Welcome back to Dry Powder. I’m Bill Cohan.

During a time of such profound

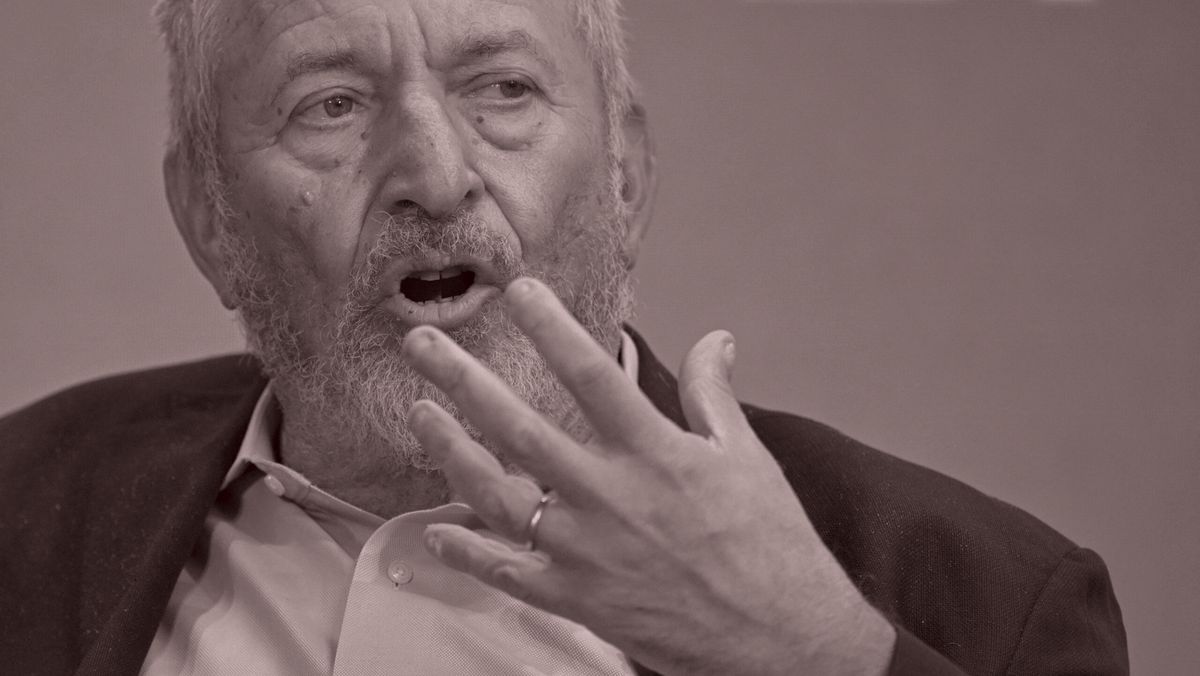

economic anxiety, there are few in the financial community that I would rather hear from than Larry Summers, the last Treasury secretary under Bill Clinton, former director of the National Economic Council, and onetime president of Harvard—bona fides that take up but a few lines on a truly enviable C.V. In our conversation below, you’ll find Larry at his most forthright, dissecting Trump’s harebrained imposition of tariffs, his attacks on the

Fed, on elite private educational institutions, and much more.

But first, a couple relevant updates from my partner Eriq Gardner…

|

|

|

|

Eriq Gardner

|

|

- A D.O.J. vs. Disney

scoop: I’ve learned that the Department of Justice has launched a formal investigation into Disney’s acquisition of a controlling stake in Fubo, the sports-oriented streaming service. Disney and Fubo are already responding to information requests, and bracing for a potential challenge from the Trump administration over the deal, which was announced in January.

The investigation itself shouldn’t be surprising. After all, the transaction effectively ended antitrust

litigation between two rivals. If you recall, Disney had planned to launch Venu—a sports streaming joint venture with Warner Bros. Discovery and Fox—until Fubo sued and secured an injunction. That litigation vanished when Disney bought its stake in Fubo in January and incorporated it into Disney’s Hulu + Live TV business. That didn’t sit well with Senator Elizabeth Warren, who urged the D.O.J. to take a closer look at the deal.

