| Eriq Gardner: Well, the Bankman-Fried trial is finally underway, and my most frequent thought as I’ve sat in the courtroom has been, Oh man, this all happened so damn quickly. I think I’ve got food in my refrigerator that’s older than many of the events being described in testimony. Remember, FTX was only founded in 2019; S.B.F. was arrested a little more than three years later. I was surprised, last December, when prosecutors brought charges just a month after FTX’s collapse, and now we’re a few weeks away from a verdict. It’s not a long period of time to go from being Dale Carnegie, winning friends and influencing people, to facing up to 115 years in prison. Teddy, you’ve written more than most on S.B.F.—what’s the trial been like for you?

Teddy Schleifer: Nostalgic, surreal. Sitting three rows behind S.B.F. when prosecutors accused him of orchestrating one of the greatest financial frauds in history, I couldn’t help but wonder, of course, whether I should have seen it coming. I was ruminating during one of the breaks about when I first reached out to Sam in October 2020, for what I think was one of his first interviews ever. When I watched his parents, Barbara and Joe, scribbling notes to one another on a yellow legal pad like they were co-solving a math problem, I couldn’t help but recall first crossing swords with Barbara four years ago for a story I wrote about her political group, before I even knew who Sam was. When I first saw Sam in his new, Mark Zuckerberg-inspired haircut on Wednesday, I thought about the last few times I met with him in person—under house arrest. I truly saw this story unfold from the beginning, but in some ways, I didn’t see it at all.

But OK, this isn’t about me and memory lane. Eriq, you’re one of the sharpest legal minds in journalism. We were together for Wednesday’s opening statements, and then traded seats Thursday and Friday. What’s your early impression of the prosecution’s case?

Eriq: You know, going only by what was previewed during opening statements, it seems that prosecutors have a solid case, if not quite a slam dunk. But strip away testimony from those FTX executives who took plea bargains and became cooperating witnesses after the initial indictment came, and this case would be much less certain, at least in my eyes. For one thing, it doesn’t have a tremendous amount of incriminating communications. Meaning, prosecutors really gambled on flipping Bankman-Fried’s colleagues and getting them to confess to knowingly breaking the law.

Teddy: I wonder if that was always the plan, or if the prosecution got lucky. The cooperating witnesses have since supplied a ton of incriminating communications. Take Gary Wang, the FTX co-founder who was on the stand all of Friday and picks things up on Tuesday. He was hardly an articulate speaker on direct examination, but he was dropping bombs because he had receipts of Signal chats and Google spreadsheets that showed Alameda’s balance sheets at various points in 2022, for instance. Or how about the scoop that Sam wanted to shut down Alameda in the fall, but couldn’t because Alameda was sitting on money from customers? Gary had that memo, too. Gary, we discovered on Friday, was sprinting to prosecutors—he was already in contact with them around Nov. 17, which is before Sam’s indictment in early December.

Eriq: I think prosecutors have done an excellent job so far at keeping the narrative as straightforward as possible, especially during the opening statements. They didn’t get distracted by trying to explain the details of how crypto works. Instead, they just made the simple point: Billions of dollars of customer money was secretly misappropriated by the lying defendant. Full stop. They sprinkled in some theatrical elements, like how S.B.F. was living large in the Bahamas and spending money to hang out with Tom Brady, but really, there’s almost nothing we didn’t already know. And that’s OK. Prosecutors leaned on their biggest advantage: common sense.

Teddy: Totally. I was in the courtroom itself and thought Thane Rehn, the baby-faced blonde prosecutor who delivered the opening statement, made this reductively simple for the jury. At one point he presented a screenshot of what the FTX dashboard looked like if you logged into your account, just to impress upon a juror that if they signed in and saw $50,000, you expected to have $50,000. At the top of my notebook on Wednesday, I wrote in all-caps the phrase that has become the prosecution’s mantra: “BUILT ON LIES.”

The crux of their case is that “this man”—Bankman-Fried, whom Rehn pointed at twice—is just a premeditated liar and a schemer who thought he was untouchable, and you don’t have to know anything about crypto to get that. Again, simple. Though I will say that on Friday, when Gary was being cross-examined by the defense, I did detect some signs of exhaustion on the faces of the jurors—eyes rolling toward the ceiling, hands rummaging through hair, one guy falling asleep. They still have five weeks to go.

