|

Good morning,

It’s Jon Kelly, the co-founder and editor-in-chief of Puck, our new media company focused on the nexus of Wall Street, Washington, Silicon Valley, and Hollywood. As ever, on behalf of our amazing team of journalists, we truly appreciate your ongoing support. We hope that you’re enjoying what you’re reading (and listening to). It’s a pleasure to build this company before your eyes.

Knowledge Partner

Herewith, some content that you might have missed during an exceptionally busy week at Puck. And stick around, below the fold, for the backstory on how it all came together.

MEDIA: Dylan Byers goes inside The New York Times’ succession horse race.

SILICON VALLEY: Teddy Schleifer reveals Reid Hoffman’s $100 million plan to remake our entire election system. and… Alex Kantrowitz uncovers the latest dish on Facebook’s cold war with Apple.

HOLLYWOOD: Matt Belloni presages the future of the movies as the theater business sinks.

WASHINGTON: Julia Ioffe breaks the news on the Cold War saga enveloping D.C. and… Tina Nguyen visits the Harvard of Trumpism.

WALL STREET: Bill Cohan explains what Wall Street learned from 2008: let the regulators go after Big Tech instead.

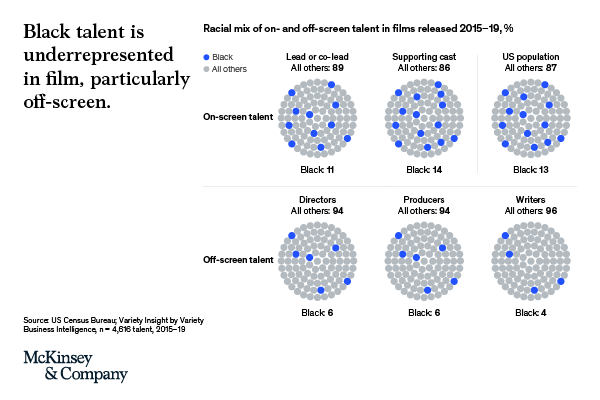

KNOWLEDGE PARTNER The challenges and impact of increasing Black representation in film and TV Black talent is underrepresented across the film and TV industry, particularly off-screen, where less than 6 percent of those playing core creative roles in US-produced films are Black. McKinsey’s research, in collaboration with the BlackLight Collective, reveals the barriers that both onscreen and offscreen Black talent face and offers key solutions to drive diversity, inclusion and equity in this complex workplace. Advancing racial equity across all underrepresented groups in film and TV will not only give audiences access to the many different products of creative expression but it will make the film and TV sector more just and more profitable.

The Times Succession Horse Race

Earlier this month, an email popped into my inbox with a fantasy headline, at least for me: NYT Succession Odds Update. The piece unscientifically detailed the odds for various newsroom leaders to succeed executive editor Dean Baquet. The note hailed from Off the Record, a new digital media platform founded by Gabriel Snyder, a well-regarded journalist, who used to edit The New Republic and Gawker, in its more respectable days, and was previously a star reporter at Peter Kaplan’s Observer, the Wednesday morning periodical of Manhattan’s ruling class. This is a long way of saying that Off the Record is a welcome addition to the media diet of media obsessives, especially those who understand that gossip and intrigue are essential raw ingredients of the trade—and that certainly includes Times succession odds.

I was interested for other reasons, too, some of them a little less dishy. I worked at The Times for about four years, about a decade ago, right when the institution and its leadership grasped the enormity of the challenges that they countenanced. Within the period of a few years, Craigslist had usurped the Times’ classified advertising business, and Facebook and Google were pillaging what remained. I remembered one meeting during my tenure devoted to the fact that The Huffington Post had essentially garnered more traffic from aggregating Times stories than the Times did by publishing them in the first place.

Those were soul-searching years, punctuated by A.G. Sulzberger’s Innovation Report, an overdue cultural colonoscopy of the joint that essentially laid bare a fact that once seemed unfathomable: without drastic improvements and optimizations, the Times was in mortal danger. I remember having drinks with colleagues at Wolfgang’s—the chintzy steakhouse in the lobby of the Times Building—on the evening that Jeff Bezos announced his $250 million acquisition of The Washington Post. That night, my co-workers fathomed the impossible: If the Sulzbergers ever sold, what would the Times fetch?

