|

|

|

Greetings from New York, and welcome back to Puck. If you were forwarded this note, or think a friend should receive this weekly intel, get started with a free 7-day trial here.

Today, of course, we return to the crisis wrought by Sam Bankman-Fried, and the political and philanthropic fallout from the collapse of FTX. I’ve been talking with insiders over the past week to take you inside the room at S.B.F.’s political organizations, in the Democratic Party, and in the world of effective altruism. In some ways, the situation is not as bad as you might think. In other ways, it is way worse.

|

|

| Inside the S.B.F. Blast Radius |

| The fate of Sam Bankman-Fried is being closely tracked at the highest levels of the Democratic Party, and by the dozens of allied political groups that are either racing to distance themselves from his surname or to find their next check. |

|

|

|

| The Thursday before Sam Bankman-Fried’s company imploded, at a Capitol Hill townhouse just purchased by one of his main political outfits, about 60 Democratic operatives and lobbyists turned up for a cocktail party with a full bar and catering—“Democratic Night,” in the unofficial words of people invited—to celebrate S.B.F.’s ascendant lobbying organization. The previous evening, the townhouse had hosted a similar soirée for G.O.P. power brokers on “Republican Night.”

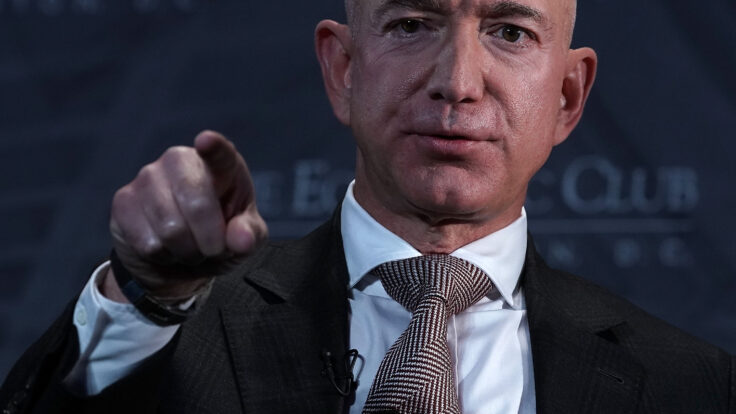

The subtext was as clear as when Jeff Bezos marked his territory by purchasing a mansion in Kalorama: S.B.F. and his network were in D.C. to stay. Some in his network—a sprawling coterie of family, political sherpas, data consultants and effective-altruist consiglieres—spoke openly about a 50-year mission for influence, and they were just getting started.

Several people who attended these functions called me, aghast, after it all came crashing down last week. S.B.F., after all, was briefly one of the biggest, and certainly among the most ambitious, donors in Democratic politics. In the three years between when he founded FTX, his crypto exchange platform, and its spectacular demise, I wouldn’t be surprised if his total political giving exceeded $100 million. Now, in the wake of FTX filing for bankruptcy and the possibility that S.B.F. could face civil or criminal charges, everyone who rode the gravy train is squinting to assess the blast radius: Just how much money was vaporized? What will be the long-term damage to those who tied themselves to his brand? Whose heads will roll?

Because while you can sell back the $3 million townhouse, the financial situation facing S.B.F.’s political-industrial complex is truly dire. Guarding Against Pandemics, the lobbying group that hosted the back-to-back soirées this month, has been looking for emergency funding to keep its work alive, I’m told, but grantees have been warned that the group has only a small amount of cash on hand. Indeed, nearly all of S.B.F.’s projects went from having seemingly infinite money to effectively zero, overnight. Sam’s brother Gabe, who founded the group, stepped down from GAP on Monday as the fuller extent of the disaster became clear.

The situation is no better elsewhere in Washington, where the fate of S.B.F. is being closely tracked at the highest levels of the Democratic Party, including by senior elected officials who are curious about what Sam’s fall means for the party and their pocketbooks. S.B.F., after all, was widely seen not only as a once-in-a-generation party donor, à la George Soros, but also as a unique political force, willing to push the envelope and take expensive risks (some would say too far). The optics for the left are awful, of course, as are the potential legal ramifications for Democratic organizations and betrayed S.B.F. aides if bankruptcy courts, class actions, or prosecutors try to claw the money back. Anxiety is running high.

