Hi, and welcome back to Line Sheet. Happy last day of New York Fashion Week.

By the time you read this, Thom Browne will be over, and I will be back uptown.

I’ll share my final thoughts on the shows tomorrow, but today, Sarah “SShapiro@puck.news” Shapiro is back with news and notes on the

Gapaissance (dang, that Mark Breitbard is a lucky guy), Kash Patel’s Shein shares, and what The RealReal’s annual results tell us about the state of fashion. At this season’s shows, you can really see The RealReal Effect in action: So many brands are designing straight-up vintage-looking wares. My fear for those brands is that

young, savvy consumers will just go to resale sites for the original rather than opt for the new, often more expensive, replica. And up top, I’ve got intel on the unexpected relaunch of a shoe brand with an incredible history, an intriguing backer, and a star designer.

By the way, Kering released its numbers today. The good news: Q4 sales and operating profit both beat analyst expectations,

but Gucci-specific revenue was down a little more than projected. My guy Luca Solca referred to 2024 as Kering’s annus horribilis, which is true. And yet, shares are up: Investors are happy that the company cut ties with Sabato De Sarno, and are confident that current management has a plan. That end-of-2025 turnaround for the luxury industry might happen after all.

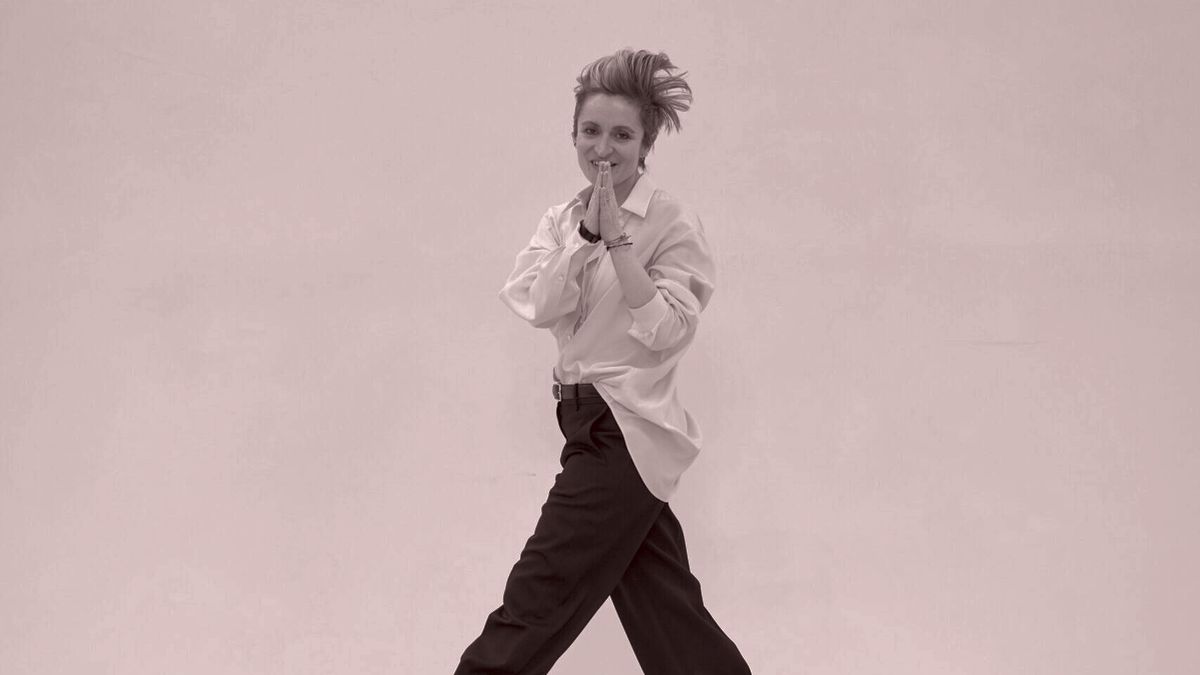

🛍️ For those of you with The Shoppies: How good did TWP look yesterday at the Bowery Hotel? In its short existence, Trish Wescoat Pound’s glam-essentials collection, backed by none other than Andrew Rosen, has become a

