|

|

Welcome back to Dry Powder. I’m Bill Cohan.

In today’s issue, a close look at the brewing controversy surrounding Lionsgate, its money-losing streaming service Starz, and Screaming Eagle SPAC, founded by longtime Hollywood entrepreneur Harry Sloan and Jeff Sagansky, with which the company closed a deal on May 13. It’s a fascinating example of a new Wall Street trend: creditor-on-creditor violence.

But first, a brief update on Sam Bankman-Fried…

- “Diesel therapy”: Just as he feared, S.B.F.’s time at the MDC, in Brooklyn, is over. He was roused from his slumber this morning for his long-awaited, but presumably much feared, “diesel therapy” bus trip to California, where he is likely to be incarcerated for the foreseeable future in a medium security federal correctional facility in Mendota. It could have been worse for Sam, given the 25-year sentence he is serving. But it looks like the Bureau of Prisons will cut him at least a little break. (Shout-out to his prison consultant, Walt Pavlo.)

Sam, of course, had wanted to stay at the MDC until at least this fall, so that he could be closer to his New York City attorney who is helping him with his appeal. Now, alas, he could be stuck on a bus, handcuffed to the seat, for what could be a four-month journey across the country to Northern California. He left without saying goodbye to me, or sending me an email via CorrLinks, in case anyone is interested.

|

And here’s Marion Maneker’s latest readout on the art market for the well-heeled among the Dry Powder universe:

- The $1.4B question: First, the bad news: There are many good reasons to fear that the U.S. elections in November will constrain what is already a frigid art market. Two years ago, New York’s May sales cycle totaled $2.74 billion, with an average price per lot of $1.8 million. But by 2023, after the Covid-era orgy had subsided, the art market began a relentless contraction. This week, the May sales at Bonhams, Christie’s, Phillips, and Sotheby’s totaled $1.39 billion, down around 50 percent in two years. The average lot value was $925k. An additional 47 lots with an estimated value of $74.4 million were withdrawn to protect the lots for future sales.

The good news is that I think we’ve reached the bottom. Part of the complex interaction between market performance and future estimates is that sellers must take into account past performance when consigning. The withdrawn lots don’t show up in the market statistics, but everyone is aware of what didn’t sell and how the lots were priced. These numbers are likely to bring the estimate level down to a place where results can begin to trend upward.

It’s also important to consider the number of works that sell below the estimate level—you know, those situations when the consignor had to make a sacrifice to get cash. This year, more than a third of the lots were sold for compromise prices, and some 40 percent were sold within the estimates. (Only 25 percent were bid above the estimates.) That’s a very high percentage of works that didn’t make the estimate level—but I’ve seen worse. Otherwise, though, the market is pretty close to being in balance…

|

| Read more, and click here to receive Wall Power. |

|

| Starz Wars |

| An only-in-Hollywood story about Lionsgate, the Screaming Eagle SPAC, and “creditor-on-creditor violence.” |

|

|

|

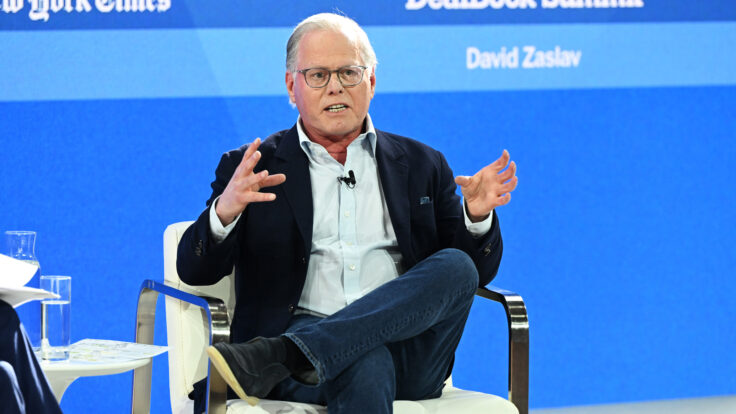

| For more than two years now, Lionsgate Entertainment has been talking about spinning off Starz—its challenged streaming service, which it bought in 2016 for $4.4 billion from John Malone’s media empire—into its own separate company. Nothing much happened with the plan until last December, when Lionsgate announced that it was joining forces with Screaming Eagle Acquisition Corp—a SPAC founded by serial SPAC sponsors Harry Sloan, a longtime Hollywood entrepreneur and the former C.E.O. of MGM, and Jeff Sagansky, a former chairman of CBS Entertainment and a former co-president of Sony Pictures Entertainment.