To Republicans, S.B.F.’s fall presents an opportunity, understandably, to bludgeon Democrats with the partisan hammer, demanding that S.B.F.-funded entities return campaign donations and exaggerating the scale of his political involvement (No, S.B.F. is not “Biden’s second biggest donor” as I discussed here). Unmentioned by the right is that Sam, who really isn’t that partisan, also made some donations to Republicans, like the $100,000 to back Alabama Senate candidate Katie Britt during her primary. More importantly, another top FTX executive allied with Sam’s advisers, Ryan Salame, was also a major ascendant donor for the G.O.P. Should his contributions be refunded too?

|

| A MESSAGE FROM OUR SPONSOR |

|

| A solid wealth plan is critical for entrepreneurs at every stage. Read Northern Trust’s guide to explore insights for building and sustaining your wealth. Learn More. |

|

|

|

|

| The philanthropic blast radius ranges from the metaphysical—S.B.F.’s improprieties have left an immediate, possibly indelible stain on “effective altruism”—to the more tangible. Will Bill and Melinda French Gates keep him in The Giving Pledge community, which he just joined a few months ago? As of Tuesday, he is still on the website, but he is no longer a billionaire, and Gates has sounded the alarm in the past about allowing ignoble people into his exclusive club. What will happen to the newsrooms, like ProPublica, that had been planning to receive money from S.B.F. in multi-tranche installments? The E.A. Forum, a brainy if earnest community bulletin board for the effective altruist community, is littered with stories about S.B.F.-backed nonprofits that are suddenly struggling. Some E.A. community leaders are now taking pains to state publicly that, in case it wasn’t clear before, committing fraud in the service of donating more to charity is not a particularly altruistic thing to do.

The political blast radius includes Mind the Gap, the buzzy donor-advisory circle founded a few years ago by his mother, Barbara Fried, which has moved some S.B.F. money in the past (Sam once told me he has “consulted” for his mom’s group). I am told that Barbara, like her younger son Gabe, has quietly resigned from the organization she founded in the wake of her son’s scandal, emailing the Mind the Gap board recently to defend her son as she stepped down as board chair. Fried declined to comment when reached briefly by phone on Tuesday.

Other groups in the splash zone include Data for Progress, a progressive polling firm that has received some funding from S.B.F., and Future Forward, a Democratic super PAC likely to be the main group behind Joe Biden’s presumptive 2024 run, though neither of those should struggle for more cash. Protect Our Future, the super PAC that S.B.F. created this cycle and spent a staggering $12 million on an ill-fated, controversial mission to support Carrick Flynn in Oregon, is obviously imperiled (though it wasn’t clear what it was doing nowadays anyway). You can also assume that Nishad Singh, a member of S.B.F.’s inner circle at FTX who was making multi-million dollar contributions to pro-abortion rights causes this year, will be out of the picture, too.

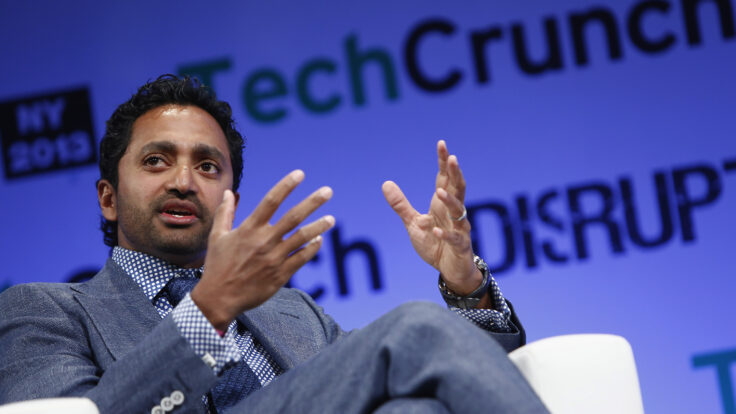

But the biggest victim in the political arena is assuredly Guarding Against Pandemics, the pandemic-lobbying group. GAP is now feverishly seeking other funders to help save the organization—there are talks happening now with billionaire Dustin Moskovitz’s Open Phil to see if there is a way for Dustin to rescue at least some of the work done by S.B.F.’s outfit, according to multiple people familiar with the matter. There is some skepticism about the tie-up here: GAP may end up being too political for Dustin, whose philanthropic profile is considered more risk-averse and policy-oriented.