top brand at stores across the country. (I recently said to a fashion exec that I heard it was printing money. They said, “Almost.”) Anyway, Trish turned all that fabulous shirting up a notch at her runway show this season by enlisting stylist Jorden Bickham, whose talent is in making everything she touches look extremely cool. After I posted a short video of the final runway walk, about a gazillion people DMed me, including my best friend Pam, saying they wanted to wear it all. Many people asked about the shoes. Sarah did the work for you here, and found that they were actually Brave Pudding’s $380 “shoe slippers,” which are so Leandra Medine Cohen–coded that I don’t understand how they aren’t called the Leandra. (As Sarah noted a few weeks ago, slippers-as-shoes-you-wear-on-cement are a real thing.) If this new TWP collection made you want to shop right now (understandable), we recommend the hoodie cashmere sweater or her signature cropped shirt… but in suede.

Mentioned in this issue: Gap, Zac Posen, Richard Dickson, Mattel, Leandra Medine Cohen, Chris Goble, Old Navy, Banana

Republic, Troye Sivan, Tyla, Quince, Coach, Trevor Houston, Salvatore Ferragamo, Olivia Nuzzi, Bobby Kennedy Jr., Pam Bondi, Bally, Aritzia, Abercrombie, and many more…

|

|

|

A MESSAGE FROM OUR SPONSOR

|

The all-electric BMW i7 merges technology and design with an available Panoramic Sky Lounge LED Roof and 4D surround sound. Learn

more at BMWUSA.com.

|

|

|

Three Things You Should Know…

|

- The

New York Fashion Week debut of the season happened off the runway: On Monday afternoon, before Coach, I headed uptown to meet Trevor Houston, the designer behind the relaunch of Herbert Levine, one of the most important brands in the history of American fashion. Founded in 1948 by Levine, a former journalist, and designed by his wife, Beth, the brand became a sort of American Salvatore Ferragamo, worn by all the politicians’ wives (yes, Jackie Kennedy) but also all the Hollywood stars (Nancy Sinatra’s walking boots were Herbert Levine).

Anyway, the brand closed in the 1970s and has been virtually dormant ever since, save for a revival attempt about 15 years ago that obviously didn’t work. Now owned by Luvanis, an intriguing company that specializes in reviving “sleeping beauty” luxury brands (and is backed by Luxembourg’s De Lummen family), Houston was enlisted to bring it back to market.

I can’t underscore enough how much I loved this collection. For his debut, Houston attempted to present a complete shoe wardrobe, if you want to call it that, from loafers to thigh-high boots. But what made it good was the balance of old and new. Right now, much of what’s offered on the designer shoe market feels like a vintage replica. Houston did a good job of loosening up old styles, such as shaping the shoe vamp of a classic pump into a V to mimic the toe. There were plenty of little nods to original designer Beth Levine’s work, which Houston has been collecting for years, from the tiny heart tacked onto the top of sole to sneaking her name onto the innersole.

But it’s the behind-the-scenes story of Herbert Levine that is going to make it so compelling to watch. Shoe designers are a fascinating and mysterious breed: They are incredibly important to most businesses (shoes are often the fastest-growing category for luxury brands), and are

routinely poached. Before making magic at The Row and Khaite, Houston worked for Irene Chung, a beloved designer who collaborated with Marc Jacobs, then Coach, and whose career I followed for years. (She tragically died in 2023.) I’m excited to see Houston front and center.

As for the De Lummens, you might remember their name because, at one point, they also owned Vionnet, Moynat, and Paul Poiret. They tend to buy these brands, let them sleep for a while, make a light play at revival, and then sell them. (It’s not a bad strategy: LVMH bought Moynat, but there are fewer and fewer buyers for these things.) They currently own Charles James, Mainbocher, Rose Bertin, and several other brands. I wonder whether the De Lummens have their first certifiable hit on their hands with Herbert Levine.

|

- Kash

Patel, fashion consultant?: Here’s the latest twist befitting these surreal times (an era when Bobby Kennedy Jr. can run for president, have a digital affair with Olivia Nuzzi, still keep together his marriage to Bally enthusiast Cheryl Hines, and then become

Trump’s secretary of Health and Human Services): Elite Depot, Shein’s parent company, had Kash Patel on their payroll as a consultant. Now Trump’s F.B.I. director pick is holding $1 million to $5 million in Shein shares, with no plans to divest if confirmed.