SPACs have a two-year window to find a deal or they pretty much go poof, forcing the sponsors to return the money they raised to investors. Screaming Eagle was on its last legs, having completed its I.P.O. in December 2021. But right before the two-year deadline, the publicly traded Lionsgate announced that it was merging its studio business, television production business, and 20,000-plus title library with Screaming Eagle. The transaction created a new public company, Lionsgate Studio Corp., valued at $4.6 billion, with Screaming Eagle shareholders owning 12.7 percent, and Lionsgate—the publicly traded entity that still owned Starz—controlling the remaining 87.3 percent. In return for its stake, Screaming Eagle would inject at least $350 million in cash into the new company.

This was an unusual structure, to state the obvious. Typically, a SPAC merges with a fully private company, taking it public, with the SPAC shareholders owning most of the company they just bought. Merging with an already public company in exchange for a small minority stake in what was a private subsidiary appears to be a sign of SPAC desperation. Nevertheless, the day after the deal closed, on May 14, the newly traded Lionsgate Studios rang the opening bell at Nasdaq. Starz remained with the old Lionsgate, preparing for its own separation later this year, if all goes as planned.

But here’s where it gets even more interesting. Lionsgate has a lot of very savvy investors hanging around the hoop. Sloan is not only the man behind the Screaming Eagle SPAC—he also knows Lionsgate more intimately than almost anyone. He was also once the C.E.O. of a company that was the largest shareholder in Lionsgate, and he served for a year as chairman of the Lionsgate board of directors some 20 years ago. In December 2021, he returned to the Lionsgate board, where he serves on important board committees and owns around 300,000 shares of the company, according to the latest proxy. Sloan is also, bewilderingly, an “independent director” of the Lionsgate board. (Peter Wilkes, the head of corporate communications at Lionsgate, declined to comment for this piece.)

Gordon Crawford, the founder of Capitol Group, the big media investor, is also on the Lionsgate board and owns more than 2 million shares of the company, according to the proxy. None other than Steve Mnuchin, Trump’s former Treasury secretary, is an even bigger Lionsgate shareholder. According to a May filing with the S.E.C., he increased his stake to nearly 8 million shares, or 10 percent of the voting stock of the company.

Alas, in the Lionsgate-Starz split, some debt investors appear to be more equal than others. Last December, when the deal with Screaming Eagle was first announced, the company claimed that it “expected to maintain its current corporate debt structure in this transaction.” This followed the company’s August 2023 quarterly earnings call where C.E.O. Jon Feltheimer was asked what would happen to the company’s bonds when, and if, the company were to be split in two. He said they would remain in “remainco,” otherwise known as Starz, “the issuer of the bonds.” Feltheimer explained that “the Starz structure … clearly includes the bonds,” and may also include some new bank debt. “Their cash flows are very visible,” he continued, “and very capable of financing that.”

But Lionsgate did not end up keeping its existing capital structure in place. On the contrary, it pulled off one of the most startling eviscerations of bondholder rights that I have ever heard about. Sadly, I’m told that such “creditor-on-creditor violence” is proliferating rapidly as the unintended consequence of years of “cov-lite” loan documents and bond indentures. This is the new normal on Wall Street, and now it’s spread to Hollywood, too.

|

|

|

| Prior to the closing of the deal with Screaming Eagle, Lionsgate benefited some of its bondholders by moving them to the new, valuable Lionsgate Studio credit—again, the company is supposedly worth $4.6 billion, or 10.7x estimated 2025 EBITDA—while leaving a bunch of others down at the Starz level, sticking them with a company stripped of its most valuable asset. Starz had segment profit of just $218 million in the 2022 fiscal year, down from $320 million the year before, and $468 million in 2018. (The company will report its most recent annual results tomorrow.) The bondholders who were relegated to the Starz level were not consulted about the move.

In particular, the brewing controversy involves the holders of a $715 million tranche of Lionsgate’s publicly traded 5.5 percent senior debt, due 2029. On May 2, Lionsgate announced that $383 million of the tranche, or 53.5 percent, would be exchanged for new notes, paying interest at 6 percent per year with their maturity extended one year, to 2030, and that the new notes would be part of the Lionsgate Studio capital structure. In the end, $389 million of bonds were exchanged, and on Wednesday, Fitch initiated a “high-yield” rating on them.

