|

|

Welcome back to Dry Powder, I’m Bill Cohan.

|

|

A strategic leak to the Journal has brought to light that Trian’s Nelson Peltz and his son, Matthew, have increased their stake in Disney and are threatening yet another proxy fight. In today’s issue, an exclusive look at their demands, their next moves, and how Bob Iger could (and should) respond.

|

|

| Nelson Peltz’s Punch List |

| The feared activist investor is back inside Disney, rattling the cage, agitating for board seats, preparing white papers, and issuing warnings about the ABC fire sale. In my estimation, Iger has two choices: work with Peltz to restore the magic, or resign and find someone who can. |

|

|

|

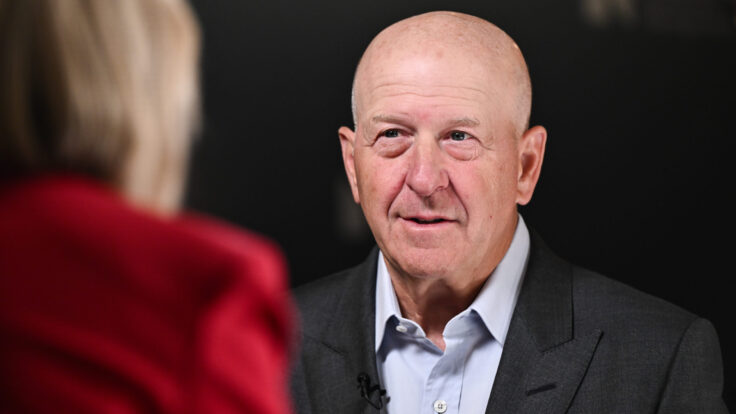

| Bob Iger is looking more and more like St. Sebastian these days. Disney stock is down roughly 13 percent since he returned to the corner office in Burbank and continues to hover around its 52-week lows. The various strategic initiatives that he’s promised to execute—fixing Disney+, selling off ABC, figuring out a plan for Hulu and ESPN—have barely materialized. Then, over the weekend, came the strategic leak that activist investor Nelson Peltz, “the smiling crocodile,” as Jeff Immelt once called him, has increased his stake in Disney and revived his firm’s plans for a proxy fight.

Could it be that Iger, the legendarily transformative C.E.O. who more than quadrupled Disney’s market value between 2005 to 2020, during a period of extraordinary M&A activity, is not the right C.E.O. to lead the company through the television industry’s macro contraction? Certainly that’s a question on Peltz’s mind, and on the mind of other shareholders. Yes, the Disney board of directors has extended his contract until 2026, but the board also gave a vote of confidence to his predecessor, Bob Chapek, before cutting him off at the knees just five months later. Of course, the board isn’t going to deprive Iger the time required to do the job that they asked him to perform. (And the ones I have talked to believe he can still get it done.) But the hard truth, alas, is that Iger is not getting the job done at Disney, either.

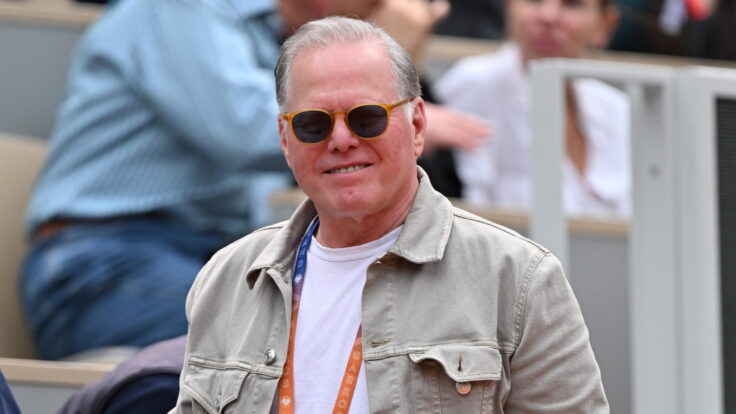

Peltz, who launched (and withdrew) a previous proxy fight in January after getting much of what he wanted, is clearly looking for a change in outcomes. On Monday morning, through a strategic leak to the Wall Street Journal, it was revealed that his hedge fund, Trian Partners, had in the last two months rebuilt its position in the company to something like more than $2.5 billion worth of Disney stock, making it one of the largest shareholders with a 1.7 percent stake. Of course, this information wouldn’t have become public unless the smiling crocodile leaked it—there is no S.E.C. disclosure requirement unless an investor passes an ownership threshold, generally around 5 percent of a company’s stock.

