|

|

|

|

Forward this email to a friend!

|

|

For our second anniversary, subscribers can share the benefit of Puck with an exclusive code (INSIDEACCESS) that gets your network 30% off.

|

|

|

|

|

|

Welcome back to Dry Powder, I’m Bill Cohan.

|

|

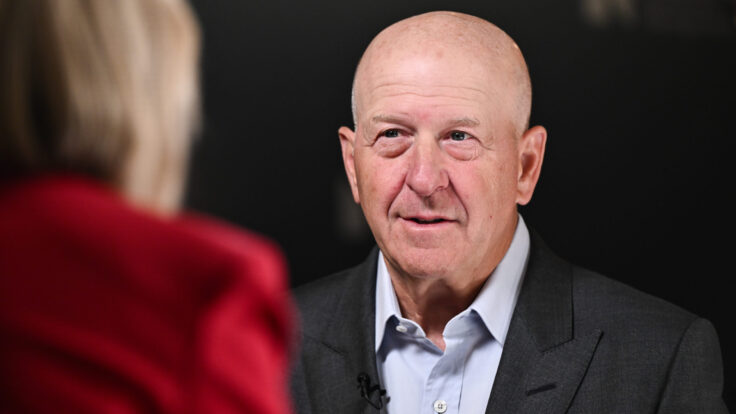

In today’s issue, my conversation with Blackstone’s Steve Schwarzman, who co-founded the private equity behemoth in 1987 with $200,00 of his own money. Today, as you know, Steve is worth a tidy $35 billion. Our discussion touched on Blackstone’s business, the upcoming presidential election, his Schwarzman Scholars program, U.S.-Chinese tensions, and much more.

P.S.: In celebration of our second anniversary, Puck members can offer their network 30% off an annual subscription. Just have them use the code INSIDEACCESS at checkout.

|

|

|

| While chatting the other day with Steve Schwarzman, the billionaire co-founder of the Blackstone Group, I asked him about his thoughts on the upcoming 2024 presidential election. Should we be resigned to a repeat of the Biden-Trump race of 2020, or is it possible we might end up with a less predictable outcome?

At 76 years old, Steve is a wise man on Wall Street. He is also quite politically astute and extremely well informed, even if he did serve for six months as the chairman of Trump’s bizarre 16-member Strategic and Policy Forum, prior to its dissolution in the wake of the Charlottesville riot. “I’ve learned that presidential elections are much more difficult to predict than people who are predicting them think they are,” Steve said. He reminded me that at the end of 2003, John Kerry was polling seventh in the Democratic primary race… and went on to become the nominee. At this point in the 2016 election cycle, he noted, it was Scott Walker leading the Republican field, followed by Jeb Bush, and “the soon-to-be indicted” Rudy Giuliani, in third.

What we know so far in 2023, Steve continued, is that 65 percent of Americans don’t want Biden to run again, and that 55 percent of Americans don’t want Trump to run again. “Seems odd,” he said, “if that’s what America wants, that’s what America is not going to get. I don’t know. I’ve seen all kinds of weird things with people ahead, they fall behind, they disappear. And it’s just way too early to have some conclusion that two people that the country doesn’t want are going to be the logical outcomes.”

The country also doesn’t want “people who are closing in on 80” to be running the government, he said, let alone the presidency, which is “not the easiest job in the world.” Sure, some small percentage of people can keep their wits about them as they get older and older. He cited, as one example, Henry Kissinger, whose 100th birthday Steve and his wife, Christine, attended in May. “Henry has complete mental acuity,” he said. But “if you look at the demands on somebody who’s president… they’re dealing with enormous crises. Almost nobody’s trained to do the full range of those things. Doing that in your eighties, I think, is asking too much of everybody.”

As for the four indictments against Trump and how seriously they should be taken, Steve was a bit cagier in his response, as you might expect. “We’re getting into the realm of theater,” he said, “and this isn’t a theater review.” He said he had read some of the indictments “and they seem pretty well wrought” and “we’ll see what happens.” But, he continued, he was always taught “that this isn’t the kind of situation you should find yourself in.” |

|

|

|

|

| We turned to the country’s challenging relationship with China and how it might get better, if that’s possible. Schwarzman, of course, is the man behind the Schwarzman Scholars program—his version of the prestigious Rhodes Scholarship—which was announced to the world in 2013 in the Great Hall of the People, in Beijing, and is now housed at Tsinghua University, the Harvard of China, in a beautiful new building designed by Robert A.M. Stern. His idea got the full-throated support of both President Obama and President Xi. (The first class of Schwarzman Scholars, admitted in the fall of 2018, included my older son and his soon-to-be wife).

