Welcome back to Wall Power, a private email about the inner workings of the art

world, arriving in your inbox four times a week. I’m your host, Marion Maneker.

Tonight, I’m going to take you to Shelter Island to visit with the estate of the crushed-car-parts sculptor John Chamberlain, who is having quite a moment: His monumental works are on display at Rockefeller Center; smaller works are being offered for sale at Christie’s; and a new lifestyle book, Living With Chamberlain, was recently published. Meanwhile, Julie

Davich looks at the marketing skills of pop culture auctioneer Travis Landry.

As we get into the May season, I will be moderating a talk at the Independent art fair at Spring Studios on May 9. If you would like to attend the fair, Puck readers can get a 20 percent discount on tickets here by using the discount code: PUCK.

|

|

|

A MESSAGE FROM OUR SPONSOR

|

A new campaign starring Julia Garner celebrates the House’s storied silk scarves and their enduring

legacy within the House’s design codes.

DISCOVER MORE

|

|

|

|

Julie Brener Davich

|

|

Holy Hammer Ratios, Batman!

|

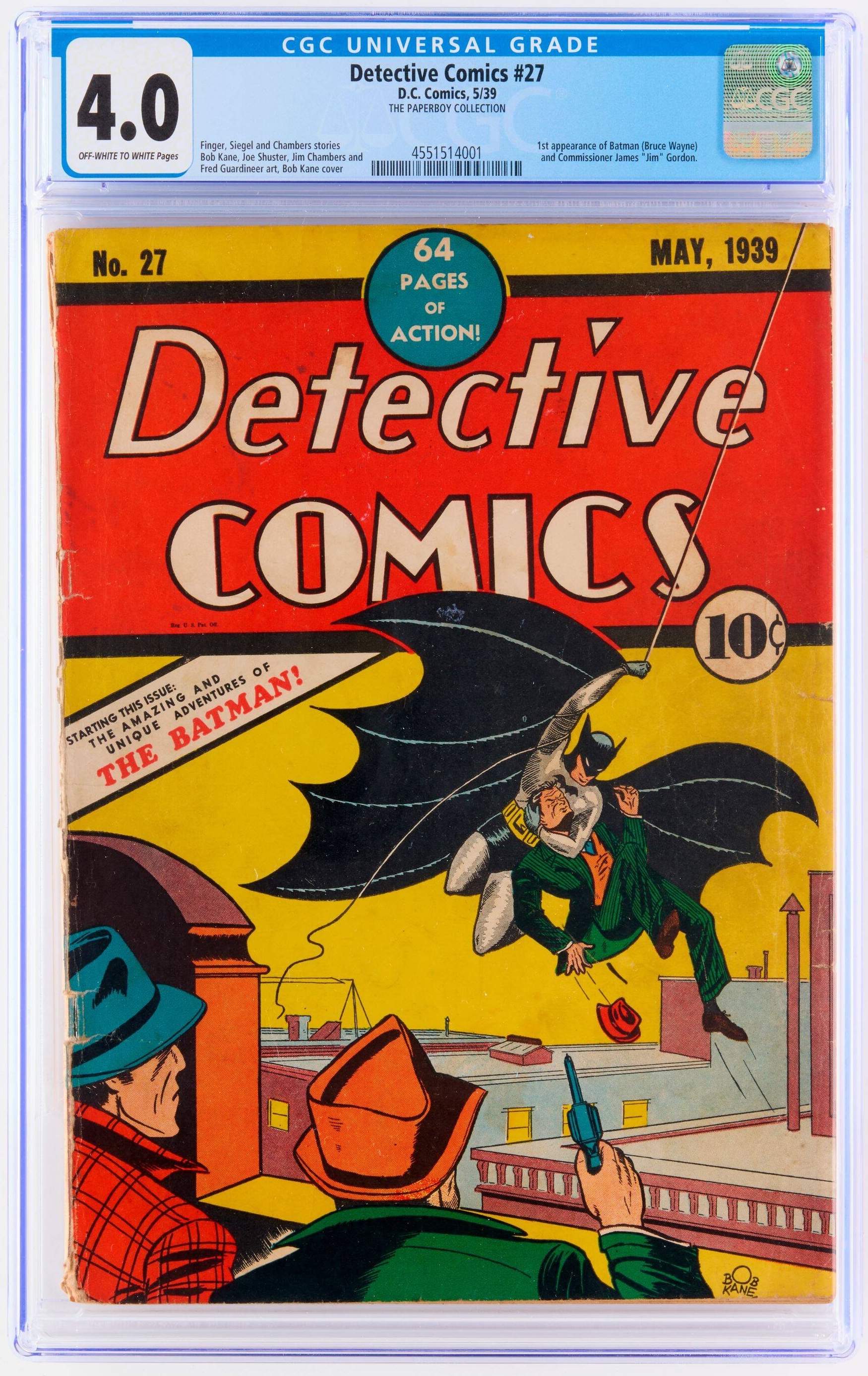

D.C. Comics, Detective Comics #27, CGC 4.0. Photo: Courtesy of Landry Pop

Auctions

|

Before Travis Landry’s white-glove sale last week of 59 comic books, which achieved a

combined $1.3 million, with a 1.5 hammer ratio, the 29-year-old pop culture specialist posted a provocative photo on Instagram. It featured the first-ever Batman comic book, sitting atop an Isamu Noguchi coffee table that was to be auctioned at Rago Wright the following day. The comic and the table were from around the same era—late ’30s,

mid ’40s—and each are rare in their own ways. Landry captioned the photo, “Batman or Noguchi? Which one would you rather have for the money?”

Buyers ultimately picked Batman. The table ended up selling for just $444,500 against an estimate of $500,000, while the 1939 D.C. Comics Detective Comics #27 (CGC grade: 4.0) brought in $683,200 against a $400,000 estimate. In the same sale, Landry set an auction record for a copy of D.C.’s Detective Comics #31 (CGC 7.0), also

from 1939, which sold for $329,400, more than double its estimate of $150,000.

Landry, who started appearing on Travel Channel’s Toy Hunter when he was still in high school, has been a collectibles, toys, and games expert on PBS’s Antiques Roadshow for the past eight years. Early last year, he launched his eponymous firm, Landry Pop Auctions, under the Rago Wright umbrella, following the collapse of his previous employer, the Rhode Island–based Bruneau & Co. Auctioneers.