So why the leak to the Journal, and why now? That’s probably what Bob Iger is wondering, too. Peltz is obviously hoping to rattle Iger’s cage. According to the published reports surrounding Trian’s increased stake in Disney, Peltz is expected to ask for “multiple” seats on the Disney board, including one for Nelson himself. I suspect that if he doesn’t get what he wants, he will launch another proxy fight this coming spring, just as he did last year.

Peltz, of course, had made similar demands of Chapek throughout the summer of 2022, after acquiring a sizable stake in Disney. Part of the justification given at that time for replacing Chapek with Iger, according to Peltz’s proxy statement, was that Iger was seen as better able to fend off the Peltz assault than was Chapek. Soon after, the Disney board kicked out Chapek and reinstalled Iger, who was indeed able to reach a detente with Nelson. Iger agreed to reduce expenses by $5.5 billion and to cut 7,000 jobs; to reinstate the dividend; to “restructure” Disney into three divisions; and to make streaming profitable by 2024. Nelson declared victory, and dropped his proxy fight. When he terminated the fight, in February, Disney stock was trading at $117 per share and, I have to believe, Peltz had made a tidy profit on his $1 billion, or so, Disney bet.

Now, the Disney stock is around $84 a share—after reaching a low of around $78 a share last week—and Peltz has more than doubled his bet. Part of his thinking must be that the Disney stock price has gotten so low—what with all the slings and arrows that the company has faced in recent months, among them the writers’ and actors’ strike, the ongoing losses in the streaming business, and Iger’s foot-in-mouth interview in Sun Valley—that he believes it is simply oversold and a good buy. (This is not investment advice.)

But part of it must also be that he thinks Iger is more vulnerable than he was at the start of the year, when he was looking more like a returning, conquering hero—and that “Trian believes it’s now time to have a seat at the table,” as a source told the Financial Times, adding that Disney’s shares are “significantly undervalued” and the board needs to be “more focused, aligned and accountable.” It’s hard to argue with any of that. The stock isn’t trading well, that’s for sure. And there is no evidence that the Disney board, under new chairman Mark Parker, is any “more focused, aligned and accountable” than it was under his predecessor, Susan Arnold. |

|

|

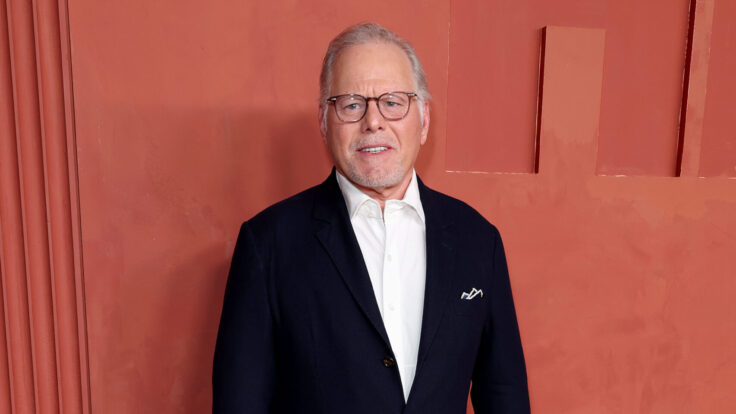

| As in its first proxy battle, Trian has a specific list of demands and grievances that it wants Disney to address. According to my Wall Street sources, the hedge fund’s latest foray is the brainchild of Nelson’s son, Matthew, a former Goldman Sachs investment banking analyst who is now co-chief investment officer at Trian. Matthew took the job from Ed Garden, Nelson’s son-in-law, who left Trian in July to start a family office. “Nelson is the lion on the team,” I’m told, “but Matt is the one who chose the fight and the one who seems to be masterminding it.”