This raises serious eyebrows among those of us who’ve been tracking Shein’s trajectory. We’ve seen the company’s attempts at reputation management—like those carefully orchestrated, mostly unconvincing influencer factory tours after the 2023 labor condition exposés. Additionally, Patel has been vocal about Shein competitor Temu, a Chinese company that he claims is a greater threat to the U.S. than TikTok. A month after Patel started consulting for Elite Depot, the company hired the lobbying firm where Pam Bondi, Trump’s newly minted attorney general, previously worked.

The potential F.B.I. director’s financial ties to a company facing scrutiny over labor practices and supply chain transparency might’ve raised eyebrows in a quainter Washington. But when I asked my partner John Heilemann, who recently wrote about Patel’s connections, he responded that this detail likely won’t even register as a blip during Patel’s confirmation.

- Everybody loves resale: Yesterday, The RealReal reported “impressive” preliminary Q4 results (their words) in all areas, beating gross merchandise value and total revenue projections and boasting a strong EBITDA, with a 15 percent-plus increase in performance. All lowkey good news for Rati Levesque, who took over as C.E.O. in the fall. The stock has also been inching up this past year, although it trades at around 30 percent of the pre-Covid I.P.O. number.

The RealReal has been leaning into a playbook that includes using data insights and A.I. to price inventory in order to get it out the door quickly while still making a healthy margin. They’ve also been strong at social media, responding to the moment and having fun with it. Their

savvy take on this week’s Kendrick Lamar flare denim conversation: Why wait for retailers to deliver this new silhouette when you can search secondhand for immediate gratification? This is a perennially challenged space, obviously, but one upside of rising luxury prices is that online resale companies allow consumers to

feel like they’ve scored a deal.

|

And now for the main event…

|

|

|

Yes, the Gap may be having a moment, but the designer behind the current enthusiasm left

the company last year. And its emphasis on marketing spectacle over merchandise substance raises questions for its latest supposed revival.

|

|

|

Gap is experiencing a phenomenon now—right now—that it hasn’t seen since at

least the mid-aughts: genuine enthusiasm. There is legit excitement about their clothes—their denim Western shirt jacket and this mini dress in particular—from actual shoppers and cool girl influencers like Leandra Medine Cohen (who recently

exalted the brand on her Substack, The Cereal Aisle), as well as a gushing appreciation in the Strategist. The Gap’s stock price is riding a wave of social media momentum and renewed cultural relevance, trading at three times its

2023 low.

At Davos earlier this year, Gap Inc. C.E.O. Richard Dickson, who joined the company after Barbie-ifying Mattel, told a corporatese story of renewal. “We’ve stabilized the top line,” he said. “We’ve expanded the margin component of our P&L pretty significantly. We’ve controlled inventory. We’ve done less promotions. We’ve controlled the SG&A.” Operating margins, he continued, were “getting back to

some historical references.”

|

|

|

A MESSAGE FROM OUR SPONSOR

|

The all-electric BMW i7 merges technology and design with an available Panoramic Sky Lounge LED Roof and 4D surround sound. Learn

more at BMWUSA.com.

|

|

|

Alas, Gap’s moment might be more fleeting than Dickson would like to admit. Its current success is largely the handiwork of Chris Goble, the mega-talented chief product officer whom Dickson let walk out the door in October after 18 years of service. And while Goble’s former team is intact, they haven’t hired a new chief product officer, leaving a significant void in product leadership just as the company needs it most.

