|

|

|

Happy Wednesday, and welcome back to Dry Powder.

After six long months, Shari Redstone has summarily and rather bafflingly stuck a knife in the David Ellison-RedBird Paramount bid, bringing to an end one of the most publicly scrutinized M&A negotiations in modern memory. In today’s issue, I have some new details on how the last few days transpired, reveal who was whispering what in Shari’s ear, and offer some insights into what might happen next.

|

|

| Shari-Kiri |

| Deal chatter around Shari Redstone’s shocking, and yet perhaps not entirely unsurprising, decision to kill the Skydance/RedBird acquisition at the thirteenth hour, and forgo billions in order to preserve her place at Sun Valley and table at Dan Tana’s. As one deal observer put it, “It’s why people shouldn’t inherit companies.” |

|

|

|

| In the hours before the stunning news came that Shari Redstone had ended negotiations to sell her family’s entertainment empire to Skydance Media’s David Ellison and RedBird Capital’s Gerry Cardinale, there were signs that the deal was sputtering. Redstone, of course, had been bargaining with Ellison and Cardinale for more than half a year over their offer for National Amusements Inc., the holding company through which she controls Paramount Global, the Hollywood heirloom she inherited from her father. But in recent weeks, the foot-dragging on the complex deal had become parodic—special committees, potential Revlon duties, media leaks, stalking horses, etcetera. Then, on Tuesday morning, just as Paramount’s special committee was set to vote on the combination, word emerged that Shari had killed the deal.

A day earlier, I had begun to receive a barrage of incoming texts and emails from Paramount insiders expressing genuine concern that Charles Phillips, the 65-year-old former Morgan Stanley banker and Paramount board member who sits on the board’s special committee, had been trying to thwart the Ellison/RedBird deal. According to these people, Phillips had been against the sale pretty much from the beginning and had been whispering in Shari’s ear that she could do better—perhaps even with Phillips himself leading a new management team. “It’s a disgrace,” someone involved in the M&A process told me yesterday. (Rich Greenfield, at LightShed Partners, wrote in a note on Wednesday that it was “likely” that Shari would appoint Phillips to replace the three men now acting as the company’s co-C.E.O.s, who are known on Wall Street as the Pep Boys.)

This was indeed a new and unexpected twist. What was even more curious, of course, is that Phillips was once a co-president and director at Oracle, the company that made Larry Ellison—David’s father—one of the wealthiest men in the world. Was there bad blood between Ellison and Phillips, who was described in the press as “embattled” at Oracle, from which he resigned in 2010 to become C.E.O. of Infor? (There was, once upon a time, a very famous billboard in Times Square of Phillips and his then-mistress, complete with a web address for a site documenting their romance.) “Everybody wanted this to happen,” I was told, referring to the Ellison/RedBird deal, “and [Phillips] was the one guy standing in the way.”

