|

|

|

Welcome back to Dry Powder. I’m William D. Cohan. Thank you for the outpouring of commentary surrounding my jailhouse interview with Sam Bankman-Fried, certainly one of the more fascinating, compelling, and jarring interviews that I’ve ever conducted. I can tell you this: Much to my surprise, Sam is as strong-willed as ever.

In today’s issue, more Paramount game theory. And a quick note for subscribers: We’ve updated our Member Information questions. They take a few seconds to fill out, and will help us develop news products tailored to your interests. You can find the page here, just make sure you’re logged in. Thanks.

But first…

- Chase West: Is Wells Fargo becoming a subsidiary of JPMorgan Chase? No, of course not. The Federal Reserve, which regulates both banks, would never allow such a thing. But it’s increasingly fair to say that Wells Fargo is becoming a material branch of the Jamie Dimon coaching tree, and that is becoming more and more evident all the time as one JPMorgan Chase alum after another gets a big job at the San Francisco-based bank.

Of course, longtime Dimon lieutenant Charlie Scharf is nearly five years into his tenure as C.E.O. My friend Jon Weiss and Fernando Rivas, the two co-heads of Wells’ corporate and investment banking division, are both JPMorgan Chase alumni. In fact, Rivas was just named co-head of the division after a 30-year career at JPMorgan Chase. Wells also just named Doug Braunstein—a former head of M&A at JPMorgan Chase and C.F.O. of the firm during the London Whale scandal—as a vice chairman. That position was briefly held by Tom Nides, the former Morgan Stanley executive and former U.S. ambassador to Israel, who gave up the Wells post after the Hamas attack on October 7 to make himself available to the Biden White House, if needed. Nides, also a longtime friend, is now a vice chairman at Blackstone.

Longtime readers will know that Braunstein and I have a special relationship, too. He used to be my boss at JPMorgan Chase when I was an M&A banker, running the media and telecom practice. Doug was the one who fired me in January 2004, as part of the many waves of layoffs at the bank following the September 11 attacks, and before Jamie arrived and made it the powerhouse it is today. Wells’ market value these days is $210 billion. JPMorgan Chase’s is $570 billion. It’ll be interesting to see if the JPM crowd at Wells can close that gap.

|

|

And now for the main event…

|

|

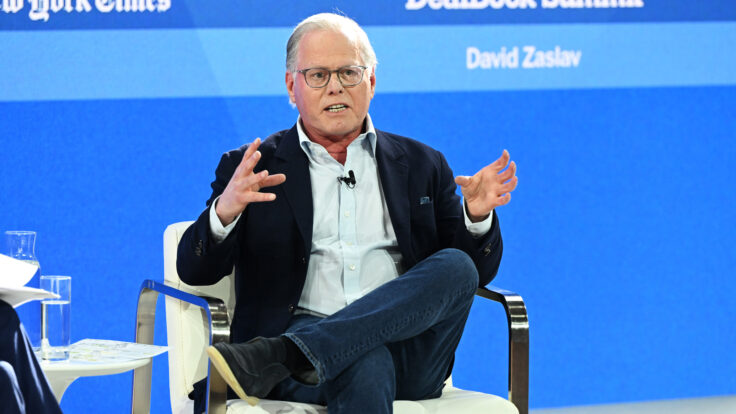

| Vulcan Zaz |

| Could the Paramount mess actually provide an unexpected benefit to David Zaslav and Warner Bros. Discovery? |

|

|

|

| Now that the battle for Paramount has entered the black box phase, wherein everyone stays quiet and the bankers and lawyers help Shari Redstone decide to sell her company to either RedBird and Skydance (and face shareholder lawsuits aplenty) or Apollo and Sony (and face months of government scrutiny) or just say Fuck it, and keep going it alone (without much of a strategy, or an individual C.E.O., and down four board members). There aren’t any brilliant solutions at this point, particularly with her potential partners all likely feeling some level of deal fatigue amid this indecisive and self-destructive auction process. That’s in part why I think the person most likely to walk away with some of the most interesting, and potentially strategic, spoils of this war will be our friend David Zaslav at Warner Bros. Discovery.

