Happy Sunday and welcome back to Dry Powder. I’m Bill

Cohan.

For tonight’s issue, my recent conversation with Puck’s own Peter Hamby, in which we discussed all the madness emanating from the Trump administration and the various effects that it’s having on the economy. We also dig into how the smart money on Wall Street is processing all of this, why some investors remain bullish on the administration, and offer some

thoughts on where it’s all headed. You’ll find that down below.

But first, a few updates from John and Eriq, starting with the deal surrounding my hometown team…

|

|

|

|

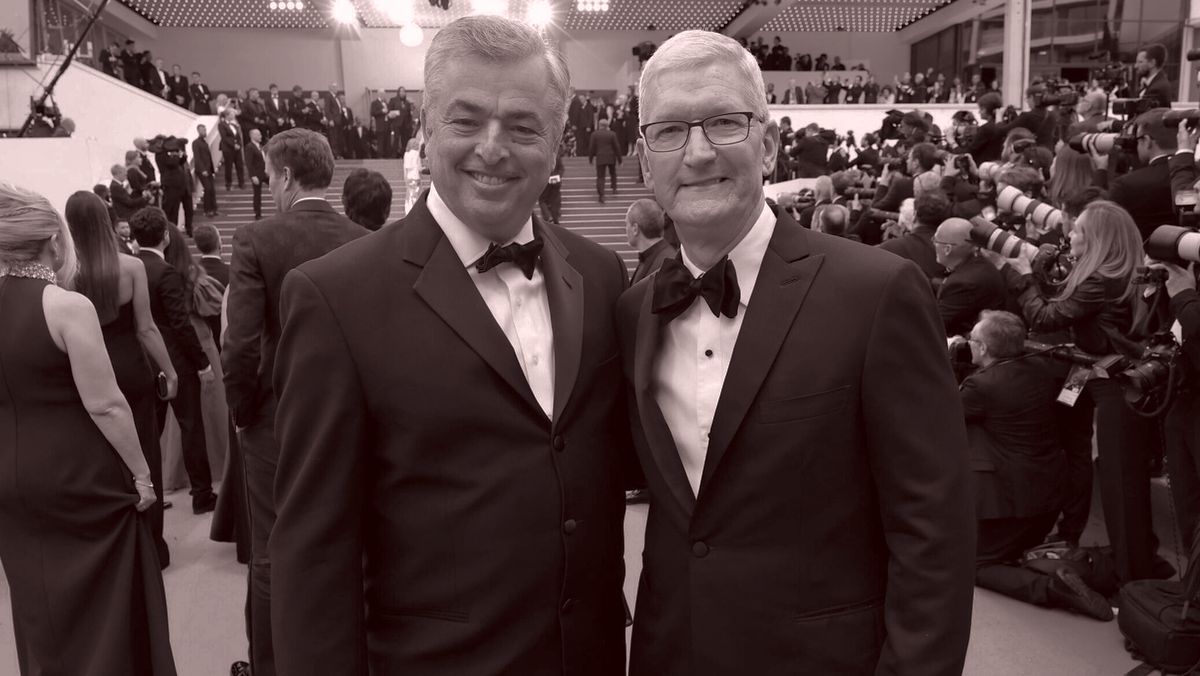

John Ourand

|

|

- The luck of the

Irish: The $6.1 billion sale of the Boston Celtics was breathtaking, if not entirely surprising. That number, which inches above what Josh Harris paid for the Commanders, not only set a North American sales record, but also padded the valuation of every other team in the league. I’m sure that Alex Rodriguez and Marc Lore must be thrilled at the $1.5 billion that they paid for the Timberwolves back in 2021—a deal that recently

succeeded in arbitration and is set to close. Bill Chisholm, managing partner of the Symphony Technology Group and frontman of the Celtics bid, obviously knows the first rule of professional sports ownership: Make your partners money and you’ll enter the boardroom with plenty of allies. Yes, Chisholm’s bid still technically needs to win approval by the NBA board of governors. But at this price, it will sail through.

The generous sale price covers more than one interesting

quirk of the deal. The bid includes a $1 billion commitment from Sixth Street, the ambitious and occasionally litigious private equity firm. Sixth Street already holds a stake in the San Antonio Spurs, and could end up being one of three P.E. firms to have investments in multiple NBA teams: Arctos is invested in the Warriors, 76ers, Kings, and Jazz; Blue Owl is invested in the Hawks, Timberwolves, and Kings.