Of course, any government

attempt to unwind the Disney-Fubo deal would play out against the backdrop of President Trump’s war on major media companies—which could present complications of its own. If this does make its way into a courtroom, expect questions from defense lawyers about political interference, and comparisons to Trump’s hands-on involvement in the proposed PGA Tour–LIV Golf merger, another antitrust case between rivals that was conveniently resolved. Disney declined to comment.

|

|

|

- The

lucrative long tail of the 2020 election: The Dominion v. Newsmax trial that Eriq wrote about last week, in which the voting systems company is seeking $1.6 billion from Newsmax after famously winning $787 million from Fox News, has been postponed by Delaware Superior Court Judge Eric Davis. I covered Newsmax’s

topsy-turvy I.P.O. in a recent piece, and have updated the story to reflect that C.E.O. Chris Ruddy and other large shareholders have registered their shares for sale with the S.E.C., and that they are subject to a six-month lockup and have not yet sold them.

|

|

|

Larry Summers, the former Treasury secretary and N.E.C. director and Harvard man, goes “Full

Larry” on the economic fallout under Trump II—capital flight, lost exports, violent deleveraging, declining competitiveness, Argentina comps, etcetera.

|

|

|

Larry Summers, the last Treasury secretary under Bill Clinton, first

director of the National Economic Council under Obama, and onetime president of Harvard, is well known to the faithful readers of Dry Powder. He remains a tenured professor of economics at Harvard, as well as a newish OpenAI board member, and a part-time resident of Arizona. Summers has also been impressively outspoken on a number of important topics related to the Trump II agenda, including the roller-coaster tariff regime; the president’s attacks on the

Federal Reserve and Jay Powell, its chairman; and the administration’s scorched earth pressure campaign against elite private educational institutions, including his alma mater.

What follows, at Summers’ request, is the Full Larry—his words, not mine, to make sure I included all of his bon mots. Our conversation has been lightly edited for clarity. And for the sake of full transparency in this dynamic environment, we spoke on Monday morning, before Trump

seemed to remove his finger from the Powell ejector button.

|

Bill Cohan: I know you’ve said a lot about them already, but what’s your

current thinking on the economic impact of this cockamamie tariff proposal?

Larry Summers: There’s the economics and the finance of the tariffs. The economics is that this is a big, short-run supply shock, raising prices and reducing spending power. It’s probably the equivalent of about a $50-a-barrel increase in the price of oil, which would petrify everyone—only we’re doing this to ourselves. The world’s not doing this to us.

In addition, it’s making all kinds

of U.S. industries less competitive because inputs are going to cost more, and because the rest of the world is going to retaliate. So it’s bad, short run, cyclical, and it’s bad for the long-run competitiveness of industries that depend on inputs and [because it will] cause the rest of the world to rebel against our products. It’s lost exports when flights to the United States from abroad are down 20 percent. It’s lost exports when students no longer want to come to our universities. It’s lost

exports when people hate Teslas because of resentment. And it’s a broader thing. We’re becoming higher inflation, higher unemployment, and less competitive.

|

|

|

A MESSAGE FROM OUR SPONSOR

|

Across the country, Walmart is investing in products made, grown or assembled in America through their commitment to

U.S. manufacturing. In fact, over two-thirds of the products Walmart buys come from U.S.-based small and medium-sized businesses, like Athletic Brewing in Milford, CT. Since working with Walmart in 2021, Athletic Brewing has opened a new brewery and hired over 200 employees. Across America, Walmart’s commitment to U.S.-made products is supporting job creation and strengthening communities.

Learn more about Walmart’s impact.

|

|

|

With finance, we’ve turned ourselves into a capital-flight country. You see that from the fact that the stock

market, the bond market, and the inverse of the value of the dollar are all moving together, and gold is on fire. It’s what happened during the Carter administration at its worst moments, and that’s really the only other time that that pattern has taken hold in the United States in a major way.

So this is hurting us, and I see no evidence that the situation is improving. It’s proved that as markets go down, values become more attractive. But as markets go down,

deleveraging becomes more violent and confidence becomes more shaky, and so I rather doubt that supply-and-demand works in a situation like this. As prices fall, demand falls faster, because of the confidence effect and the deleveraging.

Why do you think the president is doing this?

Economists are not psychiatrists or organizational theorists. I think at one level, this has been a conviction that the president has been writing about and asserting for 40 years. And

he somehow believes it in the face of massive evidence to the contrary. These are not untried policies. They have been tried by the vast majority of Latin American emerging markets, almost always with catastrophic results.

