Hi, and welcome back to Line Sheet. Happy first week of work to Matthieu

Blazy, who started at Chanel on April 1. Oh, and Dario Vitale at Versace. We’re off to the races!

Of course, the execs at Versace, Chanel, and pretty much every European luxury brand—and really, any fashion brand, high or low, that doesn’t produce the majority of its goods in the U.S. (so I guess everyone but Los Angeles Apparel?)—are thinking about what’s happening with Trump’s tariff policy. More on the current sitch from me,

below, plus Sarah Shapiro on the rise of discounting in the cosmetics world (it ain’t like fashion, that’s for sure) and Rachel Strugatz on Meghan Markle’s first As Ever product drop.

For the main event, Rachel has a rags-to-riches story that is very rich, involving a pandemic-era TikTok phenomenon from the South Shore, Nick Brown and Natalie Massenet, and millions of

dollars.

Mentioned in this issue: Donald Trump, Meghan Markle, tariffs, Mikayla Nogueira, Point of View, As Ever, Imaginary Ventures, Bobbi Brown, Hailey Bieber, Nordstrom, Nick and Natalie, Ani Hadjinian, Kelly Dill, and many more…

|

|

|

A MESSAGE FROM OUR SPONSOR

|

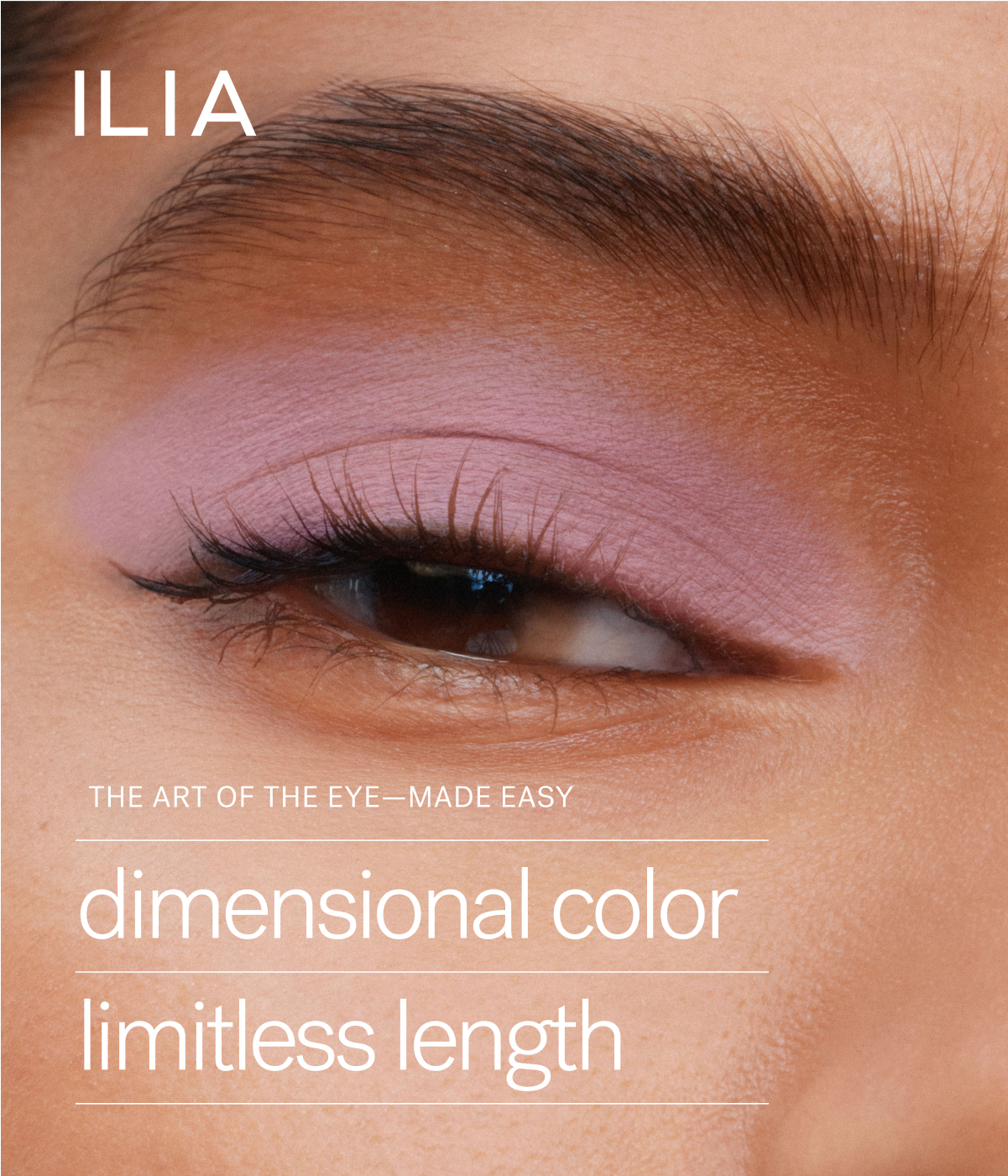

With 25,000+ 5-star reviews, best selling

Limitless Lash Mascara has been a cult favorite for years—and now we’re building on the love with a new brown shade inspired by the sky before

daybreak.

