Welcome to Dry Powder on this bizarre, post–Liberation Day weekend. I’m

William D. Cohan, and I’m trying to make sense of the chaos.

Ever since Trump’s Rose Garden address, I’ve been working the phones with senior bankers and investors to get a handle on what they’re making of the tariffs—the immediate aftermath, the politics, and the long-term economic impact. Tonight’s piece captures the essence of the inside conversation. I’ve rarely heard

the phrase shitshow used more in a single week.

But first…

|

- Trump

v. The Financial Times: Some might derive a little schadenfreude from the fact that even Donald Trump is suffering a bit personally during his market meltdown. The 114 million shares of Trump Media & Technology Group controlled by Trump’s trust, which were worth around $7 billion a year ago, are now worth less than a third that amount. Still pretty great, though, considering that the company has a minimal amount of revenue, is massively unprofitable, and

that Trump got his shares in DJT (its Nasdaq ticker) for free. In other words, it’s found money. But it also means that he’s riding the tariff-induced equity roller coaster along with everyone else.

Interestingly, the latest DJT selloff may have less to do with Liberation Day than a regulatory filing that the company made the evening before. Late on Tuesday, Trump Media filed an S-3 registration statement to re-register for sale Trump’s 114 million shares, plus the shares of

others, like U.S. Attorney General Pam Bondi. The filing of the new S-3 does not mean that Trump is selling his shares in the company yet, but rather that they will be registered for sale with the S.E.C. when they become eligible for sale.

Nevertheless, the filing of the S-3 sent the media into convulsions, thinking Trump was getting ready to bail, and therefore, other investors might want to bail, too. The folks at Trump Media were particularly peeved

about a Financial Times piece with the headline “Trump Media shares fall after president kicks off sale of $2.3bn stake.” The company is now accusing the FT of publishing a “false and defamatory” article, drawing on the paper’s presumed “political bias” against the company. This is hogwash, of course. Still, Trump Media is insisting that the FT’s article “was clearly a deliberate act of market manipulation designed to harm [Trump Media] and

depress its stock price, as an act of retaliation” against the company. (Since Tuesday’s close, the DJT stock has fallen 15.8 percent.)

As media companies and law firms capitulate to Trump, it will be interesting to see how the FT plays this one. The headline of the FT story does appear to have been altered—it now reads, “Truth Social falls after filing opens door to sale of Trump’s $2.3bn stake.” But the FT hasn’t “wholly retracted” the article, as Trump

Media demanded, nor has it announced a retraction. “Failure to take these remedial steps will result in litigation and complaints to the relevant authorities concerning Financial Times’ potentially criminal acts involved in this stock manipulation scheme,” the company warned in a filing with the S.E.C. Sheesh.

|

|

|

There are multiple contradictory theories making the rounds among smart investors to

rationalize Trump’s trade war: forcing other nations to play fair, raising revenue to offset tax cuts, crashing the economy to refinance the debt. The one point of agreement: C.E.O.s are nervous, very nervous.

|

|

|

The one word I heard over and over again on Wall Street this past week was “shitshow,” and

with good reason. U.S. equity markets lost some $7 trillion in value on Thursday and Friday after Donald Trump announced tariffs of anywhere between 10 percent and 54 percent on virtually every country in the world, many without rhyme or reason. In a cheery note, Bruce Kasman, the chief economist at JPMorgan Chase, increased the probability of a recession this year to 60 percent, up from 40 percent. “This big beautiful economy that actually was rolling pretty

good with jobs and inflation coming down. [This] feels more like the Game of Thrones red wedding,” the longtime investment banker and Biden ally Robert Wolf said on Fox News, referring to a scene in which all the guests were brutally murdered. “I mean, it’s not going well.”