Eriq: Regarding the defense, I’ve got to say I’m not particularly impressed by what I’ve seen so far. On one hand, it does seem to me that there’s a real opening for Bankman-Fried’s legal team to stress that there was never any particular plan to abscond with customer money. Mark Cohen, S.B.F.’s lead attorney, tried to make that point in his opening, where he argued that launching and running FTX was like “building the plane as they were flying it;” that crypto isn’t for the faint of heart, and that prosecutors are presenting a “hindsight case” arising from the collapse of the business. (This is not unlike the defense that S.B.F. has offered in the media, and to you, Teddy, that FTX would have been fine and nobody would have lost their money if not for the run on customer deposits and the lack of bridge financing.)

Personally, I thought Cohen came across pretty meekly: he didn’t hammer his points effectively, and hasn’t really countered what’s coming from prosecutors besides complaining about “out of context” evidence that paints his client as a “cartoon villain.” Sure, it’s early, but do you share my assessment that the defense seems to be struggling?

Teddy: The defense’s opening was certainly much less of a story and much more technical—they even showed FTX’s Terms of Service! Of course, it’s their view that the story is much less facile, and that complexity strikes me as S.B.F.’s friend here: If his team can convince a jury that this was all pretty convoluted and who’s to say how FTX customer deposits really ended up at Alameda—hey, isn’t business pretty confusing and complicated?—then maybe that swings a juror to acquit. They only need to convince one person that Sam wasn’t at fault.

But yes, so far, the defense isn’t punching through, though I did think their case was summed up pretty well by the line that “It’s not a crime to get Tom Brady to do ads for your company.” The gist is that Sam’s decisions were “reasonable” and “in good faith”—an endorsement deal with Brady is just smart marketing, not some brazen scheme—but just look bad in hindsight.

There’s a little bit of a Nixonian “Mistakes Were Made” undercurrent to the defense; we’re hearing plenty of passive voice about things “getting overlooked.” If anything, the defense is gearing up to essentially prosecute Caroline Ellison—who, duh, isn’t on trial, but is taking the stand later this week, where she’s expected to testify that Sam instructed her to commit crimes. Of course, she’s also Sam’s ex-girlfriend and the person who most shares responsibility for the misappropriation of customer funds. (Remember, she pleaded guilty and took a plea deal almost immediately after Sam was arrested.) I can’t wait for that cross-examination. She’s clearly the most important witness in the entire trial, so if Cohen doesn’t land his punches then…

Eriq: Certainly it might impact what you recently described as the $30 billion question: whether S.B.F. himself will take the stand. I agree it’s going to be one of those last-minute calls based on the state of the trial after all his ex-colleagues testify—particularly Ellison. He might have to testify in order to clean up any damage she does to him.

As for the witnesses called so far, Wang has no question been the most spectacular, straight out confessing to a conspiracy to commit wire fraud and telling the jury about conversations with Bankman-Fried after Alameda racked up losses. For example, there was that time in early 2020 when Alameda’s negative balance had climbed past $200 million. Wang said he was surprised by the amount and went to Bankman-Fried to discuss. Ordinarily, this might mean that Alameda’s account would be liquidated on the FTX exchange. But Bankman-Fried told him they should include the value of FTX to cover Alameda. There were problems with doing that, and the point really is that the two had consciousness about the debts, about the commingling, about the shady financial moves being made to keep the operation afloat. It’s no surprise why prosecutors really seized on it.

Matt Huang, the co-founder and managing partner of Paradigm, which invested over $250 million in FTX, was also a compelling witness. He effectively conveyed how he was promised that his hedge fund’s money would go to FTX, not Alameda, and that Alameda wouldn’t receive any preferential treatment on the trading platform—both claims that turned out to be obviously false. I didn’t hear much of a rebuttal during the cross. Did anything in the witness testimony stand out for you so far?

Teddy: When I saw Wang on Friday, I thought he was a highly credible witness—especially given his reputation inside FTX as someone who barely spoke. On the stand, he was clinical about the chronology and almost wry with his ripostes. When prosecutors showed jurors the famous November S.B.F. tweet about FTX and customer assets being “fine,” Wang was asked whether that was “accurate.” “No,” Wang replied. “Because FTX was not fine and assets were not fine because FTX did not have enough assets for customer withdrawals.” Simple as that!