And he’s showing himself to be a savvy marketer—leveraging his flexibility as a digital-first, independent operator to bypass the often stifling bureaucratic processes of traditional auction houses.

Both of the comics at Landry came from the Paperboy Collection—an inspired name—consigned by the daughter of a paperboy who acquired them almost a century ago during his childhood in rural Maine. “It feels unreal, like maybe it was just a dream,” she said in a statement regarding the

astounding auction results. “I never expected anything like this in my life.”

Like baseball cards, comic books have a grading firm, called Certified Guaranty Company, that “slabs” each one. The process involves authenticating, grading the condition from 1-10, sealing the comic in plastic to preserve it and ensure its authenticity, and labelling and barcoding the entire package for easy verification—hence the “CGC” grades. The record price for any comic book is $6 million, set

last year at Heritage, for an 8.0-graded copy of the first-ever issue of Action Comics, from 1938, which introduced the world to Superman.

|

|

|

From the

Gladstone Estate

|

Sotheby’s upcoming Thursday night sale of contemporary art is turning into a novel

affair. The evening will open with two short single-owner sales. Before the previously announced sale of works from dealer Daniella Luxembourg, which precedes the contemporary auction, there will be a brief, 12-lot sale of works from dealer Barbara Gladstone’s estate. Gladstone died somewhat unexpectedly last year at age 89, and we reported several weeks ago that the estate was shopping a selection of marketable works, presumably to pay their taxes. The works

have a low estimate of nearly $12 million.

Two works by Richard Prince comprise more than half the value of the Gladstone sale: Man Crazy Nurse, from 2002-3, is estimated at $4 million—pretty cheap for one of his nurse paintings, which are among his most valuable and sought-after. The most

recently auctioned nurse painting made $6.7 million with fees. This work is priced below that number, obviously, but Phillips also has a nurse painting that’s priced at $3 million. There’s also a 1988 joke painting, Are You Kidding?, estimated at $2.5 million. Emily Fisher Landau had two similar paintings—albeit in different colors, different orientations, and with different jokes—that both sold in the $2 million region.

