Welcome back to Dry Powder. I’m Bill Cohan.

In today’s

issue, a close look at another Bill Ackman micro-scandal that erupted across my X feed in recent days, wherein the prolix hedge fund manager found himself vigorously defending a podcast appearance in which he seemed to take several potshots at his hero and “unofficial mentor,” Warren Buffett. Ackman, of course, is in the midst of attempting to stand up his own version of Berkshire Hathaway, which made the alleged attacks appear all the more pointed. The

interview itself offered some news, which I share below alongside some observations on the incident writ large. Also in this email: my analysis of how Elon’s West Wing side gig is hurting Tesla shareholders, and some important news from my partner Eriq Gardner on the latest wrinkle in the Paramount-Skydance deal.

By the way, I’m pleased to offer Inner Circle members the opportunity to join me and the celebrated astronaut José

Hernández for a lunch in Midtown Manhattan on March 11, courtesy of the space tourism company Zero-G, the business responsible for my unforgettable zero gravity experience back in December. If you’re already an Inner Circle member, email Fritz@puck.news to get on the list. One lucky guest will leave the lunch with a seat on an upcoming Zero-G flight—which, as I can

attest, is one of the most remarkable experiences one can have.

|

|

|

A MESSAGE FROM OUR SPONSOR

|

Take your first step into space on a zero gravity flight.

Flying on Zero-G’s specially

modified aircraft, you will experience true zero gravity where you can float, flip, and soar as if in space. It’s not a simulation–it’s real life, minus gravity.

Whether you’re a training astronaut, a scientist conducting ground-breaking research, or a civilian pursuing a lifelong dream, it all starts in the same place: with Zero-G.

Only a fraction of humanity has experienced zero gravity. Let’s change that.

Use code PUCK10 to receive a 10% discount when booking on GoZeroG.com

|

|

|

- Elon puts Tesla on autopilot: Incredibly, Elon Musk seems to be shaking off the precipitous decline in his personal net worth—some $80 billion in the first two months of the year—which is intimately tied to the plunging value of Tesla stock. He’s still the world’s richest person, of course, with a net worth estimated at $350 billion, but it’s notable that there hasn’t been any real pushback from shareholders, or from the Tesla board, on Elon’s political antics.

As my partner Peter Hamby recently reported, a majority of likely voters (51 percent) disapprove of Musk’s role with the Trump administration, and 57 percent disagree with his dismantling of federal agencies.

The impacts are real: Tesla sales have

reportedly dropped by double digits in true-blue California, the largest U.S. market for EVs. January sales were down 45 percent year over year in Europe, where protesters have been demonstrating outside Tesla showrooms and factories, even as the EV market is growing. (Tesla registrations dropped

76 percent in Germany last month, following Elon’s endorsement of the far-right Alternative for Germany party in the recent elections.) Meanwhile, it’s not like consumers who are fed up with Elon don’t have plenty of cheaper, less politically toxic alternatives. In China, for example, Tesla is hemorrhaging

market share to BYD, a less expensive, domestically produced rival. (BYD’s sales were up nearly 100 percent year-over-year in Germany last month.)

Since Trump’s inauguration, Tesla’s shares are down an extraordinary 29.2 percent, while the S&P 500 index is down only 1.7 percent. In February, Tesla lost more of its market value—$359 billion—in a single month than any company in history, besting Nvidia’s $347 billion drop in January. Of course, the Tesla stock was up 71 percent in 2024,

with most of those gains—69 percent—coming after November 5. If some of that gain gets dissolved, I guess it’s not the end of the world, but it’s a rude awakening for the retail investors who piled in after Trump, and Elon, took the Oval.

