Welcome back to another exclusive Inner Circle issue of The Varsity,

our thrice-weekly private email on the conversations, business decisions, and everything else that goes down in the owners’ boxes.

As you know, Peacock will start carrying NBA games this fall. Comcast’s Mike Cavanagh has described the new deal as a potential “launchpad” for the streaming service. But, as Julia Alexander notes below, Peacock has

already hosted NFL games, and a little event called the Paris Olympics. In a must-read piece, she offers an acerbic assessment of the NBA deal’s actual likely impact on Peacock’s numbers.

Before getting to Julia, I want to briefly highlight today’s Wall Street Journal

report that SportsNet New York, the Mets’ regional sports network, has hired Moelis to explore a sale. Of course, given the state of the business, nobody is in the market to acquire R.S.N.s right now. Like all other R.S.N.s these days, SNY—whose rights deal with the Mets runs all the way through 2035—has seen its

revenue evaporate due to cord-cutting. The network’s principal owners—the Wilpon and Katz families, who used to own the Mets—would love to get out of the business if they could, as would minority owners Charter and Comcast.

In fact, YES Network used Comcast’s ownership of SNY as leverage to work out a deal earlier this spring. The crosstown MSG Network is

facing similar headwinds, so maybe there’s a potential merger ahead? If they can pull this off, maybe there’s hope for Marchand’s one-man illusionist show (he saws himself in half). My guess, however, is that it’s private equity or bust here. And that’s not going to be pretty.

Okay, enough about R.S.N.s. Let’s get to Julia…

|

Stat of the

Week: $100 Million

|

That’s the amount Spotify says it’s paid creators through its partner

program—the latest attempt by the streamer to compete with YouTube in the fast-emerging hybrid podcast-video space—since January. Obviously, that figure doesn’t include the massive checks Spotify is cutting to its biggest in-house talents, including Joe Rogan and Alex Cooper. But it’s still a long way short of the tens of billions of dollars that YouTube pays out each year.

Of course, sports content will be a key component of Spotify’s

strategy. Since 2019, mass-reach audio platforms have recorded a 41 percent increase in demand for sports content across radio and podcasting, per SiriusXM. The demand is manifesting in new deal flow, too. Last year, Jason and Travis Kelce signed a $100 million deal with Amazon for their podcast, New Heights. And earlier this year, LeBron James signed a deal with Amazon to bring back his podcast, Mind the Game.

Spotify executives always saw podcasts as a key potential growth area, and competition for some of the top athletes is clear. Meanwhile, if you peruse the leaderboards, four of The Ringer’s podcasts appear in Spotify’s top 10 sports list. No wonder Daniel Ek was eager to renew Bill Simmons’s deal.

|

Trend I’m Watching: An NFL Draft Record

|

ESPN notched 13.6 million viewers on day one of the NFL Draft—the second-largest

audience ever—which is both impressive and collinear with a wider trend. Earlier this year, the WNBA also scored its second-largest draft audience ever—a 307 percent increase over 2023. As college stars like Ole Miss QB Jaxson Dart blur the boundary between athlete and digital creator, there is more interest in these guys on and off the field.

Indeed, social media has created a larger pool of athletes that fans care about. It’s

no longer just the top prospects who can draw eyeballs to a game… or a draft. In fact, day three of the NFL Draft—i.e., the final four rounds of picks—drew 4.3 million viewers, a record, up more than 40 percent over last year’s final day. (ESPN should send Shedeur Sanders a gift basket.) This draft viewership trend explains why YouTube is so interested in streaming rights to the NFL Draft, which are now up for grabs.

|

- YouTube TV keeps leaning into sports: YouTube is marking its twentieth anniversary with a slew of incoming updates, including one that seems tailored for sports fans: a multiview setting for YouTube TV that allows users to watch as many as four streams across sports and non-sports content simultaneously. (YouTube has already rolled out select four-boxes for sports contests.)