Left unsaid in the announcement was that the other $332 million of the debt would stay with Starz, the worse credit, and then be layered with a secured term loan. “The key point,” one of the unfortunate bondholders told me, “is that this exchange agreement was not offered to all bondholders! It was apparently proposed by the holders of the majority of the bonds and agreed to by the company. The bondholders who did not participate in the exchange—who were not even informed the exchange was happening—effectively now hold debt in Starz, while the ones who did participate hold debt in the studio business, which is undoubtedly far more valuable.”

He told me the “majority of covenants,” including the “important” change-of-control provisions, which would require the bonds to be bought at par or above if Starz were sold, were “stripped” from the bondholders who did not get to exchange their bonds into Lionsgate Studio. PJT Partners and Wachtell advised Lionsgate on the secret exchange offer, while White & Case and Perella Weinberg worked with the lucky bondholders who got to participate in the beneficial exchange offer. The non-participating bondholders had no idea it was even happening.

I’m told it’s happening more and more as well, including in two leveraged buyouts—United Site Services and Wheel Pros (now known as Hoonigan)—engineered by private equity firm Clearlake Capital. Another famous example of “creditor-on-creditor violence” is the 2022 restructuring of Incora, an aerospace supplier owned by Platinum Equity that PIMCO and Silver Point Capital supposedly saved from bankruptcy by pulling off a deal similar to what is happening to the Lionsgate creditors. (The Incora deal is currently being litigated.)

The economic effect of the Lionsgate deal is already being felt. The bonds that were exchanged to the better credit trade around 91 cents on the dollar. The bonds that were not exchanged trade around 71 cents on the dollar, “a clear reflection of the inequitable nature of this exchange transaction,” the bondholder told me. He said the bonds had been trading in the high 70s before the split.

|

| “Creditor-on-Creditor Violence” |

|

| It’s hard to know which of the specific bondholders benefited from this scheme and who engineered it. According to the Bloomberg terminal, the biggest holder of the $715 million tranche of bonds is BlackRock, with a position of almost $160 million, followed by Allianz, with $95 million, and the State of Wisconsin Management Board, with $19 million. Double Line Capital, the savvy debt investor, owns $4.4 million of the bonds. Other holders of the bonds include JPMorgan Chase and Goldman Sachs. I’m told that BlackRock and Prudential, along with a few other creditors, engineered the transaction with Lionsgate management. (Neither BlackRock nor Prudential responded to a request for comment.)

Mnuchin is also an owner of the bonds that were exchanged into the new notes at Lionsgate Studio, according to a 13D filing his firm made with the S.E.C. earlier in May. (A spokesman for Mnuchin and his fund, Liberty Strategic Capital, declined to divulge the amount of exchanged notes that Liberty owns.)

It’s easier to know who is pissed off. One bondholder who did not get offered the exchange is Sycale Advisors, a Park Avenue-based investment advisor. Recently, Sycale hired the law firm Selendy Gay “to explore potential litigation” against Lionsgate, per an Americas Covenants by Reorg research report issued May 15. (A spokesman for Selendy Gay declined an interview to discuss the firm’s litigation plans.) My bondholder source, nearly apoplectic, described it as the most egregious abuse of bondholders that his peers have ever seen. “It’s outrageous, right? I mean, everybody that I’ve spoken to says they don’t know how this could possibly have happened.” (In fact, he told me, he thinks it’s so outrageous that he’s holding on to his bonds because he thinks the transaction will be reversed or resolved in a fairer way, meaning his bonds will trade back up. But who knows.)

But another Lionsgate bondholder, who is participating in the exchange and was speaking generally to me about the recent wave of “creditor-on-creditor violence” as a (perhaps unintended) consequence of years of bonds issued without covenants, explained, “What’s happening in 95 percent of these situations is there’s no covenant breach. The company is just doing poorly, and the private equity sponsors are just screwing one class of creditors and slightly favoring the other to create equity value for themselves. It’s not a zero-sum game, it’s a negative-sum game.”

That’s not quite what happened in the Lionsgate situation, since the studio was doing well and Starz was doing well enough. This case of “creditor-on-creditor violence” seems more opportunistic and designed to benefit the big, savvy creditors, such as BlackRock, Prudential, and the former Treasury secretary against the smaller, slightly less sophisticated creditors who may not have realized that such a thing could happen. The opposite of a Hollywood story, for sure, but one it will no doubt end up loving soon enough.

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|