Whether you choose black or brown, Limitless Lash lengthens and lifts without clumping—then resists flaking and smudging for up to 12 hours. With every swipe of the dual-sided wand, powerful lash care ingredients strengthen like a lash serum. Safe for sensitive eyes, it removes easily with warm water—no scrubbing needed.

Try award-winning Limitless Lash and

take 15% off your first purchase with code LINESHEET on ILIAbeauty.com.

|

|

|

Three Things You Should Know…

|

- Well,

are you feeling liberated?: You have to hand it to the copywriters over at Trump Inc.: They sure can craft a catchy tagline, foreboding implications or not. On that note, I did the requisite outreach to fashion industry leaders this morning regarding Liberation Day, the president’s moniker for Wednesday, April 2, when he unleashed a minimum 10 percent tariff on all U.S. trading partners and even higher rates on countries that charge more on U.S. imports, including China (a

34 percent tariff), European Union countries (20 percent), and Vietnam (46 percent). The highest levy is hitting Cambodia, whose exports to the U.S. will be taxed at 49 percent. (Obviously, there are a lot of clothes being made in Asia, which accounts for more than half the world’s clothing and textile exports.)

Trump is

calling these targeted rates “reciprocal tariffs,” meaning they are in response to tariffs that various countries have imposed on American-made imports. It’s unclear at this point whether these by-country tariffs will affect all products or specific product categories; for example, foreign-made automobiles will be taxed at a 25 percent rate starting at midnight on April 2, but I’m not sure whether the 200 percent tax on European wine and spirits that Trump threatened is being put into practice

or not.

It’s likely that Trump is going to make deals with individual countries on a category-specific basis. Most of the executives I talked to this morning, before Trump’s speech, don’t want to say much about the strategies they’re implementing to counter this—because, to be honest, I don’t think they really know how “this” is going to go. America’s G.D.P. is driven by consumption, not manufacturing, and ramping up production at factories that do exist—which Trump insists is one of the

benefits of imposing these tariffs—will be incredibly difficult. Louis Vuitton’s factory in Alvarado, Texas, for instance, is capable of producing only a certain (small) number of Louis Vuitton products, and it’s a challenge to find people to fill already vacant roles.

Regardless of how things shake out in the short-term, many fashion companies will need to find potentially costly workarounds, like moving manufacturing, or at least moving distribution centers, to countries with more

favorable deals with the U.S. They’ll also have to make new deals with suppliers. And, of course, reevaluate their pricing. Brands will have to figure out how much of the costs they can immediately transfer to the consumer, how much their suppliers can absorb, and how much of their own margins they’ll have to eat into.

For luxury brands in particular, there is a little wiggle room on the price front, but not as much as they had five years ago. And it’s not going to be good for anyone if a

$50 bottle of Moët & Chandon suddenly costs $150. I imagine we’ll see an uptick in American tourists traveling to Europe (particularly France and Italy) on shopping trips, where goods will be significantly cheaper. All this reminds me of the situation in Brazil, where there is a robust appetite for luxury goods, but taxes are so high that it has led to increased counterfeiting and, more than anything, a muted market. Welcome to a new era of isolationism.

- Sarah

on the Nordstrom-Sephora arms race: For the first time in its nearly 123-year history, Nordstrom is putting almost all of its beauty department on sale… just before Sephora’s own big savings event on April 4. This timing is no coincidence: According to industry insiders, Nordstrom has viewed Sephora as its primary rival for more than a decade. (All beauty retailers are out for Sephora’s

business.) Nordstrom even redesigned their beauty departments—based on customer feedback—in the vein of Sephora’s open-sell concept.

While discounting luxury beauty was taboo before the 2010s—limited to gift-with-purchase offerings like CZ earrings, another unnecessary tote, or predetermined sets that included maybe one desirable item—department stores like Neiman Marcus, Saks, and

Bloomingdale’s have gradually normalized the practice. Previously, Nordstrom found other, more subtle ways of discounting via loyalty points programs and anniversary sales (plus discounts on supersized skincare items or those aforementioned sets), believing these drove sufficient high-margin business without compromising prestige positioning.

