|

|

Happy Wednesday, and welcome back to Dry Powder.

|

|

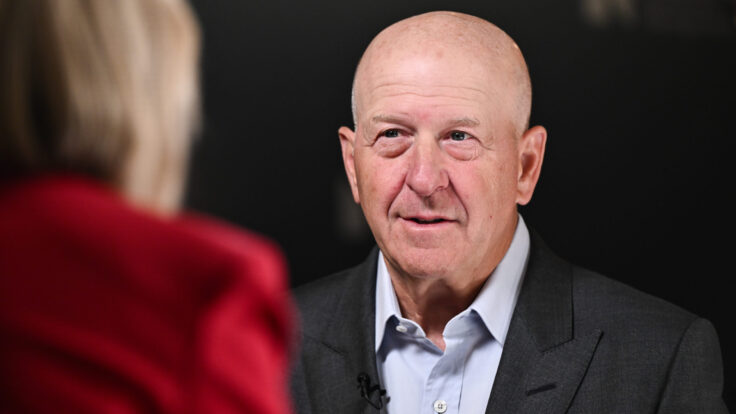

Disney C.E.O. Bob Iger has notched three impressive wins in his six months back in the saddle: gracefully disarming activist investor Nelson Peltz, outfoxing Ron DeSantis, and cleverly restructuring the company. But his two biggest challenges remain: resuscitating Disney’s essentially lifeless stock price and, most important, choosing a worthy successor (again). Herewith, a few candidates and predictions for the Succession Planning Committee.

|

|

| The Iger Six-Month Itch |

| Despite his early successes, the ageless C.E.O. still has two vitally important tasks in front of him: cranking up Disney’s moribund stock price and finding a real successor, one that can outlast the 33-month tenure of Bob Chapek. He’s got some 18 months left. |

|

|

|

| Hard to imagine, but it’s been six months since Bob Iger boomeranged back into the Disney corporate suite with the clearly articulated, multi-pronged goal of un-fucking up the Chapek messes (within the talent community, the Florida legislature, etcetera), rejuvenating the stock price, and finding his real successor, and all in a tidy two-year window. Iger’s successes in this short span have been impressive. He’s seen off a serious threat from an activist investor, restructured the company and outfoxed the governor of Florida. An impressive trifecta of early accomplishments.

When Iger rejoined Disney as its C.E.O., last November, the company was in the midst of a five-month quiet war with Nelson Peltz, one of the fiercest activist investors around. Peltz and his hedge fund, Trian Partners, are known for getting their way, whether through successful proxy fights (as with Procter & Gamble and Heinz) or even through unsuccessful proxy fights (such as with DuPont). In other words, Peltz was not the kind of adversary who could be easily dismissed.

But Iger proved to be a match for Peltz. A close reading of Peltz’s proxy-fight materials has led me to conclude that the Disney board decided to decapitate Chapek—just months after unanimously granting him a three-year contract extension—precisely because it saw the looming Trian threat and anticipated that Iger would be able to garner more shareholder support, if it came to a proxy fight, which it did. And the Disney board bet on the right horse. Less than a month after he launched Trian’s public proxy fight, on January 11, Peltz conceded the bout, either because he didn’t think he would win the contest or because, as he claimed, Iger’s so-called restructuring plan gave Trian pretty much everything it wanted, except for a board seat. “We congratulate Disney and Bob Iger on their recently announced operating initiatives, which are a win for all shareholders and broadly align with our thinking,” Peltz announced on February 9.

Iger not only saw off Peltz in a relatively painless way, but he was also clever enough to take his advice. Iger agreed to restore Disney’s dividend, a casualty of the pandemic, by the end of 2023. He agreed to cut $5.5 billion in costs and 7,000 jobs, or 4 percent of the Disney workforce. He also agreed to reorganize Disney’s business units into three divisions: Disney Entertainment, including Disney+ and Hulu, under Alan Bergman and Dana Walden; ESPN, under Jimmy Pitaro; and Disney’s theme parks, cruise lines, retail stores, resorts, games and publishing, under Josh D’Amaro.

