Hi, and welcome back to Line Sheet. Rachel

“Rachel@puck.news” Strugatz is here for your weekly dose of beauty industry intel. Today, it’s all about Estée Lauder. How’s Stéphane de La Faverie doin’ over there? Rachel reports on what’s happening inside the walls of 767 Fifth Avenue, where pretty much everyone has had a heads-down attitude since de La Faverie’s first day in January.

Meanwhile, I’m headed to New

York tomorrow to join you all for a few days. Late-breaking news: In addition to the overflowing handful of Met afterparties that I reported on yesterday, I hear that Baz Luhrmann and Stella McCartney are also planning to do something. I’m tired just thinking about this stuff. I’ll have more Met updates tomorrow, because we’ve got a lot of ground to cover today, including the latest news from Europe (Kering and Miu Miu price hikes, and Prada’s Q1

performance), a note on Blake Lively’s current outfit strategy, and why all the speculation around Jonathan Anderson was good for Loewe’s business.

Mentioned in this issue: Estée Lauder, Stéphane de La Faverie, Fabrizio Freda, Tom Ford, Balmain, Jane Hudis, MAC, Philippe Pinatel, Raffaella Cornaggia, Kering Beauté, Jonathan Anderson,

Blake Lively, the Prada Group, Miu Miu, Loewe, and many more…

|

|

|

A MESSAGE FROM OUR SPONSOR

|

Tariffs are coming fast — but Swap moves faster. Built for ecommerce brands that manufacture in China and sell

cross-border, Clear by Swap Global is your B2B2C compliance solution for surviving—and thriving—in this new reality.

➡️ Clear goods at fair market (not retail) value

➡️ Reduce tariff exposure via intra-company transfers

➡️ Get fast 2-day delivery from UK/EU warehouses

➡️ Achieve

full compliance & eliminate surprise border fees

Margins are shrinking and complexity is growing. Clear by Swap Global helps your brand stay compliant.

Get a demo today.

|

|

|

Three Things You Should Know…

|

- Price hikes at Kering, Miu

Miu, and more on the Prada Group’s Q1: Last week, sales associates at Kering-owned fashion brands started messaging top clients, warning of an expected price hike. Seems the time has come. Prices on certain Kering products are increasing by as much as 5 percent in the U.S. as a result of Trump’s tariffs. An increase of that size shouldn’t affect consumption at most Kering brands, such as Bottega Veneta, which is already positioned near the top of the luxury pyramid

and selling exceptionally well stateside.

It’s a similar situation over at the Prada Group, where Miu Miu—which is still underpenetrated in the U.S.—is also well positioned to weather the tariff storm. (On its earnings call this week, the company said that the typical “maintenance” price increase would more than offset the tariff impact, but the company remained concerned about consumer confidence.) While prices are set to increase by May 5, the group announced this morning that sales

grew 60 percent this past quarter. Prada itself missed on analyst expectations—growth was essentially flat—but that shouldn’t have been unexpected, given the brand’s tremendous expansion over the past few years. Meanwhile, the group’s deal to buy Versace will close in the second half of the year, when everyone is hoping the sector will start to normalize. Hope!

- Blake Lively’s no-strategy red carpet strategy: Despite the whole legal

saga with Justin Baldoni, Serena van der Woodsen and Ryan Reynolds have spent little time away from the spotlight. This week, Lively was out in full force promoting Another Simple Favor, the sequel to her well-reviewed 2018 movie co-starring Anna Kendrick (and directed by the ever-dapper Paul Feig). Lively and Reynolds also went to see their friend Hugh Jackman’s Broadway thing. I could

write 1,000 words on Reynolds’ tan alone, but let’s keep with Lively’s approach here. There was the crosshatch-ribbon bodice grown by Tamara Ralph, a pink latex house

dress by Reneé Masoomian, and the Sergio Hudson yellow sweater and skirt set, inspired by ’90s Versace and worn originally by Beyoncé last fall. Then, as a finale of sorts, she picked a black leather top and pants set with a tucked-pleat peplum contraption on top. It was unequivocally hideous.

Lively, who famously does not work with a stylist, typically knows how to dress in such a way that, even if you don’t like it, you understand it. Other than the Sergio Hudson look—which, on many levels, was perfect—the all-out approach during this press tour felt a little strange given her current P.R. and litigation miasma. Since Lively stopped

working with stylists more than a decade ago, their role has changed—they are more psychologists than anything else—and this tour is a strong argument that she needs one.