Now, though, retailers are playing a more aggressive game. Discounting programs aren’t just about encouraging repeat purchases—they’re sophisticated

data mining operations, in which every transaction helps to build comprehensive consumer profiles, allowing retailers to fine-tune marketing efforts, optimize product assortments, and microtarget customers. So yes, capturing revenue is great, but so is capturing data. —Sarah Shapiro

- Rachel on As Ever after: Meghan Markle’s newly launched lifestyle brand, As Ever, sold out all nine of its products before 11 a.m. today,

including a $14 raspberry spread in “keepsake packaging” and $15 flower sprinkles meant to “surprise and delight.” Of course, being “sold out” doesn’t mean much if there were only a few units made to begin with, which is likely the case here. (Optics are often more important than revenue at launch.) What is the strategy, though? Is it just selling a few jams and teas from white-label suppliers? The lack of big-picture thinking from a person who has access to some of the best brand-builders in

the world—Oprah, Gwyneth Paltrow, etcetera—feels like another missed opportunity. I would almost prefer Markle starting a beauty brand to this. ––Rachel Strugatz

|

|

|

Mikayla Nogueira was working at an Ulta in Massachusetts when she parlayed her pandemic

furlough into semi-stardom as a beauty influencer, and then to launching an actual business.

|

|

|

When beauty influencer Mikayla Nogueira, beloved for her huge personality and huge

Bahston accent, launched a skincare brand, Point of View, last week, that was all the industry could talk about. The line debuted with five “skin prep” products, intended for use before makeup application, as well as various milks and glazes that retail from $22 to $38, the most expensive item being a whipped, soufflé-like moisturizer. Initially, some industry observers were surprised that an influencer known for maximalist makeup looks would launch skincare. Why buy a

barrier-boosting moisturizer from Nogueira when there are similar products from Tatcha or Dieux? What authority does this self-taught makeup artist have in skincare?

Well, Nogueira does know makeup––and, more to the point, what skincare works best with makeup. Her breadth of knowledge spans primers and setting powders and sprays; what to layer under foundation; what skincare is best for long-wear makeup; and, most importantly, what does and doesn’t pill. It’s

fair to say that few have thought more about pre-makeup routines than Nogueira, and that’s earned her an authority that most influencers can’t match. Her followers trust her.

