Welcome back to Wall Power, our private email on the inner workings of the art

market. I’m Marion Maneker.

Tonight, Julie Davich sends in her dispatch from the European Fine Art Foundation fair, a.k.a. TEFAF, which now takes place over eight days in Maastricht—a necessary improvement over the 10 days that dealers used to spend in the drab and remote Dutch city. TEFAF is a world unto itself, where museum curators pore over pictures with UV flashlights and art dealers are available to answer questions—no question too arcane!—for the

entire duration of the fair. It’s famous primarily for the depth and variety of Old Master art and objects from antiquity, but changing tastes have caused some recent soul-searching, and the fair is still trying to regain its footing. Julie has more on how the dealers fared.

But first, there were some sparks at auctions this week…

|

- M.F. Husain sets a record: Indian art is currently on fire. A large mural by Maqbool Fida Husain, a towering figure in Indian modern art, set a huge new record for the artist (and for South Asian art in general) at Christie’s this week. For most of the past 60 years, Husain’s Untitled (Gram Yatra) had been hanging in a

Norwegian hospital, where art historians had lost track of it. Now found, the mural just sold for $13.75 million in the multiwork sale, which totaled $24.9 million.

Several other Husains sold for multiples of their estimates. A work on paper by S.H. Raza, another driving force in the South Asian

modern market, was estimated at $300,000 but sold for $2.34 million with fees. A painting by Sudhir Patwardhan, Five Figures, from 1976, was estimated at $200,000 but sold for $756,000 with fees. Francis Newton Souza’s Untitled (Woman and Mirror), from 1952, was also estimated at $200,000 but sold for nearly $530,000. Finally, two works by the American orientalist painter Edwin Lord Weeks were estimated at $70,000. Each made a

final price several times that, more than $300,000 and $400,000 with fees.

- Chinese furniture on the rise at Christie’s: Huanghuali furniture was very popular at Christie’s. A 17th century “official’s hat” chair, estimated at $800,000, sold for $3.25 million with fees. A “corner-leg painting table,” estimated at

$500,000, sold for $1.8 million with fees. And a 12-panel folding screen estimated at $150,000 sold for $600,000.

- Heritage sells a Hokusai ‘Great Wave’ for $425,000: Heritage, the Dallas art and collectibles powerhouse, has been auctioning collector Ruth Nelkin’s Asian art in a series of sales. This

week, the house offered a number of woodblock prints, including an example of Hokusai’s Great Wave Off Kanagawa, which was estimated at $100,000. As we saw earlier in the week, the condition and quality of Hokusai’s prints can vary widely. Already during New York’s Asia Week, two examples had sold at Christie’s for $882,000 and $252,000. The question was how Heritage’s example would do, since it was estimated toward the lower end of the range. Now we have our answer: In

the end, it was bid up to a very strong $425,000 selling price.

- Christie’s Modern British & Irish sales total £14.6 million: At a time of torpor (or dread) in the art

market, the modern British and Irish art category can be a reminder that there are still fascinating pockets of strong demand. Christie’s Modern British & Irish evening sale saw Frank Auerbach’s Nude on Bed III, from 1961, sell for just under £1.5 million. The estimate was less than half that. A painting of a silver bowl by William Nicholson, The Lustre Bowl, from 1908, was estimated at $120,000 but sold for nearly £1.19 million with fees. A

painting by Winston Churchill, The Bay of Éze, from 1950, sold for £945,000 with fees—it was estimated at £500,000. (Shout-out to the Churchill collectors who emailed me this week. I see you.)

In the day sale, Edward Burra’s 1955-57 watercolor View at Florence sold for £352,000, even though it was estimated at £50,000. There were also strong prices across sales for William Scott, Barbara Hepworth,

Bridget Riley, Ben Nicholson, Frank Bowling, Walter Richard Sickert, and Euan Uglow, among others.

|

Now here’s Julie on TEFAF…

|

|

|

The Netherlands’ annual European Fine Art Foundation fair has been plagued by

brazen jewel heists, leadership churn, and its distinction as an early Covid superspreader. None of that makes it any less remarkable or irreplaceable.

|

|

|

The annual European Fine Art Foundation fair—better known as TEFAF and referred to by the

in-crowd as simply “Maastricht”—has an unfortunate art world distinction: Many people who have never attended (including myself, at least until this week) think they know the fair, but they don’t really know the fair at all. The eight-day event, held on the Dutch panhandle (Europe’s answer to flyover country) is a mecca of the art and antiques market that’s often overlooked by collectors outside Europe.