After all, both Sony/Apollo and Skydance/RedBird are primarily interested in the Paramount studio; neither cares as much about Paramount+ and CBS. Meanwhile, Zaz has long coveted CBS, as he told me years ago, before he did the deal for WarnerMedia. My bet is that he would still love to get his hands on the asset and combine it with CNN to create a news-gathering behemoth, and then unleash C.F.O. Gunnar Wiedenfels and his team of synergy experts to jettison costs left and right. Would Zaz also be interested in the local CBS stations? I don’t know, but if WBD doesn’t want them, chances are they could find a home at Tegna, Nexstar, Gray, or Sinclair. The sale of CBS and its affiliated stations would likely have significant tax implications, but their value is much lower than it was years ago, so I suspect that can be managed.

|

|

A MESSAGE FROM OUR SPONSOR

|

|

| Dissatisfied with your checking or savings account yield? The Global X 1-3 Month T-Bill ETF (CLIP) provides a strategic alternative to cash holdings through a basket of short-term U.S. Treasuries – all in one trade.

Discover how short-term treasuries could serve as a buffer against the ups and downs of interest rates in a simple and smart way.

Explore CLIP

|

|

|

| What about Paramount+? No matter who wins, Paramount+ has to be shut down or merged with another streamer. Losing $1.6 billion a year on a streaming service is not tenable (although the company hopes Par+ will be profitable by next year). Former Paramount Global C.E.O. Bob Bakish famously nixed a joint venture opportunity between Par+ and Peacock for reasons that apparently miffed Shari. But Max might be a better dance partner than Peacock. According to Zaz’s comments during last week’s earnings call, Max was profitable in the first quarter “despite heavy launch investments” in Latin America, and its subscriber base increased by 2 million, bringing the total subscribers into the range of 100 million. Zaz has also said that he believes the streaming service is on track to earn $1 billion, or more, in EBITDA—note he didn’t say “adjusted EBITDA”—in 2025.

Obviously, Max still has less than half of Netflix’s 220 million subscribers, for which the market has rewarded Netflix with a value of $262 billion, or more than 10 times WBD’s market value of $20 billion. (It’s worth noting, of course, that Netflix makes money—$5.4 billion of net income in 2023, compared with a $3.1 billion loss for WBD. Perhaps combining Max’s 100 million subscribers with Paramount+’s 67 million will allow WBD to not only better compete with Disney+, Prime Video, and Netflix, but maybe even begin to capture a fraction of Netflix’s extraordinary earnings multiple of 48x its 2023 net income.

|

| Between a Rock and a Zaz Place |

|

| Now that the Reverse Morris Trust restrictions are off, WBD can do deals again without fear of tax consequences. And I would not be the least bit surprised to see Zaz walk off with CBS, its local stations, Paramount+, or some combination of the three, if Paramount ends up in Apollo hands. He may, in fact, be the savior that each of Sony/Apollo, Ellison/RedBird, and CBS chief George Cheeks are looking for to guide them through the regulatory and financial thicket that may result if Shari finally picks one of her suitors.

Part of why I think Zaz emerges a winner in the Paramount follies has to do with him having thrown off the Reverse Morris Trust shackles, but I also think the market is truly underestimating WBD’s first-quarter performance and the growing momentum at the company. (This is not investment advice.) First of all, WBD is making money, even if it’s not yet producing net income. And by that I mean free cash flow, one of the most important metrics on Wall Street—and, yes, the key factor in Zaz’s endlessly fascinating compensation calculus. In the first quarter of 2024, historically WBD’s weakest of the year, the company generated $400 million of free cash flow, a turnaround of $1.4 billion from a $1 billion loss a year earlier.