|

|

|

A MESSAGE FROM OUR SPONSOR

|

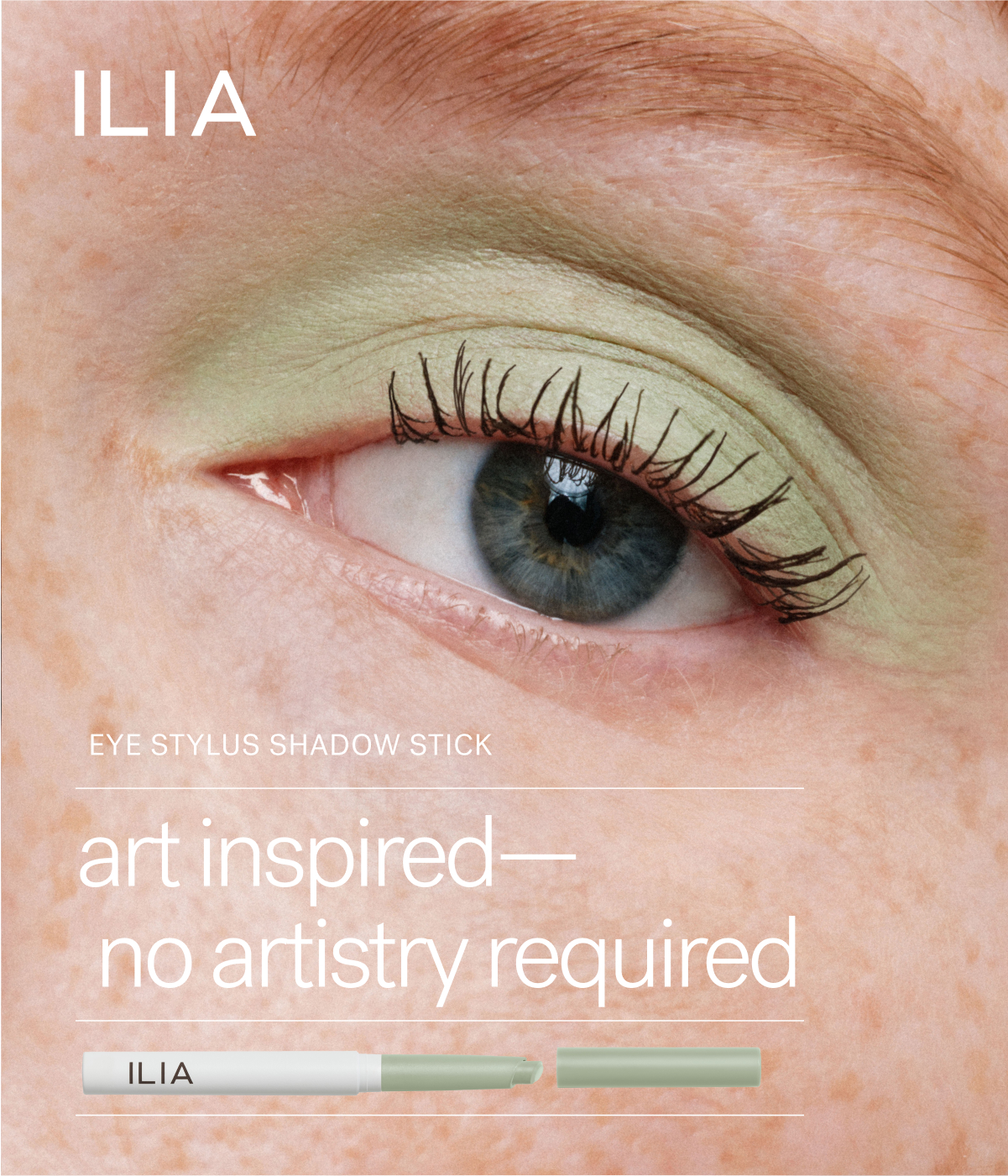

Makeup is a medium—let your lids be your canvas. Paint your point of view

with new Eye Stylus Shadow Stick, a waterproof, crease-resistant eyeshadow that lasts for up to 12 hours.

With the versatile angled tip, it’s easy to be playful or precise. Use the flat side for a wash of all-over color, or the edge

to line and define. Choose from 20 hues inspired by Renaissance paintings—they’re made to mix, match, and create your own unique look.

Use code LINESHEET for 15% off your first purchase on ILIAbeauty.com.

|

|

|

No wonder everything was sold out within hours. I heard Point of View’s site did about $1 million in sales in

its first seven minutes, and wound up reaching “close to $3 million” in D.T.C. sales before selling out completely. When Bella Hadid’s Orebella brand launched last May, its site generated under $350,000 during a similar time frame.

Point of View has just one outside investor, Imaginary Ventures, the V.C. firm co-founded by Natalie Massenet and Nick Brown, which has taken stakes in Skims, Good American, Everlane, and a pretty robust beauty

portfolio that includes Glossier, Nécessaire, Half Magic, Kosas, Ami Colé, and, my personal favorite, Westman Atelier. Point of View was definitely a “nontraditional” investment for the fund, which typically comes in during later rounds (although Natalie and Nick did cut a pre-seed check for Ami Colé). In this case, Imaginary got involved with Nogueira to build Point of View from the ground up.

Imaginary, perhaps the only V.C. firm in the business with legitimate high-fashion

connectivity, has deviated from its traditional investment thesis before; it wasn’t the lead, but it did participate in The Row’s later-stage round of financing last year, valuing Mary-Kate and Ashley Olsen’s fashion empire at $1 billion. To me, what differentiates Imaginary from other V.C.s is that they’re less focused on a specific stage or check size. Rather, their investment decisions are guided by consumer behavior and how it’s changing. When they

see a brand or a founder—like Nogueira and POV—that can really connect, they pounce.

Prior to investing, Imaginary had noticed a positive uptick on their portfolio companies every time Nogueira mentioned one of them. “Mikayla was creating the biggest revenue days digitally across the entire portfolio,” a person with knowledge of the deal said of its genesis. “You would see spikes for Westman or Kosas––always on a Mikayla day.”