Maastricht first popped up in the 1970s as an Old Masters fair that

later merged with an antiques fair, and TEFAF is still very much a product of that marriage. This year’s edition featured 273 dealers from 21 countries across eight categories: paintings, antiques, jewelry, modern and contemporary art, design, arts of Africa and Oceana, ancient art, and works on paper. (The fair also attracted more than 50,000 visitors, including hundreds of representatives from museums like the Rijksmuseum, the Met, and the Louvre Abu Dhabi.) Each of these sections is its own

mini-fair, and each booth a mini-museum stocked with tapestries, clocks, rare books, etcetera. Many exhibitors have been showing there for decades. Once you go to Maastricht, you can’t imagine not going back again.

That’s not to say that TEFAF hasn’t had its share of issues in the past few years. In March of 2020, as Covid was descending on Europe, fair organizers chose not to cancel the show, and many attendees became ill. Then, in 2022, four men ran into the fair, smashed the

glass cases of a London jewelry dealer, and fled with a 114-carat diamond necklace valued at €27 million, whose whereabouts remain unknown. And this year, authorities reportedly thwarted a planned act of vandalism by the climate change activist group Extinction Rebellion.

Leadership of the foundation has been similarly chaotic. Since president and C.E.O. Patrick van Maris announced in January 2020 that he would be stepping down after that year’s event, there have been four

different leaders—most recently the new managing director, Dominique Savelkoul, who came to the role this past September from the Belgian institution Mu.Zee. And because the fair is run by a nonprofit board composed primarily of dealers, but also collectors and curators, decision-making is done by committee and often hijacked by parties with competing interests.

But the fair goes on. After a few tough years, with participants expressing concerns over declining attendance

and quality, the general consensus this year was that things were back to pre-Covid levels, both in terms of foot traffic and the offerings. Still, crowds and quality didn’t translate to frenzied buying—there were lots of sales at accessible price points (perhaps due to the fair’s increased outreach to entry-level collectors), but buying at the higher tiers was more considered. The talk of the fair was a recently rediscovered early Klimt portrait, on offer for €15 million, which

Austrian gallery W&K is reportedly in negotiations with two museums and two private collectors to sell. This year’s most expensive offering—a late Picasso painting for $50 million at Landau Fine Art—went unsold, but that kind of thing never seems to bother the Landau family.

TEFAF has an unmistakable art history nerd appeal: Everyone’s homework was on full display, from the detailed wall labels—with full provenance, literature, and exhibition history—to

hardbound catalogues. The fair’s strict vetting process—undertaken by museum curators in the two days preceding the main event—is meant to root out misattributions, but it also gives the institutions first crack at the inventory. At Patrick Bourne & Co., an American institution reserved a 21-inch 1899 bronze cast of Saint George by British sculptor Sir Alfred Gilbert for an undisclosed sum.

Mercé Valderrey Art, in association with Athena Art Foundation, created a

Women Artists Map for the fair, with 100 galleries submitting over 500 works. There were multiple reported sales of works by female artists, including Dame Elisabeth Frink and Marie Bracquemond, reflecting the market’s continued interest in rediscoveries.

|

“People Hungering for Nice Things”

|

Overall, dealers reported a constant flow of people and a decent amount of buying—some sold more

than others, but nobody was despondent. TEFAF board member Jonathan Green, of London-based Richard Green Gallery, which sells Old Masters through 20th century paintings, said the fair has been relatively consistent for him—“from fine to fantastic” year to year, as he put it. This year, he told me, sales had been okay up to £500,000, but he sensed “reticence” from buyers for works over £1 million. In particular, Green saw less buying from Americans, which he blamed on the current

geopolitical uncertainty. By comparison, he said that last year, against a backdrop of wars in both the Middle East and Eastern Europe, was his best year ever, demonstrating the magnitude of the “Trump effect” on the current market.