Siloing ESPN got Wall Street speculating that Iger is preparing to spin off the unit into its own publicly traded company, loaded up with some of Disney’s $40 billion of net debt, or to swap it for Comcast’s 33 percent of Hulu that Disney does not already own. But Iger has been careful to tamp down that speculation, and has suggested that Disney plans to keep ESPN despite its subscribers falling to around 75 million, from more than 90 million a decade ago. I still suspect the fate of ESPN remains very much in flux. It could form the basis of a swap with Comcast for its stake in Hulu. Or, perhaps more conveniently, it may be the easiest way to send some of that $40 billion debt out to sea.

Last week, Iger also began the process of firing some 7,000 Disney employees, as he promised he would, and proved that he’s not averse to a little political payback. As part of the first round of layoffs, he managed to fire a longtime nemesis, Ike Perlmutter, who was the 80-year-old chairman of a small Disney division, Marvel Entertainment, a consumer products business not to be confused with the much larger, and more significant, Marvel Studios, which is run by Disney executive Kevin Feige.

Iger’s defenestration of Perlmutter can only be seen as retaliation of sorts for Perlmutter’s support of Peltz in his proxy fight with Disney. The two men are friends and the Trian proxy statement revealed that Perlmutter had been an active participant on Peltz’s behalf, including contacting Disney board members six times between August and November to try to win a board seat for Peltz. Of course, Iger dressed up the firing of Perlmutter as part of the overall reorganization that eliminated Marvel Entertainment while folding it into other parts of Disney. The layoffs, which will continue in two more waves and conclude by the summer, also revealed that Iger had no interest in the 50-person “metaverse” division that had been a particular focus of Iger’s predecessor; those employees were also let go. More winning.

Speaking of retaliation, Iger also notched an improbable victory against Florida governor Ron DeSantis, who had tried to reward Chapek’s opposition to his so-called “Don’t Say Gay” bill by eliminating the tax breaks Disney has enjoyed for 55 years in and around its Orlando theme park. The tax gimmick was seen as petty political payback for Disney’s opposition to the new law. But Iger’s Disney seems to have found a clever legal loophole around the DeSantis move. Apparently, on February 8, the day before DeSantis planned to replace the special tax district’s oversight board with a new board loyal to him, the old board signed an agreement with Disney that allows the company to continue developing the area around its Orlando theme park for decades, and for as long as 21 years after the death of the last surviving child of Charles III, the current King of England. (Yes, the whole thing has become a bit like a Disney animated fairy tale.)

Disney claims everything was done legally and in the open, during public sessions, although even some of the reporters who were in attendance at the February 8 hearing were not aware of what had transpired; the new agreement was only discovered more recently as DeSantis’s board took charge. This, too, has to be considered a major win for Iger, although DeSantis and his Republican allies in Florida have pledged to keep fighting Disney’s special tax break. On Monday, DeSantis called for a state investigation into the board’s maneuver; Iger called DeSantis “anti-business and anti-Florida,” whatever that means, and said that Disney has “a right to freedom of speech just like individuals do.” |

|

|

| But these successes, as legitimate and meaningful as they are, are merely the warm-up act for the two big challenges that Iger still faces, and that will ultimately define whether his boomerang C.E.O-dom will be considered a triumph and whether his legacy will be blemished or embellished. First is the Disney stock price. Since Iger returned to Disney last November, the Disney stock has been essentially flat, notching a mere 2.2 percent increase, although it is up 12 percent since the start of 2023.