Of course, this isn’t a product that most casual viewers are pining for, but it’s essential for

die-hard sports fans who need to be able to keep tabs on an NFL playoff game, even if their kid insists on watching Bluey, or pin the Yankees (on mute) while their spouse binges Real Housewives. This is a literal game changer for sports fans with children or couch-adjacent reality TV junkies.

- NASCAR’s golden years: As announcer Mike Joy recently noted on driver Kevin Harvick’s podcast,

Happy Hour, NASCAR has a youth problem. While viewership is up overall, the audience isn’t getting any younger. Joy suggested the age of the average NASCAR viewer has increased by 10 years over the past two decades. This aligns with other data sources, including a report from Ampere Analysis that estimated that about 35 percent of NASCAR’s audience in the U.S. is between 55 and 64 years old.

Theoretically, NASCAR’s giant streaming deal with Amazon should help.

After all, the NFL’s partnership with Amazon Prime Video for Thursday Night Football resulted in a streaming audience that skewed several years younger than on broadcast and cable. Of course, cultivating the next generation of fans is a necessity for any sport, but it’s especially important now, as long-term media rights deals skyrocket in value. Those economics can be tough unless you’re on the right side of the actuarial table.

- College

sports betting goes pro: A new partnership between the NCAA and the data analytics firm Genius Sports marks the first time that the governing body of college athletics, whose leaders have expressed significant concerns about the cocktail of gambling and amateur sports, is licensing its data to sports books. As cable evaporates and regional sports networks crumble, sports betting is increasingly becoming a major revenue source for leagues at all levels—in fact, many executives privately

concede that wagering will eventually fill the hole left by media revenue once the platform shift fully plays out. But I was surprised that the NCAA was so quick to go this route, particularly because its president, Charlie Baker, has gone so far as to ask Congress to help curb betting on college sports. Alas, as sports betting becomes fundamental to the leagues, and to the fan experience itself, I expect partnerships like this to proliferate, even if everyone involved feels

kinda gross about it.