Gap came to dominance in the ’80s and ’90s by filling the gap (sorry) between the runway and the department stores while maintaining scale and delivering the product innovation that consumers expected. These days, though, consumers have plenty of competition to pick from, including Aritzia, Abercrombie, and a plethora of D.T.C. brands, like Quince, which just raised a Series C. Recent store visits reveal hints of the old Gap magic in categories like denim and classic knits, as well as the return of some solid dresses. But the channel checks also reveal the company’s emphasis on marketing spectacle over merchandise substance.

|

Zac Posen’s arrival as creative director of Gap Inc. a year ago ushered in excitement, and a bit of vexation. So far, Posen’s work has shown up more on social media than on the shelves of the company’s 1,100+ Old Navy stores—the core of his remit as the brand’s chief creative officer. GapStudio, the line created by Posen and launching in April, seems to be set up to facilitate the moving of some of Posen’s work into Gap proper, without him designing the main mass line. It’s hard not to conclude that Gap Inc. is leaning heavily on marketing that doesn’t necessarily reflect the potentially great products in stores. In December, Vogue produced a day in the life video that featured Posen’s involvement in the brand, but the focus was on marketing and a few pops of product from Old Navy and Banana Republic Men’s. (A Gap spokesperson told me the crew had been filming for Vogue and another interview with Dickson and Posen for Business of Fashion at the same time.)

True, Dickson’s success at Mattel was also largely about marketing—and the Barbie phenomenon proved the value of the discipline. But turning around a brand like the Gap takes time and talent. The company’s Troye Sivan and Tyla holiday marketing campaign—which felt like a return to the heart-warming, song-and-dance-filled campaigns of the ’90s—generated $482,000 and $355,000, respectively, from their social accounts, according to data from Launchmetrics. Tyla’s Linen Moves campaign generated a total of $1.2 million in Media Impact Value in the two weeks after launch. These are stunts for a $9 billion market cap company.

|

|

|

Can Gap translate social media buzz and nostalgic marketing into sustained merchandise success without dedicated product leadership at the helm? For a company that built its empire on perfectly executed basics, the balance between spectacle and substance may determine whether this apparent comeback becomes a lasting transformation or a fleeting moment of paid cultural relevance. At the end of the day, Gap needs merchandise to sell, and it’ll be another 12 to 18 months before we see what the merchandise looks like without Goble’s direction. Furthermore, Dickson isn’t a merchant at heart; he’s the

marketing guy. We won’t get the Q4 financial results until March, but marketing can pivot faster than inventory. In other words, it will take a few more quarters to find out whether the Gap’s turnaround is real—or just a clever marketing mirage.

|

What We’re Reading… and Listening To…

|

We’re closely tracking the growing rivalry between affiliate marketing platforms LTK and ShopMy. Most recently, LTK founder and C.E.O. Amber Venz Box hinted at a new product that I suspect will be a competitor to ShopMy Opportunities, which allows brands to incentivize creators quickly and efficiently. [Instagram]

For those of you craving something different: Kim Masters’s big debut at Puck has behind-the-scenes details on how the credibly canceled Brett Ratner, who’s been M.I.A. from Hollywood since 2017, somehow landed the deal to direct a Melania Trump documentary while living it up at Mar-a-Lago. Naturally, Amazon paid $40 million for the project.

[Puck]

Shopify removed Ye’s online store following the whole Super Bowl ad debacle. There’s no room for debate on hate. [CBS News]

How do you feel about doing something you’re bad at? I’m rethinking how I approach it after reading this article from Arthur C. Brooks, who is literally the host of a podcast titled How to Build a Happy Life. [The Atlantic]

This is what Nicole Johnson—a partner at the be-all-end-all of consumer funds, Forerunner Ventures—is looking to invest in this year. [Inc]

|

Until tomorrow,

Lauren

P.S.: We are using affiliate links because we are a business. We may make a couple bucks off them.

|

|

|

Puck fashion correspondent Lauren Sherman and a rotating cast of industry insiders take you deep behind the scenes of this

multitrillion-dollar biz, from creative director switcheroos to M&A drama, D.T.C. downfalls, and magazine mishaps. Fashion People is an extension of Line Sheet, Lauren’s private email for Puck, where she tracks what’s happening beyond the press releases in fashion, beauty, and media. New episodes publish every Tuesday and Friday.

|

|

|

An essential, insider-friendly Hollywood tip sheet from Matthew Belloni, who spent 14 years in the trenches at The

Hollywood Reporter and five before that practicing entertainment law. What I’m Hearing also features veteran Hollywood journalist Kim Masters, as well as a special companion email from Eriq Gardner, focused on entertainment law, and weekly box office analysis from Scott Mendelson.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|