|

|

|

Welcome to Dry Powder. I’m Bill Cohan, coming to you from the island of Nantucket after a few days in town for Puck’s first corporate offsite. Thanks to everyone who has supported our company, which recently celebrated its third anniversary. It was great to see so many of you at our little soirée atop Nine Orchard on Thursday evening.

Tonight’s email is all about Sam Bankman-Fried. Loyal readers will recall that I developed an epistolary relationship with Sam earlier this year, and spent a memorable hour or so with him at the Metropolitan Detention Center in Sunset Park, Brooklyn. As I previewed back then, Sam was dead set on appealing, and he had a curious theory of the case that centered on Sullivan & Cromwell’s role in FTX’s demise. I analyze that newly unfurling argument here.

But first…

- The Apollo sitch: The New York Post has reported that my friend Marc Rowan, the C.E.O. of Apollo Global Management, and his wife, Carolyn, a fashion designer, have separated after “living apart for years.” Marc and Carolyn have four children together and the Post contends that the split is “amicable.” Marc is an admirable guy whom I have known for a very long time, and a very private person, but this was news to me, especially since I am writing my next book about Apollo. He had never brought this topic up in our many hours of conversation. Fair enough.

Naturally, the book focuses on Marc, Leon Black, and Josh Harris, the three co-founders of the firm—although, of course, everyone knows that Leon really created the business and then named Marc and Josh as “co-founders” when it was time for Apollo to go public. (Leon wanted to show investors that he was building a firm that would last.) These days, of course, Leon and Josh no longer speak and, in fact, are in arbitration about whether Josh breached the terms of their shareholders’ agreement. As a result of Leon’s Epstein proximity and other extramarital complications, as I have chronicled, Leon left Apollo behind in 2021, although he is still Apollo’s largest shareholder, with something like 90 million shares, and a fortune of around $13 billion these days. Josh has his own private equity boutique and growing sports enterprise, and a net worth of around $9 billion. (He is a controlling partner of the Washington Commanders, the Philadelphia 76ers, and the New Jersey Devils.) Marc is making do with a fortune of around $7 billion.

My surprise aside, separations are miserable, I’m sure, and I wish everyone here all the best throughout the process and beyond, including Marc. And while he deserves as much of an opportunity at happiness as anyone else, I was surprised to learn that he has recently been spending some extracurricular time with a senior employee at Apollo, whom I will not name.

Yes, it’s early, we’re all adults here, and Rowan hasn’t bent any corporate rules that I can figure, except perhaps the unwritten one about “judgment.” Marc has flagged the potential relationship to his board and hasn’t violated any internal policies, especially since his new friend doesn’t report directly to him and he doesn’t set her compensation. (The company’s code of conduct and ethics doesn’t address interoffice relationships per se as far as I can tell, but it does say, “all employees are expected to exercise sound judgment and always demonstrate appropriate behavior as all of our actions can have an impact on the [c]ompany’s reputation.”) But you don’t need to run an enterprise valued at $70 billion to know that it’s probably best to separate the personal and the professional if you are the C.E.O.—see this recent Wall Street Journal story about the scandal at Norfolk Southern—and especially so at Apollo, after the Leon Black ordeal, which was obviously orders of magnitude different but nevertheless highly consequential to the careers of the three co-founders. Given the often admirable scruples of Apollo’s dealmakers, I have a feeling that everyone will soon enough return to their senses and update their Raya accounts. I reached out to Marc, of course, to see if he would comment. His spokesman, Steve Lipin, declined on his behalf.

- Happy anniversary, Lehman…: Given that it’s the 16th anniversary of the collapse of Lehman Brothers, which precipitated the worst global financial crisis since the Great Depression, who can resist a little nostalgia, courtesy of Rich Handler, the C.E.O. of Jefferies. As the crisis was continuing to unfold, on Friday, September 12, 2008, Handler emailed Dick Fuld, the Lehman Brothers C.E.O., heading into that fateful weekend, and reminded him that although they had met once very briefly, which “is of absolutely no help to you right now, I just want you to know that I have always been in awe of the company you built and modeled much of Jefferies after what I watched you and your team accomplish. My thoughts are with you and your entire company this weekend.” Fuld did not respond.