They bear no resemblance to the [tariff] policies that were pursued in the United States at the end of the 19th century, because you had a government of very different scale. You had nothing like modern technology. And the United States was a catch-up nation, not a

leading nation, at that time. So I don’t think there is an intellectual case that the president has developed.

At another level, I think it is understandable, in human terms, that if you have been written off, if you have been despised by many, if none of the major financial institutions are willing to lend you money, and then you have been [convicted] on 34 criminal counts, and then you have been shot at, and then you have been reelected as president of the United States, that you come

to have inordinate faith in your own judgment, and disregard for the judgment of others.

At yet another level, this is a failure of organizational functioning. No entity succeeds where everybody is afraid to even confidentially tell the boss he is making a mistake. There has never been an administration so short on adults in the room, who are in a position—and who have the gumption—to tell the president that he is making a mistake. For that, ultimately, the president bears the

responsibility. I have long believed that politicians get the staff that they deserve and choose, and I think that is the case here. Anything is possible in economics, and I have learned to never say never, but I find it very hard to envision any positive scenario that does not run through a substantial course reversal.

Explain what you mean by course reversal…

I mean backing off of the policies that have been pursued. If

the president backs off tariffs, if the president backs off Fed bashing, if the president backs off fiscal irresponsibility, if the president backs off undermining the rule of law—then the United States has very, very fundamental strengths. And while there will be a shadow that is cast forward, I believe that the economy will surely recover.

But it is not that these policies, as implemented, can be expected to involve a short period of pain followed by some kind of improvement. What the

evidence all shows is that populism is much better in the short run than in the medium term or the long run. So this is not an investment in a better day—this is a first step down a steep and long staircase if we continue on our current path.

I don’t expect that you believe that he will concede on these points. He’s not prone to reversing course.

I’m not very good at prognosticating economics. But I’m better at prognosticating economics than I am on human

behavior. I think the president is very unlikely to admit error, right? But he is much more likely to de facto reverse course than he is to admit error. I’m not sure the president is actually much more loyal to ideas than he is to people, and he has not shown a track record of consistent loyalty to those he has put in positions of influence and power.

|

You referenced Fed bashing. As someone who has been talked

about as a potential Fed chairman yourself at various points, what do you make of his outright attacks on Jay Powell, whom he put in place? How does that affect all the other aspects of what’s going on in the economy?

Fed bashing is a fool’s game. The Fed doesn’t listen, so short-term interest rates don’t get lowered. But the market does listen, so long-term interest rates go up. And so, even judged by the narrow criteria of [influencing] Fed policy and getting interest

rates down, I don’t think this is a very good idea. I think it is likely to have damaging, damaging effects. I have to say, though, that of all the various mistakes that the president is making, from the perspective of my kind of economics, I would judge that the tariffs, the undermining of the rule of law, are more serious than adverse rhetoric about the Fed.

My best guess would be that the president will not act on his rhetoric, because he will recognize that the immediate consequence

will be very substantial market dislocations that he will not like. And so I suspect that the right way to interpret the rhetoric is less as a statement of intention than as an exercise in blame-shifting: The president recognizes that there’s a substantial risk that the choices he has made will lead to adverse economic outcomes, and he wants a place to point at and blame.

|

|

|

A MESSAGE FROM OUR SPONSOR

|

Across the country, Walmart is investing in products made, grown or assembled in America through their commitment to

U.S. manufacturing. In fact, over two-thirds of the products Walmart buys come from U.S.-based small and medium-sized businesses, like Athletic Brewing in Milford, CT. Since working with Walmart in 2021, Athletic Brewing has opened a new brewery and hired over 200 employees. Across America, Walmart’s commitment to U.S.-made products is supporting job creation and strengthening communities.

Learn more about Walmart’s impact.

|

|

|

Can a president remove a Fed chairman before his time?

I am not an administrative

lawyer. I am confident that doing so for no reason other than a policy disagreement is a grave error. My limited understanding of the law suggests that a Fed chair could be removed for cause, and cause would clearly include embezzlement, or the commission of a crime, or something like that. Whether policy error constitutes cause, even egregious policy error, strikes me as a pretty dubious argument. And I’d expect that the president would lose that argument, both in courts of law and in courts of

public opinion, especially as people see what the president’s action means for their 401(k)s and other retirement accounts.

|

Switching gears to your alma mater, the institution that you led very admirably for a long time: What

do you make of this gambit against higher education, Harvard in particular?