|

|

A MESSAGE FROM OUR SPONSOR

|

|

|

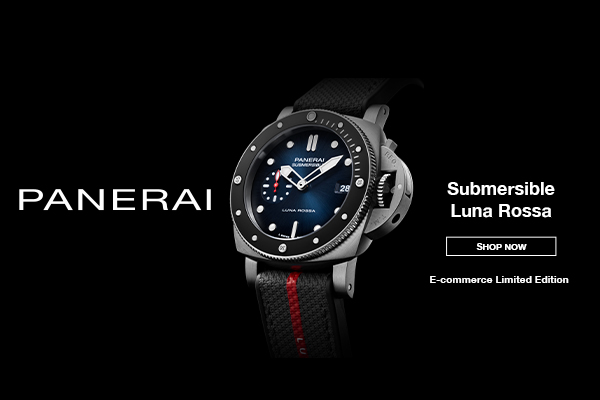

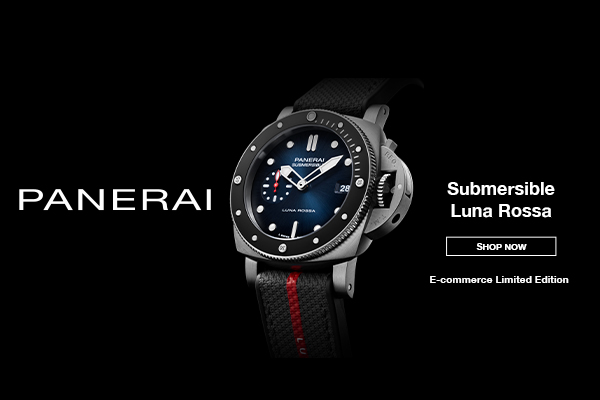

The Submersible Luna Rossa PAM01565 is here. Introducing the new e-commerce limited edition timepiece, limited to only 300 pieces. This masterpiece encapsulates the spirit of competitive sailing, embodying a relentless pursuit of victory and profound respect for the sea. Crafted for the audacious, this new release, developed by the Laboratorio di Idee at the Panerai Manufacture in Neuchâtel, is a symbol of Panerai’s innovative spirit and the valor of the Luna Rossa Prada Pirelli Team.

|

|

|

| There were other potential blockers, too, of course. As I reported last week, Shari was increasingly concerned about anticipated shareholder litigation related to the Ellison/Cardinale deal, which provided a disproportionately larger premium to Shari, at NAI, than the rest of the Paramount Global shareholders. In recent days, she had considered calling a vote of the non-Redstone voting “A” shareholders in the hope of getting a majority of them to approve the deal, thus providing some amount of legal absolution, or at least air cover, from inbound lawsuits. Meanwhile, the Pep Boys—George Cheeks, Chris McCarthy, and Brian Robbins—presented an alternate plan in which they might turn around the company, themselves, by cutting $500 million in costs and seeking partners for Paramount+, the money-losing streaming business… a plan that would be moot if Phillips becomes C.E.O.

Shari’s final decision had been expected by 11:30 a.m. eastern time on Tuesday, as my partner Matt Belloni reported. But noon came and went without any update. “It’s one guy,” a well-connected source told me at the time, referring to Phillips. “The special committee wants this to happen. Everybody’s on board. Shari’s on board. Everybody wants this to happen. It’s this one guy standing in the way.” Another source told me that Phillips and Shari “pulled” the company off the market at the last minute. I emailed Phillips and called his cell phone yesterday to see if any of this was true. He didn’t reply. I also tried Molly Morse, Shari’s spokesperson at Kekst CNC, but she didn’t reply until after Shari had sent word, through her lawyers, that the deal was off.

That afternoon, Morse issued a terse, legally proper statement on behalf of Shari and National Amusements Inc. saying that the two sides had been unable “to reach mutually acceptable terms,” and that NAI was “grateful” for Ellison/RedBird’s “months of work” and hoped the years-long “collaboration” between the Paramount studio and the Skydance studio would continue. The statement noted that Shari threw her support behind the Pep Boys triumvirate, and that Paramount’s board would “continue to explore opportunities to drive value creation for all Paramount shareholders.” (There was no mention of Phillips or his role in killing the deal or whether he would emerge to replace the triumvirate.)

According to a separate statement provided by a representative at the Brunswick Group, the P.R. firm retained by the special committee after it terminated Joele Frank, the committee had met on Tuesday to “discuss progress of discussions” about the Skydance deal and was told by NAI that it “did not have an agreement on a deal with Skydance Media and didn’t anticipate a path forward on this transaction.” No vote was taken, obviously. (Brunswick’s assignment may end up being one of the shortest on record.)

The fallout was immediate. “She killed the deal,” one participant texted me. “It’s over… I’ve seen some crazy shit over the last thirty years, but this takes the cake.” So far, no one seems to know why Shari made this decision. And she hasn’t explained herself. Shareholders were furious, especially those arbitrageurs who had piled into the stock hoping for a deal. The Paramount stock closed down around 8 percent on Tuesday and was down another 2 percent before flattening out on Wednesday in an up market. Shari, of course, will bear the brunt of the economic pain for her decision, at least in the short run. Her stock is now worth $775 million, a far cry from the $2.3 billion or so that she and her family were about to get. “Really weird, bordering on the unhinged,” one faithful correspondent wrote to me about the collapsed deal. “It’s why people shouldn’t inherit companies.”

|

|

|

| I had wondered if Shari was getting cold feet, earlier this month, when I began to hear rumblings that she was thinking of reintroducing the requirement that Paramount Global’s non-Redstone Class A shareholders be allowed to vote on ratifying the deal. Shari, who owns about 77 percent of the voting shares in Paramount Global (and about 10 percent of the economics), didn’t need the support of the other Class A shareholders, of course. The best explanation for her last-minute request for a so-called “majority-of-the-minority” vote was that she wanted legal protection from angry shareholders.