On the evening of September 15, after Lehman had filed for bankruptcy, Handler wrote Fuld again: “I am so very sorry for you and the special company that you built.” Finally, on October 3, two weeks later, Fuld responded to Handler using a Bloomberg email address and a Barclays Capital handle, “Thank you for your note of support + for thinking of me + the firm.” Not particularly profound, of course. But a moment in time worth capturing, for posterity if nothing else.

Handler, who is still the C.E.O. of Jefferies, offered up on X—or Twix, as I like to call it—10 “life-saving lessons,” among them such pithy observations as, “There is no such thing as a ‘slight liquidity crisis,’” and, “Leverage can’t distinguish between good and bad, but it will happily magnif[y] both,” and, “You never have as much time as you think.” Thanks, Rich. Happy 16th anniversary of the collapse of Lehman Brothers to all who celebrate.

|

|

And speaking of liquidity crises…

|

|

| Inside S.B.F.’s Legal Bunker |

| Notes on Sam Bankman-Fried’s fiery 102-page appeal, his demand for a new trial, and why he argues that everyone—well, at least Judge Lewis Kaplan, FTX’s attorneys, and the media—was out to convict him from the start. |

|

|

|

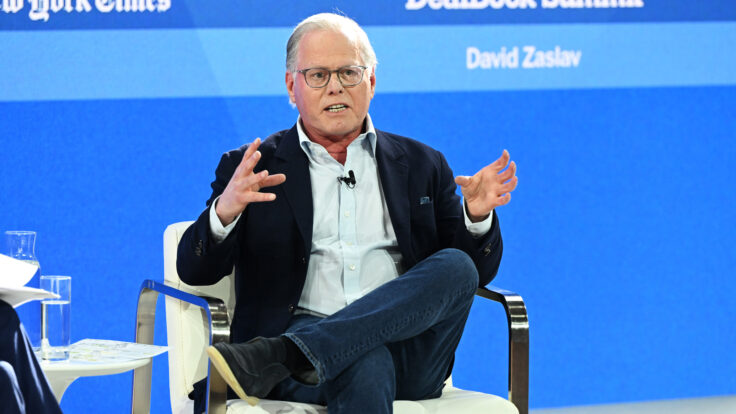

| Late Friday, Sam Bankman-Fried filed the long-expected appeal of his 25-year prison sentence and $11 billion fine. In many ways, of course, S.B.F.’s appeal had begun taking form even before a jury convicted him, last year, in a scheme to defraud customers out of $8 billion. The disgraced founder of FTX, the crypto-trading exchange, and Alameda, his now-defunct hedge fund, also previewed some of his appeal for me, in May, when I met with him inside Brooklyn’s charming Metropolitan Detention Center, where he resides in a section of the women’s facility—presumably for his own protection, given that he’s a high-profile, first-time, non-violent offender—along with other men who are presumably similarly at risk.

In his 102-page appeal, S.B.F.’s attorneys at Shapiro Arato Bach, a small Manhattan law firm, essentially argued that he did not get a fair trial a year ago, and that the federal prosecutors were colluding with the new executives running his bankrupt company—as well as with Sullivan & Cromwell, the debtors’ attorneys that represented Sam and FTX prior to the company’s bankruptcy filing in November 2022. Furthermore, Sam’s attorneys argued that the prosecutors and the debtors were given much more than the benefit of the doubt by Judge Lewis A. Kaplan in his Manhattan courtroom.