The Schwarzman Scholars program has continued to thrive, despite the continuing deterioration of the Chinese-American relationship. As Hank Paulson, the former Goldman Sachs C.E.O. and Treasury Secretary, once told Schwarzman, urging him not to worry about the impact of geopolitics on his school, “China always needs a backdoor, they need a connection to the world. Even if it looks like they don’t. They’re quite smart about this. You will be that backdoor. And, in point of fact, that seems to be what’s happened.”

Alas, Steve said he expects the relationship between the U.S. and China to remain strained for the foreseeable future. He articulated the view in Washington that there is a “security risk” in transferring technology to China because of the so-called “dual use” concern, where our technology is also being used by the Chinese military. “There’s a big military build-up,” he said. “Our government has concluded that we have been facilitating the rise of China through those cybersecurity breaches and other types of things. We’ve provided a lot of their intellectual property. And we should stop that.”

From the Chinese perspective, he said, they have long been used to getting their hands on our technology, one way or another. No longer having access to what they have come to take for granted is viewed as “a change” and as “a threat.” He said that these conflicting points of view are why there has been a breakdown in the relationship, which has become exacerbated by the issues in both Hong Kong and Taiwan.

He recalled a relevant piece of 20th-century Chinese history—the war between Mao and Chiang Kai-shek, in the 1940s, which Mao won, and which led the Nationalists to retreat to the island of Taiwan. “From the perspective of Mao and his people,” Steve continued, “the Nationalists stole the treasury, and they stole the art treasures of China. There never was a treaty between the two of them, and the war ended. And they want to get their island back, and they want to get their stuff back. They’ve been making speeches since 1949 that they’re going to do it. And these speeches are made over and over again, and those of us who have some familiarity with this, when they say, ‘I want to get Taiwan back,’ we regard it as threatening, but they’ve been doing it for my entire lifetime. And eventually, they probably will.”

The problem, of course, with the Chinese taking control of Taiwan, is that 80 percent of the world’s semiconductors are made in Taiwan. “If China gets control of Taiwan, theoretically they could control the global economy, because you can’t really run a modern economy without access to semis,” Steve noted. “And that’s one reason why the Chips Act was passed. Our interest in Taiwan could be on a human-rights basis but, economically, this is not negotiable for us. We have to have access to that production. I don’t mean just us, I mean, the West. The world needs to have that access.”

He said he has explained to his “friends in the Chinese government” that China would do the same thing if the tables were turned, and suddenly China did not have access to the semiconductors that it needs and wants. But he also said that Nancy Pelosi’s trip to Taiwan a month before an election, in August 2022, was not helpful. “Anybody who knew China knew just what the reaction would be: blockades and ships and missiles,” he said. “That was not helpful to the Taiwanese or to the United States.”

I wondered why we couldn’t get along better with China, given that it is our largest creditor and one of our largest trading partners. Shouldn’t there be plenty of common ground between the two countries, on which to build a more constructive relationship? He reminded me that when China joined the World Trade Organization, in December 2001, its per capita G.D.P. was around $300 a year. “That’s like going to a good Nantucket restaurant for dinner,” he said. “That was the entire income of the average Chinese person.” Nowadays, that number is $12,000. “They’ve had an enormous run since 2002,” he said. “And they want to keep that run going.”

Two decades later, the U.S. and China are 40 percent of the world’s economy. (The U.S. is 23 percent; China is 17 percent.) “If you don’t get this relationship on some kind of decent functional level with 40 percent of the world’s economy, something bad is going to happen,” he said. “I’m not smart enough to know which of the many bad things can happen, but I know that something bad is going to happen if that much of the world economy is tied up with two countries basically having difficulty living together.” |

|

|

| We also spoke about what Steve is doing these days on the philanthropy front. He has been very generous and has signed the Giving Pledge for his $35 billion fortune. In addition to the Schwarzman Scholars program, he has also given more than $100 million to the New York Public Library—his name adorns the Fifth Avenue mothership—and to Yale, his alma mater, to renovate and reimagine what is now the Schwarzman Center building on campus. But much of his philanthropy these days is focused on artificial intelligence, including the $350 million he gave to MIT for what has become the Schwarzman College of Computing.

Steve first became aware of A.I. in 2015, as a result of his time in China. “I was on a bus with a guy named Jack Ma,” he said, when Ma—the co-founder of Alibaba Group—started talking to him about A.I. “I had no idea what he was talking about,” he continued. “One thing I’ve learned in life, if you don’t know what you’re doing, you better ask somebody to really explain. So he explained what A.I. was going to become, how it was going to lead to all kinds of amazing things,” from tripling the innovation of drug development, to changing individualized education globally to changing the nature of work and how organizations are going to be managed.