But there are persistent rumors that Sixth Street has a preferred stake on

the Celtics cap table, which would pose a novel wrinkle. (Other institutions tend to purchase common shares.) The board has come to accept the increased presence of private equity. But a pref, which would presumably come with some governance rights, is simply a sign of where things are heading. After all, the leagues need to get comfortable with the presence of private equity firms and their deal structures. Outside of modern oligarchs like Jeff Bezos, these teams are

becoming increasingly unaffordable even for humble ole billionaires.

|

|

|

A MESSAGE FROM OUR SPONSOR

|

|

|

|

Eriq Gardner

|

|

- Open A.I.’s copyright

argument: OpenAI is urging the Trump administration to add a startling provision to the government’s A.I. Action Plan: Namely, a blanket declaration that copyrighted material falls under “fair use” when it comes to training A.I. models. You may have seen the open letter that 400 Hollywood people released opposing such a move. Sam

Altman & Co. are trying to justify the request by arguing that unless the U.S. relaxes the legal barriers, China’s unrestricted access to the same data will hurt U.S. companies, meaning “the race for A.I. is

effectively over.”

Of course, how copyright law applies to A.I. is one of the most heated legal topics of our time, and it’s debatable whether a White House policy statement alone will shift judicial thinking. That said, I wouldn’t entirely dismiss the idea that Trump could take aggressive action here. After all, as a property developer, he was a vocal advocate for the government using the principle of eminent domain to seize land. As president, he’s surrounded himself with A.I.

boosters and “accelerationists” who are embedded in his administration and have his ear.

Should Trump apply a similar approach to Hollywood I.P.—declaring that copyrighted works could be repurposed for the sake of America’s A.I. dominance—it would set up a massive Fifth Amendment fight. Major studios would undoubtedly challenge his authority to commandeer their content without just compensation, sparking a legal showdown over whether the government can take creative assets for

the sake of a technology arms race. I’ll be watching this one closely…

|

|

|

An honest conversation about the stock market “correction,” the folly of Trump’s trade

wars, the Scott Bessent security blanket, the rotation into Europe, and why Wall Street is missing Gary Cohn.

|

|

|

Uncertainty is one of the few constants on Wall Street these days, as markets weigh the

helter-skelter combination of deteriorating consumer sentiment; Trump’s pressure on the Fed; on-again, off-again tariffs; persistent inflation; rising unemployment; and the promise of a multitrillion-dollar tax cut. Meanwhile, policy confusion over Trump’s broader economic vision—or lack thereof—has deepened an atmosphere of angst and instability that’s caused investors to rotate out of U.S. equities and in to opportunities abroad.

There’s an old adage that Wall Street isn’t Main Street. But tell that to the folks in Terre Haute, Indiana, bracing for the sting of higher prices at Walmart. Or the farmers who aren’t sure which crops will be targeted for reciprocal tariffs, or the factory worker whose raw materials just shot up in price. The market doesn’t exist in a vacuum; it does, in fact, mirror consumer sentiment, corporate earnings, and economic trends

writ large—making it a direct reflection of what’s happening in everyday life. When confidence in the markets wavers, it isn’t just hedge fund managers and investment bankers who bear the burden—it impacts every corner of the economy. Indeed, rising prices on imported goods, supply chain disruptions, and erratic investor behavior has ripple effects that extend far beyond the stock tickers.