As a result, Sam and his attorneys are asking for his sentence to be vacated, and for a new trial in front of a different judge. Barring that, they have asked for an “evidentiary hearing” to determine whether the debtor, S&C, and the prosecutors were in cahoots. “In the United States, people accused of crimes are presumed innocent unless and until proven guilty beyond a reasonable doubt,” Sam’s attorneys wrote. “They are entitled to a fair trial by a jury. When the government introduces evidence, defendants have the right to rebut that evidence and present their side of the story. That, at least, is how it’s supposed to work. But none of that happened here.”

|

|

A MESSAGE FROM OUR SPONSOR

|

|

|

Reasons to Consider a Covered Call Strategy

Seeking to retain equity exposure while mitigating downside risk? The time could be right for covered call strategies. Navigate volatile markets with the Global X Nasdaq 100 Covered Call ETF (QYLD) — it writes call options on the Nasdaq-100 Index, aiming to generate monthly income.

Explore QYLD.

|

|

|

| Sam Bam, Thank You, Ma’am |

|

| In short, Sam’s attorneys argued that he was “presumed guilty” from the get-go—by the media, the debtor and its executives, the prosecutors “eager for quick headlines,” and Judge Kaplan, himself—and that the government’s narrative that he had squandered billions of dollars of other people’s money “on luxury condos, political donations, and outlandishly risky investments” was false. After all, according to the appeal, “everyone knows by now” that FTX’s customers and Alameda’s creditors will be repaid in full by the bankruptcy estate. Sam claims that the estate now expects to distribute between $14.7 billion and $16.5 billion, and has “billions more in assets than liabilities.” According to Sam, his investments were not “risky or stupid,” but rather “illiquid” in that they could not easily be turned into cash during the November 2022 “bank-run of customer withdrawals.”

The jury never got to hear that counternarrative, Sam’s attorneys argued. They also noted that Judge Kaplan did not allow the jury to hear what Sam said during his pretrial deposition—testimony, they suggested, that would have made his case more sympathetic. That’s not unusual, of course: Judges are empowered to make these sorts of determinations, and appellate courts are typically hesitant to second-guess them. An appeal on any of these grounds is surely a long shot.

Sam’s attempt to argue that FTX “faced a liquidity crisis, not a solvency crisis” centers on his $500 million investment in Anthropic, the A.I. company, and his investment in the cryptocurrency Solana, which he calls “prescient.” (Ironically, during the 2008 financial crisis, many of the banks that failed made a similar argument.) Per the filing, that Anthropic investment is now worth between $1 billion and $1.4 billion, and as a result, the “alleged victims” are now expected to be made whole, plus interest. What’s more, Sam claimed that he didn’t “know” Alameda was “irredeemably insolvent.” Rather, “he believed that with more time, Alameda could sell its assets to cover its liabilities—and he was proven correct in the end.” His attorneys continued: “The court permitted the government to introduce evidence of loss but precluded the defense from presenting contrary evidence, on the erroneous premise that the defense’s evidence was ‘immaterial as a matter of law.’ That grossly one-sided ruling denied Bankman-Fried his right to present a defense.”

|

|

|

| As I expected after our conversation in May, Sam and his lawyers reserved much of their collective ire for Sullivan & Cromwell and Judge Kaplan. “The last few decades of American white-collar practice have produced a disturbing trend of collaboration between large law firms and federal prosecutors,” Sam’s attorneys wrote, arguing that this collaboration “allows the government to avoid its Brady obligations,” which require prosecutors to turn over all exculpatory evidence to the defense in a criminal case. The “cooperating law firms” are then able to bill many hours while pursuing investigative work for the prosecution, they wrote.

