Welcome back to The Varsity, my twice-weekly private email on the

people who sit in the owners’ boxes. I’m busy packing for the annual broadcasters convention in Vegas. Then I’ll be in Gotham for a panel organized by the Center for Communication, alongside Brian Stelter,

Oliver Darcy, Marisa Kabas, Nick Pinto, and Julianne Escobedo Shepherd.

🚨🚨 Big news: The Varsity is expanding to a third weekly issue next week! Yes, Christmas came a little early: Streaming savant Julia Alexander will helm a Tuesday edition available only to Inner Circle subscribers.

(Click here to upgrade.) As you’ll see below, in her story on the NBA and NFL’s upcoming Christmas battle, Julia’s sourcing and analysis of streaming media are unparalleled. After all, many of you paid zillions for her advice at Parrot Analytics and watched her magic when she worked at Disney. Now you’ll be able to enjoy her work for a small upgrade, which you can all afford.

Sign up now to make sure you don’t get replaced by a younger, smarter colleague!

🎧 Pod alert: Fresh off cutting a 12-year, $7.7 billion deal with Rogers Communications for the NHL’s Canadian media rights, league commissioner Gary Bettman returns to the

Varsity podcast this weekend to offer details about the deal and how it came about. Also, in case you missed it, I let Marchand back on the show this week, when I granted him a reprieve from making my foie gras, harvesting the season’s truffles, and decanting the “crisp” sancerre, not the “tart” one!

