Greetings from Los Angeles, and welcome back to In the Room. Godspeed to those heading to

Coachella. I’m staying home and watching The Masters.🏌

In tonight’s issue, news and notes on the dual headlines emanating out of Warner Bros. Discovery: John Malone’s decision to step down from the board, and David Zaslav’s big payday. Plus, WME’s Mark Shapiro takes a shot at CAA’s Bryan Lourd.

🍸 On today’s podcast, new Grill Room regular Julia Alexander and I yapped about a handful of

hot-button media topics: the MLB’s crafty use of the “torpedo bat” to boost ratings, the challenges and opportunities for CNBC in the looming SpinCo era, and signs of stagnation in the creator economy. Follow The Grill Room on Apple, Spotify, or

wherever you prefer to listen.

Also mentioned in this issue: Rupert Murdoch, Michael Rapino, Mathias Döpfner, Mike Fries, Chase Carey, Anna Wintour, Bret Baier, Brian Ballard, Greg Maffei, Janice Min,

Stefano Domenicali, and many more…

Let’s get started…

|

- Lourd

have mercy: Following Creative Artist Agency’s recent debt raise, my partner Matt Belloni reported that CAA chief Bryan Lourd had decided to limit the cash-out option for equity holders to a mere 1.2 percent of their holdings. (One agent described it as “beyond offensive.”) After reading Matt’s report, I asked WME Group president and

managing partner Mark Shapiro for his thoughts. “After years of doubt and criticism that the Endeavor stock price would ever amount to anything, it’s ironic that Ari’s plan largely worked and all the WME partners were able to cash out 90 percent of their holdings,” he told me. “It might not have been at the monster stock price they all dreamed of, but it was a nice payday for everybody. Even our new plan as a private company will allow all partners to cash out 20

percent per year going forward. So I guess they had to do something.” Shots fired!

- Fox News takes on broadcast: Fresh off the highest-rated quarter in the history of cable news, Fox News sales execs are

pitching advertisers on the idea that the conservative cable channel can deliver the same scale as the Big Three broadcast networks—ABC, NBC, and CBS—and at a lower cost. It’s a remarkable sign of Fox’s dominance in an era when Trump governs the national discourse and the rest of television is in decline. Indeed, Fox News outperformed both ABC and NBC in weekday primetime last quarter, and regularly bested them during

major news events. Bret Baier’s Special Report even occasionally beat the CBS Evening News—which, as I noted earlier this week, is suffering through a misguided dual-anchor programming strategy that has become a metaphor for Paramount’s rudderlessness during this extended sale

period.

Now, two months after Lachlan Murdoch celebrated an influx of blue chip advertisers who had once shunned the network, they’re hungry for more. Fox News “is cheaper than broadcast prime, but we have the same scale, the same reach, and high duplication of their audience,” Trey Gargano, Fox News’s E.V.P.

of ad sales, told Variety this week. “I don’t think there’s anything else like it in the marketplace.”

- Future Formula: Formula One’s Chase Carey and Stefano Domenicali are struggling to secure a new U.S. media partner, despite the sport’s still-surging popularity. The Wall Street Journal reported that F1 has been shopping a rights package at around $150 million to $180 million per year, or double what ESPN has been paying. “ESPN walked away late last year from its exclusive negotiation window for a new package,” the Journal reported. “Netflix, Warner Bros. Discovery, Fox, Amazon and NBC are lukewarm on the offering, too—at least, at the current price.” Obviously, F1 will find a partner, and likely on better

terms than the ESPN deal—but it does highlight how wary mediacos have become about overspending on rights, especially for nontraditional sports.

- Mathias courts Trump: Axel Springer chief Mathias Döpfner has enlisted G.O.P. power lobbyist Brian Ballard to help the mediaco navigate its relations with the Trump administration. Long considered the

most influential lobbyist in Trump’s Washington during both the first and current term, Ballard has become the go-to guy not only for foreign governments and blue chip corporations, but also for the vast majority of media companies navigating the uncertainty of the Trump era. His clients include Netflix, Disney, Comcast, Paramount,

and, most recently, PBS. Döpfner’s decision to enlist Ballard Partners reflects his desire to professionalize government relations in the U.S. the way he has in Europe. And, of course, it comes on the heels of Trump’s decision to cancel $8 million worth of government subscriptions to Politico Pro.