I have, I think, been quite forceful in saying that elite universities, in general, and Harvard, in particular, have very profound flaws. They have been much too tolerant of antisemitism, as one aspect of a major bias toward so-called progressive policies. They have embraced social justice as a mission, compromising the pursuit of truth. To a greater extent, they have celebrated identity politics and

demographic diversity, and denigrated diversity of perspective. They have over-indexed on mutual self-esteem and disregarded excellence.

All of that said, it does not remotely justify the entirely extralegal approach that has been taken. I did not object when the Biden administration opened a Title VI investigation around antisemitism at Harvard. I thought there were grounds for concern. I thought that that element of external pressure would likely be salutary in its

effects. But to compound a broad agenda of micromanagement—to cut off funding with no regard to whether the [funds] are linked to the wrongs described in the statute, with none of the notice, tailoring, and targeting requirements contained in the statute, and with none of the due process protections required by past Supreme Court judgments—I think is unconscionable.

I think that Columbia made a real mistake, though an understandable one, in its capitulation. But I think that Harvard had

no choice but to respond to the kinds of demands that were being made in the forceful way that it did. And so I salute President [Alan] Garber’s eloquent statement to the Harvard community, and the letter written by Harvard’s lawyers responding to the government’s claims. However unreasonable and outrageous, the proposed freezing of funds was subsequently taken to a different level with the discussion of 501(c)(3) and removing Harvard’s charitable tax-exempt

status.

When you walk into the Treasury Building, you very quickly learn that right up there with the idea that you’re not supposed to take bribes, right up there with the idea that you’re not supposed to commit felonies, you see an idea that you’re not supposed to interfere with the I.R.S. on taxpayer-specific matters. That the president of the United States did so publicly, and then gave instructions to Treasury officials to pressure the I.R.S., and the Treasury officials did so, is the

stuff of a banana republic, not in line with any kind of U.S. precedent.

Do you buy this idea that this letter was sent to Harvard by mistake?

No. People have commented on things starting as tragedy and ending as farce, and perhaps things start as tyranny and end as comedy, as well. I cannot conceive of any government, or large organization that I have been part of, that a major, highly newsworthy event involving communication with an external party would happen by

mistake. There may have been some confusion as to the exact moment at which that letter was sent, but I doubt that it was a mistake.

|

One final overarching question. Between the attacks on elite universities, the Kennedy Center, the

prestigious law firms, what is the message from this president to the American people and to the world?

Argentina, after the Second World War, looked like it was going to be one of the wealthy countries of the world. It looked like it was going to be in a category with Canada and Australia and New Zealand—countries with great natural resources, not-immense populations, and highly educated people. It was headed for success. It then came to have hugely populist governments that

pursued extreme economic nationalism, that engaged in crony capitalism, that removed institutions of law and tradition, that undermined the independence of the central bank and any kind of commitment to fiscal balance, while engaging in heated rhetoric about enemies of the people.

That is the Argentine story, and it shows in a very powerful way what populism can lead to over time. And I think that is the single best example for understanding what it is that this presidency is all

about—with one very large difference: Argentina never was a superpower, never had the responsibilities of being a superpower, never was a model for other nations, and never was a source of strength and protection for other nations. And so a Peronist turn in the United States is a vastly more serious thing than a Peronist turn in Argentina.

Of course, I’m struck by the irony that the individual leading this populist movement, you couldn’t possibly imagine him being

less a man of the people.

If one studies the history of populism, it is not uncommon for the carriers of the populist messages to not have lived the life that they claim to be speaking on behalf of.

|

|

|

A professional-grade rundown on the business of sports from John Ourand, the industry’s preeminent journalist, covering the

leagues, players, agencies, media deals, and the egos fueling it all.

|

|

|

Join Puck’s chief political columnist, John Heilemann, as he roams the corridors of power and influence in America on this

twice-weekly interview show, taking you beyond the headlines with the people who shape our culture: icons and up-and-comers, incumbents and insurgents, moguls and machers in the overlapping worlds of politics, entertainment, tech, business, sports, media, and beyond. The conversations are rich and revealing, unrehearsed and unexpected… and reliably impolitic. A Puck-Audacy joint, new episodes drop every Wednesday and Friday.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|

_01JSFJ6EJAKCJ9XR5V251QW12X.png)