What you wear has always been the clearest way to communicate who you are, and that’s truer than ever in the social media age. Because these images travel farther than they did previously, an outfit can change broad opinions about a person. (Lively’s fabulous, all-white Michael Kors look at the CFDAs last November, for

instance, was a positive.) It’s good that Lively has an opinion about clothes and looks comfortable in them, but bringing in the right stylist with an outside perspective could be a boon as she continues to navigate the public fallout of these lawsuits. (By the way, Puck’s legal eagle, Eriq Gardner,

has an update on that for you.)

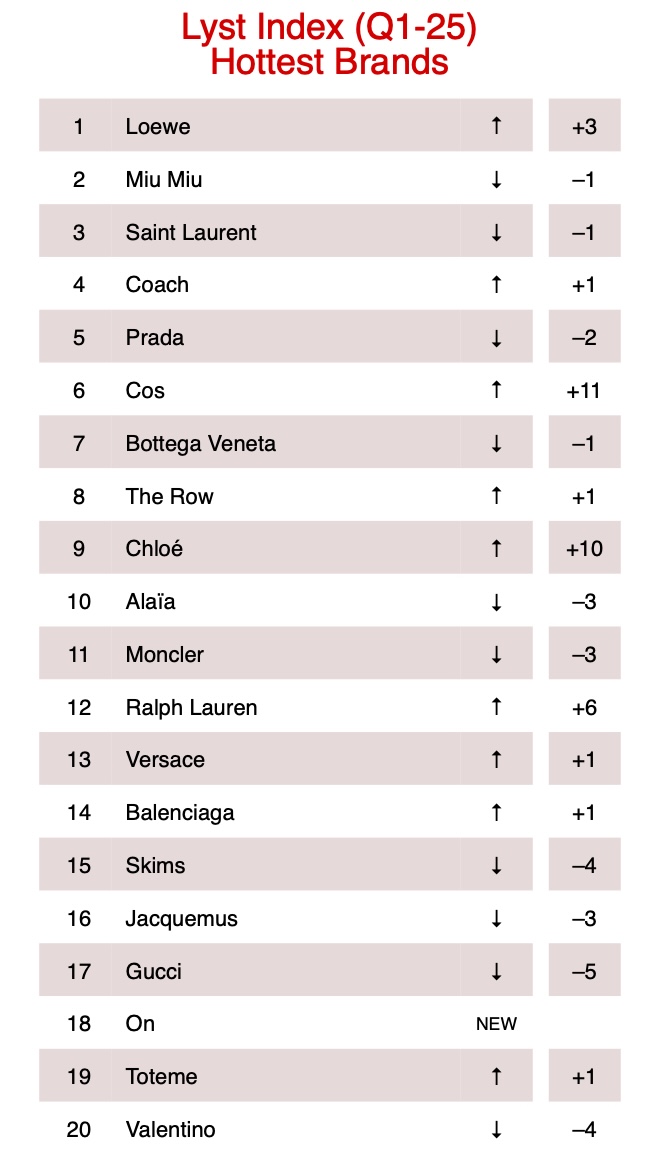

- Sarah on the Jonathan bump and Toteme light: Lyst’s

rankings—compiled from digital searches, browsing behavior, and sales—offer an analysis on what’s popping up editorially and in shoppers’ actual carts.

|

- In Q1,

the speculation around Jonathan Anderson’s move from Loewe to Dior made a positive impact. Loewe knocked Miu Miu and Saint Laurent down to claim the top spot—a likely result of the endless speculation over and eventuality of Anderson’s departure. (We’re already seeing #oldloewe trending in social chatter.) Meanwhile, Cos surged a notable 11 places to become the sixth hottest brand and the first mass-fashion (or high street) brand to crack the top 10. Its success stemmed largely from being the “light” version of considered basics from Toteme or even The Row.

Also of note: Chemena Kamali’s Chloé has finally entered the top 10, jumping an impressive 10

spots. Similarly intriguing has been Dries Van Noten’s continued momentum, increasing 11 percent in demand during Q1 despite the founder’s departure last summer.