It was understandable. The Ellison/RedBird deal was going to pay her a price for NAI well above what her economic stake alone was then worth. Meanwhile, the other shareholders were going to get their pro-rata amount of $4.5 billion in cash, divvying up $15 a share in cash, if they wanted out. (That’s $4.3 billion for the “B” shareholders at $15 a share, and $200 million for the non-Redstone A shareholders, pro-rata-ed for demand, so most shareholders would get less than $15 a share.) Shari, in other words, was going to get a bigger premium than anyone else. Would the difference be so offensive that a major stakeholder might sue? That appeared more than likely. In any event, apparently, Shari did not want to know the answer.

There was also plenty of chatter that Shari didn’t just want the majority of the minority Class A shareholders to vote; she wanted the majority of the non-voting shareholders, who own some 625 million Class B shares, to ratify the deal, too. Who knows if these conversations went anywhere. It would have been one thing for Gerry Cardinale, the ex-Goldman banker who founded RedBird, to try to win over Mario Gabelli, who owns the majority of the non-Redstone voting shares in Paramount. But to make that argument to a sea of irritated, long-suffering minor shareholders, some of whom have complained bitterly and publicly about the proposed deal? That seemed like a very long putt.

In any event, it was a moot point, because Ellison/Cardinale didn’t like the “majority-of-the-minority” provision at the end of the negotiations any more than they’d liked it the first time Shari brought it up. It was a nonstarter, as they say on Wall Street. But Shari was already on edge about her profit margins on the sale, even before factoring in the hundreds of millions of dollars she would likely end up spending on legal fees to combat the inevitable lawsuits. After all, even with the $2.3 billion she would receive for NAI, she would still have to pay off NAI’s bank debt of around $200 million, plus the $175 million in preferred stock she owes BDT & MSD Partners, her financial advisor on the sale of NAI. That would leave roughly $1.9 billion or so, pre-tax, to divide between her and her late father Sumner Redstone’s five grandchildren. “It was ugly,” one longtime family observer texted me last night. “Like, scary ugly.”

|

|

|

| The buyers didn’t want to risk a vote, they just wanted Shari to approve the deal. Major disagreement number one. Another issue for Team Ellison/RedBird was that they weren’t really in the mood to keep negotiating with Shari. The truth is that the advisors to the special committee of the Paramount Global board—Blair Effron at Centerview Partners, and Faiza Saeed, at Cravath—had done a great job getting Ellison/RedBird to revise their offer, repeatedly, to make it more palatable to all the Paramount Global constituents. In addition to the $2.3 billion, or so, for NAI, they agreed to inject $1.5 billion into Paramount Global to pay down some of the $12.2 billion in net debt, and the additional $4.5 billion to buy out about half of the non-Redstone Paramount shareholders at $15 per share. That was not part of the original offer.

They also agreed that Paramount would buy Skydance for just $4.75 billion in stock, down from the original $5 billion—another concession on their part. The final piece of the Ellison/RedBird deal was that Paramount Global would remain a publicly traded company, with a new management team led by David Ellison, Jeff Shell, and probably Jeff Zucker. Ellison/RedBird wouldn’t make a return on its sizable investment until the stock traded back up to between $30 and $40 a share, promising plenty of upside for the Class B shareholders.