|

|

|

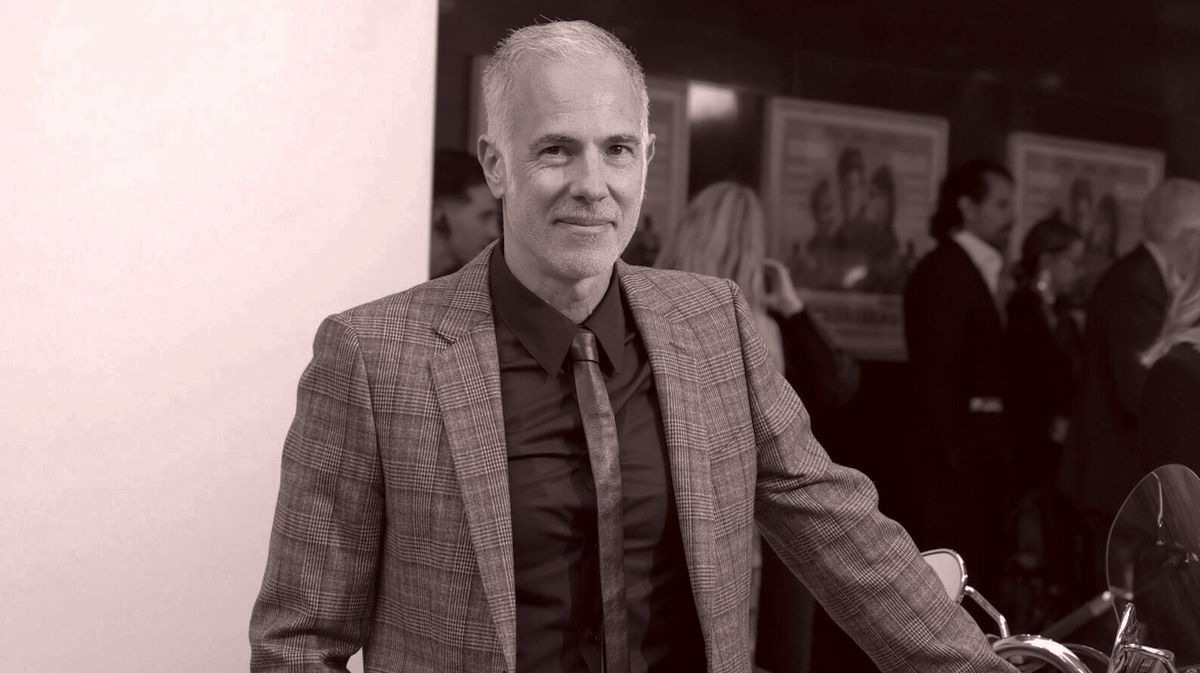

Comcast president Mike Cavanagh has touted Peacock’s NBA deal as a “launchpad” to

streaming supremacy. But it’s not quite that simple.

|

|

|

I’m sure I wasn’t the only one who raised an eyebrow when, during last Thursday’s

earnings call, Comcast president Mike Cavanagh described the NBA as a “launchpad” to “further scale Peacock” over the next decade. For one, NBCU’s 11-year, $2.45 billion-per-annum deal for NBA rights was somewhat controversial. The company paid—or overpaid, depending on who you ask—for an asset that’s increasingly consumed in clips by a younger, social-first audience, which is almost certainly among the reasons that regular season ratings were soft this year

(down 2 percent) despite a new generation of talented stars.

For two, Peacock has already streamed much larger sports events, including two Olympics, regular season NFL games, and an exclusive NFL wild card game that drew more than 27 million viewers—all seismic live spectacles that any other streamer would kill for to help “scale” subscriber growth. And yet none of these events have created any sort of launchpad for a 5-year-old streamer with 41 million subscribers

that still loses $200 million per year.

The Peacock folks will tell you that the 50 exclusive games, including playoff games, set to air on the streaming service will attract a new, younger, and more advertiser-friendly demo. Peacock also likes the fact that the NBA fills out its year-round sports calendar, particularly in the late spring during the NBA playoffs and in the summer months with the

WNBA.

Peacock executives will also tell you that a huge percentage of the people who come for sports stay to sample other programming, and they expect to see that same stickiness when the NBA kicks off this fall. They will compare the NBA deal to their deal for WWE’s Premium Live Events, which attracts a different demographic than your typical Peacock user and brings in subscribers year-round.

But rather than conjuring a launchpad, I’d suggest something more akin to a landing pad. After all, the NHL has a similar deal with Max, via its Bleacher Report add-on, and the results are illustrative. Yes, yes, it’s not a perfect comparison—the NBA has better demos and is more popular than the NHL, plus Max is more than twice the size of Peacock—but the results may help refine expectations. On the

positive side: The total hours of NHL watched on Max this season increased by 26 percent, according to SBJ research, despite league viewership declining by 12 percent on traditional TV.

Unfortunately, the gaudy NHL streaming numbers did little to boost Max subscriptions. Most hardcore fans want to watch their local teams, and any games broadcast on a regional sports network are going to be blacked out elsewhere. (This ongoing frustration is almost certainly why ESPN’s Jimmy Pitaro is interested in picking up local team rights if they become available.) Again, Peacock will carry a lot of exclusive NBA games, so the R.S.N. blackouts will be

mitigated somewhat, but for Max at least, adding a major sport to the service didn’t help it scale at the same rate that cable is declining.

The rise of streaming could be described as a race to find creative ways to offset pay TV’s decline before the bottom drops out entirely. (Comcast lost another 1.52 million customers over the past 12 months.) And while the continuing migration of sports from linear to streaming

will help smooth this transition for many legacy companies—higher advertising fees, younger audiences, the promise of gaming or shopping features, etcetera—the expectations that the NBA is some sort of growth engine should be tempered. In fact, it seems more like a very sexy churn-reduction tool.

|

Out

of Sight, Out of Mind

|

Streamers have an object permanence problem. Generations

of media consumers have been biologically programmed to flip through channels to find content. In the streamingverse, however, the content finds consumers. And if the content can’t find an audience, it might as well not exist.