Peltz fils has studied Disney and the industry deeply, I’m told, and is about to publish another one of Trian’s infamous “white papers” about the company, an update of the Disney deck Trian published in January, titled “Restore the Magic.” It’s apparently Matt’s view that despite Iger’s cost-cutting effort, Disney is still bloated and “enormously inefficient” and that more cuts are needed—as well as more “accountability.” For instance, Wall Street wants to know why Netflix’s EBITDA margins are around 19 percent while Disney’s streaming business, which is expected to have something like $25 billion in revenue this year, is losing money. If Disney’s streaming business had Netflix’s margins, it would be generating nearly $5 billion a year.

The Peltzes are also focused on the fact that Iger and the Disney board of directors own so little stock in the company. (Iger sold almost all of his Disney stock, per Bloomberg, during his first retirement, a small amount of which he sank into investments like Funko and Canva and a 3D-printed rocket company.) I’m told that Matt is also willing to be patient both on the restoration of the Disney dividend and on the sale of Disney’s linear assets. “The company should be very price sensitive about selling TV assets,” is what Matt is telling people, I’ve heard. “Sure, at a price it will be great to offload linear TV for the benefit of the company’s growth rate. But Disney should not puke these assets just to have a higher growth rate because they do create content that Disney can use in its various distribution channels. And if Disney sells these assets, they will end up licensing that programming or creating it from scratch. You wouldn’t want to sell for less than you go and actually buy for.” (I reached out to Nelson and his longtime communications executive, Anne Tarbell, who declined to comment.)

Matt apparently thinks Trian “deserves” the board seats and is prepared to again launch a proxy fight unless Iger “welcomes” Trian representatives onto the board. The question is whether Iger will fight back or cave in to Peltz’s demands.

It’s hard to know at this moment. Iger has a powerful ego and he won’t want to be seen giving in to Nelson. But things at Disney are looking a lot different today than they looked in January. For one thing, Iger has not shown anyone that he knows what to do to solve Disney’s problems. Arguably, you can say he’s made things worse by putting “everything on the table” and then doing pretty much nothing, save for reaching a bizarre gambling deal for ESPN with Penn Entertainment, coming to an accommodation with Charter, and announcing he intended to spend $60 billion on Disney’s parks in the next decade.

Meanwhile, he’s made no progress on the sale or spin of Disney’s linear assets. The Hulu situation remains unresolved, as does the ESPN situation. We’re still months, if not years, away from a profitable solution for Disney’s streaming platforms, nor is any solution on the horizon for ESPN’s direct-to-consumer aspirations. As for finding a successor, there is no evidence anywhere that Iger has made any progress on that front.

In fact, I’m hard-pressed to identify any out-and-out success that Iger has had in the past year since his return to the corner office. He’s at risk and Nelson knows it. Peter Supino, an analyst at Wolfe Research who covers Disney, agrees. Iger, he told me, is “much more vulnerable” today than he was in January. Back then, Supino said, he was the “returning savior,” now “he looks unsure.” |

|

|

| With the stock down more than 13 percent and $70 billion of shareholder value flushed in the second Iger era, I bet that this time Iger will fold, and give Peltz what he wants: the two board seats, including one for himself and one for another Trian designee. Frankly, there are good reasons he should give in to Nelson this go around. At 81 years old, the smiling crocodile has learned a thing or two about solving corporate problems. Iger could use his help, to be honest. He could use his help finding a proper successor and he could use his help deciding what to sell from Disney’s stable of assets. Nelson could also help Iger decide whether to spin off ABC and ESPN together, loaded up with some Disney debt, into the public markets, turning it over to the fates.

In any case, Iger is better off having Peltz inside the tent than lobbing grenades from the outside, especially since he’s now one of the company’s largest shareholders and the stock is trading at or near its lows. Iger has a huge number of problems he has to try to solve, and the last thing he needs to add to that heavy burden is a new proxy fight with Nelson Peltz.

Earlier this year, fending off Peltz’s proxy fight was a nuisance. This time around, it could end up derailing the whole Disney enterprise. In my estimation, Iger has two choices: Either concede to Peltz, give him his board seats, and take his advice; or resign, and turn over the job to a successor who has the willingness to think about Disney in a whole new way. And, let’s be honest here, he’s definitely not likely to do the latter. Welcome to the board, Nelson! |

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

|

|

|

|

| S.B.F. on Trial |

| An inside exchange on the financial trial of the century. |

| ERIQ GARDNER & TEDDY SCHLEIFER |

|

|

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|