Welcome back to Dry Powder. I’m Bill Cohan. Happy Liberation

Day to all who celebrate.

Some of my loyal readers may recall a piece I wrote in the earlier days of Puck, entitled Carlos Watson Has a Cold, about my brief run-in with the embattled media entrepreneur. Of course, Watson was subsequently convicted and sentenced to

almost 10 years in prison for his fundraising antics—a sentence that was recently commuted by President Trump. I’ll recall some of the backstory and play the narrative forward this evening. Some things you simply cannot make up!

But first…

|

- GameStop

raises $1.5B for Bitcoin: Last week, GameStop announced that it was raising $1.5 billion in a new, private, zero-coupon convertible debt offering. This was a surprising turn of events for the moribund video game retailer and glorified meme stock with $3.8 billion of revenue in 2024 (down 27 percent from 2023) and an operating loss of $26 million for the year. Even more bizarre: The proceeds are apparently going to be used to buy—you guessed it—Bitcoin. The capital raise came two days after

the company announced, on March 25, that its board had “unanimously approved an update to its investment policy to add Bitcoin as a treasury reserve asset.”

This is either the most meme stock move ever, or it’s GameStop’s bid to become more like Michael Saylor’s enterprise software company, MicroStrategy, a massively overhyped business with an equity value of $75 billion—up 77 percent in the past year alone. That value is based mostly on its ownership of 506,137 Bitcoins

at a purchase price of $33.1 billion. The coins are now worth around $42.4 billion.

Saylor predicted last week that Bitcoin would one day trade for $50 million per Bitcoin, up from his previous estimates of $13 million, $1 million, and $500,000—and that it would have a market value of $500 trillion… yes, with a T. (The currency is now trading around $83,000 a Bitcoin, making it a steal, right?) Saylor has also pioneered, I guess you could say, the use of zero-coupon

convertible debt to buy Bitcoin, and presumably influenced GameStop C.E.O. Ryan Cohen to do the same thing at his company. (Cohen has been called “the meme king” for good reason.)

After GameStop’s announcement that it was heading into Bitcoin territory, the stock jumped 12 percent. Then, last Wednesday, came a reversal of fortune, with the stock trading down 22 percent. After the roller coaster ride, the stock ended down 23 percent over the next five trading days, and now

has a market value of $10 billion, up 85 percent in the past year. Meme stocks gotta meme, I suppose.

|

|

|

How Carlos Watson, with help from Donald Trump and his “pardon czar,” remade himself as the

victim of his own $100 million fraud.

|

|

|

As has become all too apparent, President Trump is pardon-happy—flexing

his extraordinary powers on a near daily basis to mete out punishment or mercy. The pardons, in particular, seem to be motivated less by righting perceived injustices than by taking actions that own the libs. No other president in modern memory has so delighted in reversing the convictions of high-profile prisoners, or sanctioning law firms that he

perceives as enemies, especially if it sends the message that the justice system is corrupt.

During his first term, Trump pardoned a who’s who of white-collar criminals, including Mike Milken and Charles Kushner; Trump’s buddies Steve Bannon, Paul Manafort, Roger Stone, and Michael Flynn; plus a

whole gaggle of people you’ve never heard of. So far in Trump II, he’s pardoned Ross Ulbricht, who was serving a (rather unfair) life sentence for his role in operating Silk Road, the dark-web marketplace where criminals thrived. Last Friday, Trump pardoned Trevor Milton, the founder of electric-truck maker Nikola, who was sentenced to four years in prison for fraudulently inflating the potential revenue and profits of his company. The day before, Trump pardoned

the three co-founders of BitMEX, a cryptocurrency exchange, who had been charged with failing to comply with anti–money laundering statutes.

