|

|

Welcome back to Dry Powder. I’m Bill Cohan.

During my recent prison interview with Sam Bankman-Fried, he made clear his belief that Sullivan & Cromwell, the prestigious Wall Street law firm that served as outside counsel for FTX, had wronged him—and that he planned to make his beef with S&C the focus of his appeal. With Sam now packed onto a cross-country bus headed for a federal prison in Mendota, California, I interrogate the evidence surrounding the argument.

But first… A few notes on a French boardroom scandale from my partner Lauren Sherman from her excellent private email, Line Sheet…

- More LVMH intrigue: At last, some clarity on the sudden defenestration of LVMH fashion group C.E.O Michael Burke. By all accounts, outgoing Fendi C.E.O. Serge Brunschwig is likely to take over the role at the $392 billion market cap company, since Burke’s deputy Pierre-Emmanuel Angeloglou is taking over for Brunschwig at Fendi.

A person who knows each of the players well suggested that this isn’t how the game of musical chairs will end, and I tend to agree. The chief executive of the fashion group isn’t just a vast job that requires overseeing the executive team, managing brands, recruiting designers, and managing up to Arnault. It’s also traditionally been a big personality job. Burke and his predecessors, Sidney Toledano and Pierre-Yves Roussel, were three of Arnault’s most public-facing, iconoclastic deputies. They all made big moves that changed the company, from hiring Phoebe Philo in 2008 to bringing Hedi Slimane aboard in 2018.

And yet, Brunschwig’s operational bearing may be a representation of the changing times within the Arnault family and their heirloom. All those consiglieri of Bernard’s generation—Toledano, Toni Belloni, Burke—are beginning to recede into the background while the kids, as insiders like to call the five Arnault heirs, grow into their stations and assert their power. Today, leading the fashion group is more of a chairman role.

I talked to more insiders about what might be happening with Burke, and the narrative is pretty much the same across the board. There may be some personal stuff, and a company like this will do everything in its power to protect the privacy and wishes of a 38-year veteran. So the enigma may remain, but what’s clear is that Burke ran Louis Vuitton the way he wanted to run it for the past decade, while simultaneously training eldest child Delphine Arnault—who worked under him at the brand—on how to do his job. Now she’s doing that job as C.E.O. of Dior, the second-largest fashion business in the company. Meanwhile, she and her brother Alexandre, the middle child, have more influence over their father than ever. Whether or not Brunschwig gets the fashion group C.E.O. job is almost an afterthought compared to all the musical chairs yet to come… —Lauren Sherman

|

|

| S.B.F.’s Diesel Therapy |

| The crypto convict is on a cross-country prison bus to California, planning his appeal, and claiming Sullivan & Cromwell bartered away his freedom. Does he have a case? |

|

|

|

| Two weeks after we chatted in person at Brooklyn’s Metropolitan Detention Center, earlier this month, Sam Bankman-Fried was handcuffed to the seat of a prison bus and began his long journey to what will likely be his home for the foreseeable future: the medium-security federal prison in Mendota, California. In the corrections trade, these cross-country bus trips are known as “diesel therapy.” According to the Federal Bureau of Prisons, Sam is currently at FTC Oklahoma City, which is described as “an administrative federal security transfer center.”

With no lawyers to distract him and endless hours to fill, Sam will surely be reflecting on his upcoming appeal. During our May 7 interview, Sam seemed less focused on the $8 billion that he misappropriated from FTX than the idea that the company’s outside counsel, Sullivan & Cromwell, had wronged him—in particular, by setting up a meeting with the U.S. Attorney’s office in the Southern District of New York on November 9, 2022, ostensibly to flag FTX’s balance sheet crisis but also, in his telling, to exculpate itself and to throw him under the metaphorical prison bus. The next day, S&C advised Sam to step down as C.E.O. and turn over the company to John J. Ray III, who has a long and impressive history of recovering assets from failed businesses. Ray’s first act as chief executive was to have FTX file for bankruptcy, which catalyzed the unwinding of the company and the legal ramifications for Sam and many on his team. On March 28, he was sentenced to 25 years in prison for misappropriating billions of dollars of customer funds and defrauding his investors, among other criminal acts.

Sam was already up shit creek, of course. On the previous day, Binance C.E.O Changpeng Zhao announced that he had decided against bailing out FTX, possibly after being horrified by the increasingly obvious financial crisis at the company and the sense that he was better off letting FTX fail. As FTX customers were becoming frustrated in their efforts to withdraw assets from the exchange, Zhao’s decision exponentially increased the likelihood that FTX would be forced into a bankruptcy filing.