|

And here’s Eriq on the latest wrinkle in the Paramount sale…

|

|

|

|

Eriq Gardner

|

|

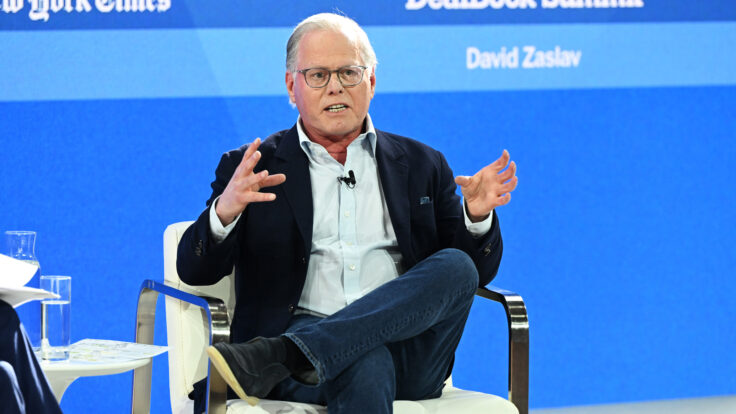

- Could pension

funds derail Shari’s Skydance deal?: Have you heard about Project Rise Partners? This shadowy group, with equally mysterious investors, surfaced a few months ago with a $19-per-share bid to buy Paramount—a supposedly fully financed offer that appears more lucrative for the company’s Class B shareholders than the Skydance deal that’s been accepted by Shari Redstone. But the whole thing is bizarre and bordering on farce. PRP’s grand vision includes turning the Paramount lot

into a tourist attraction, reviving the “I Want My MTV” slogan, and expanding into hospitality in the Middle East. Not surprisingly, Paramount’s special committee—formed to evaluate bids—rejected it outright.

But that rejection didn’t sit well with a handful of New York pension funds that hold stakes in Paramount, and they’re taking the fight to the Delaware Court of Chancery. The pension funds, perhaps eyeing a way to drag David Ellison to the renegotiation table, are

seeking a temporary restraining order to block the Paramount-Skydance transaction from closing. A hearing took place on Monday.

In a sealed briefing, Paramount’s special committee has apparently warned that granting the restraining order could trigger Skydance’s right to walk away from the deal. Given how aggressively Ellison pursued Redstone’s position, there’s no reason to believe he’d actually pull out—but the fact that Paramount even raised the issue is interesting on its own.

|

|

|

And now on to the main event…

|

|

|

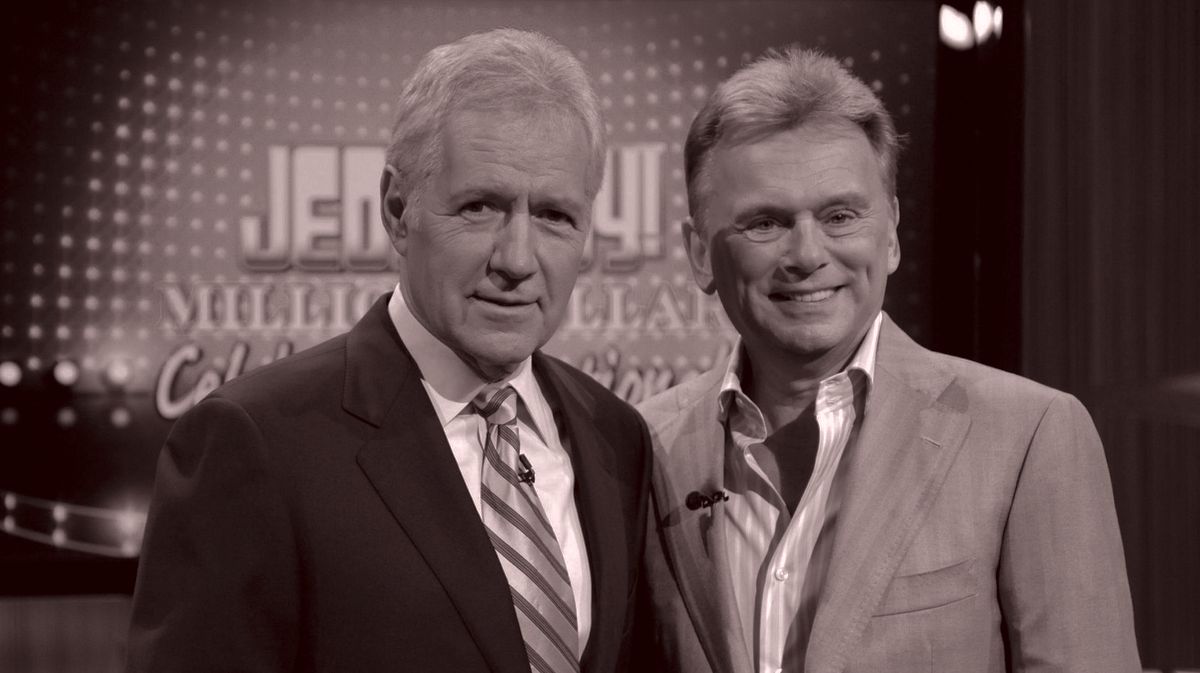

Ackman’s professed admiration for his hero Warren Buffett was

questioned in some quarters after a recent podcast appearance, where the hedge fund billionaire appeared to second-guess the Oracle of Omaha’s strategy.