Did Shari not want to be shown up by the new owners? Questions began bubbling up as Shari took her sweet time to reach a decision on the deal, which the special committee had approved and recommended on May 31. Psychologically, perhaps, her reluctance made some amount of sense. Her family has owned Paramount Global, the corporate offspring of Viacom and CBS, for some 35 years. Once it’s sold, it’s sold. But it’s not like the deal emerged like a summer squall. Negotiations, with Shari’s countenance, had been going on for months. And nobody involved in the process truly knew what was taking her so long to decide. Even her spokesperson, Molly Morse, couldn’t provide a timetable. Something seemed fishy, and it was.

|

|

|

| Obviously, the Ellison/RedBird team lost the opportunity cost in the months it spent trying to put together a deal. (And Centerview Partners probably lost out on its $60 million success fee for advising the special committee.) But Ellison/RedBird may have dodged a bullet. Can Paramount Global even be rehabilitated?

It’s a good question. Paramount remains one of the smaller players in the land of giant Hollywood media companies, where even behemoths like Disney, Warner Bros. Discovery, and Comcast have ongoing, macroeconomic problems. Greenfield, at LightShed, wrote that Paramount needs to “take immediate action” to “stem the bleeding at Paramount+” and needs to do it “within weeks.” He also said Paramount should begin a process of asset sales, including BET, CBS’s local affiliates, and the famed Paramount lot on Melrose Avenue. Another problem, of course, is that Paramount still has too much debt—more debt on a multiple of cash flow basis than WBD—as well as no real leader, at a crucial moment in its history. “That’s a problem,” a person deeply involved in the failed deal told me.

Was the Ellison deal dead dead? I wondered aloud to this person. Yes, this person said, very dead. And while other, seemingly random, parties have expressed interest in buying NAI to get Shari’s control of Paramount Global—including a partnership between Bain Capital and Edgar Bronfman Jr., the Seagram heir who already has a failed turn in the broader industry on his résumé with Universal, as well as a group of investors corralled by film producer (and Friend of Shari) Steven Paul—they seem like long shots. Neither has done a deep dive into the Paramount books and may never. Any transaction with either of them, if it even happens, is months away. And who knows what happened to the Sony/Apollo proposal. That seems to have just withered away, under the weight of Shari’s opposition and the real risk of a long regulatory review.

This seems to be it, for now. But the need for a deal remains. “The company needs to fix the balance sheet, and I assume Shari wants money,” the person involved in the deal continued. “But beyond that, I have no idea.” Greenfield predicted Shari might revisit a deal in 12 to 18 months. “We believe National Amusements is keen to sell Paramount eventually,” he wrote. After the news broke, Gabelli paraphrased Yogi Berra in a tweet, “Paramount….it ain’t over till it’s over///a NY Yankee fan to a Boston …” (Shari is from Boston.) Another Class A investor, John Rogers Jr., at Ariel Investments, was more blunt: “It’s the most screwed up sale and governance I’ve ever seen.”

|

|

|

| I can safely say I’ve never seen anything quite like the way this deal was prosecuted, and that comes after nearly 20 years as an M&A banker at Lazard, where I worked on the Paramount sale to Sumner’s Viacom back in the early 1990s, and at Merrill Lynch and JPMorgan Chase. There was too much noise around this deal, for starters. M&A processes are best handled stealthily, with an announcement only when the deal is done. This process was too public—to the media’s delight, mine included—and that’s not the way to get deals done.

That aside, I don’t think I’ve seen a deal where a special committee is appointed and does its job by negotiating the best deal it possibly can, including any number of sweeteners, only to have the plug pulled at the last minute. I know shit happens and can happen in any deal. But this outcome was beyond the pale, though always a real possibility given Shari’s unilateral power. In the end, she got cold feet. I’m told Shari “freaked out” this past weekend about the prospect of not being invited to the Allen & Co. media conference anymore. (Morse declined to comment.) At least now, she’ll still be invited to the grown-ups table at Sun Valley and always be able to get a booth at Dan Tana’s, and I guess, in the end, that kind of currency is more important to her than the money. Kind of refreshing, in a weird way.

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

|

|

|

|

|

|

|

|

Need help? Review our FAQs

page or contact

us for assistance. For brand partnerships, email ads@puck.news.

|

|

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

|

Puck is published by Heat Media LLC. 227 W 17th St New York, NY 10011.

|

|

|

|