|

Willem Claesz Heda, A Banquet Still Life (1642). Photo: Courtesy of Sander

Bijl

|

Sander Bijl, the proprietor of his eponymous Flemish and Dutch Masters gallery,

Bijl-Van Urk, said he’d notched sales up to £50,000 and over £1 million. Indeed, TEFAF is known for its slow sales cycle, as conversations begun in the booth often reach their fruition weeks or months later. Bijl is still hoping to find a buyer for a silver-toned Willem Claesz Heda banketje (banquet piece) that he discovered at a British regional auction house, acquired for only £80,000, and then had retouched. There were also two other Heda paintings in nearby

booths, which is remarkable given their rarity—they are all in the neighborhood of €900,000.

At Dickinson gallery, Simon Dickinson and his son, Milo, sold a unique Golden Age double-painting at an asking price of €120,000—a self-portrait by Isaack Luttichuys turned sideways and partially painted over with a stormy seascape by Ludolf Bakhuizen. They slyly positioned it as the first-ever surrealist

composition, though I doubt anyone took them seriously.

|

Galerie Marcelpoil’s booth at TEFAF Maastricht 2025. Photo: Courtesy of Galerie

Marcelpoil

|

Art deco dealer Galerie Marcelpoil, specialists in André Sornay furniture,

reported “all right” sales, including a 1936 walnut sideboard with the designer’s signature brass nails, in the region of €60,000-€80,000. They said they do better at the New York edition of TEFAF that takes place in May, since buyers there are more familiar with art deco. Fine silver dealer Lewis Smith, of Koopman Rare Art, had a rosier outlook on this year’s fair. “It’s been like 2019, 2020, with people hungering for nice things,” he said. His team sold a set of twelve 19th

century Florentine silver-gilt plates from the Borghese service back to descendants of the Borghese family for an undisclosed sum.

In the modern and contemporary section, first-time exhibitor Marianne Boesky Gallery successfully paired Edward Hopper works on paper with eight small paintings by Danielle McKinney, highlighting both artists’ use of shadow and light. The Hopper watercolor Gloucester Houses (Houses on a Hill), circa

1926-28, sold at an asking price of $2.85 million, and the McKinney works all sold at asking prices between $70,000 and $115,000.

|

The lifeblood of TEFAF, as Savelkoul explained to me, is the confluence of collectors, curators,

and dealers—many of whom, not surprisingly, are close to retirement age. In the past few years, the TEFAF board has taken steps to attract younger representatives from all three groups to the fair. Last year, as part of the Emerging Collectors program, the fair started offering a “secret map” of items at more accessible price points. Access to the map was by invitation only from the dealers. “Their mission to attract younger clientele seems to be beginning to work,” said Asian-art dealer

Michael Goedhuis, who sold five Chinese and Japanese 12th-19th century bronze vases, ranging in price from $15,000 to $65,000, to an American collector who is donating them to a museum in the Midwest. This is also the second year of the five-day Curator Course, a crash curriculum for 10 emerging curators to learn the acquisition side of their jobs.

Last year, in an effort to bring in younger dealers, the fair added a “Focus” section comprising 10 tightly curated

presentations, like Paul Coulon’s standout display of Dan Flavin’s 1963 white fluorescent sculpture The Nominal Three (to William of Ockham). The “Showcase” section—10 smaller booths for midsize galleries to test the waters before moving into the main fair—included a presentation of Maison Jonckers furniture from Belgian gallery Objects With Narratives, and a selection of Hilla Rebay paintings from Galerie Raphael Durazzo, based in

Paris. “The board had the vision to attract younger dealers who are adding vitality that was beginning to dissipate,” Goedhuis told me. “It’s critical to the future of the fair.”

|

Thanks for that, Julie.