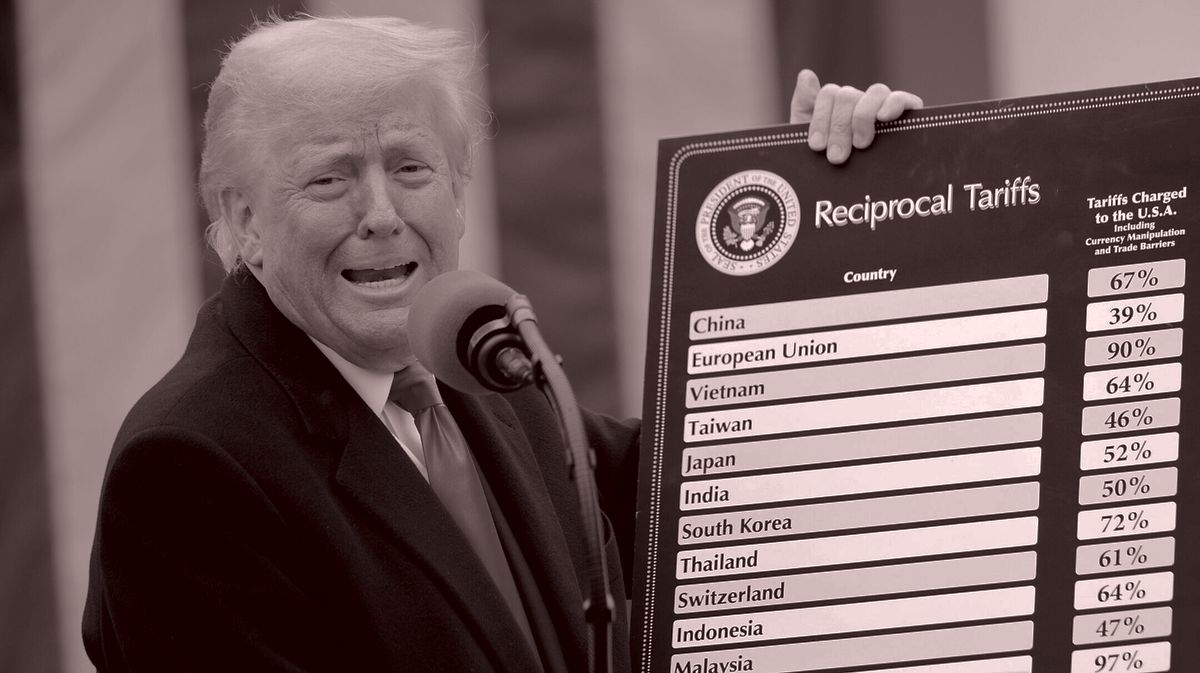

The panic stems in part from the widespread confusion over whether the so-called “reciprocal” tariffs Trump imposed—in fact, the tariff rates were

calculated based on the U.S. trade balance with each country, not trade barriers—were intended to be an opening bid to negotiate more than a hundred new bilateral agreements, or rather were expressly intended to be a semi-permanent new source of revenue. According to one prominent M&A banker, C.E.O.s are nervous, very nervous. “The concern goes beyond tariffs,” the banker said, “to our economic framework in general, and what it means to upset the world order, and what it means

politically. There is a concern that not enough people in the White House understand the implications here.”

|

|

|

A MESSAGE FROM GOLDMAN SACHS

|

Early financial gains from recent tech cycles were captured by hardware companies.

After that initial boom, infrastructure software

usually takes over, bridging hardware innovation with app development — a transition fast approaching for AI.

Read more on how AI is re-platforming the economy.

|

|

|

This banker gave me an example of a company that has a manufacturing plant in Wisconsin

that makes products that are sold in Canada and are shipped on a daily basis across the border. He said the C.E.O.s he talks to are already thinking about closing the U.S. manufacturing plant and building a new plant in Canada to avoid the tariffs. “That’ll be a net American job loser,” he said.

The M&A banker was particularly focused on the second-order effects of the tariffs on corporate earnings.

At some point, he predicted, the tariff histrionics will peter out, and the stock market will have a nice bounce back up. But then the effect of the tariffs, at whatever level they shake out, will begin to show up later this year in corporate earnings, where it really matters. “That’s what’s going to worry the market more,” he said. “It’s hard to imagine that the downturn is not significant.” Moreover, he added, “These things take just a long time to change, and even if they do, our

trading partners are going to be wary of what we’ve done here, and you’re going to see a kind of general trade shift, with the obvious beneficiary being China.”

