|

Welcome back to Dry Powder...

...And thanks for following my work here at Puck. As a reminder, you're receiving the free version of Dry Powder at . If you're enjoying these notes, consider subscribing for full access or sharing this email with a friend.

In today's column: Bill Ackman vs. Carl Icahn, Steve Tusa vs. Larry Culp, and how to invest like Warren Buffett if you aren't Mark Spitznagel.

Thanks, Bill

SPONSORED BY

The inside conversation on Wall Street about Pershing’s new investment thesis, the wisdom of Warren Buffett, and JPMorgan in the penalty box. The bloom is off the rose for Netflix, which has dropped some 40 percent in value ever since Wall Street decided that the former hyper-growth technology platform has become something decidedly less sexy: a maturing, cash-positive media company. As my partner Matt Belloni recently wrote, this is more than just a correction as part of the broader Nasdaq sell-off. Investors are afraid that more competition and weakening subscriber growth portends a harder, more costly path forward. So naturally my friend Bill Ackman, the hedge fund investor, has stepped forward to buy the dip.

Ackman’s thesis is simple: the Netflix stock is oversold. On Friday, January 21, Ackman’s firm, Pershing Square Capital Management, began accumulating more than 3.1 million shares—a position worth more than $1 billion. From a recent low of around $354 a share on January 24, the stock has rebounded to around $384 a share, potentially giving Ackman a profit of some $90 million already. (He has not disclosed the average purchase price on his 3.1 million shares.) In a letter to his investors, Ackman praised Netflix for its strong recurring revenue, “best-in-class” management team, formidable “pricing power,” and the possibility of “substantial margin expansion” over a growing—albeit somewhat less rapidly than desired—subscriber base.

It’s hard to argue with Ackman’s thesis. He wrote that he was pleased the market’s overreaction to the less-than-robust subscriber numbers in the last quarter gave him an opportunity to buy in at a 40 percent discount. “We are pleased to add Netflix to our portfolio,” Ackman wrote. “Many of our best investments have emerged when other investors whose time horizons are short term, discard great companies at prices that look extraordinarily attractive when one has a long-term horizon.” In this regard, Ackman seems to be taking a page from his one-time nemesis, Carl Icahn...

ADVERTISEMENT

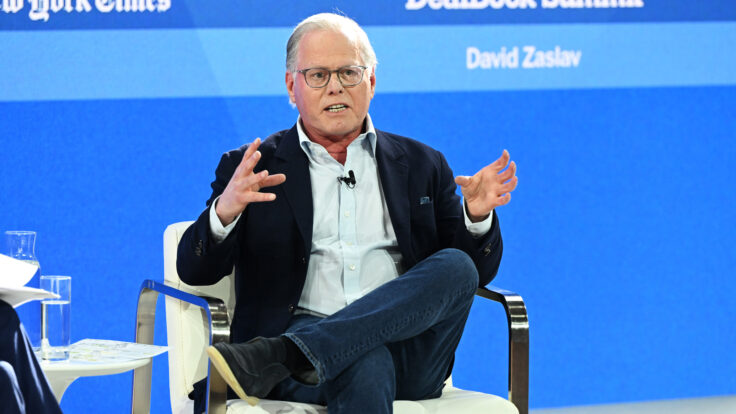

FOUR STORIES WE'RE TALKING ABOUT Executives are verklempt. But could a lower valuation return some competitive normalcy to the rest of the entertainment industry? MATTHEW BELLONI A conversation with Fiona Hill about the Russia-Ukraine crisis, Putin's next move, and where the White House goes from here. JULIA IOFFE Ari Emanuel has now negotiated a fifth hour for Joe & Mika, and helped Stephanie Ruhle take over for BriWi. What's next? DYLAN BYERS In media, the new trend is the flight to scarcity. And the subscription reset impacting Netflix will soon descend on publishers, too. BRIAN MORRISSEY

|

-

Join Puck

Directly Supporting Authors

A new economic model in which writers are also partners in the business.

Personalized Subscriptions

Customize your settings to receive the newsletters you want from the authors you follow.

Stay in the Know

Connect directly with Puck talent through email and exclusive events.