This is precisely why so many smart people in the industry are focused on the secondary competition between streaming operating system

platforms, like Roku, Amazon Fire TV, Google TV, and Apple TV. We’re fast approaching a world in which the majority of TV watchers are relying on these platforms to navigate the ever-expanding sea of content. So for streamers, it’s as important to partner with these discovery platforms as it is to have great content. While NBCU doesn’t currently have a partnership with Amazon, I’m told that there’s a debate inside Comcast over whether to join Amazon Channels, which allows users to subscribe to a

service while Amazon takes a percentage of the subscription fee. (A representative for Comcast didn’t comment on this point.) Previously, Comcast had held out through multiple rounds of public negotiations before signing a similar deal with Roku.

Without Amazon Channels, Peacock will have to rely on other pathways to drive people toward the NBA—and then from the NBA to some of their non-sports content.

But for a prized, multibillion-dollar asset, Peacock should be looking for any and all pathways to attract viewers. It would also be wise to use its NFL deal to drive subscribers to basketball—and to use basketball to protect the gains made by the NFL. Ample data shows that audiences are more likely to watch something that is advertised to them during a game if it’s available to watch within the same service.

Also, more than 80 percent of NBA fans are also NFL viewers, per an S&P Global report from last year. We know that the NFL is actually scalable for Peacock: The wild card game not only generated more than 27 million viewers, but 2.8 million people signed up for the service just to watch. Nearly a third canceled their subscription after six months, per Antenna, but that’s only a slight uptick from the average benchmark. Peacock has many problems, including

its conspicuous lack of original breakout hits, as evidenced by its perennial absence from Nielsen’s weekly top 10 lists, but failing to retain the customers it draws from big tentpole events like the NFL playoff game is one of the most significant.

The NBA starts one month after the NFL, but runs four months beyond the Super Bowl. Those few months where the NFL, college football, and the NBA overlap could help push

subscribers who come to Peacock for the NFL toward more NBA games (and vice versa). Similarly, Peacock could use those audiences to increase the overall engagement with its general entertainment programming. Peacock’s overall average weighted churn rate over the last year has hovered around 6 percent, about two percentage points higher than the average. (For context, Netflix sits at around 2 percent, while Apple TV+ is closer to 8 percent.) Those four months of sports season overlap could prove

absolutely vital to Peacock over the next decade.

|

On the problems with multiview telecasts: “As you note, multiview is

pretty niche. It’s a must-have because technology enables it. But like alt casts—with one really big exception—it really doesn’t impact viewing or create value for advertisers so much.” —A media consultant via X

On UFC media rights: “It’s wild to see how UFC has

grown. I remember our most intense programming meetings were whether there would be a risk to the Disney brand by airing UFC.” —A former ESPNer

On who should be sent down to the J.V.: “re: Fox’s NASCAR telecast. Fox stayed on a split-screen commercial until five laps to go. So much for building the excitement.” —A sports media fan via X

|

Thanks, Julia. And thank you for reading. We’ll be back in your inbox on

Thursday.

John

|

|

|

Puck sports correspondent John Ourand and a rotating cast of industry insiders take you inside the executive suites

and owners boxes where the decisions that shape the entire sports business are made. You’ll hear interviews with players, network execs, and everyone in between. The Varsity is an extension of John’s private email for Puck by the same name. New episodes publish every Wednesday and Sunday.

|

|

|

Ace media reporter Dylan Byers brings readers into the C-suite as he chronicles the biggest stories in the industry:

the future of cable news in the streaming era, the transformation of legacy publishers, the tech giants remaking the market, and all the egos involved.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|