What’s more: In the last trailing 12 months, WBD has produced $7.5 billion in free cash flow. Thanks to the free cash flow generation, WBD has paid down more than $6 billion of debt in the last 12 months, including debt reduction of $1 billion during the first quarter, which featured the clever move of buying $400 million of its own debt in the market at a discount. Since the start of the WBD experiment, the company’s net debt has been reduced to less than $40 billion from $55 billion. WBD management remains “committed,” Gunnar said on the first-quarter earnings call, to reducing the leverage ratio to between 2.5x and 3x.

|

|

|

| According to Gunnar—and I find this most interesting—the average cost of WBD’s debt is 4.6 percent. That means the company’s cost of capital is relatively low, especially since the debt has an average maturity of 15 years. That also means, in the current rate environment, that WBD’s debt trades at a discount to par because interest rates on newly issued and similarly rated BBB debt are much higher than 4.6 percent. According to Gunnar, the spread between the actual cost of WBD’s debt and what it would cost WBD if that debt were issued or refinanced today is a “$6 billion asset in our debt stack.” He added that WBD would try to capture the value of that asset by continuing to buy WBD’s debt at a discount, using up to $1.75 billion of WBD’s cash. That’s just smart.

Equity investors may not like WBD’s stock price or its prospects—the stock is down 67 percent since WBD started trading publicly in April 2022—but WBD’s creditors seem to be pretty happy. WBD is a publicly traded L.B.O., and when its debt gets paid down and its cash flow increases, equity value is created (or should be). I understand why equity investors are still skeptical of the WBD story, but Zaz’s longtime mentor John Malone didn’t get to be a multibillionaire by making big mistakes, and he is still a big shareholder and on the WBD board. At some point, equity investors are going to clue into the fact that as the WBD debt gets paid down, the company’s equity value should increase.

In addition to the ongoing financial engineering, there are other green shoots. Warner Bros. is currently one of the hottest movie studios in Hollywood, amid a run that includes Barbie, Wonka, and Dune 2. So far this year, Warners has generated $1.8 billion in box office revenue and was the first movie studio to generate more than $1 billion in revenue in 2024. Not for nothing, I assume, are all of Ryan Coogler, George Clooney, Tom Cruise, Peter Jackson, and Paul Thomas Anderson in the Warners fold. HBO had a big year in 2023, with House of the Dragon, White Lotus, The Last of Us, etcetera, and Warner Bros. Television remains one of the most important producers of TV shows in Hollywood, with some 110 in its repertoire, including Abbott Elementary, Shrinking, Ted Lasso, and the Chuck Lorre portfolio on CBS.

I also want to take the other side of the NBA debate. I have no idea whether WBD will be able to make a deal with the NBA or not. But if Brian Roberts and NBCU get the NBA rights, it will be because they paid up big time for them. And if Zaz loses the NBA, I suspect he will find a profitable alternative use for that $25 billion-plus that he would have spent over the next decade on NBA content. Perhaps he’ll go after UFC rights, or deploy the cash elsewhere. While it’s obvious that the NBA would shore up TNT’s and WBD’s cable leverage with distributors in the near term, who knows what the future value of those advertising packages will be after all the biggest players build out their AVOD tiers.

Zaz also has the right to match Amazon’s offer of $1.8 billion a year for 11 years for a different package of NBA games, including games on Saturday nights, the in-season tournament and some postseason games. And as he said on the earnings call, “We’ve had a lot of time to prepare for this negotiation, and we have strategies in place for the various potential outcomes. However, now is not the time to discuss any of this. Since we are in active negotiations with the league and under our current deal with the NBA, we have matching rights that allow us to match third-party offers before the NBA enters into an agreement with them.”

I get that in its first two years, WBD has unquestionably been a loser stock. But I think equity investors are missing the bigger picture here. As the WBD debt continues to get paid down, the equity value has no choice but to go up. After all, we are in an age when content is just as important as distribution. (That’s certainly what we believe at Puck.) And there’s little doubt that WBD continues to produce some of the best content anywhere on the planet. Does it have the best distribution? Probably not. But Zaz is doing everything he can think of to solve that problem, too, including the Spulu sports bundle deal he made with Lachlan Murdoch and Bob Iger and the streaming partnership he just forged with Iger and his Disney+ and Hulu. And if he somehow ends up with CBS or Paramount+ and unleashes Gunnar? Well, then, we may just find out what the whole WBD narrative that Zaz and Malone have been cooking up is all about.

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|