- Banality Fair: Finally, Dame Anna Wintour has shared her vision of the ideal Vanity Fair editor with the Times, describing

it as “an incredible job, one that requires an entrepreneurial spirit and deep belief in great journalism,” as well as wit, courage, connections, a global perspective, and “a certain fearlessness.” The ideal editor “will need to break news and make noise—and have a little fun, too, whether that means with politics, Hollywood, the doings of reality stars or the billionaire class.” Meanwhile, the available pool of candidates seems dubious about a job that will inevitably be about managing decline

and playing Remember When: “You could cosplay a 1990s or aughts E.I.C. for a hot minute in your mind,” Janice Min told the Times. “But then for talented editors, reality sets in. The fun parts of being a top editor are harder now to achieve in legacy media without a mandate to shake things up.”

|

|

|

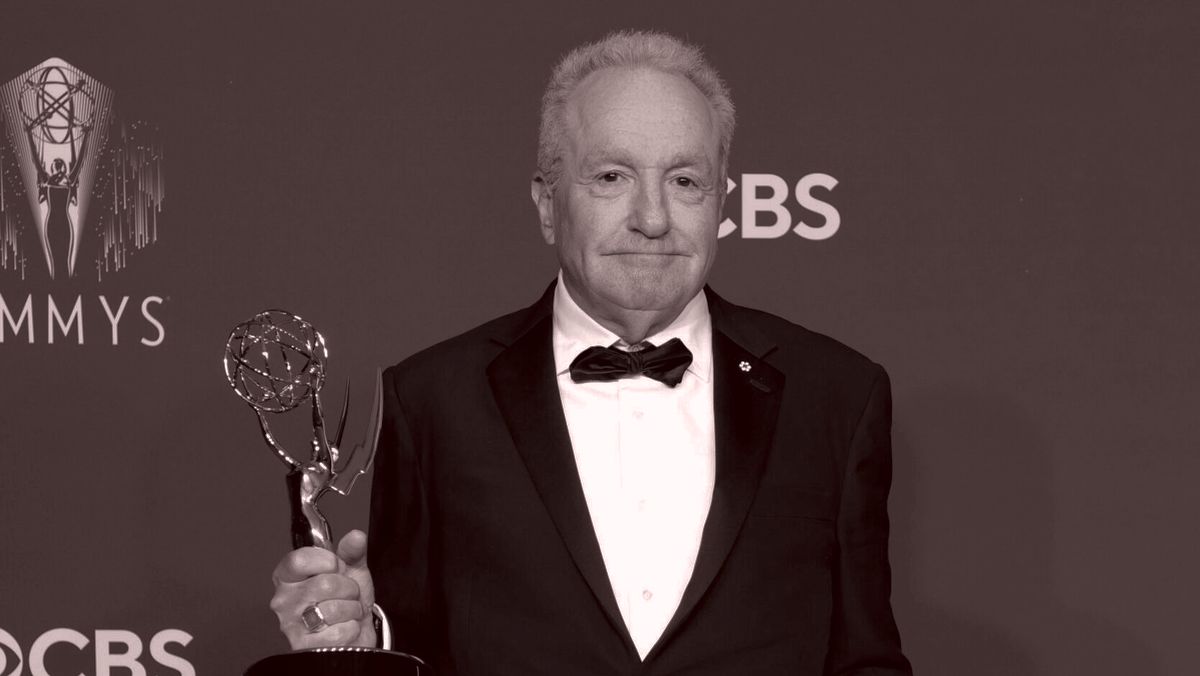

Master of the cable universe John Malone is giving up his seat on the board of Warner Bros.

Discovery, where he’s been an unwaveringly patient, big-picture strategist. What does his departure mean, if anything, to the future of WBD or his mentee, David Zaslav?

|

|

|

On Friday, John Malone, the cable pioneer and Liberty Global chairman, announced that he

would be stepping down from Warner Bros. Discovery’s board of directors and taking on a chairman emeritus role. The move, I’m told, had been in the cards for quite some time. Malone, who is 84, signaled his intention to begin unwinding his business back in November, spinning off some assets and dispensing with Liberty C.E.O. Greg Maffei in the process. As WBD’s chair emeritus, he will still attend board meetings and offer “strategic counsel.” But now he can Zoom into these

meetings from his various ranches and estates, and has more freedom to trade the stock.

