|

Welcome back to Dry Powder, I'm William D. Cohan.

Thanks as always for following my work here at Puck. As a reminder, you're receiving the free version of Dry Powder at .

In today's email, I'm talking to my partner Matthew Belloni about a number of urgent industry questions at the intersection of Wall Street and Hollywood—including the future of Paramount Global's stock price and streaming strategy.

SPONSORED BY FACEBOOK

The inside conversation at the nexus of Hollywood and Wall Street. It’s been a dramatic couple of weeks in the entertainment and media sphere as the soon-to-be Warner Bros. Discovery grappled with an abrupt leadership change atop CNN, ViacomCBS rebranded as Paramount Global, and Netflix and the other Hollywood studios pulled out of Russia amid Vladimir Putin’s escalating war on Ukraine. So, this weekend, I went back and forth with fellow Puck founding partner and Hollywood correspondent Matthew Belloni about what it all means for Wall Street and the future of entertainment in the post-Covid, post-streaming, post-everything era.

Matt Belloni: Bill, you floated in a column that the recently exited CNN president Jeff Zucker might be a good fit to run Paramount Global (the former ViacomCBS). Not sure I agree with that. Zucker had some stumbles as C.E.O. of NBC Universal from 2007-2011. I remember when he put the erratic Ben Silverman in charge of NBC, which everyone knew would be a disaster. (It was.) And he engineered the botched Tonight Show transition from Leno to Conan and then back to Leno, and he wasn’t exactly loved by his bosses at the end. What makes you think Shari Redstone needs Zucker?

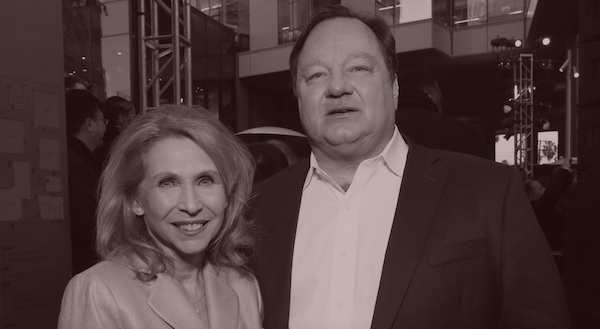

William D. Cohan: Well, Matt, Paramount needs to do something, anything to make it relevant to a potential acquirer. That’s got to be Shari’s main goal after years of financial engineering. She has to prove to her family that wresting the company away from her father Sumner and recombining CBS and Viacom—all pretty much against his previous wishes—was worth it. Her chosen leader, Bob Bakish, has done little, if anything, to improve the Paramount Global share price. Since he took over the combined company in December 2019, the stock is down nearly 14 percent (and that includes last week’s surprising 18 percent jump), at a time when the S&P 500 index increased 39 percent. Some say that Bakish deserves credit for merging these complex entities and refocusing on its streaming services, but these are simply the baseline requirements of the job. So Bakish is not exactly inspiring confidence.

Belloni: But that’s Bakish. What makes you think Zucker could be the solution?

ADVERTISEMENT

FOUR STORIES WE'RE TALKING ABOUT If theaters are going to survive, they badly need to evolve the model. Does Adam Aron have a solution, or just another schlocky ploy? MATTHEW BELLONI How to contextualize the atrocities from the first week of Putin’s war on Ukraine? Is this Europe’s 9/11, or the next Syria? JULIA IOFFE With his Senate bets struggling to gain traction, Thiel heads to Palm Beach for help making good on a $10 million investment. THEODORE SCHLEIFER Barry McCarthy, Peloton’s new C.E.O., is on a mission to recover the other 80 percent of his company's left-for-dead stock. WILLIAM D. COHAN

|

-

Join Puck

Directly Supporting Authors

A new economic model in which writers are also partners in the business.

Personalized Subscriptions

Customize your settings to receive the newsletters you want from the authors you follow.

Stay in the Know

Connect directly with Puck talent through email and exclusive events.