Here’s what else I’m keeping an eye on: Coach’s steady ascent, Skims’ decline (down four spots—let’s see whether the new L.A. destination and NikeSkims’ imminent launch can help them climb in Q2), and Ralph Lauren’s impressive six-place climb to 12th. Perhaps most telling: Gucci’s continued slide, now down to 17th place. If this trend continues, could the Italian house fall out of the top 20 entirely? —Sarah Shapiro

|

|

|

All is eerily quiet at Estée Lauder, despite a brand new C.E.O., ongoing layoffs,

underperforming brands, and Stéphane de La Faverie’s executive search for someone to finally lead makeup.

|

|

|

It’s been a quiet few months at the Estée Lauder Companies, where still-newish C.E.O. Stéphane de La

Faverie is preparing for the first quarterly results under his watch. Wall Street is expecting that earnings could be down as much as 11 percent, although the stock has been up a bit the past week, perhaps in anticipation that ELC could surprise to the upside. We’ll see.

Regardless, not much has changed for Lauder since January: Consumer sentiment in Asia remains somewhat negative, and seems destined to get worse as tariff pains take hold; sales

of makeup are down; fragrance is up. Meanwhile, former C.E.O. Fabrizio Freda is continuing to hang around, apparently enjoying his two-year consulting gig—a sinecure, or perhaps a consolation prize, of sorts, after he was pushed aside last year.

|

|

|

A MESSAGE FROM OUR SPONSOR

|

Tariff turmoil is here. Is your ecommerce business prepared to weather the storm? In a survey of 100 ecommerce

executives, 83% expressed concern that new regulations could threaten their business. So how can you stay ahead and stay competitive?

Download Swap Commerce’s “5 Ecommerce Growth Strategies for the Age of Tariffs” for insights and future-proof tips including:

➡️ The hidden costs that could disrupt your business

➡️ How to

protect margins and prevent shipping chaos

➡️ Tips to get ahead of uncertainty

Download the playbook.

|

|

|

Indeed, Freda is still regularly attending management and strategy meetings at the GM Building, I’m told. He

also recently joined de La Faverie’s first offsite in London, an event that the former C.E.O. was not originally scheduled to attend, and which quickly devolved into “a long-winded toast to Fabrizio’s retirement” where “not much got accomplished,” according to a person present. Much to the relief of the senior leadership team, I’m told Freda is finally moving back to Europe in the coming months.

The rolling “Beauty Reimagined” layoffs that kicked off last year are still

in full swing, while executive and senior leadership teams remain pretty stable. Brian Franz was just named chief technology, data, and analytics officer––de La Faverie’s first external hire on the executive leadership team––and Amber Garrison, a rising star and global brand president of Origins, recently quit. Earlier today, it was announced that Carl Haney, the E.V.P. of global innovation and research and development, is also departing. And I

also heard that another executive has informed higher-ups of their plans to leave the company. Meanwhile, de La Faverie has yet to appoint anyone to lead the company’s all-important makeup “cluster.” (Estée Lauder declined to comment on any of this.)

As you can imagine, who will or won’t get the makeup gig has been a hot topic both inside and outside of Lauder. De La Faverie has more or less grouped brands by clusters, or categories, as part of the restructuring—except for the

brands that continue to operate independently under existing leadership: Tom Ford and Balmain are still under Guillaume Jesel; the Estée Lauder and Aerin brands are under Justin Boxford; and Deciem, parentco of The Ordinary, is under Jesper Rasmussen. Along with the creation of the makeup unit, another significant reorg was the formation of a skincare cluster—comprising La Mer, Clinique, Origins, Dr.Jart+, Darphin, and Lab Series—headed up by

Sandra Main, a seasoned Lauder exec credited with turning La Mer into a multibillion-dollar business.

As for the yet-to-be-determined makeup head, this person will oversee MAC Cosmetics, Bobbi Brown, Too Faced, Smashbox, and Glamglow. (But really, it’s only the first three that matter, given the persistent rumors that Lauder will divest Smashbox and Glamglow or shut them down altogether.) My understanding is that Jane

Hudis, Lauder’s chief brand officer, will manage the unit until de La Faverie finds his person.

|

No one has officially gotten the job, at least not to my knowledge, but I’m told the ideal candidate

will likely be an external hire who is ex-Lauder and who works really well with Hudis—prerequisites that narrow the hiring pool substantially. I’ve discussed potential candidates at length with many current and former Lauder executives, high-level industry types, etcetera, over the past few months, and have compiled some of the top contenders—including people who are actually being considered, some who were rumored candidates (including former L’Oréal executive Nathalie

Gerschtein), and one person who just should get the job.