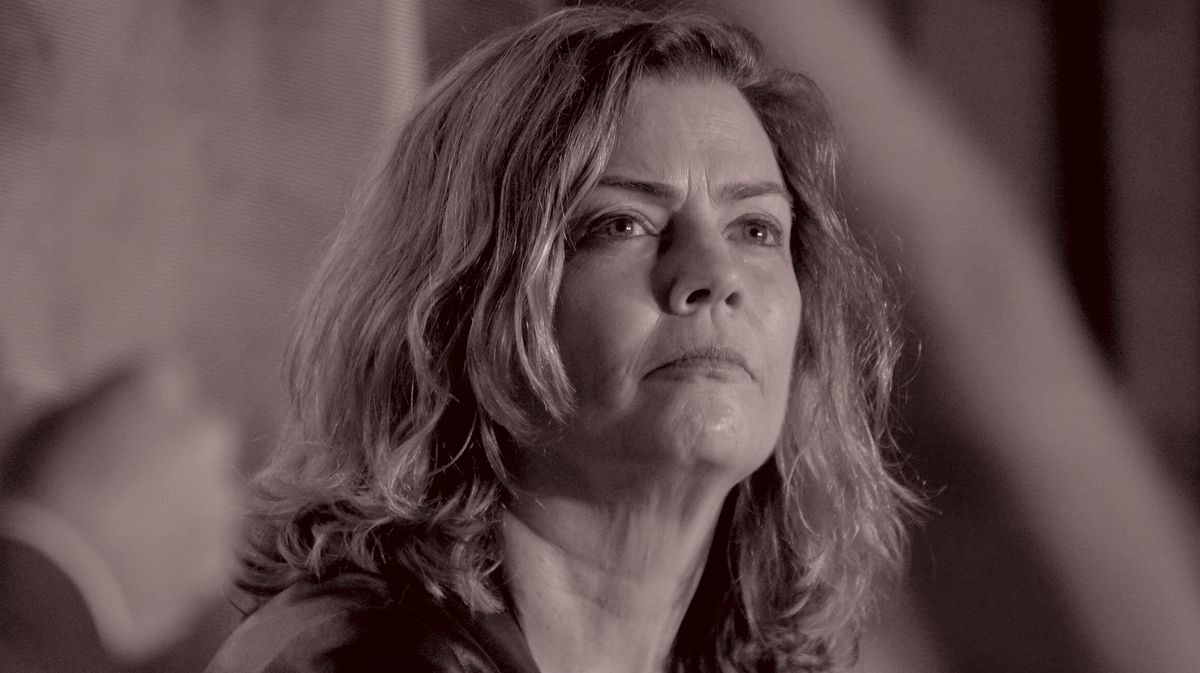

Former art advisor Lisa

Schiff, who grew too close to her clients, particularly Candace Barasch, and ended up siphoning off millions from them, was sentenced to 30 months in federal prison this week, as I’m sure you’ve seen in the media or on social media. In the court’s final tally, Schiff owes $9 million in restitution to her former friends and

clients. Of course, there’s no excuse for this kind of behavior. And Schiff is rightly suffering the consequences of her actions, which she claims were exacerbated by addiction. But every time I think of this story, I’m reminded of my own dealings with Lisa, who could be erratic—so erratic, in fact, that I would not have blindly trusted her with my money or property. I can only wonder what possessed the people who did trust her for so long. Being in business with friends requires more,

not less, diligence.

Enjoy your weekend, whatever your plans. And we will be in touch on Sunday.

Yours,

M

|

|

|

Puck founding partner Matt Belloni takes you inside the business of Hollywood, using exclusive reporting and

insight to explain the backstories on everything from Marvel movies to the streaming wars.

|

|

|

The ultimate fashion industry bible, offering incisive reportage on all aspects of the business and its biggest

players. Anchored by preeminent fashion journalist Lauren Sherman, Line Sheet also features veteran reporter Rachel Strugatz, who delivers unparalleled intel on what’s happening in the beauty industry, and Sarah Shapiro, a longtime retail strategist who writes about e-commerce, brick-and-mortar, D.T.C., and more.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|

_01JPX4KB0N2VRWC5P0CA6KS0ZP.jpg)