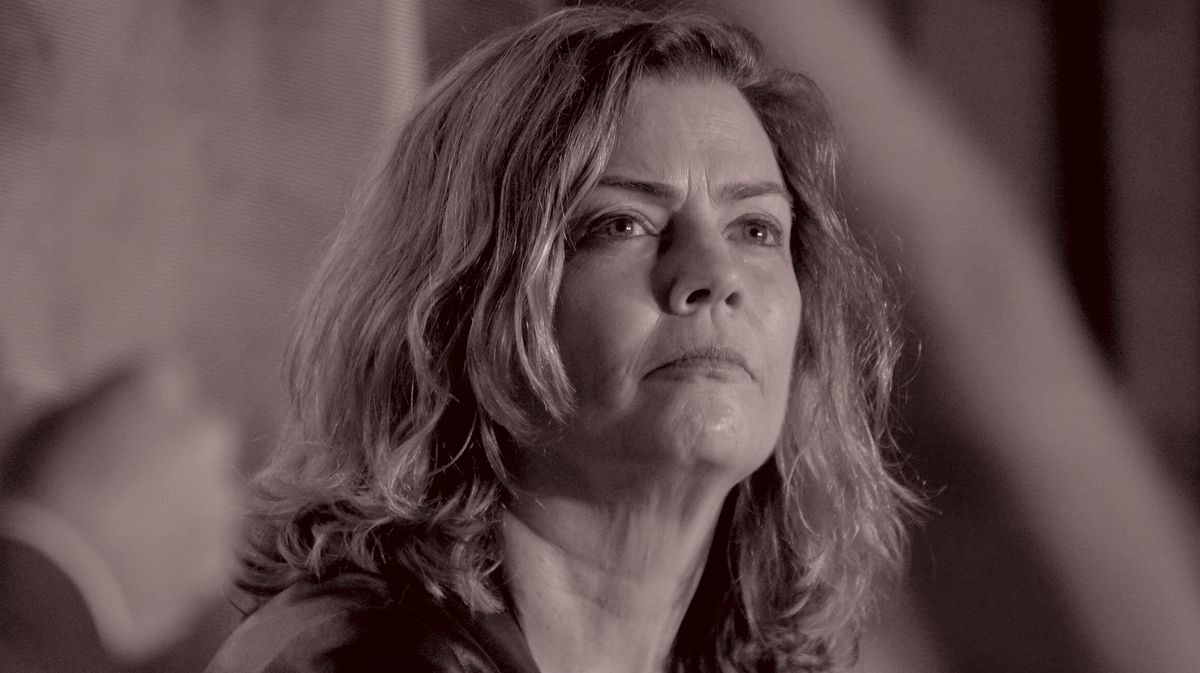

Last week, I sat down with my partner Peter Hamby on

Puck’s flagship podcast, The Powers That Be, to break down how Wall Street is responding to Trump’s loony and impulsive attempt at an economic reset. We discussed how the smart money is processing the chaos, why some investors are still bullish on this administration, and whether the market is simply correcting or signaling something worse. As always, this conversation has been

lightly edited for brevity. (You can listen to the entire thing here.)

|

The Wall Street vs. Main

Street Sophistry

|

Peter Hamby: What is Wall Street saying right now?

Everything is down, down, down. Is it just because of Trump’s tariffs, or are there other policies and statements that are leading to this volatility?

Bill Cohan: First of all, people love to say, “Wall Street is not Main Street,” but I don’t actually agree with that. Wall Street absolutely reflects Main Street. It reflects corporate earnings, so it reflects what you and I do,

what you and I buy and don’t buy, what we’re excited and not excited about. The equity markets reflect earnings and earnings potential and earnings expectations, and that’s very much driven by what happens on Main Street. So I think there is correlation. Now, obviously there are many more companies that are private than there are public and trading on equity markets. But I think it absolutely reflects the mood, sentiment, and feelings.

That mood and sentiment is changing because of the things coming out of Washington, and what’s coming out of the mouth of our president on a daily basis. He’s really into chaos. He’s really into disruption. He’s really into confusion. And he seems to be quite taken with the prospect of tariffs. He has a certain view of what he thinks they’ll do—it’s just too bad that everybody else has a very different view of them. The chaos is definitely being

reflected in the market, and it doesn’t take much to change sentiment. The Wall Street markets are a confidence game. And if confidence is lost, the momentum shifts, and people start voting with their feet by selling.

The other thing is, we have to be cognizant of the fact that the markets have gone up for eight straight years. We tend to have corrections in this country once every 20 years or so. And the

last big correction was obviously in 2008. So you could argue that we are overdue for a correction. Even if Trump wasn’t the chaos agent that he is, we would be overdue.

On the other hand, things seemed to be going just fine under Joe Biden, even though people like to crap on him constantly. The markets were going up, and his sort of laissez-faire attitude seemed to be working, at least from the market’s point of view. Trump claims to

be doing what he’s doing to fix the economy, and to make everybody much richer on a long-term basis. Trump suggests we just have to take this short-term pain, and it’ll all be fine. So at the moment, we’re in the short-term pain phase. And if he keeps up with the kind of chaos and policies that he’s pursuing—without Congress by and large, by the way—I think we’re going to be experiencing short-term pain for a lot longer.

|

|

|

A MESSAGE FROM OUR SPONSOR

|

|

|

Would you say we’re in a correction right now?