Having realized Nogueira’s power, Imaginary

partner Kelly Dill—previously of Glossier—formed a relationship and started looking at how to capitalize on her influence. I’m told that Imaginary owns “just north of 30 percent” of the business, an unusually large stake at an unusually early stage for the firm. An insider assured me that Imaginary Ventures isn’t rethinking future involvement in beauty brands. “There will be some opportunities that are super early stage, and some opportunities that are late stage, and some stuff

that’s in between,” the person with knowledge of the deal noted, adding that Point of View had the “single strongest launch” they had ever seen in one of Imaginary’s portfolio companies—excluding Skims, which is said to have done around $5 million in sales in its first day. (Imaginary Ventures declined to comment, and Nogueira did not respond.)

|

Much of Nogueira’s success boils down to her relatability and authenticity. She’s a former Ulta Beauty store

employee who started creating content when she was furloughed during the pandemic, she has a big personality and strong opinions, and she’s never boring. When everyone else was doing the “clean girl” thing, she was an unabashed champion of over-the-top makeup, and there’s no denying that she taught herself incredibly well (even if that kind of makeup isn’t your thing). Ironically, it’s an asset that, in the words of one beauty executive, “she hasn’t been embraced by the beauty and

fashion set at all. She’s still very much an outsider.”

Many of the people buying her products are regular consumers who live outside of major metropolitan cities and don’t care about what the cool girls in downtown NYC are using. “They see themselves and want to support Mikayla. The numbers speak for themselves,” this executive added.

|

|

|

Nogueira may not know the nuances of formulating skincare and cosmetic chemistry, but most other founders

don’t either: Hailey Bieber didn’t have any skincare authority (apart from being an avid consumer) when she launched Rhode almost three years ago. Beauty brand founders like Bieber and Nogueira tend to hire other people—cosmetic chemists, dermatologists, marketers—to do this. In POV’s case, Imaginary made sure a seasoned beauty veteran was involved from the beginning: the company’s chief executive is Ani Hadjinian, the former C.E.O. of Augustinus

Bader.

From a product perspective, Nogueira’s K-beauty-inspired lineup is filled with all the Rhode-adjacent buzzwords that young skincare consumers want to hear right now: peptides, milk, glazing, etcetera. Bieber’s influence is clear, but that’s not a knock on Point of View; Rhode is the most successful celebrity beauty brand to come along in years, and it’s hard not to be influenced by it. Plus, the brands have different followings. The maximalist beauty girls need skincare,

too, and since Point of View is specifically designed for “makeup prep,” I’d imagine that many of its customers are serious makeup users.

While Point of View will eventually find a retail home, the brand isn’t currently “leaning in any direction toward Ulta or Sephora,” although I’d be shocked if Point of View didn’t land at Ulta, where Nogueira used to work. “Based off the magnitude of success of the D.T.C. business, the focus for the short and medium term will be meeting demand online,”

said the person with knowledge of the deal. Furthermore, I’m told that future launches were pushed out by a few months to “build some sense of availability” and understanding of core products before anything new is added to the mix.

In the near term, Point of View does have some logistical hurdles to work through. “Sold out” status may seem cool, but it’s actually a nightmare for brands since they lose out on millions of dollars of potential revenue––and it’s even trickier for a

new brand. (Early momentum is everything.) Being out of stock for too long can lead to a loss of interest and, worst case, people moving on to something more readily available. I’m told that product arriving later this month has already sold out (a decent amount of sales were preorders shipping on April 21). In the meantime, the team is using any means necessary to rush replenishment, even if it means using costly air methods instead of transporting via ocean freight.

Presumably, this is where Imaginary, which has experience managing this type of explosive growth, can be a crucial partner.

|

I’m continually amazed by Jones Road being better than Bobbi Brown at being Bobbi Brown.

[BoF]

The Estée Lauder Companies legal drama continues. A judge ruled earlier this week that a class action alleging Lauder misled investors about revenue guidance related to grey market China sales can proceed forward.

[Reuters]

Rare Beauty launched a Substack. Why? [Substack]

|

And finally… congrats to

Duran Lantink, who won this year’s Woolmark Prize. We like him!

Until tomorrow,

Lauren

P.S.: We are using affiliate links because we are a business. We may make a couple bucks off them.

|

|

|

Puck fashion correspondent Lauren Sherman and a rotating cast of industry insiders take you deep behind the scenes of this

multitrillion-dollar biz, from creative director switcheroos to M&A drama, D.T.C. downfalls, and magazine mishaps. Fashion People is an extension of Line Sheet, Lauren’s private email for Puck, where she tracks what’s happening beyond the press releases in fashion, beauty, and media. New episodes publish every Tuesday and Friday.

|

|

|

An essential, insider-friendly Hollywood tip sheet from Matthew Belloni, who spent 14 years in the trenches at The

Hollywood Reporter and five before that practicing entertainment law. What I’m Hearing also features veteran Hollywood journalist Kim Masters, as well as a special companion email from Eriq Gardner, focused on entertainment law, and weekly box office analysis from Scott Mendelson.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|