In Sam’s revisionist history, however, he could have stayed in his role as C.E.O. and somehow recovered the company from its liquidity crisis. In his conversations with me, Sam claimed he’d already circled $4 billion of the necessary $8 billion, though he didn’t name any of the potential investors. Perhaps the absurdity of this alternate reality explains why S.B.F. has fixated on the Sullivan & Cromwell subplot. That said, it is a fascinating subplot…

|

|

|

| Details of what allegedly transpired during the November 9 meeting are still coming to light. But a recent research paper by two law professors, Penn’s David Skeel and Temple’s Jonathan Lipson, has attempted to add some insights into the events that day.

According to the academics, Sullivan & Cromwell and Ryne Miller, a former S&C partner who was general counsel at FTX.US, may have distorted the legal process by telling the U.S. Attorney for the Southern District of New York that they were concerned about “problems reconciling entitlements and digital assets on the FTX.US exchange.” The professors’ source was a filing in bankruptcy court by Andrew Dietderich, an S&C partner and one of the lead attorneys representing the debtors. Sam told me he believes that lawyers at the firm also used the meeting to brief prosecutors on their theory about Sam’s malfeasance at FTX, in an effort to try to absolve the firm from allegations of wrongdoing by getting ahead of the curve with prosecutors.

In their paper, Skeel and Lipson raise the question of whether S&C “had the authority to report their concerns” and if S&C should have reported Miller’s findings about FTX.US to Sam first. According to the professors, during the meeting S&C lawyers also “entered into an agreement”—or caused FTX to enter into an agreement—to “voluntarily produce documents” for the prosecutors, including financial statements, general ledgers, and employee contact information. A few days after the bankruptcy filing, on November 15, S&C provided the first batch of documents to SDNY. Skeel and Lipson noted that S&C did not copy Bankman-Fried on its transmittal letter.

The two professors take Sullivan & Cromwell to task for “undisclosed potential conflicts of interest” and say the firm may have “cast a troubling shadow over puzzling and costly decisions in the case.” And, alas, S&C’s direct communications with S.B.F. can seem misleading. At 9:30 p.m. on November 9, hours after the SDNY meeting, Dietderich emailed Sam and Miller that the firm was “here to help … however we can,” but didn’t mention that S&C had just met with the U.S. Attorney’s Office. In the email, Dietderich acknowledged that Sam was focused on “rescue alternatives at this time”—i.e., trying to raise $8 billion ASAP to plug the giant liquidity hole at FTX—and that Dietderich and the firm were focused instead on “the safety net” alternatives, a reference to a possible bankruptcy filing, which he wanted Sam to approve “in case you need it.”

In his email, Dietderich said the firm had “the process” underway, but wanted Sam’s help in taking other, immediate steps. Specifically, he wanted Sam to name a point person at FTX.US to help S&C collect the information it needed to prepare the filing. Furthermore, he wanted Sam to hire both Alvarez & Marsal, a forensic accounting firm, for “case prep,” and an external communications firm to prepare messaging around a possible bankruptcy. Dietderich also made the case for Ray, writing that “ideally” Sam would “appoint a [chief restructuring officer] to be on stand-by as the manager of the company in a possible chapter 11. We recommend Sam stay as a director. The manager is there because of conflicts. We have considered candidates and suggest John Ray. Resume attached. The C.R.O. works by the hour and can be terminated anytime. We can set up so he does nothing before a decision to file if you prefer.”

In their paper, Skeel and Lipson point to peculiarities in Dietderich’s email. For example, he was recommending Ray as FTX’s chief restructuring officer, not its C.E.O. Dietderich wrote, too, that Ray could be “terminated anytime” by Sam. The next day, Sam told me, he was persuaded to sign the infamous “Omnibus Corporate Authority,” ceding his role as C.E.O. of FTX to Ray, at the urging of both Sullivan & Cromwell and Sam’s lawyers at Paul Weiss. In testimony Sam planned to give before Congress on December 13, 2022, he told me, he was going to say that he had wanted to rescind the Ray appointment and the Omnibus Corporate Authority, but neither was apparently possible, contrary to Dietderich’s assurances. (Instead of appearing before Congress on December 13, Sam was arrested in the Bahamas at the request of U.S. authorities.)