Here is the guess offered by absolutely no one that night: that by 2021, the Times would have a $9 billion market capitalization, be expanding rapidly into the green fields of audio, and hope to become the dominant credible news source of the English-speaking world, and then some. This would have seemed preposterous a decade ago partly because of the very culture of the organization that Sulzberger was scrutinizing—and, though he would never use these words, attempting to transform.

Back then, the Times’ executive editor position, the newsroom leader, was a quasi-regal statesman role, a vaunted post absent any economic considerations. Abe Rosenthal and Joe Lelyveld didn’t ever worry about the business of the Times; they worried about publishing the Pentagon Papers. But by the time Bill Keller and Jill Abramson ascended the greasy pole, it was clear that things had changed drastically.

Much has been written about the so-called “Chinese wall” that for decades existed between the editorial and commercial sides of the operation to prevent not only any impropriety, but the appearance of it. But that always seemed ridiculous to me. Anyone who could master the professional and political challenges of becoming executive editor surely had some fiduciary understanding of the profession that they had mastered. Or at least they would know how to delegate or manage it, and find ways to be a meaningful partner to the C.E.O.

The problem, it seemed to me, was deeper: back then the culture of the Times didn’t want the newsroom to think about the business—not just the P&L, but also the user experience, the product, the user flow, the customer acquisition strategy. The newsroom generally viewed the business side with disdain, suspicion, or indifference.

KNOWLEDGE PARTNER

Of course, so much about our industry has changed in the past ten years—including the Times’ culture and the role of the executive editor. So when I read the story about the company’s succession odds, I sent it to Dylan Byers to see if it squared with what he was hearing.

Dylan, after all, is an expert kremlinologist of the institution. Earlier in his career, he broke the first story about the tensions within the executive ranks that eventually presaged Dean Baquet’s ascent. It’s one of those stories in which I remember where I was when I first read it. And I can assure you that every employee had scanned the piece two or three times before heading into 620 8th Avenue that morning. As usual, this time around, Dylan spoke to his expert sources and came back with the goods. Joe Kahn, Baquet’s current number two and the odds-on favorite, appears to be a shoe-in for the job, barring some unforeseen (and, frankly, unimaginable) professional crisis. And his number two will likely be Carolyn Ryan. And much of the logic behind the pair comes down to not only their inimitable careers in the news business, but also their business acumen, itself. Khan’s tenure as Beijing bureau chief will help amplify the company’s ambitions overseas. Ryan is perhaps the executive most responsible for transforming the newsroom culture into a Timesian version of the high-octane, always-on, cross-platform machine that Sulzberger fetishized when he authored The Innovation Report. It’s a fun story, and I urge you to check it out.

The rapid digital transformation of our economy has been a leitmotif in this space, and with that in mind I want to call your attention to a couple more exceptional pieces that we’ve published this week. First, Matt Belloni has endeavored on a new series, MovieFutures, which brilliantly assesses the changing nature of the theatrical experience. It’s not actually as bleak as you think. But it is quite nuanced. And as Matt reports, certain genres of film may basically disappear from the movie house entirely.

Similarly, Teddy Schleifer has a fantastic exclusive on Reid Hoffman’s attempt to remake our election system in a manner that might mute the electability of fringe candidates on both the right and left. Is it quixotic? Sure. But it’s yet another example of the manner in which Silicon Valley billionaires are bringing their moonshot thinking to politics and other fields, often to the consternation of their critics.

Speaking of which… You know who will love this idea? Wall Street C.E.O.s. As Bill Cohan notes in this week’s most unlikely feel-good story, Wall Street is having a record year in almost every respect: earnings, profitability, EBITDA, deal flow. But the industry’s greatest gift may be a black swan event it could have never predicted: that more than a decade after the financial crisis, politicians and regulators would have moved on to direct their ire at the tech industry, allowing them to have their cake and eat it, too.

Thanks so much for your support. Have a great weekend.

Jon

P.S. - if there's something holding you back from becoming a subscriber, I'd love to hear about it. Please feel free to reply to this email with your feedback (replies go directly to my inbox).

|

-

Join Puck

Directly Supporting Authors

A new economic model in which writers are also partners in the business.

Personalized Subscriptions

Customize your settings to receive the newsletters you want from the authors you follow.

Stay in the Know

Connect directly with Puck talent through email and exclusive events.