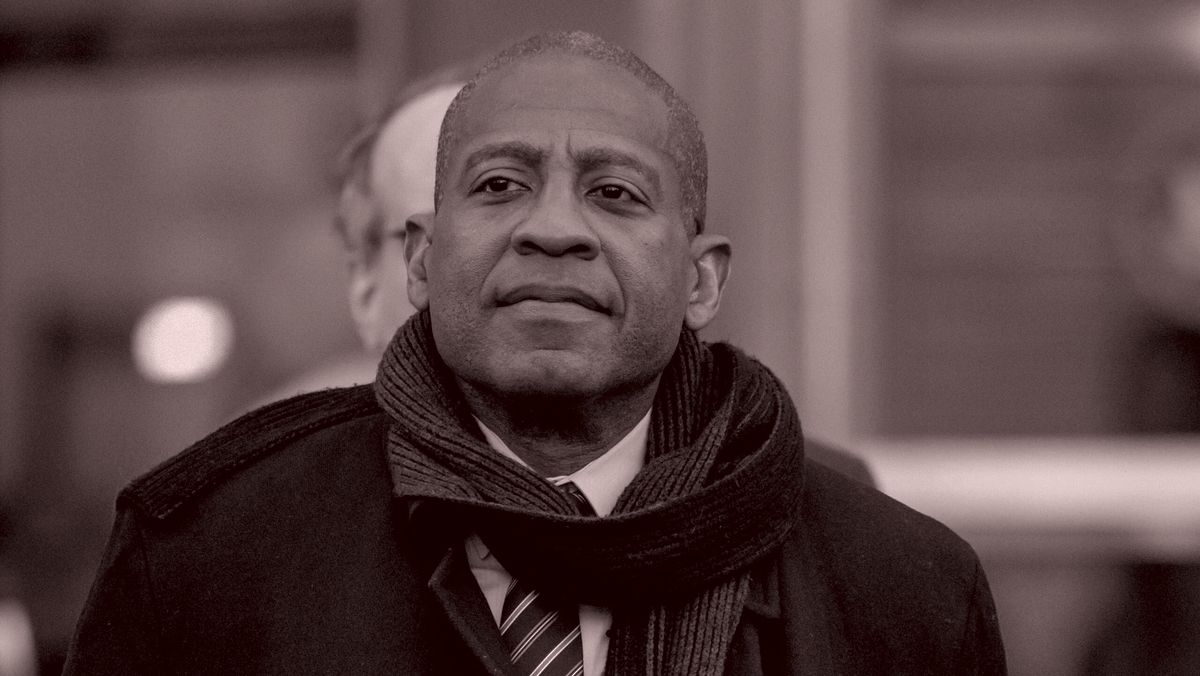

But the Trump commutation that really got my attention was that of Carlos Watson, the 55-year-old founder of now-defunct digital media company Ozy Media, who was just hours away from beginning a nearly 10-year sentence—which also seemed a little harsh, to be honest. Last summer, a Brooklyn jury

convicted Watson of conspiracy to commit securities fraud, conspiracy to commit wire fraud, and aggravated identity theft, in connection with a years-long scheme to defraud Ozy investors and lenders out of tens of millions of dollars. By the stroke of Trump’s pen, Watson was set free before spending even a day in federal prison, and was also relieved of having to pay the nearly $100 million in fines that Judge Eric Komitee, a Trump appointee, imposed on him in

February.

|

Longtime readers will recall that Watson’s precipitous downfall started with a September

2021 bombshell piece in The New York Times by Ben Smith, then the Times’s media columnist, where he reported on a due diligence phone call that Goldman Sachs had conducted in February 2021 with a person the bank thought was an executive at YouTube. Goldman was considering a $40 million investment in Ozy,

and the call was meant to verify Ozy’s representation to Goldman that it had a great relationship with YouTube, and that its videos were popular on the platform.

But, Smith reported, the Goldman team started to suspect something was off about the voice of the supposed YouTube executive, who “told the bankers what they had been wanting to hear”: that Ozy’s videos were generating views and ad revenue,

and that Watson was a great C.E.O. In fact, the alleged YouTube executive was actually Samir Rao, Ozy’s co-founder and chief operating officer, who had altered his voice using software.

“During the call, Watson was in the same room as Rao, and texted Rao instructions about what to say and what not to say on the call,” the Justice Department later explained. “Shortly after the call, one of

the employees of the financial institution contacted the actual media executive of the online video service, who confirmed that he had not been on the call, and that the online video service had no role in the production of The Carlos Watson Show. When members of the financial institution later spoke with Watson, he falsely claimed that Rao had acted alone and as a result of a mental breakdown.” In the end, Goldman passed on the Ozy investment and the incident went unreported—until

Smith’s column.

Watson told Smith that Rao had taken a leave from Ozy after the call, but had since returned to work at the company. He said he was proud to have stood by Rao “while he struggled.” Hedge fund manager Marc Lasry, who was chairman of the Ozy Media board, told Smith that the board was aware of the incident, and that the board, too, was proud of the way Watson and his

team had handled the Rao matter.

Ozy’s support for Rao apparently had its limits. On October 15, 2021, in a letter to investors, Watson noted that Rao had left Ozy and would “not be returning to the company.” In the letter, Watson also acknowledged having “heard” from the S.E.C. and from the Justice Department.

In February 2023, the U.S. Attorney for the Eastern District of New York indicted Watson and Ozy Media, charging them with conspiracy to commit securities fraud and conspiracy to commit wire fraud as part of an alleged scheme to defraud investors and creditors out of millions of dollars by

materially misrepresenting Ozy’s financial condition. “Watson repeatedly attempted to entice both investors and lenders through a series of deliberate deceptions and fabrications,” said Michael J. Driscoll, then assistant director-in-charge of the F.B.I.’s New York field office, in a statement announcing the charges.