In his report published last week, however, FTX examiner Robert J. Cleary found that S&C did nothing wrong. “There was no error in the Court’s decision concerning the Debtor’s retention of S&C,” Cleary concluded. Without mentioning Skeel and Lipson by name, Cleary wrote that “certain academics have argued that S&C’s cooperation with prosecutors may have violated S&C’s duties to the Debtors, wasted estate assets, or misled Bankman-Frieds… Specifically, these scholars allege that, prior to the Petition Date, S&C violated its duty of confidentiality, candor, and loyalty to its client by disclosing to prosecutors, without proper authorization from the FTX Group, that a crime had occurred at the company.” But, Cleary continued, he did not see any “email or other document in which S&C expressly disclosed a crime to prosecutors or regulators prepetition.”

He noted that S&C disclosed to the government that FTX.US “had discovered an anomaly on its balance sheet—that there were not enough assets to cover liabilities,” and that those anomalies did not “amount to” and were not the “result of” a crime. Rather, Cleary concluded, “[T]he FTX Group’s decision, in consultation with S&C, to make a swift and decisive self-disclosure concerning the balance sheet anomaly is consistent with the prudent and common strategy for companies to promptly self-disclose corporate misconduct, and may have helped preserve estate resources by enabling the company to earn cooperation credit.”

In a statement to me, the firm said it was pleased with Cleary’s findings: “Sullivan & Cromwell remains confident in our pre-petition work for FTX and the commencement of the Chapter 11 cases, and we welcome the Examiner’s findings to date rejecting various baseless allegations about our work for FTX. If the Court concludes that any points require further review, we will continue to cooperate fully with the Examiner.”

|

|

|

| In a joint response, Skeel and Lipson conceded they might not have been fully informed about everything that transpired. For instance, they note that SDNY may already have been investigating Sam before November 9, and therefore S&C’s meeting with the U.S. attorney’s office that day “may have done little damage” to Sam and indeed, “may have helped to prevent greater harm to the company.” They questioned why Sam’s attorneys at Paul Weiss didn’t do more to warn him about the repercussions of the Omnibus Corporate Authority document and how the appointment of Ray would change things for him dramatically. But, they also note, there is “no evidence” that Paul Weiss, or Sam, knew that S&C had “gone to prosecutors” before Sam relinquished control of FTX to Ray in the early morning hours of November 11. But he did it all the same.

Overall, Lipson and Skeel described Cleary’s report as a mixed bag. “He reports some important information that was not previously known publicly, and he did so under difficult conditions,” they explained. “Unfortunately, he does not engage evidence that appears to be critical—in particular the timing of S&C emails reassuring Bankman-Fried of his role at FTX without disclosing that the firm had gone to prosecutors. He seems to rely heavily on the fact that Bankman-Fried had his own counsel, which has never been in dispute. The important question is: What did those lawyers know about what S&C did, and when did they know it? If there is an answer to that question in the Examiner’s Report, we have yet to see it.”

The professors have a point. In any case, now that Cleary’s report has cleared S&C, we’ll likely have to wait until Sam’s appeal to see whether there is anything more to his theory that Sullivan & Cromwell threw him under the bus during its November 9 meeting. You can bet he’s thinking about it, and little else, during his diesel therapy.

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

|

|

| London Falling |

| Mapping the great reshuffling of art’s global power centers. |

| MARION MANEKER |

|

|

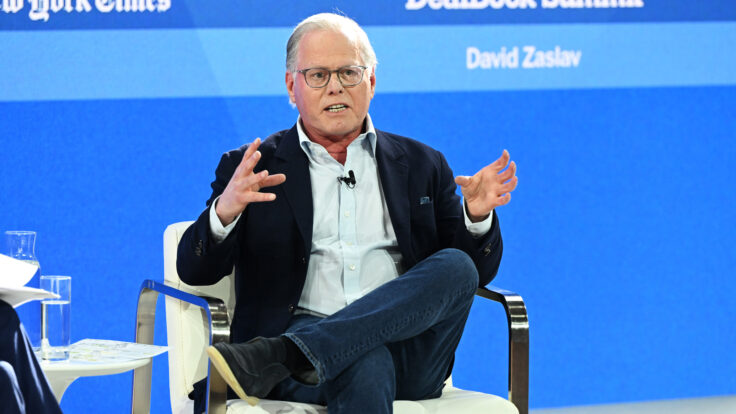

| Zaz NBA Economics |

| Foreshadowing David Zaslav’s post-NBA sports strategy. |

| JULIA ALEXANDER |

|

|

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|