The next-highest estimate in the sale, at

$1.5 million, is for one of Rudolf Stingel’s self-portrait paintings, Untitled (Bolego), from 2006. There’s also a rare, 24-inch-square Andy Warhol Flowers painting from 1964—one of only four to feature black petals on the flowers—estimated at $1 million. And there is an Alighiero Boetti embroidery work from his Arazzi series that’s estimated at $400,000, but likely to have strong market appeal given the robust interest in

Boetti’s work right now. Of course, there are also works by artists like Elizabeth Peyton, Mike Kelley, Sigmar Polke, On Kawara, Carroll Dunham, and others that might do exceptionally well, simply because they were owned by a legendary dealer.

Now for the main event…

|

|

|

The artist best known for assemblages of crushed car parts has never

had a market commensurate with his reputation. That may start to change, thanks to some new tactics by his estate.

|

|

|

The sculptor John Chamberlain is having a moment. Three of

his large, brightly colored “foil” sculptures are currently lined up in the middle of the plaza at Rockefeller Center, following last October’s display of another work in the series on Avenue Winston Churchill during Art Basel in Paris. Mnuchin Gallery sponsored both exhibitions, with the monumental works priced at $5 million–$6 million, and the gallery is negotiating to sell one of the Rockefeller Center works.

Half a block away, Christie’s is hosting a private selling

exhibition featuring maquettes of the foil works as well as smaller, tabletop versions of Chamberlain’s more recognizable crushed-sheet-metal sculptures, including some fabricated from toy trucks, all priced below a million dollars. Meanwhile, Assouline has published a book, Living With Chamberlain, that shows off photographs of the artist’s work in the collections of prominent dealers (Marc Glimcher, Larry Gagosian, Robert Mnuchin,

Karsten Greve, Heiner Friedrich), as well as artists, designers, and collectors (Vera Wang, Helen Marden, Rainer Judd, Michael Ovitz).

|

|

|

A MESSAGE FROM OUR SPONSOR

|

A new campaign starring Julia Garner celebrates the House’s storied silk scarves and their enduring

legacy within the House’s design codes.

DISCOVER MORE

|

|

|

It’s a remarkable turn of events for a distinctive artist whose signature

work—assemblages of crushed car parts from the early part of his career—was quickly sanctified by museums. But his market never quite kept up. Just before his death at age 83, in December 2011, Gagosian took over representation of the artist. A Guggenheim retrospective followed in 2012 (he had previously had one in 1971). At the time, the art market was gathering momentum. Chamberlain looked to be positioned to move up a rank, with his most recognized work attracting prices commensurate with his

museum presence and art historical recognition. In 2011, a classic 1958 work, Nutcracker—owned at different times by two of his important former dealers, Martha Jackson and Allan Stone—was offered in an auction of Stone’s inventory with a $1.2 million estimate. It was bid up to a $4.8 million selling price.

Works from the late 1950s and early 1960s, the period when the sculptor was influenced by high abstract expressionist painters like

Franz Kline and Willem de Kooning, were the most prized, and auction prices seemed to be catching up to his reputation. But it also seemed as if the market for Chamberlain’s later works had to expand to unleash prices for work from his early heyday. In 2012, shortly after the retrospective, Gagosian displayed some of Chamberlain’s large “foil” works on the plaza at the Seagram Building, in a bid to attract new buyers.

But the strategy didn’t work. Even though

Chamberlain’s works had fetched prices in the $4 million range before and after the Nutcracker sale—one work made $4.6 million in 2008 and another made $4.6 million in 2013—there was little upward momentum. The artist achieved only a handful of additional sales in the $1 million–$2 million range during the same period.

