|

|

Happy Sunday, and welcome back to Dry Powder.

|

|

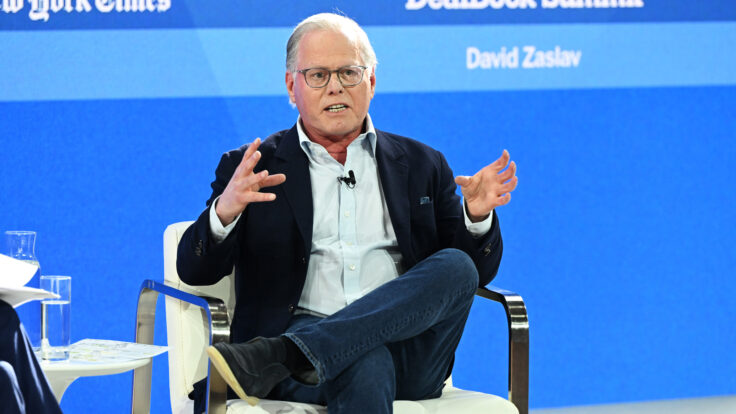

Tonight, my latest analysis of the evolving Paramount Global sale process, and why I believe David Ellison & Co., after a topsy-turvy series of oscillations, have actually taken the lead away from Apollo et al.—for now, at least.

But first, a real estate dispatch from Nantucket…

- Billionaire cautionary tales: At long last, Barry Sternlicht’s home on a spit of land on Nantucket, between the Atlantic Ocean and the beautiful Hummock Pond, is no more. This past week, the house finally ended up in a dumpster, after he acquiesced to the reality that ongoing erosion (and an ongoing dispute with his fellow-billionaire neighbor) made relocation impossible. Don’t worry, Barry will be just fine. He seems to have already resettled in Miami. But it’s a cautionary tale when a billionaire can’t prevent one of his homes from being swallowed up by the rising tides.

Meanwhile, another real estate cautionary tale was playing out on another island: Manhattan. This past week, Blackstone perfected a loss on a building it owned at 1740 Broadway, the old Mutual of New York building, that the alternative asset firm bought in 2014 for $605 million. Blackstone went on to plow millions of dollars into a gorgeous renovation of the lobby. Alas, Blackstone defaulted on the $308 million mortgage on the property in 2022 and handed the keys over to the lender, a publicly traded commercial mortgage-backed security. This past week, Yellowstone Real Estate bought the defaulted loan for “just under $200 million,” according to Commercial Observer, putting the final stamp on Blackstone’s involvement with 1740 Broadway, and marking a rare instance where the vaunted Blackstone real estate investors got it wrong. Yellowstone, run by Isaac Hera, made news last year when he also bought the defaulted loan on the old New Yorker hotel, in Manhattan. According to Commercial Observer, Yellowstone is considering turning 1740 Broadway into a residential building.

- What would Sumner think?: On Thursday, right before I attended Puck’s splendid Washington, D.C., soirée in honor of White House Correspondents’ Dinner weekend, my partner Matt Belloni and I exchanged our views on the past and future of Paramount, what the various sales options will mean for the Hollywood creative community, and more. Matt and I had a great time chatting through it all, and I hope that you’ll give it a read, here.

Before diving into the latest twist in the Paramount shit show, below, I wanted to excerpt a particularly perspicacious comment that Matt made about the deal choices. It’s one that may be a bit underappreciated on Wall Street, but remains extraordinarily important in Hollywood as the second-order effects of any putative deal are contemplated. As usual, no one could put it better than Matt.

Here goes: “We saw what happened when Disney bought most of Fox. That eliminated a buyer for Hollywood content. The 20th Century Fox studio essentially became a small label at Disney, and we are now down to five legacy Hollywood studios. If this deal happens with Apollo/Sony and Paramount, we would be down to four. Bankers must love this because there are incredible synergies. You just combine the film and television studios. You either spin off or include the TV networks in some new company, you sell off the Paramount lot, and then you fire everybody. Not great for Hollywood. And increasingly, the F.T.C. and the Department of Justice have been looking closely at the impact on the market for creative work. That was a problem in the Simon & Schuster sale, the book consolidation deal. They didn’t look at the impact on consumers; they looked at the impact for authors like Stephen King that would have one fewer buyer for their work. From this perspective, a Sony/Paramount deal is a disaster.”

