It’s hard to know sometimes where the tipping point lies. Or what causes one event to happen rather than another. But, there’s no question les jeux sont fait, as Jean-Paul Sartre might have said, for my old colleague, Ken Jacobs, at the top of Lazard at the time of my May 11 column about the firm and Jacobs’ tenure as its chief executive. It was obvious to anyone watching that his time as the C.E.O. of the firm had to be nearing its end: He’d been there 14 years, during which time the stock had done nothing except go down 27 percent; he had just made the decision to lay off 10 percent of the workforce, something Lazard had never done before in its majestic 175-year history; and, to put it mildly, the troops were getting restless.

Try Puck for free

Sign up today to join the inside conversation at the nexus of Wall Street, Washington, A.I., Hollywood, and more.

Already a member? Log In

- Daily articles and breaking news

- Personal emails directly from our authors

- Gift subscriber-only stories to friends & family

- Unlimited access to archives

- Exclusive bonus days of select newsletters

- Exclusive access to Puck merch

- Early bird access to new editorial and product features

- Invitations to private conference calls with Puck authors

Exclusive to Inner Circle only

Latest Articles from Wall Street

William D. Cohan

•

May 21, 2023

The Epstein Files Backdoor

While Republicans have fled Washington for the summer in the hopes that the Epstein scandal goes away, attorney Dan Novack’s FOIA battle with the F.B.I. has been wending its way through the courts. This fall, we may finally get some answers.

William D. Cohan

•

May 21, 2023

The World According to Yergin

Welcome to the fourth annual State of the Energy Markets conversation with my friend Dan Yergin, Pulitzer Prize–winning author and vice chairman of S&P Global.

William D. Cohan

•

May 21, 2023

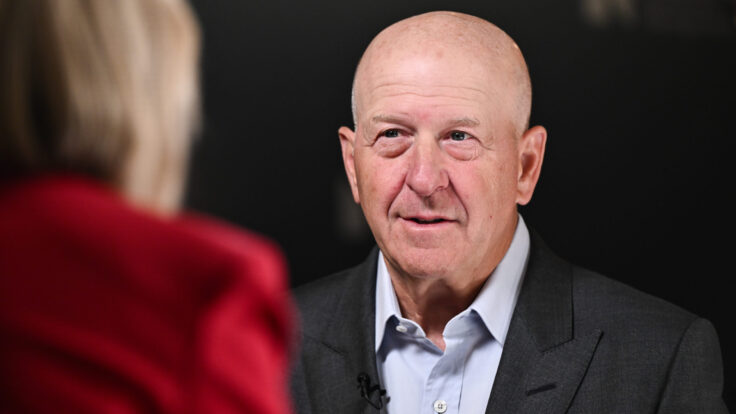

The New Goldman Age

David Solomon has Goldman Sachs operating as effectively as ever—returning billions to shareholders and prepared to take advantage of the regulatory environment to capitalize on a fertile M&A landscape.

William D. Cohan

•

May 21, 2023

The Chanos Big Short

Michael Saylor’s Bitcoin repository, now known as Strategy, is enjoying a 2x premium on its BTC holdings. Is this legit, or simply erogeny for Bitcoin maximalists? The legendary short Jim Chanos has another idea…

William D. Cohan

•

May 21, 2023

Make-Up Saks

News and notes on the latest creditor-on-creditor violence taking place at Marc Metrick’s debt-stacked baby, Saks Global—including a new twist in the form of a potential big short.