Both Rao and Suzee Han, Ozy’s chief of staff from

June 2019 to October 2021, had already pleaded guilty to their role in the “scheme,” according to the U.S. Attorney’s Office press release, which detailed how Watson and his co-conspirators allegedly “lied to prospective investors about who else might be investing in Ozy, the existence and size of acquisition offers received by Ozy, the existence and timing of ‘Series C’ and ‘Series D’ financing rounds by Ozy, and the existence and terms of Ozy’s business contracts,” among other generally

frowned-upon behaviors on Wall Street.

Last July, a federal jury in Brooklyn convicted Watson on the charges in the indictment. “The jury found that Watson was a con man who told lie upon lie upon lie to deceive investors into buying stock in his company,” said United States Attorney Breon Peace after the verdict. “Watson invented phony financial figures and caused others to forge fake contracts and impersonate a media executive. Ozy Media ultimately

collapsed under the weight of Watson’s dishonest schemes and with today’s verdict, Watson himself has been held accountable for his brazen crimes.”

|

Watson, who is Black and a graduate of Harvard and Stanford Law School, called his

prosecution “a modern lynching” and compared himself to Nelson Mandela when addressing the court at his sentencing. “I made mistakes,” he eventually conceded. “I’m very, very sorry that people are hurt—including myself.” But, he added, “I don’t think it’s fair.” That last bit didn’t seem to sway Judge Komitee, who sentenced Watson to 116 months in prison.

But then, last Friday, Trump

reached for his lucky pardon pen and set Watson free. According to Glenn Martin, a criminal justice reform advocate, it was Alice Marie Johnson, Trump’s recently anointed “pardon czar,” who intervened with the president on Watson’s behalf. Johnson herself was pardoned by Trump (with an assist from Kim Kardashian) during his first term, when he commuted her life sentence for

cocaine trafficking, of which she had already served 21 years.

In her new position, Johnson has Trump’s ear when it comes to suggesting pardon-worthy figures. “She saved the life and family of Carlos Watson,” Martin wrote in a Medium post. “She has saved countless others. She is straight Harriet Tubman 2.0, navigating the underground railroad of mass incarceration,

guiding people from the depths of injustice to the light of freedom.” Watson deserved the relief, according to Martin, because he was “a charismatic, successful, Ivy League educated Black entrepreneur” who was a victim of “a political witch hunt.”

Martin’s theory of the case is a bit much, of course. Watson was a convicted felon who sought to defraud creditors and investors in his company. He caught

a break because his case came to the attention of Trump’s “pardon czar.” Trump hasn’t commented, but presumably he knew how disruptive letting Watson off the hook would be to Wall Street and the efforts to prosecute white-collar crime. (Note to Sam Bankman-Fried, Charlie Javice, and Elizabeth Holmes—seek out Alice Marie Johnson ASAP.) Another theory is that Trump pardoned Watson to piss off

Laurene Powell Jobs, an investor in Ozy Media who is also a board member and the owner of The Atlantic, which has published stacks of stories critical of Trump and his inner circle, including the one that touched off Signalgate.

One Wall Street observer I spoke to about Watson’s good fortune, who has followed the case from the start, said that while his 10-year sentence was “too punitive,” it was a

miscarriage of justice that Watson was somehow able to shift the political narrative about himself from someone who “committed real crimes” to being a victim of both “the Biden deep state” and “The New York Times.” He said he found Watson’s commutation especially “demoralizing” because “what’s the point of exposing wrongdoing and prosecuting it?” Trump, this person contended, has essentially proclaimed with his pardon spree that there are no victims, and should be no

punishment, for white-collar crime—at least for those with a connection to the White House. “It’s fucking insane,” he added. “We’re watching the collapse of the rule of law.”

|

|

|

Join Puck’s chief political columnist, John Heilemann, as he roams the corridors of power and influence in America on this

twice-weekly interview show, taking you beyond the headlines with the people who shape our culture: icons and up-and-comers, incumbents and insurgents, moguls and machers in the overlapping worlds of politics, entertainment, tech, business, sports, media, and beyond. The conversations are rich and revealing, unrehearsed and unexpected… and reliably impolitic. A Puck-Audacy joint, new episodes drop every Wednesday and Friday.

|

|

|

Puck’s daily political newsletter from Washington on what’s really happening in this town, from the White House to the Pentagon

to Capitol Hill, K Street, and the campaign trail.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|