No, because a correction is technically a 20 percent decline, and we were at a 10 percent decline and then recovered a little bit from that. I would say we’re trying to digest the return of chaos, and that’s going to take time. We’re on a roller coaster with these tariffs, which nobody but Trump thinks is a good idea. No economist thinks they’re a good idea. Nobody who’s going to pay more for imported goods thinks they’re a

good idea.

Nobody wins a tariff war. It’s just idiocy. It’s economically unviable. You see the markets reacting to that. The markets get a reprieve when Trump changes his mind and says, Okay, we’ll give you 30 more days. But last week, when he was like, I’m serious this time about the tariffs, the markets freaked out.

One doesn’t know how to deal with

this chaos. And people say Trump responds to the equity market. Now, he’s taking a different stance and saying we could have a recession, and that the short-term pain is going to be worth it because in the long run, everybody’s going to be rich. What’s clear to me is that Donald Trump—who’s scammed with Truth Social, or his Trump memecoin, or any of his other scams—he doesn’t care. He’s got hundreds of millions, maybe a billion or so. Elon Musk certainly doesn’t

care. Nobody in Trump’s cabinet cares, because they’re all rich.

|

In your recent

interview with Mike Mayo, he told you that Scott Bessent is the security blanket in the White House, and that Bessent is the best hope. What’s your take?

I was a little surprised when Mike said that. I don’t know

Scott Bessent. I knew Gary Cohn; I knew Steve Mnuchin. I wasn’t wild with enthusiasm for Steve Mnuchin, but I did take some comfort from Gary Cohn, as long as he was there. He did single-handedly drive the bus on reducing the corporate tax rate to 21 percent, which I know he’s proud of.

I think a much better choice for Treasury secretary would have been

Marc Rowan at Apollo instead of Scott Bessent. I think Mark Rowan, who was under consideration for a nanosecond, would have objected to tariffs. I think he understands that they’re a tax on consumers, and they make no sense. And when you start down that path, it becomes a trade war. Scott Bessent, on the other hand, seems like he’s just a good ol’ boy willing to go along with whatever Trump wants. And that’s what he’s done so far. He’s done a few interviews on the lawn of the

White House; he did one with Maria Bartiromo—who’s about as pro-Trump as you get—and even she was questioning Scott Bessent’s thought process and decision-making on supporting tariffs.

So I was a little surprised to see Mike Mayo be so enthusiastic about Scott Bessent. But I guess that just speaks volumes about how desperate the situation is—that the best you can hope for here is

Scott Bessent, and he’s the one we’re pinning our hopes on to be rational. And I haven’t seen any sign he’s being rational. He’s definitely on the short-term pain bandwagon. Easy to say, Scott, when you’re a billionaire and you’ve got your pile, and you’ve got your $22 million house in Charleston, among many others.

I recently

wrote about our poll with Echelon Insights. Back in January, after the inauguration, 39 percent of likely voters said the country’s economic conditions were deteriorating. That number has climbed 10 points in just eight weeks. What do you think is the endgame here? When are everyone’s Schwab accounts going to get better? Are prices

going to come down? How does this end?

Again, we are overdue for a correction. Many stocks are overpriced and overvalued—and have been for a while. For instance, Tesla trades at 122 times earnings. That is just not sustainable, even for a meme stock. So that’s why it’s lost a third of its value since the first of the year. That, and the fact that Elon Musk is kind of a lunatic, and the

lunatics are running the asylum. But even Nvidia and Apple are trading around 30 to 40 times P.E., which is high, but not crazy high. European stocks are much cheaper.

Rotations happen, sentiments change. Trump is forcing sentiment to change, because of the crazy things he’s doing. Plus, the fact that so much money is now in index funds, which drive the market. So when Tesla cracks happen, our markets are going to

fall. We just have to wait and see what the rotation is.

|

|

|

A professional-grade rundown on the business of sports from John Ourand, the industry’s preeminent journalist, covering the

leagues, players, agencies, media deals, and the egos fueling it all.

|

|

|

Join Emmy Award-winning journalist Peter Hamby, along with the team of expert journalists at Puck, as they let you in on the

conversations insiders are having across the four corners of power in America: Wall Street, Washington, Silicon Valley, and Hollywood. Presented in partnership with Audacy, new episodes publish daily, Monday through Friday.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|

_01JPAE9WQG3G2ZY9JP5M0F53X8.jpg)

_01JPAE9WD3263EG397ZWXT4FFA.jpg)

_01JPAE9W43VKKE25DM6BDTKQ2Y.jpg)

_01JPAE9VR354YNS1DKN1G9S6NW.jpg)