By 2018, when Nutcracker sold again at auction, for a bit more than $5.5 million, the Chamberlain market seemed little changed. The next year, Hauser & Wirth

announced that it had taken over representation of the artist’s estate, and there was a lot of talk in the industry of an eight-figure guarantee spread over a five-year period. That didn’t seem to do the trick, either. And so began the multipronged approach by the artist’s estate—run by his widow and stepdaughter—to build interest in his market, a strategy that we are seeing the fruits of this month. In two years we’ll be at Chamberlain’s centenary; the estate is already making plans.

|

On a beautiful spring day last week, I drove out to Shelter Island to have lunch with

Alexandra Fairweather, the artist’s stepdaughter, at the converted stables the estate now uses as an exhibition space. On the ferry ride over, I realized that I had not been on Shelter Island in a long time. Driving up to the former horse farm, I was struck by how little the place had changed (though I did drive by one farm that was a

little too picture perfect, with a vintage red tractor and restored Land Rover parked strategically out front; it turned out to be a $10 million real estate project that was, well, languishing in manicured splendor). Fairweather had grown up on Shelter Island, moved to New York to attend Columbia, and then moved back with her husband and three small children.

When Chamberlain died in 2011, he left his estate to Fairweather’s mother. In 2012, Fairweather’s mother bought the horse farm from

a friend and neighbor, and renovated the stables and indoor riding ring during the pandemic to house and display Chamberlain’s work. They poured and polished a concrete floor and added arched windows that give the vaulted space the feeling of a large ballroom. Fairweather placed her old dining room table in the middle of the new exhibition space so she could host dinner parties surrounded by her stepfather’s work. (We briefly played a game where I was asked to identify the oldest work in the

massive space—the joke being that Chamberlain had worked with plexiglass in the early 1970s, and the clear, crumpled forms were actually the oldest objects, not some of the later works made from car parts salvaged from an earlier era.)

|

|

|

After lunch, I followed her low-slung black Porsche a short ways to Chamberlain’s

studio, which sits across the street from her mother’s house. Cobbled together from older buildings, the studio is now storage for the estate, and Fairweather led me into another massive space with huge sliding doors where we saw some of her stepfather’s more gigantic works. Tucked away on a staircase were a number of the masks he had made, and a few examples of other work, like a crumpled 55-gallon drum.

|

John Chamberlain’s studio in Shelter Island, New York.

|

Walking into the attached house, we saw dinnerware that Chamberlain had crafted by using

car parts as the basis for molds; Fairweather told me that her stepfather had run an Italian restaurant on the island for a number of years. She led me through the studio that contained his inkjet printer, and I saw dozens of brightly colored canvases Chamberlain made from photographs of friends and family, all work I would never have imagined came from the artist.

There was even, somewhat incongruously, an indoor pool in its own pavilion adjacent to the studio and former house.

Fairweather explained that Chamberlain had made sketches for works he intended to place around the pool, but never completed the project before he died. On display in the kitchen of the studio are some of the foil maquettes that Chamberlain made while conceptualizing that idea, carefully maintaining the impression that the artist had just left in mid-thought.

As managers of the estate, Fairweather and her mother are behind the push to expand interest in Chamberlain’s whole body of work,

not just the welded and crushed car parts. They’re also partnering with Mnuchin Gallery to show the mammoth foils, backing that up with domestic works at Christie’s, and supporting the whole project with the polished lifestyle book Living With Chamberlain. The idyllic farm and studio on Shelter Island is just the most visible step. Behind the scenes, they have created and manage a registry of the artist’s work, necessary steps to build Chamberlain’s market and extend his legacy.

|

I’ll be back tomorrow with the Inner Circle email looking at the May auctions using

ARTDAI’s data. I’m curious to see what I learn. If you want to come along with me on that journey, sign up here.

That’s it for today,

M

|

|

|

The ultimate fashion industry bible, offering incisive reportage on all aspects of the business and its biggest

players. Anchored by preeminent fashion journalist Lauren Sherman, Line Sheet also features veteran reporter Rachel Strugatz, who delivers unparalleled intel on what’s happening in the beauty industry, and Sarah Shapiro, a longtime retail strategist who writes about e-commerce, brick-and-mortar, D.T.C., and more.

|

|

|

Finally, a media podcast about what’s actually happening in the media—not the oversanitized,

legal-and-standards-approved version you read online. Join Dylan Byers, Puck’s veteran media reporter, as he sits down with TV personalities, moguls, pundits, and industry executives for raw, honest, sometimes salacious conversations about the business of media and its biggest egos. New episodes publish every Tuesday and Friday.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|