|

Market Frenzy, Donny vs. Ronny, and the Showtime Dilemma

Happy Monday and thanks for reading The Daily Courant, your afternoon snapshot of what’s new at Puck.

Today, Matt Belloni cuts through the hysteria with a grounded, incisive analysis of Netflix’s recent stock market collapse. Even with a slower trajectory, Netflix’s business hasn’t changed, and its fundamentals are pretty solid. Hell, Netflix is even cash flow positive this year. So who cares what Wall Street thinks?

Then, below the fold: Tina Nguyen examines the game theory underpinning the Donny-Ronny feud in South Florida; Belloni considers the merits of Showtime; and Bill Cohan performs a health check on Peloton C.E.O. John Foley.

The stock price apocalypse is a market problem more than a business problem. Netflix may not be growing fast enough for Wall Street, but what’s wrong with throwing off tens of billions of dollars in cash? Sssh, don’t say this too loudly. What if, just maybe—this is tough—but maybe, stay with me… Netflix is just a regular old entertainment company? I know, that’s blasphemy. Entertainment? What? That’s the Business That Must Not Be Named. Netflix, of course, is a technology company—a global, algorithmically driven, product-first engagement machine. It might produce and distribute what Hollywood people call “movies” and “television shows,” but to the stock market, the content is merely a $15 billion a year annoyance. The Netflix platform—and its seemingly unending growth, thanks to its first-mover position in streaming—is what has driven the sky-high valuation.

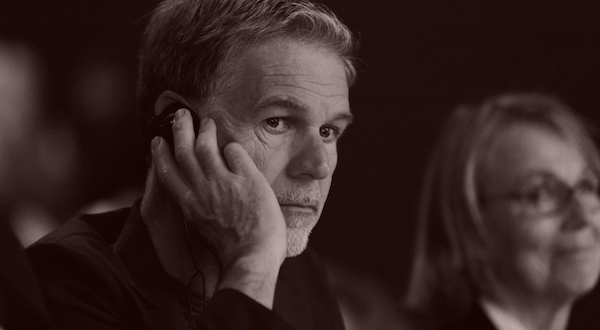

Not anymore. This week’s wild stock slide—down 20 percent in a day to below $400 a share, and off about 40 percent since the high of nearly $700 just two months ago—is more than merely a correction, or part of an overall NASDAQ retrenchment. Netflix’s subscriber miss and, most alarming, its forecast of just 2.5 million new subs for the current quarter, pissed all over its growth narrative. Instead, with 222 million members, Netflix is now—gasp—a maturing media company, with all the pros and cons that entails. “For now, we’re staying calm,” co-C.E.O. Reed Hastings said. Few investors joined in his serenity.

The company’s worst stock drop in a decade is certainly a big deal, so it’s no surprise that the Netflix bears immediately came out of hibernation. That includes the Hollywood traditionalists who have watched in horror as the Los Gatos interloper used its vaulting stock price to remake the industry in its image, devaluing content with its always-on firehose, killing talent backends, maiming movie theaters and the cable bundle, and convincing stars like Leo DiCaprio and Jennifer Lawrence to happily appear in what Spielberg called “TV movies.” Everyone cashes the Netflix checks, of course, but there’s always been a tinge of distrust around town, like maybe co-C.E.O. Ted Sarandos, in his fancy sports car, is driving everyone off a cliff. The stock sell-off has reinforced those doubts…

FOUR STORIES WE’RE TALKING ABOUT HBO Max had a rough launch. But in the span of several months, it has transformed itself into a credible Netflix challenger. JULIA ALEXANDER Despite the narrative, Trump and DeSantis don’t hate one another’s guts. Instead, they are involved in a more complex game theory. TINA NGUYEN C.E.O. Bob Bakish should do the obvious: merge Showtime and Paramount+ into a single, more valuable streaming service. MATTHEW BELLONI Notes on Peloton’s market value collapse, Netflix’s future, M&A arbitrage, and Apollo’s next potential pound of flesh. WILLIAM D. COHAN

|

-

Join Puck

Directly Supporting Authors

A new economic model in which writers are also partners in the business.

Personalized Subscriptions

Customize your settings to receive the newsletters you want from the authors you follow.

Stay in the Know

Connect directly with Puck talent through email and exclusive events.