Let’s start with C.E.O. of Supergoop Lisa Sequino, whose name has come up several times over the past few months. Despite being less experienced than others, I’m told she’s very well liked by Hudis, is gifted at performance marketing, and has strong retail relationships. Two people close to Lauder said Sequino might also be considered for a revived C.M.O. position, a role the beauty giant hasn’t

had in years that probably would be a better fit for her.

|

|

|

Either way, Sequino is fluent in Lauder. Before joining Supergoop, she spent nearly a decade in various roles

at Tom Ford Beauty, Estée Lauder, Aerin, and Becca (R.I.P.) before decamping to the ill-fated JLo Beauty. A high-level source said Sequino “seems to be very much committed to her current role,” but it’s no secret that things have been bumpy at Supergoop, largely due to factors out of Sequino’s control (increased competition, hard shoes to fill, the P.E. deal with Blackstone that many say overvalued the company, etcetera).

Then there’s Raffaella Cornaggia, the C.E.O. of

Kering Beauté, who spent 14 years at Lauder. When Cornaggia joined Kering two years ago, the luxury conglomerate had ambitions of building a beauty division from the ground up, with a goal of developing beauty lines for Balenciaga, Bottega Veneta, and eventually Gucci, once its longtime licensing deal with Coty expires. That may not happen, but not because of Cornaggia. “Raffaella came to Kering for a big job, and the job isn’t there. They don’t have the means, and there’s no way––with the sales

of their top brand going down the drain––that they’re going to do more in beauty,” said a person with close ties to Lauder’s executive leadership team. “The reality is that Kering Beauté is going nowhere. It would be a smart move for her to go to Lauder.”

I’m told Cornaggia has the right experience: She’s a talented, no B.S. marketer who spent time at Estée Lauder, the brand, and has worked closely with de La Faverie in the past, both as his head of international and travel retail. (I’m

not sure whether her relationship with Hudis is as strong.) I assume that Cornaggia has been given a decent amount of freedom at Kering, since she knows far more about beauty than any of her superiors, but the conglomerate’s issues are so acute now that beauty surely isn’t a focus. “Kering’s not in expansion mode about anything. They’re in stability mode,” an insider said. “Raffaella probably has a limited mandate and limited capital to do her job.”

What

Lauder really should do, however, is bring back Philippe Pinatel, a former Lauder executive (despite being very un-Lauderlike) who spent the majority of his six years at MAC Cosmetics as the brand’s global president. Pinatel and Drew Elliott, MAC’s former global creative director and one of the most celebrated creatives at ELC, joined MAC around the same time, marking the first significant change in leadership since Lauder acquired the makeup

brand in the late ’90s. Early last year, Pinatel resigned to go be the C.E.O. of Katherine Power’s makeup line, Merit, which in just four years has become about a $130 million business.

Unfortunately, it’s unlikely Pinatel would ever return to the GM Building––that is, unless Lauder were to buy Merit, which they should do, but probably won’t. “They don’t have the money to buy Merit,” a person with intimate knowledge of Lauder’s business told me. Plus, even though I’m told

Merit is not officially in a sales process yet, I have a suspicion that some liquidity event is going to happen very soon. So, alas, ELC will probably have to go with one of the other two.

|

Last week, Ulta Beauty held its first “consumer-focused convention,” which was basically the opposite of the

secretive Sephora Summit, where there were about 200 brand booths, 1,500 attendees, and a mega-influencer host. [BoF]

It was only a matter of time before Alix Earle partnered with Pantene. [WWD]

Experts say hyperbaric therapy could treat… just about anything. [The Cut]

|

Until tomorrow,

Lauren

P.S.: We are using affiliate links because we are a business. We

may make a couple bucks off them.

|

|

|

Puck fashion correspondent Lauren Sherman and a rotating cast of industry insiders take you deep behind the scenes of this

multitrillion-dollar biz, from creative director switcheroos to M&A drama, D.T.C. downfalls, and magazine mishaps. Fashion People is an extension of Line Sheet, Lauren’s private email for Puck, where she tracks what’s happening beyond the press releases in fashion, beauty, and media. New episodes publish every Tuesday and Friday.

|

|

|

Puck’s daily art market email, anchored by industry expert Marion Maneker, offers unparalleled access to the mega-auctions and

galleries, elite buyers and sellers, and the power players who run this opaque world. Wall Power also features Julie Brener Davich, a veteran of Christie’s and Sotheby’s, who provides unique insights into how the business really works.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|