|

| Now, some refreshed thoughts on the latest smoke emanating from the deal heat! |

|

| One Flew Over the RedBird Nest |

| The looming apparent ouster of Bob Bakish, which I previewed long ago, has the RedBird and Ellison group inching ahead of Apollo in the Paramount Global foot race—at least for now. |

|

|

|

| On Friday, The Wall Street Journal reported that the Paramount Global board and Shari Redstone were considering replacing C.E.O. Bob Bakish with an interim leadership triumvirate during the pendency of the sale process. The following day, CNBC’s Alex Sherman reported that Bakish would be gone on Monday morning, and would not be present for the company’s earnings call later that day. Needless to say, replacing the C.E.O. of a company in the middle of a sale process is highly unusual. Even Logan Roy, had he not died, wouldn’t have conceived of such a wild scenario.

Two weeks ago, I reported that the relationship between Shari and Bakish was “increasingly tense and complex” and that Bakish would be replaced if, say, the Ellisons got control of Paramount, with a new RedBird-led team consisting of David Ellison, Jeff Shell, and likely Jeff Zucker. And before that, on March 12, LightShed Partners’ Rich Greenfield wrote that Shari should fire Bakish “to save Paramount.” Rich is now running a poll on Twitter/X asking followers to vote on the Bakish defenestration odds. So far, 61 percent have suggested he’s toast. (After the CNBC report, Greenfield tweeted, “Welp guess this poll is moot!!!”)

Of course, Sherman’s reporting gelled with my own previous writings about the frostiness. I’d heard that Shari and Bakish were on unfriendly terms after disagreements about how to stem the losses at Paramount+ and the fate of Showtime. According to one person at the center of the action, people also believed Bakish had apparently even considered procuring the financing himself to buy the company. (A Paramount spokesperson disputed all of this, particularly the financing piece, when I first broached the topic two weeks ago. Charlie Gasparino tweeted earlier today that “Shari’s people” are calling Bakish “difficult.” The FT confirmed as much this afternoon.) Alas, recriminations, miscommunication, and differences of opinion seem inevitable at a company that probably never should have been created through a recombination in the first place; is being chased down by two aggressive suitors; just endured four recent high-profile departures from its board of directors; has disgruntled investors threatening lawsuits; has seen its stock drop nearly 50 percent in the last year; has billions in operating losses; and yet still paid its C.E.O. $30 million-plus in annual compensation.

There is no question, as I have written before, that the best deal for all Paramount shareholders is the Apollo, Sony, and Legendary Pictures confection—an all-cash offer for all shareholders that values Paramount at $26 billion, at least. That’s $12 billion for the equity that is now valued in the market at $8.3 billion, roughly a 50 percent premium, plus the assumption of Paramount’s $14 billion in net debt. My sense is that Apollo/Sony will raise its price for the equity before the group formally unveils its bid, whenever that may be, but likely this coming week in and around the expiry of the exclusive period for Skydance. And that’s part of the problem here. Apollo has not publicly released its letter to the Paramount board and the Paramount special committee, which gives the company plausible deniability to not consider it seriously. That’s a shame.

The standard reporting at the moment about the Apollo deal is that its sources of funding are unclear. That’s a load of crap. Apollo has plenty of money, and its partnership with Sony and Legendary merely bolsters that fact. And Apollo is nothing if not clever. Presumably, the firm is still working out its deal with Sony, and it makes little sense to release the offer publicly until the Paramount special committee decides whether to endorse the Ellison deal, and on what terms. My bet is that Apollo will hang around the hoop to see what kind of deal the special committee structures with Ellison. Will there be a “go shop” provision that permits the special committee to pursue other offers for Paramount, like Apollo’s, or requires an approving vote by the majority of the minority voting shareholders, like Mario Gabelli and John Rogers Jr.? It’s not clear whether the special committee—which is being advised by Blair Effron at Centerview Partners and Faiza Saeed, at Cravath—will demand those provisions as a way to protect the committee from any legal fallout. So Apollo will wait, with its cannon aimed and loaded…

Nevertheless, even though the Apollo deal promises to be better for all shareholders—and I am a big fan of treating all shareholders fairly—I am actually beginning to come around to the view espoused by my partner Matt Belloni, as we discussed last week, that the Ellison-RedBird-KKR deal has inched ahead in terms of likelihood. In the end, although there are risks to the Ellison deal, especially for the non-Redstone equity holders of Paramount, it’s probably the easier deal for the special committee to swallow, all things considered, which I have to say is not exactly a ringing endorsement of good corporate governance. But it is an example of realpolitik in action. First, Shari seems to prefer it, and that makes life a lot easier for the board members on the special committee. After all, she could fire them in an instant and replace them with more pliable board members.