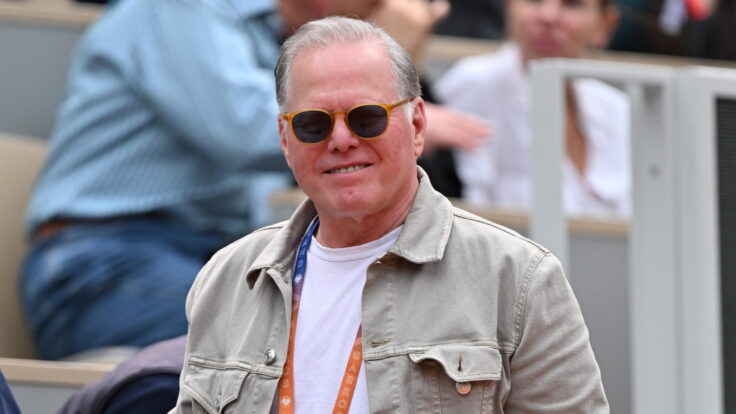

While one could argue that comparisons are unfair, they are inevitable, and comparatively speaking Disney’s stock is a laggard. Warner Bros. Discovery stock is up 55 percent so far in 2023, even the lowly Paramount Global is up 27.5 percent year-to-date. (Comcast’s stock is up 7.4 percent.) Like it or not, until Iger’s strategic moves get rewarded by equity investors, he’s not going to get credit for his successes during the last six months. Does that mean that Iger has to continue to find ways to reduce Disney’s $40 billion or so of net debt? Or that he has to find a solution for Hulu, either by selling it to Comcast or buying Comcast’s stake? (Goldman Sachs has been hired to explore “strategic alternatives” for Hulu.) Or that he has to find a way to stem the losses at Disney+? Or that he has to decide what to do with ESPN? Yes, to all of the above.

Rich Greenfield, a partner and analyst at LightShed Partners, told me that there are two “massive” strategic questions hanging over Iger’s Disney. First, figuring out what to do about Hulu and Disney’s other “general entertainment” businesses, such as ABC, the Fox assets that Disney acquired in the 21st Century deal, and other “adult mature programming,” as he put it. Then Disney has to figure out if it wants to continue to be in the sports media business.

Greenfield’s point underscored the different business models that the vast company needs to consider. Its core content business is vertically integrated: Disney, Marvel and Pixar movies are owned by the company, appear on its streaming platforms, and become Disney merch as well as the theme park rides, cruise ships, etcetera, providing a long tail of downstream monetization. Sports, of course, is different: the rights are expensive as hell and the leagues own the product. “They make a movie, they make a TV show, they own that I.P. and they can exploit it in their theme parks, in their retail stores, licensing movies, anywhere,” Greenfield told me. “They have the ability unlike any other company to leverage content in more ways than anybody else. When you are in the sports business, obviously you don’t own the NFL, you don’t own the NBA, you’re just licensing somebody else’s content and you’re very restricted in terms of what you can do with it. It’s sort of these two big huge questions that we, six months in, I don’t think we have any visibility on.”

There needs to be a serious catalyst to propel the Disney stock higher, and any one of these moves could do it. (This is not investment advice.) But, as Greenfield notes, Iger has been silent about these major outstanding strategic initiatives. If he could find a way to make Disney+ cash-flow positive in the near-term, that would make Iger a Wall Street hero, but it would require some kind of new alchemy that others haven’t figured out. |

|

|

| Barring a sale to a company like Apple, a notion that has been floated but hardly seems logical or advisable in this regulatory environment (or any other), Iger’s single most important remaining decision is choosing his successor (again). He blew it once, of course. And like the dilemma of our friend Jamie Dimon at JPMorgan Chase, there don’t seem to be any obvious contenders inside Disney.

The good news is that the Disney board (and Iger, presumably) have recognized the importance of this task and are focused on it. The board has named a “Succession Planning Committee,” comprised of new board chairman Mark Parker, the former C.E.O. of Nike; Mary Barra, the C.E.O. of General Motors; Calvin McDonald, the C.E.O. of Lululemon Athletica; and Francis deSouza, the C.E.O. of Illumina. (I’m not sure how much use deSouza can be on this committee in the near term; he has his hands full with his own proxy fight, courtesy of Carl Icahn, and the F.T.C.’s decision, also on Monday, to block Illumina’s acquisition of Grail, a topic I have covered previously here.)

The Disney succession committee will hire a search firm and vet the candidates and report its findings to the full board as well as lead a discussion of potential successors. Appropriately, according to the Disney PowerPoint used at Monday’s annual meeting of shareholders “C.E.O. Succession is a top Board Priority.”