William D. Cohan

•

May 21, 2023

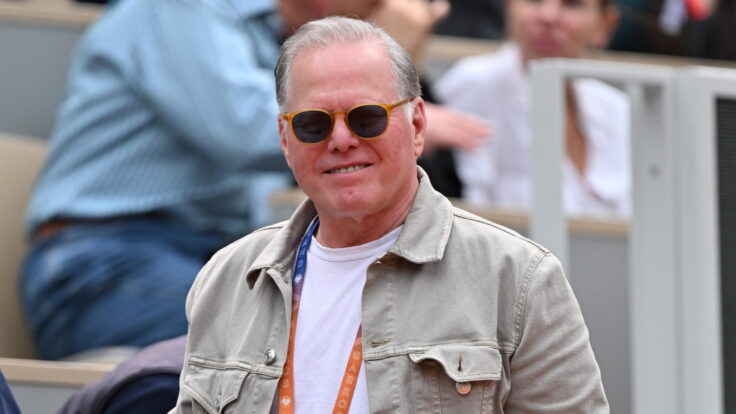

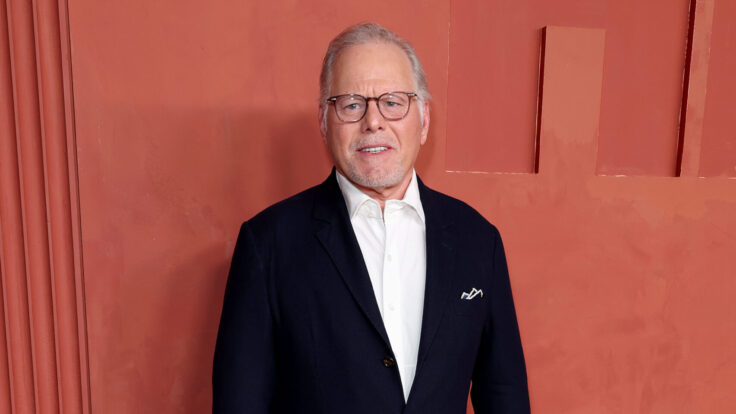

Zaz’s $6 Billion Debt Dowry & A Hedge Fund’s Happy Ending

As Warner Bros. Discovery prepares to split in two, Wall Street is salivating over the financial alchemy underpinning the company’s plans to pay down, and divvy up, its outstanding debts—with something like $20 billion or so staying with the cable TV group, and the remaining $6 billion following Zaz on his new Studios & Streaming journey.

William D. Cohan

•

May 21, 2023

Everything You Wanted to Know About Saks…

…But were too afraid to ask. Yes, we’ve reached the creditor-on-creditor violence stage of this financial soap opera.

Get access to this story

Enter your email for a free preview of Puck’s full offering, including exclusive articles, private emails from authors, and more.

Latest Articles from Wall Street

William D. Cohan

•

May 21, 2023

How Wall Street Stopped Worrying and Learned to Love the Bomb

In an informal survey of the lords of high finance, executives praised Trump’s strike on Iran, admitted to getting a little verklempt over Israel, and said they won’t worry about the market until there are American boots on the ground. It’s the New York mayor’s race that keeps them up at night.

William D. Cohan

•

May 21, 2023

A Matter of Life and Jeff

Correcting the record on the decline and dismantling of GE—once the most valuable company in the world—under Jeff Immelt.

William D. Cohan

•

May 21, 2023

Debt Becomes Him

David Zaslav leveraged his way to media moguldom, then diligently paid down $21 billion of debt in three years, and is now making an unusual debt tender offer as part of the process of spinning out WBD’s linear TV assets. Is the offer really too good to refuse, or is it a coercive maneuver that leaves bondholders with little choice?

William D. Cohan

•

May 21, 2023

The Zaz Age

As Gunnar Wiedenfels licks his chops over the debt-reduction possibilities at his cable-asset-heavy RemainCo, it’s time to contemplate the possibilities for Zaz’s Streaming & Studios venture. Is a 13x EBITDA multiple possible? If so, could this business kiss a $40 billion market cap, which is nearly twice the value of WBD?

William D. Cohan

•

May 21, 2023

Zaz’s Financial Alchemy & The GunnarCo Perimeter

Now that WBD is splitting in twain, a series of complex deals—a $17.5 billion bridge loan, a syndication, bond buybacks, etcetera—are about to commence… all likely in the name of future transactions. Let the games begin.

William D. Cohan

•

May 21, 2023

The Shari Nightmare Scenario

It’s not at all clear where Shari Redstone would come up with the $550 million she would owe her creditors if the Skydance-Paramount deal falls through—and the consequences are mind-boggling.

William D. Cohan

•

May 21, 2023

Another Day in Sharidise

So what happens if Shari Redstone can’t close her Paramount deal by the fall—as is becoming increasingly likely? A $300 million payment to the Ellisons, another $250 million to Byron Trott, the potential liquidation of National Amusements, and that’s only the start. (This is not investment advice.)

You have 1 free article Left

To read this full story and more, start your 14 day free trial today →

Already a member? Log In