|

|

|

Bill Ackman, the voluble hedge fund manager, has a tendency to

shoot from the hip, leaving even his friends scratching their heads. Lately, those misfires mostly occur on X, f.k.a. Twitter, where Bill is prone to long, unedited, unfiltered flights of fancy on all manner of topics. Earlier this week, for example, he speculated that perhaps CNN had been “tipped off” about last year’s assassination attempt on Donald Trump—a

conspiracy theory that the network categorically rejected. Instead of backing down, Ackman defended his post by attributing his prowess as an investor to his “willingness to consider the improbable as possible.”

So of course I found it particularly notable when Ackman posted a seemingly apologetic note this week to “clarify” his comments on a much more personal subject:

Warren Buffett. Last week, Ackman appeared on an episode of the Boyar Value Group podcast with Jonathan Boyar, president of the eponymous Wall Street research firm. The ostensible reason for Bill’s appearance was to discuss his new offer to turn the Howard Hughes Corporation—the real estate concern in which Bill and his

affiliates are the largest shareholders, with a 37.4 percent stake—into the next Berkshire Hathaway by buying $900 million more of the stock at $90 per share. But things took a bizarre turn when the topic turned to Buffett, Bill’s hero, north star, and investing inspiration.

The conversation surfaced some real news, including a bit of Wall Street lore that I’d never heard before. Bill told Boyar that in 2014, he “got permission” from Jon Gray, the heir apparent to

Steve Schwarzman at the Blackstone Group, to pitch Hilton Worldwide Holdings, the huge, publicly traded hotel company, to Warren as an acquisition target. At the time, Blackstone was Hilton’s largest shareholder, having done a big leveraged buyout of the company just prior to the 2008 financial crisis. This was a few years before Bill bought his own stake in Hilton, in 2018, so it’s a mystery to me why he was serving as a middleman between Blackstone and Buffett at the time.

(Bill declined to respond to my questions about his involvement.) But in any event, Warren turned Bill down. He wanted no part of Hilton.

Bill told Boyar that he thought this was a mistake. “It would’ve been an incredible home run for Berkshire,” Bill said. He then damned Warren with some faint praise. “Warren sort of has this price discipline, where if [a company] trades for more than 10 times operating income, no matter how good the business, he won’t buy it,” Bill said. “And that’s

worked really well for him for 60, 70 years. Why should he change?”

Buffett’s approach, Bill told Boyar, could be seen as too conservative. “We’re in a world where there’s some amazing businesses that have very long-term growth trajectories, where you have to pay more than 10 times operating income to succeed in buying a stock or buying a business,” he said. “And I think the market has gotten overpriced relative to what he’s prepared to pay.”

|

|

|

A MESSAGE FROM OUR SPONSOR

|

With a spotless safety record over 20 years and 900+ flights, Zero-G has made the excitement and

adventure of space accessible to the general public.

As the only FAA-certified provider of zero gravity flights, Zero-G does it all: Astronaut training; scientific research; corporate incentives; media production; and even public flights.

Join an upcoming zero gravity flight in your area:

March 29th (Houston, TX) | April 5th (Tampa, FL) | April 27th (New York, NY) | May 31st (Long Beach, CA) | June 7th (Seattle) | June

14th (Denver, CO)

View full flight schedule

|

|

|

Bill ploughed ahead with what, in Ackman-speak, bordered on blasphemy. He noted

that, other than when Warren bought a big chunk of Apple—and made a fortune on it—“it’s been a pretty dry well in terms of private companies that Berkshire has purchased.” (Of course Apple was a public company when Buffett bought the Apple stock, but anyway.) Bill must have been listening to himself, because he was quick to add, “Love the man. [He’s] been an amazing inspiration. I think Berkshire owns some incredible businesses.”

Bill noted that he himself had bought Berkshire Hathaway

stock around the onset of the Covid pandemic, and sold the stock at a loss—making him one of the few supposedly brilliant people to lose money on it. (His mistake was selling way too soon, not unlike when he bought and sold Netflix in 2022, perfecting a loss of $400 million along the way, on a company that has seen its market valuation quadruple since then. If Bill had held on to Netflix he would have made a fortune.)

