

|

|

|

A MESSAGE FROM OUR SPONSOR

|

GET NOTICED

Every detail of the Range Rover Sport has been engineered for exhilarating driving dynamics and spirited

performance.

EXPLORE

|

|

|

It’s really that bad, and you all know that. Perhaps not as bad for luxury brands, which

have far fatter margins and balance sheets to withstand all the new costs incurred by rerouting supply chains and the like. Luxury brands can, to an extent, pass costs off to the consumer or shift manufacturing to less impacted countries. But many have already stretched their pricing elasticity too far.

I’m by no means an alarmist on these matters. Ours is a culture of consumption, and that’s not changing. Ultra-rich people are not disappearing. But when all this tariff nonsense is

over—and it will end someday, whether or not Bernard Arnault gets his wish for a free-trade zone between America and Europe—other challenges will linger: the fast-growing secondhand market, the emphasis on experiences over goods, and the consumer’s growing discernment when it comes to those goods. Luxury may still be in fashion—the market for personal luxury goods was €363 billion in 2024, according to Bain—but it’s no longer cool.

The company

hit hardest has arguably been Kering, once home to the most jealousy-inducing brands in the business. (LVMH may be more diversified, but Kering is more progressive and exciting.) Its current problems—mostly, the catastrophe at Gucci—can be attributed to a mix of brand misfires (Sabato) and various macro issues. But I think we underestimate the significance of several big luxury brands opening too many stores.

Overstoring is the retail jargon typically applied to

mass brands and specialty retailers. But luxury is overstored now, too, and Kering deputy C.E.O. Francesca Bellettini must fix a situation she inherited. Her challenge is not dissimilar to what Delphine Arnault faces at Dior, which has been pumping out too much product.

During Kering’s Q1 2025 earnings call, on Wednesday, Bellettini and C.F.O. Armelle Poulou attempted to explain

why the company did not meet analyst expectations, and why they were still committed to their strategy despite a 14 percent dip in revenue from the same period a year earlier. Investors, who pushed for the firing of former Gucci executive Marco Bizzarri two years ago, are not pleased with what Bellettini and her boss, François-Henri Pinault, have achieved thus far. Shares fell once again, shrinking the

company’s market cap to $20.7 billion, down from $22.5 billion earlier that morning. (The company was worth more than $100 billion at its peak in 2021.) We knew it was going to get worse before it got better, but I’m not sure anyone expected it to get this bad.

|

That said, let’s read a little bit between the lines. First, the positives. Bottega Veneta was up

19 percent in North America and 17 percent in Western Europe, despite declines in Japan and the rest of Asia. Yes, analysts expected Bottega to perform a bit better than it did. But given the overall situation, it’s a good showing, both for the brand and former creative director Matthieu Blazy—an indication that designs that feel special are driving what’s left of consumer spending at the moment. (On that note, expect Bottega to increase its prices

stateside very soon.)

|

|

|

Saint Laurent actually beat expectations, even though it was down 8 percent. Bellettini

continues to attribute the sales decline to a rationalization of the retail makeup: less wholesale, and more focus on owned stores, after a run of tremendous growth. But I suspect that Saint Laurent’s pricing architecture also got mucked up during the great inflation run of the past five years, and it will take consumers a while to accept Saint Laurent as one of the priciest of the high-end brands. Then there’s the Gucci situation: We all know they need to close stores and further refine the

carryover product. But Gucci is simply not a carryover brand—it’s a fashion brand. Bellettini said “novelty” is what’s working right now. The Demna proposal is going to have to succeed, too, in order for everyone to keep their jobs.

It’s a lot of pressure for Pinault’s favorite child. And yet, if you’re searching for hope, look at what’s happening right now at Balenciaga. The bags are performing, despite a slowdown in foot traffic, which indicates to me that Demna

can take himself out of the equation in order to engineer a hit product. (The bags are designed, but hardly on the edge of anything.)

The other good news for Kering is that the first half of 2025 is going to look better than the brutal second half of 2024, at least in terms of EBIT. But even if Demna’s Gucci is a massive hit, and his successor at Balenciaga helps move the stock price, I imagine that Pinault is thinking harder than ever about what he

wants Kering to be a decade from now. The promotion of Bellettini to deputy C.E.O. is a clear succession plan, and Pinault has other interests: his family office, his art collection, CAA, and Christie’s. Several analysts on the Wednesday earnings call asked about Valentino, which Kering is apparently on the way to buying from Qatari investment vehicle Mayhoola by 2028. (It already owns 30 percent.) That deal was made in 2023, long before things really fell apart. Could that transaction be

jeopardized?

The terms of that deal stipulated that the remaining 70 percent of Valentino could be paid for, in part, with shares of Kering stock. The maximum was 3 million shares, just 2.4 percent of the overall business. That’s not nothing, and while it’s difficult to imagine Kering as a joint venture with Mayhoola, I’m more convinced than ever that some sort of merger could be in its future. They don’t call these groups “strategic” for nothing.

|

What I’m Reading…

and Looking At

|

Pamela Love—who was recently embroiled in an

intriguing, if unsurprising, lawsuit—designed a necklace for Coterie, the diaper brand. Kinda weird, right? Sure, but here’s the thing: After having a baby, people buy tons of stupid stuff that they never end up using. Why not buy something beautiful that you will wear forever? (Also, there’s a significant charitable element.)

[Coterie]

Good design is very powerful. [WSJ]

More Nuzzi! [Puck]

I

had fun procrastinating while writing this by listening to “It Ain’t Me Babe” and searching for photos of Joan Baez and Bob Dylan—together. (I was inspired by a recent plane screening of A Complete Unknown. Anyone who complains about this movie needs to stop.) [Getty Images]

Liana Satenstein on the Proenza Schouler tie-dye t-shirt, which is essentially a neutral now. [Neverworns]

|

Until tomorrow,

Lauren

P.S.: We are using affiliate links because we are a business. We

may make a couple bucks off them.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|