Even among the Republican C.E.O.s he talks to—generally an optimistic bunch, and predisposed to giving the president the benefit of the doubt—he senses despair. Some are beginning to fixate more on issues like democracy, and checks and balances in Washington,

as it’s become clearer that the guardrails that constrained Trump during his first term no longer exist. Others are fed up with the capitulation they’ve observed from their peers. “This is not about the school that says, ‘Woe is me. We’ve ruined the country,’” he said. “You don’t get that from C.E.O.s. Instead, you get, ‘Man, buckle your seat belt, this is going to be one rough ride.’”

|

Alas, fear is setting in that the president is not, in fact, playing 4D chess. As one Wall

Street attorney close to the Trump administration explained it to me, the president believes in his bones that other countries have been ripping off the United States by selling us cheap goods while protecting their own industries. “And irrespective of what the consequences may be, he’s going to set that straight,” this person told me, while conceding the obvious point that has governed thinking on tariffs for generations: “Responding to tariffs with tariffs only makes the problem worse. Tariffs

are a bad idea even if they’re retaliatory because, ultimately, you’re beggaring your own consumers. And you’re protecting inefficient industries that will ultimately collapse. It’s not a path to prosperity. It’s a path to impoverishment for all parties.”

That’s not to say we should give “a free pass” to countries that tariff our exports, he said, but addressing the imbalance requires a bit more

diplomatic and strategic framework. “We can’t be pro-tariff when it’s the rest of the world, and anti-tariff when it’s us,” he said. “You either think tariffs are a bad idea, which I do—and I think all this is stupid and bad—or you don’t. Two wrongs don’t make a right.”

A better approach, he suggested, would be akin to what Bill Clinton did with NAFTA, which encouraged other

countries to drop their tariffs on the U.S. “Maybe I’m just a global elitist,” he joked, “but I actually think NAFTA was a pretty good thing because it reduced tariffs, and we created supply chains that were very efficient, with trusted allies to the north and south.” (On Meet the Press this morning, Treasury Secretary Scott Bessent unequivocally defended the White House tariff policy, as he has been doing all week, playing down fears of a

recession and asserting that most Americans don’t pay attention to the “day-to-day fluctuations” in that market..)

Instead of creating a global “game of chicken,” the attorney suggested, Trump should have employed a more deliberate approach where trade negotiators sit in conference rooms for months and hash out a deal. Of course, that “requires some pointy-headed nattering nabobs with economics degrees, and it’s not glamorous, and you can’t flex your muscles, and it

takes time, and it’s complicated.” Conversely, he said, “tariff wars” result “in economic calamity where people, after they’ve been beaten up and bruised, come crawling back, and say, What have we done? Make it stop.”

|

|

|

A MESSAGE FROM GOLDMAN SACHS

|

The European tech sector is evolving, driven by capital investment in sectors like AI and cybersecurity.

With more investment, the

number of European unicorns — private startups valued at over $1B — is on the rise and driving IPO opportunities.

Read more analysis on European IPOs.

|

|

|

He wondered about which path is best—the slow, steady, boring path to getting a trade deal, or the high-beta

path where you are hurting yourself as much as you are hurting your counterparty. “The trade deal—hard work, country by country, product by product, if need be—is the sensible way to go,” he said, “and that has been historically what’s created more free trade.” But that can’t be done quickly. And Trump doesn’t have the patience for a slow, boring negotiation. He wants the quick, high-beta fix. “I think they’re all viewing it that their clock is running out at the next midterms,” the

lawyer said, referring to Republicans, “and they’re probably right.”

|

In the meantime, what are investors to do amid a market meltdown? Since I don’t give

investment advice, I turned to someone who does: Jay Pelosky, the founder of TPW Advisory, an investment management firm founded on the principle that we’re now in a “tri-polar world,” consisting of Asia, Europe, and the Americas. (Jay is a longtime friend and Duke classmate. He was also a managing director and global strategist at Morgan Stanley for many years. Yes, last night’s loss was tough to stomach.)

Among Jay’s big takeaways is that there has never been a better time to be “a global investor” given the “secular change” away from U.S. equities. Since 2009, there has been no better place to invest than the United States, particularly our tech industry. Since the inauguration, however, foreign markets have been on a tear, as investors rotate to equities overseas, particularly in Germany and China, both of which have the capacity to raise their fiscal

spending. Meanwhile, he thinks the U.S. will likely be heading into a recession with fewer fiscal and monetary tools available to combat it, given our high national debt, chronic budget deficits, and persistent inflation. Indeed, Jay thinks the Federal Reserve won’t be much help this time—“it’s in a box,” he said—because Trump’s tariffs will raise prices, putting pressure on Jay Powell to largely abandon the interest rate cuts the market has been expecting. The much ballyhooed

proclamation of “a soft landing,” he said, is pretty much kaput.