Bill was now in deep waters, without a life vest. He told

Boyar that he hopes Warren lives forever—but then noted that the next generation of leaders at Berkshire is “much more disciplined” and that there’s “a lot of value to be extracted in running the businesses that Berkshire owns better.” In case anyone missed Bill implying that perhaps he might be able to run Berkshire better than Warren, he added that his mentor was “reluctant to, in any way, get involved in fixing companies” and “has C.E.O.s that he probably should have replaced years ago.”

|

At this point, Bill was on a roll, and decided to tell Boyar about yet

another time Warren ignored Bill’s investment advice and lost a chance to make a bundle. You may recall that Bill struck platinum betting that the Covid pandemic would freak out the bond market so much that the Federal Reserve would come to its rescue, much as it did during the 2008 financial crisis. Bill was proven right, turning a $27 million investment in credit default swaps into $3.5 billion in about three weeks—inarguably one of the greatest trades of all time. After

buying and selling the credit default swaps, Bill funneled his $2.5 billion of winnings into his stock portfolio, including both Hilton and Lowe’s, and made another $1 billion in profit.

Bill told Boyar that he tried to interest Buffett in the same trade at the time, specifically the part about buying stocks in and around March 2020, in anticipation that the Fed would backstop the bond market. “I actually reached out to Buffett in February of 2020 expressing my concern about Covid,” he

said. “He dismissed my concerns. … I thought Buffett would be taking advantage of this amazing opportunity to buy stocks. And he was frozen. The opportunities had expanded dramatically in March of 2020, and we said, ‘You know what? We can sell Berkshire at a loss,’ which we did. We probably lost more money on Berkshire Hathaway, ironically, than almost anyone else, because of the scale of our investment.” And with that, Bill ended his All About Eve-like ruminations on the Oracle of

Omaha.

A few days after the podcast dropped, Bill posted on X that, “as they sadly often do,” the “media” had “twisted” his words about Buffett to make it seem that Bill had taken “a shot” at him. Bill insisted that he wasn’t being critical of Warren—or certainly didn’t intend to be critical of Warren—“who has been an extremely important hero for me and an unofficial mentor.” He added that what he’d said about Warren’s “price discipline” wasn’t meant as “a criticism,” but rather,

“just an observation.” As for why he sold his stake in Berkshire during the pandemic, “We found better things to do with our capital,” Bill explained.

He also added some additional context to his prediction that the next generation at Berkshire, such as Greg Abel, the designated C.E.O.-in-waiting, would be more aggressive in managing businesses in the firm’s portfolio. “I don’t think he likes firing C.E.O.s,” Bill wrote about Warren. “He has built many-decade

relationships with his C.E.O.s and the families that run businesses that he has acquired. He values those relationships over the incremental economics that could be extracted if a better operator were running those businesses.”

On X, Bill went on to say that Boyar’s edit of the interview lumped together his comments about Buffett—“which may have changed, perhaps subtly, the impression the original would have conveyed. I believe that podcasts should be largely unedited real time

recordings of what was said, … so I was surprised when I read the transcript, in that it did not match my recollection of how the interview transpired, which may have contributed to any misimpressions.”

Bill asked Boyar to reissue the podcast in its original form, which Boyar subsequently did. For his part, Boyar wrote on X that “no substantive changes” were made to the interview, and that he’d communicated the changes to Bill and his team before releasing the podcast. “Integrity is

everything,” Boyar wrote in response, “and I would never alter an interview in a way that misrepresents a guest’s words.”

When I reached out to Boyar to elaborate on the kerfuffle, he responded with a statement describing Bill’s analysis as both fair and factual. “I don’t see why pointing out Buffett’s mistakes in a respectful manner should be considered blasphemy,” he said. “The bottom line is that Buffett is the GOAT of investing, but like all investors, he makes mistakes.” He

continued: “Buffett has always maintained that in investing, there are no called strikes—you don’t have to swing at every pitch. And he’s still practicing what he preached his entire career, choosing his spots carefully and prioritizing avoiding mistakes over chasing every opportunity.” On that, at least, I think we all can agree, right Bill?

|

|

|

Puck senior political correspondent Tara Palmeri grapples with the aftermath of what may be the most chaotic

and consequential presidential election cycle of our lifetime. With 15 years covering politics, Tara speaks with the smartest political minds to discuss what’s happening behind the scenes in Washington, D.C., from the campaign trail to the Capitol.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click

here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY

10006

|

|

|

|

_01JNHXJN60ZA7AXZD4C6WB49EZ.png)

_01JNKDJ27W00TN9THDDTC6MTKV.png)