Sam claimed that both John J. Ray III, who took over from Sam as C.E.O. of FTX in November 2022, and Sullivan & Cromwell “provided extraordinary assistance to the government.” Sam’s attorneys argued that S&C, in particular, “performed prosecutorial tasks that had nothing to do with bankruptcy,” adding that FTX, the debtor, and S&C “were motivated” to “place all the blame” on Sam in order to “avoid scrutiny of their own business decisions, their own conflicts on interest, their own exorbitant billing and their own misconduct.” (Sam’s emphasis.) According to the filing, the government, S&C, and the debtor made a point of proclaiming that Sam was the “villain” who had stolen the money because of “hubris, incompetence, and greed,” and then waited until “after he was convicted” to reveal that “customers and creditors would get back their money.” The debtors were not “mere spectators” in all this because they “took control” of FTX, “a solvent company,” and “forced it into bankruptcy,” it claimed. (Sullivan & Cromwell declined to comment on Sam’s appeal. But the firm did respond to similar allegations made in the FTX examiner’s report a few months back with, “Sullivan & Cromwell remains confident in our prepetition work for FTX and the commencement of the Chapter 11 cases, and we welcome the examiner’s findings to date rejecting various baseless allegations about our work for FTX.”)

Sam further argued that the debtors—FTX and its subsidiaries and affiliates—were essentially an “arm of the prosecution,” and that S&C “likely conducted a more voluminous investigation than the government itself” on behalf of the government and against him. Sam also wrote that his defense team identified documents that “were likely exculpatory” and wanted them disclosed, but that the government, the debtor, and the court “stonewalled the defense” and did not allow their entry into the proceedings. (I reached out to a spokesman for the U.S. Attorney’s office in the Southern District of New York but didn’t hear back by press time.)

As for the $11 billion judgment, Sam’s attorneys called it “astronomical,” arguing that he has “no assets” and that “the forfeiture will destroy” Sam’s “future livelihood.” Even if Sam “survives his 25-year sentence” and is released from prison, they argued, it will be impossible for him to earn “substantial wages” because of his conviction, and that he would never “come close” to being able to satisfy that judgment against him. The judge should have “accurately estimated victim loss,” Sam’s attorneys argued, rather than ensure that Sam “would be personally indebted to the government for the rest of his life.”

Finally, Sam and his attorneys requested a new trial before a different judge, arguing that Kaplan was “one-sided” in his handling of the case. The judge “did not like” Sam, his attorneys wrote, and “didn’t like his demeanor,” and was “coaching the prosecution on an argument to make.” (Needless to say, this is a tall order, and successful claims of judicial bias tend to rise far above a judge simply not being a fan of a given criminal defendant.)

|

|

|

|

|

| For what it’s worth, Sam did not appreciate my reporting on our visit together at the MDC in May. When I did hear from him again, via the prison email system, in late August, it was to again express his dissatisfaction with what I had written. This surprised me, frankly, given that I had made the effort to represent his thinking as best I could, even though I was not allowed to record our conversation or take notes, and that the meeting ended abruptly after about an hour. I thought I was extremely fair to Sam, but he disagreed.

He declared his note to me in late August off the record, but I can convey that he thought my reporting was snarky, condescending, and wrong. Subsequently, I got the feeling that he was dismissive of ideas that contradicted his belief about what he had and had not done. Sam, I learned, is not one to admit mistakes.

The truth of the matter is that FTX experienced a run on the bank, not unlike what happened to Bear Stearns or to Lehman Brothers or to Silicon Valley Bank. None of the executives involved in those bank failures were convicted or went to prison. Few were even prosecuted. Financial institutions, whether they be banks, or exchanges, or hedge funds, are confidence games. Everything is fine until people lose confidence in their efficacy, at which point little can be done to prevent their collapse. Just ask the late Jimmy Cayne, or Dick Fuld, or Greg Becker, the C.E.O. of Silicon Valley Bank. In the case of FTX, nearly everyone lost confidence in the company at pretty much the exact same time.

On the other hand, Sam was convicted of using his customers’ money at FTX to make big investments at Alameda without their knowledge or consent. And yes, some of those long-shot investments have paid off. But that doesn’t make what he did right, or ethical, or legal. Many of these FTX accounts weren’t margin accounts, after all. So Sam needs to take responsibility for those decisions, at the very least. (He admits to very little wrongdoing, if any, in his appeal documents.)

I suspect he’ll get the new trial he is seeking, because I don’t think he had a chance to present his defense in a thorough or balanced way. We’ll see whether that proves to be the case, or not, soon enough.

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|