Eriq: In the courtroom, numerous reporters have been snickering at the struggle of S.B.F.’s attorneys, Cohen and Chris Everdell, to ask questions without eliciting objections. What I find remarkable here is not the struggle per se—cross-examination is always tough!—but the source of the difficulty. It seems that the defense really hoped Wang and former employee and friend Adam Yedidia would confirm that Bankman-Fried at least had honest intentions for his enterprise when, for example, he ensured that Americans weren’t using the international version of FTX (which allowed margin trading), or when he asked Congress to regulate the crypto market.

The problem, of course, is they’re not permitted to speculate about what Bankman-Fried wanted. Which strongly suggests that S.B.F. will indeed take the witness stand at some point. After all, it’s presumably the goal of the defense to tell the jury that this was more than a criminal racket, that jurors should take a broader view of the entire situation, including of the fly-by-the-seat crypto market. They need someone to tell that story. And if not S.B.F, then who?

Teddy: If S.B.F. doesn’t testify, I’ll eat some of that old food in your fridge. Regardless of what happens over the next few weeks, he will not be able to help himself.

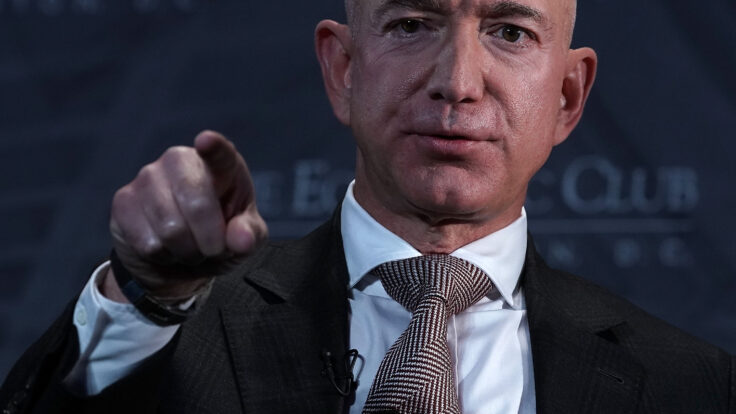

Eriq: I spied you reading the new Michael Lewis book about S.B.F., Going Infinite, during the trial breaks. So far, it’s received a fairly negative response from critics, many of whom seem to have come to the same conclusion as the smirking reporters in the courtroom: that Bankman-Fried is a crook and that prosecutors have already made their case. There was a sense after Lewis’s 60 Minutes interview, in particular, that he got snowed by S.B.F., whom he still views as a somewhat sympathetic antihero, or that he was caught off guard by his own story’s end.

The backlash may also have more to do with the author than the subject, following last month’s Blind Side controversy. (As Bloomberg notes, “It’s impossible to miss the differences in Lewis’s treatment of Bankman-Fried, a socially awkward young man afforded near endless empathy by the author, and Michael Oher, the socially awkward young man whom Lewis treats as a nearly mute spectator in his 2006 book, The Blind Side.”) Anyway, what did you think about the book?

Teddy: How did things get so sideways over the last week that it’s become contrarian in the culture to think that the Michael Lewis book is actually good? Yes, I shared the public’s outrage based on the early snippets from his media tour, but now that the book is out, maybe critics should actually read it? There is some juicy stuff about Sam’s childhood, his time at Jane Street, and the break-up at Alameda Research, for instance. The fly-on-the-wall tick-tock of FTX’s final weeks—from inside S.B.F.’s penthouse in New Albany—are unlike anything I’ve read. My notes in the margins of the book feature a lot of “How did he get that?” Well, it’s obvious how he got it—Sam gave Lewis a lot of Google Docs and Signal chats, including those of other people—but it’s a mistake to think that the book is entirely from Sam’s perspective. There is plenty of other reporting from other sources in there. People are free to disagree with the sympathetic portrait, but as a reporter I was jealous of all the vivid scenes.

Eriq: I actually wonder whether Bankman-Fried’s team should be putting Lewis on the witness stand. It’s probably too late and it might have provoked an interesting side fight, and yet, watching him a week ago on 60 Minutes, it occurred to me that Lewis, who apparently was a first-hand witness for so much, is exactly what S.B.F. needs during this trial. A gifted storyteller who can explain to the jury that the defendant was trying to run an honest business and got over his skis. I think there’s irony in the fact that Lewis’s book will reach millions of people—but none who will actually decide S.B.F.’s fate.

|