Eager to learn more, he started talking to Rafael Reif, then the president of MIT. “Everything Jack told you about A.I. is true,” Reif told Schwarzman, “but it’s understated. This is going to be astonishing.” Reif told Steve that while some 40 percent of MIT undergraduates take computer science, the university didn’t have enough faculty to meet the desire of the students for even more courses. “This is the start of a revolution,” Steve recalled Reif saying. “So when somebody in that position tells you that and you’re sort of a know-nothing, you sort of go, ‘Sounds like something is really going on.’”

Steve was intrigued. “I said, ’Well, what do you think we should do?’ Because I was meeting younger people in China developing commercial applications for A.I. and I wasn’t meeting younger people in America doing this, which meant [we] were falling behind.” Reif told him his “fantasy” was to double the MIT computer science faculty. So he asked Reif how much he thought that would cost. “Don’t ever do that with a university president,” Steve joked. Three weeks later, Reif told him it would cost $1.1 billion, and asked if maybe he’d like to write the check. “I was having a perfectly fine day,” Steve recalled. “There’s no way I’d give you $1.1 billion,” he told Reif, who countered by asking for half. “Is this a negotiation?” Steve replied. “What is this?”

They settled on $350 million, but only on the condition that the MIT board of trustees donate $125 million by writing checks, too. “If they don’t put the money out, then they don’t believe that this A.I. revolution really is profound,” Steve told him.

A few weeks later, Reif told him he had the money from his board. And now, MIT is up to around $1 billion in new fundraising for the project. “So now there’s a Schwarzman College of Computing at MIT,” he said. “It’s sort of astonishing, since I don’t use a computer, right? I mean, I’m still a liberal arts guy.”

He said a lot of technologists think A.I. is a more important discovery than the Internet and that A.I. will eventually have the intelligence equivalent to someone with an I.Q. of 12,000, as absurd as that sounds today. He’s had meetings about A.I. with Blackstone’s C.E.O.s. Blackstone has hired more than 50 data scientists since Steve clued into A.I. on that bus ride with Jack Ma. “I want us at Blackstone to be in that first-mover category,” he said. |

|

|

| Of course, we also spoke about how his business has evolved since he founded Blackstone with Pete Peterson, in 1985. What was first called an L.B.O. firm then evolved into the “private equity” business, and is now the “alternative asset” business, with much of Blackstone’s $1 trillion assets under management in products other than private equity. He said when he started Blackstone, there were around seven other private equity firms; now there are more than 10,000. “So, this has become somewhat popular, and for good reason,” he said, adding that private equity returns have historically outperformed the stock market by between 500 to 1,000 basis points.

Blackstone’s market value, at $127 billion, is more than that of Goldman Sachs, at $108 billion. “We started with $400,000,” Steve said. “200 from me; 200 from my partner, Pete Peterson. And now we have a market cap of about $120 billion. And that’s down from the top where it was sort of $180 billion. We have $1 trillion under management. We started with $400,000. So this really has been quite a journey.” He said Blackstone has figured out how to make money when interest rates were high (like when the firm started), when they were low (such as during the 13 years after the 2008 financial crisis), and now that they are relatively high again. “But everyone can’t,” he said. Blackstone continues to have access to capital, even when others find it harder to obtain. “Blackstone has an odd distinction, we’re the largest fee payer to Wall Street in the world,” he continued. “What happens is they like you more. It’s just not personal. When you pay them more, they like you more. And so if there’s credit to get, we can get it. It’ll cost more. But what happens in these cycles is that it’s just temporarily expensive.”

He said that private equity firms can make companies better because they control them. They can replace management, if need be. They can put more capital in if need be. They can make acquisitions. (They can also fire people, if need be—and do.) “If you buy a public stock, you hope somebody’s making it better,” he said. “But if they’re not making it better, you can’t do anything about it… You can almost always fight your way out of something.” You can sell the stock, I interjected. “But that doesn’t do anything,” he replied. “You’ve only sold it because it’s a dog, so it can bark for you.”

As we were wrapping up our hour-long conversation, it was clear that Steve has as much enthusiasm for Blackstone as ever. It certainly has been very, very good to him, turning that initial investment of $200,000 in 1985 into a fortune of some $35 billion. He offered an example of the kinds of opportunity he finds quite profitable these days, especially on the risk-reward continuum. “You can now buy senior secured debt, yielding somewhere around 13 percent,” he said. “And so for those of you who are not financial people, it doesn’t get simpler than lending somebody senior debt and have the security of all their assets and make 13 percent. How wonderful. And you don’t have to work. Imagine you’re not taking equity risk. You’re taking some kind of risk, but not really. So stick with people who do what we do. It really is fun, and it’s safe, and it’s very lucrative. So I’ll leave you with that.” |

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

|

|

|

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|