In a poetic bit of timing, Malone’s announcement coincided with the revelation that Warner Bros. Discovery chief and Malone protégé David Zaslav saw his comp package increase by 4 percent, to $51.9 million, last year—a reward that reflects the company’s recent prioritization of cashflow over market valuation. (The fact that free cashflow doesn’t directly correlate to the WBD

stock price suggests how complex this publicly traded leveraged buyout has been to manage. But anyway…) The raise has also elicited the predictable eye-rolling and resentment from rank-and-file employees across the WBD portfolio (most audibly at CNN), as well as WBD shareholders who have lost two-thirds of the value of their equity since the 2022 Warner–Discovery merger, and could conceivably force a “say on pay” vote at this summer’s annual meeting. (By way of comparison, Amazon chief

Andy Jassy made a mere $40.1 million last year.)

The interplay between Malone and the Street here is actually quite illustrative. Malone is a legendary operator with a long track record of seeing around corners and capitalizing on opportunities few others could countenance. Recall, this is the man who once amassed a 19 percent stake in News Corp. while Rupert Murdoch was sleeping, then used it to wrest away control of DirecTV. (Not for nothing,

he’s also the largest landholder in the United States of America, which probably deserves more attention). “He sees the world through math,” one veteran media executive said. Alas, he has less of an appreciation for the creative side of the business, which is either a strength or a weakness, depending on who you ask.

As notably, Malone is a man who has extreme confidence in most of his operators, and is willing to give them a lot of runway to build and manage businesses

without sweating the stock price. Indeed, the Malone associates, fellow executives, and even rivals I spoke with on Friday all painted a picture of an extremely smart, strategic, and innovative deal-maker, who built great companies and created a lot of value along the way—and who did so by standing behind leaders like Zaz (who created value at Discovery, even if he hasn’t at WBD), Liberty Global C.E.O. Mike Fries, Live Nation C.E.O. Michael Rapino,

etcetera, all while staying out of the limelight and advising from backstage. “His real overall mission has always been to support the C.E.O., the operator, the person who’s building that business, and playing along with them to build a great business with a long time horizon,” Rapino told me. “He never asks about the stock price. It’s just: How can we build the business, and how can I support you?”

Perhaps that’s what makes the years-long scrutiny around Zaz and Warner Bros. Discovery so

intriguing. While the media kicks the shit out of Zaz, and BofA and MoffettNathanson analysts bemoan WBD’s failure to deliver shareholder value and plead for a sale or merger, Malone still seems to have total faith in the play, and complete conviction in Zaz’s ability to execute it. Presumably, he’s less focused on the stock price than the fact that WBD now has a global streaming business that delivers more than $1 billion in annual profit, which could conceivably double in the years ahead. Also

presumably, he’s pleased by the reduction in debt—which has been paid down by $20 billion, lowering operating costs in turn (ergo, Zaz’s bonus)—and focused on reaching the next deal under the most favorable terms. Either way, his decision to step back is the latest reminder that Zaz got himself into this mess of his own volition, and now he’s really on his own to find a way out.

|

|

|

The ultimate fashion industry bible, offering incisive reportage on all aspects of the business and its biggest players.

Anchored by preeminent fashion journalist Lauren Sherman, Line Sheet also features veteran reporter Rachel Strugatz, who delivers unparalleled intel on what’s happening in the beauty industry, and Sarah Shapiro, a longtime retail strategist who writes about e-commerce, brick-and-mortar, D.T.C., and more.

|

|

|

Puck sports correspondent John Ourand and a rotating cast of industry insiders take you inside the executive suites and owners

boxes where the decisions that shape the entire sports business are made. You’ll hear interviews with players, network execs, and everyone in between. The Varsity is an extension of John’s private email for Puck by the same name. New episodes publish every Wednesday and Sunday.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|