The Ellison deal is also a lot more romantic than the Apollo deal, and who doesn’t like a bit of romance in their deals? There is the new management team, plus the promise of reducing Paramount’s $14 billion debt load by at least another $3 billion, maybe more, thanks to the injection of new equity from the partnership. There’s also the promise of $3 billion or so in cost cuts and whatever synergies can be achieved by combining Skydance with the Paramount studio. The RedBird team seems to think they are going to create a new and profitable streaming paradigm at Paramount while intelligently managing the decline of the linear assets at CBS and Viacom. If they pull it off, it could be a template for both Comcast and Disney to follow.

Will all that lead the stock to hit $30 or $40 a share, as Team RedBird hopes? That’s what you need to believe, as investors like to say, if you intend to hold on to your Paramount stock after the Ellison deal is consummated. (This is not investment advice.)

|

|

|

| The exclusive period for Ellison supposedly ends on May 3, but I’m told it will be extended by a few weeks—at least in part because Bakish was slow to open Paramount’s books—by which time the two sides expect to sign a definitive agreement. I’m also told that the due diligence on both sides is going smoothly, with no major surprises cropping up at either Skydance or Paramount, aside from the rumored departure of the C.E.O., which is presumably welcomed by Ellison and RedBird. There does seem to be the still unresolved matter of the negotiation between Paramount and Charter Communications about their retransmission deal, which comes up for renewal on April 30. Some people say that CBS, Paramount, et al. will go dark on Charter after April 30, which would be a major embarrassment, especially in the middle of a sale process. But my partner John Ourand told me on the sidelines of the Puck party in Washington last week that everything should work out just fine.

I am also told that if the special committee endorses the Skydance deal, that’s probably it. Unless the special committee demands it as part of the deal with Skydance, there’s probably no shareholder vote or proxy statement filing required. As previously mentioned, the special committee could also demand a “go shop” provision, which would allow for competing bids to be considered. (Hello, Apollo!) A spokesman for Paramount didn’t offer any comment on the matter.

What happens procedurally remains to be seen, though. A recapitalization of this magnitude often requires public filings with the Securities and Exchange Commission since there would be a lot of change without any non-Redstone shareholder input. If the special committee endorses the Ellison deal, there are likely to be shareholder lawsuits up the wazoo. Even if Cardinale and his team manage to do an exceptional job of selling the upside to Gabelli, Rogers, and all the other voting shareholders at Paramount—and Gerry, a Goldman alum, is a very persuasive banker—there will likely be some shareholder lawsuits.

But Shari will probably prevail, I’m advised, because who in their right mind can make a credible argument that they didn’t know there was a controlling shareholder at Paramount? Then it will be Gerry’s problem to unload all those movie theaters at National Amusements Inc., the family holding company, though his team is almost certainly planning for this.

Is all hope lost for Apollo and Sony? I don’t think so. I think they are holding back, like a jackal waiting to pounce on its prey. If there’s a “go shop” provision in the Ellison deal, or if, say, Gabelli and Rogers team up to challenge the deal, Apollo could have its opening. Apollo may also be able to exploit any opening by narrowing the gap between its offer to Shari and Ellison’s.

The problem for Apollo, however, is that Shari can reject its bid out of hand. There is also the regulatory concern coalescing around Sony, a foreign company, buying into a company that owns CBS. And there are separate concerns around the fact that Apollo already owns a bunch of local television stations—some 30 stations between Cox and Northwest Broadcasting—while CBS owns another 28 local stations. Current regulations say that no station group can reach more than 39 percent of U.S. households, and a combination of Apollo and CBS would be way over the limit. Presumably, though, the geniuses at Apollo can restructure their way around these issues.

But given these myriad challenges, the Ellison-RedBird-KKR offer may be the swiftest way to end the long national nightmare that is the sale of Paramount Global, if only because Shari wants the deal and these buyers, by some miracle, actually seem to want the business, not just its parts to hawk. And then there is the promise of a fresh start with a new management team and new ownership and lower net debt and a whole new story, with the promise of a higher stock price. Ah, the romance of it all. But this drama is still far from over. I’ll be back with more on Wednesday.

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

|

|

| Ellison vs. Apollo |

| Matt & Bill debate the likely path forward for Paramount. |

| MATTHEW BELLONI |

|

|

|

|

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|