Whatever happens, GAP will surely need to downsize into a much smaller organization, without the limitless spending and the townhouse and the consultants. Before all of this happened, I am told that GAP actually was working to expand its remit into other effective-altruist issues such as A.I. safety—now the entire nonprofit might be dead by year’s end. Gabe Bankman-Fried’s organization will also be hurt by the fact that he shares a last name with Sam, but when you ride the success of your brother, that comes with the territory. Gabe, formerly a young Hill aide and still a fairly novice operative, knew that he was able to become a major player in Washington overnight in large part because of his brother’s political largesse.

That’s a whiplash-inducing reversal from the access and opportunities afforded the Bankman-Fried family earlier this year. I reported a few months back that when S.B.F. sat down with the Problem Solvers Caucus for a dinner in Washington last May to talk about his work, members knew that S.B.F. planned to max-out to every member of congress who planned to attend the dinner. Now, the surname is a liability. And so on Monday, Gabe was self-aware enough to step down from the organization he founded in 2020. “I don’t want to be a distraction,” Gabe told his staff at an all-hands, I’m told, as he explained all of the uncertainty surrounding his organization. “I’m not the right person to be making these decisions right now.”

|

|

|

|

|

| Some Democratic operatives I’ve spoken with argue that the S.B.F ricochet could be worse. Sam was not sitting on the board of the Democracy Alliance, or anything like that, nor was he single-handedly propping up any critical machinery of the Democratic establishment. On the contrary, while Bankman-Fried was an aspiring Soros—and plenty of people hoped that he would step into his shoes—S.B.F. was more interested in his own idiosyncratic projects than being a party man. Several sources pointed me to the fact that Sam’s money this cycle was primarily restricted to his own groups—$27 million of the $40 million he spent went to his personal super PAC. The greater shanda is the theoretical role that S.B.F. could have played going forward. Once upon a time, he might have filled in the funding gaps in youth organizing created by the declining contributions of Tom Steyer, for instance. S.B.F. also had very real designs on being a major player in the 2024 presidential election—his team was telling people that they wanted to support more lefty groups during the general election, and I know he was actively trying to make more hires for his political-advisory team in advance of a presidential cycle where he boasted he could spend $1 billion.

None of that will happen now, which disappoints Democrats who welcomed S.B.F. as a creative player in a stodgy campaign-finance universe. One illustrative example: I’ve reported on the California ballot initiative that S.B.F. seeded with Moskovitz that would have set up a new government bureaucracy to boost investments in pandemic preparedness. As Puck readers know, after $20 million-plus of total spending from S.B.F. and Moskovitz’s respective groups, the effort failed at the last minute due to what seemed to be a clerical issue involving the submission of signatures to the California Secretary of State—an embarrassing setback for the ballot committee. I have since learned that the clerical issue was intentional self-sabotage—that Californians Against Pandemics, after receiving word that Gavin Newsom would likely come out strong against the ballot proposition, intentionally screwed up so it wouldn’t qualify until the 2024 ballot, missing the June 30 window by a single day.

S.B.F.’s political operations, with their many, many consultants, could be very exacting and strategic in that way, often emphasizing a desire to “talk about multi-cycle plays,” according to one person who pitched them recently. I always find that the word “play” comes up frequently in conversation with S.B.F. world—like an offensive coordinator, they wanted to draw up attacks and execute them. The upside to that closely-held playbook, to that insularity, is that the rest of the Democratic establishment may be somewhat insulated from FTX’s fall, and the toxicity now surrounding its founder. Washington, after all, has been around much longer, and the left has its own plays in store—it’s just S.B.F. who won’t be a part of them.

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

| The Pelosi Afterlife |

| Notes on Pelosi succesion drama, Biden’s age, and a White House wedding. |

| TARA PALMERI |

|

|

|

|

| Potter’s I.P. Curse |

| Notes on David Zaslav’s obstacles preventing further Potter hits. |

| MATTHEW BELLONI |

|

|

| The FTX Meltdown |

| Wall Street comes to terms with a generational financial tragedy. |

| WILLIAM D. COHAN |

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs page or contact us for assistance. For brand partnerships, email ads@puck.news.

|

|

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|