We also discussed the theory that Trump’s trade war is designed to generate enough revenue to extend his 2017 tax cuts, which expire this year. Bessent has estimated that the new tariffs will produce something like $600 billion a year, and $6 trillion over a decade—which theoretically might offset the

estimated $4.6 trillion-$5.5 trillion cost of Republicans’ tax plan. Whether the tariffs will actually generate the revenue needed to offset the tax cuts remains to be seen, of course. If the president’s Liberation Day announcement was simply an opening bid to force other countries to

drop their own tariffs, as many of Trump’s supporters on Wall Street hope, then Bessent’s $6 trillion will never materialize. So which is it, a temporary negotiating tactic or a long-term strategy to offset income taxes? Nobody knows.

On one level, Jay contended, it doesn’t matter: Republicans will control Congress until at least the end of 2026, time enough to get the tax bill extended. “It will have served this purpose,” he said. “Five, 10 years down the road, will it turn out to have

generated the money that it supposedly was going to generate? No, I mean, I think that’s highly unlikely.” But what the tariffs will do, he fears, since companies will face higher costs and suppressed demand, is increase the chances of a U.S. recession, as JPMorgan Chase and much of the rest of Wall Street now figure is more likely than not.

And regardless of whether Trump backs off some of

his tariffs, the global damage will have been done. “All this stuff is playing out to the tri-polar world thesis, right?” Jay said. “Europe is integrating and becoming stronger. Asia is going to integrate and become stronger. We’re slapping 40 percent tariffs on Vietnam and Indonesia and everyone else. Our name is going to be mud in Asia. So all that does is just integrate Asia more aggressively, more quickly, with China at the center of it. Trump is an accelerant to the tri-polar world.”

Yet another, more disturbing, theory making the rounds on Wall Street posits that Trump’s tariffpalooza is designed to lower interest rates in the near term—the 10-year Treasury is now below 4 percent, mostly because of a proverbial “flight to quality”—so that it will be less costly to refinance the $6.5 trillion of U.S. government debt coming due in June. According to Bessent, each one-basis-point

reduction in the interest rate that the government pays on its debt saves $1 billion a year. So, you know, it may be worthwhile figuring out how to get interest rates lower if the Federal Reserve won’t play ball. That would put the country through a lot of pain, of course, just to get a reduction in annual interest expense. Is that really what’s going on here, or just another post-hoc rationalization for the gang that can’t shoot straight?

For fun, let’s give

Ray Dalio, the multibillionaire hedge fund manager, the final word on the current economic mess. Dalio, of course, is the highly opinionated founder of one of the world’s largest hedge funds, Bridgewater Associates. Like Pelosky, Dalio is an advocate for a “balanced” portfolio, across asset classes and geographies. And he seems almost giddy at the prospect of navigating the current storm. “Expect the ride ahead to produce some very big tests and shakeouts that will be great

tests of investors’ skills as the critically important monetary, domestic political, and international geopolitical orders are breaking down,” he wrote in a recent lengthy X post. “Frankly, I look forward to this challenge as it is during such challenging times in the game that the opportunities [to] make a big difference and distinguish oneself are the greatest.” To which I say to you all, Good night, and good luck.

|

|

|

An essential, insider-friendly Hollywood tip sheet from Matthew Belloni, who spent 14 years in the trenches at The

Hollywood Reporter and five before that practicing entertainment law. What I’m Hearing also features veteran Hollywood journalist Kim Masters, as well as a special companion email from Eriq Gardner, focused on entertainment law, and weekly box office analysis from Scott Mendelson.

|

|

|

Puck sports correspondent John Ourand and a rotating cast of industry insiders take you inside the executive suites and owners

boxes where the decisions that shape the entire sports business are made. You’ll hear interviews with players, network execs, and everyone in between. The Varsity is an extension of John’s private email for Puck by the same name. New episodes publish every Wednesday and Sunday.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|

%20(1)_01JQSJ0JZ4CD9NG1Z1WA89MMHG.jpg)

%20(1)_01JQSJ0MY113T7TDM9KCFW1FFK.jpg)