The likely candidates are anyone’s guess at this point. My friend Charlie Gasparino, over at Fox Business News, took a stab at a list of potential Iger successors last month that included Adam Silver, the NBA Commissioner—Silver has denied having any interest in the job and why would he, he already has one of the best jobs in the world—as well as Dana Walden, the co-head of Disney’s entertainment division, and Kevin Mayer, a former Disney and TikTok executive who is now the founder and C.E.O. of Candle Media, the Blackstone-backed media company that owns Moonbug Entertainment and Hello Sunshine, Reese Witherspoon’s media company. (Mayer’s co-founder at Candle, Tom Staggs, was also a longtime Disney executive once considered as a possible Iger successor.)

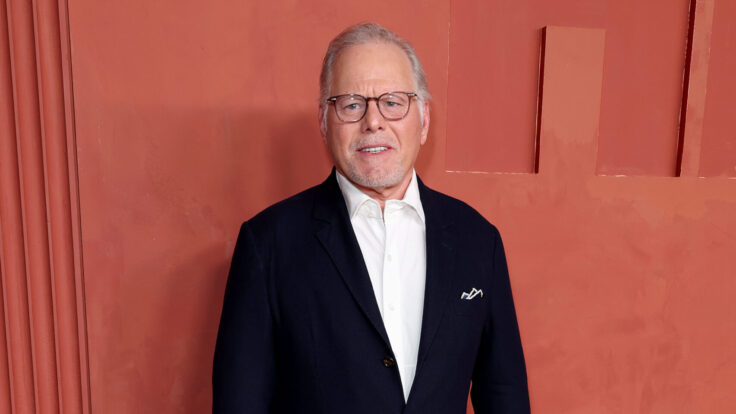

But the jury is still out on Candle and whether the two Disney alumni overpaid for its businesses at the top of the market. And, of course, whether Mayer would really want to boomerang back as well, especially after he was passed over once before. Gasparino’s list also included the other more obvious candidates, including Bergman, Pitaro and D’Amaro. One smart Disney observer suggested to me over the weekend that the best person to lead Disney, following the end of Iger’s second stint in the corner office, is none other than our old friend David Zaslav. But I think we can all agree that the Zaz is quite otherwise engaged at the moment, and will continue to be into the foreseeable future.

Where does that leave the Succession Planning Committee? In need of some out-of-the-box thinking, if you ask me. Names that have been posited range from the ridiculous to the sublime, including David Nevins, the former Paramount+ and Showtime executive (not uninteresting) to Michael Lynton, the wealthy former Hollywood executive (he has the chops) to the aforementioned Jamie Dimon, who would be a barnburner of a choice if he ever relinquishes his role at JPMorgan Chase and isn’t offered the Treasury Secretary job, two ginormous ifs.

I asked Greenfield who he thought would be a worthy successor to Iger. He seemed genuinely stumped, not that he hadn’t thought about it quite a bit. He said it depends, in part, on what assets are still around. If Disney gets out of ESPN, you don’t need someone who understands that business. If Disney sheds Hulu, you may not need someone who understands the “general entertainment” market. And so on. He mentioned Peter Chernin, but at 71, he is probably too old; and Jason Kilar, who is both young and ambitious but probably a bit tainted by his WarnerMedia experience. Greenfield said he thought Ted Sarandos would be great—the right combination of content and technological savvy—but figured he’d never leave Netflix. He didn’t think David Nevins or HBO’s Casey Bloys were crazy ideas, and noted that Tony Vinciquerra had done a great job making Sony Pictures relevant again. Maybe he should be considered? “You were asking such an obvious question,” Greenfield said. “And I don’t have an obvious answer.”

But Greenfield’s smart observations underscore a poignant reality about Iger’s double-barreled agenda for Iger 2: He doesn’t face two critical decisions, but rather one single interconnected multi-part dilemma. To wit, he needs to figure out what kind of company Disney should become to face a fast-changing media landscape and then he needs to appoint the appropriate executive to lead it. The Succession Planning Committee has its work cut out for it. |

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

| Lil Dicky Monologues |

| Comedian, rapper, and actor Lil Dicky on his hit FX show, Dave. |

| MATTHEW BELLONI |

|

|

|

|

| Streaming Money Squeeze |

| Entertainment guru Matt Ball assesses the next front in the streaming wars. |

| JULIA ALEXANDER |

|

|

| Elon’s Blue Period |

| A close look at Elon’s pay-for-Twitter-verification scheme. |

| BARATUNDE THURSTON |

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|