|

Player of the Week: Randy Levine

|

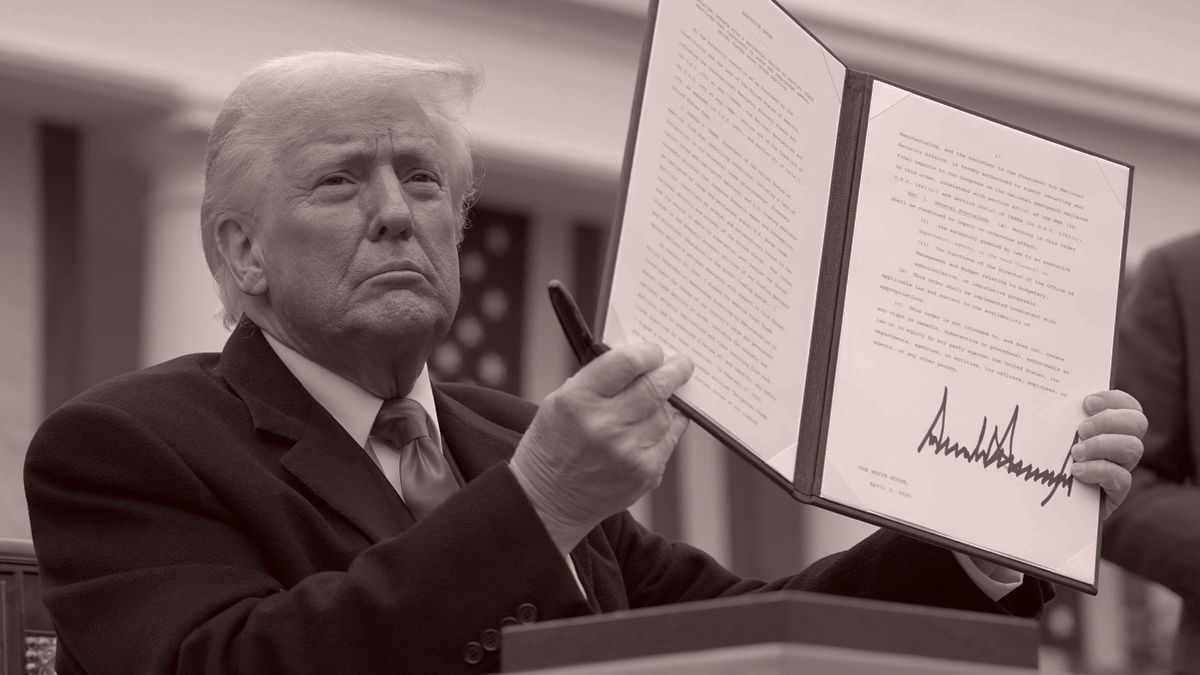

For a full year, Comcast’s grinfucking cliff path R.S.N. strategy went

undefeated. Every local sports channel—the FanDuel R.S.N.s, and even some of the NBC R.S.N.s—was demoted to a digital tier. But that winning streak ended this week when Randy Levine, the Yankees president and POTUS buddy, leveraged his Trump kinship to coerce Comcast into a deal that keeps YES Network off that digital tier for now. (Notably, Trump was the first person Levine thanked after securing the Comcast extension on Tuesday.) I’m told the

extension runs through September, and carries a small rate increase. That means YES and Comcast will likely plunge into a new round of carriage battles after baseball season.

This Pyrrhic victory would seem to benefit Comcast, since the hapless Brooklyn Nets, also carried by YES, don’t inspire Yankees-level fan engagement. Nevertheless, Levine will still be YES Network chairman in September, and Trump will still be

president.

|

Down to the J.V.: Elliott Hill

|

Elliott Hill, the president and C.E.O. of Nike, has been working on a turnaround strategy since he

returned to the business late last year. Alas, as my partner Lauren Sherman has noted in her incredible Line Sheet private email, Nike absolutely lost control of the performance sports market—ceding share to brands as varied as Lululemon, Alo, On, Hoka, and even Vuori, which I often fear doubles as the wardrobe of the Varsity community on the weekends. (Marchand, those shorts are tacky!) Anyway, Nike’s supply chain and logistics operations are uniquely susceptible to

Trump’s trade war, and Hill should not have left the company so exposed. Nike lost some $10 billion in market cap in a single day. Nike stock is down nearly 30 percent over the past six months.

|

Down to the

J.V. (Honorable Mention): Pat McAfee

|

ESPN brass have always known that Pat McAfee is the type of on-air talent who

pushes the envelope, which sometimes puts top executives in uncomfortable positions, as Norby Williamson knows all too well. This is one of those weeks. As The Athletic and NBC News reported, a freshman at Ole Miss has threatened legal action against McAfee for broadcasting false rumors about her. Both Disney and ESPN have remained mum on the allegations, but it will be interesting to behold whether McAfee is punished, slapped on the wrist, or something in between. Indeed, McAfee isn’t actually a Disney employee, so the potential angles of a lawsuit could get interesting.

|

- Bell to LA28: Former NBC honcho Jim Bell has been quietly working for the 2028 Summer Olympics over the past few months as senior vice president of the media team. His role involves everything from overseeing operations for broadcasters and credentialed press, to dealing with the rights holders, to determining which events should be put in primetime, and even figuring out where the cameras and announcers should be positioned. He’ll also essentially run the

world feed from Los Angeles.

Bell’s hiring represents a coup for the beleaguered LA28. An NBC lifer, he has tons of Olympics experience dating back to the 1992 Barcelona Games, when he worked under broadcast legend Dick Ebersol. After Ebersol resigned from NBC in 2011, Bell took over as executive producer, and then president of production. In addition to overseeing multiple Olympics and a World Cup, Bell executive produced The Today Show and

The Tonight Show Starring Jimmy Fallon.

- Caitlinsanity: Kudos to ESPN and the NCAA for their ability to spin the news about disappointing ratings for the women’s NCAA tournament. According to SBJ’s Austin Karp, viewership through the Elite Eight was down 31 percent—a disaster, in television terms—and that’s after Nielsen’s revised policy of counting even more out-of-home viewers. Understandably, ESPN

and NCAA are making the case that last year’s Caitlin Clark–inspired numbers were an anomaly, and are more comfortable juxtaposing the ratings with those from the 2023 women’s NCAA tournament (which also starred Clark). This year’s tournament is up 47 percent from 2023. For the record, the men’s tournament viewership is flat through the Elite Eight compared to last year, and up 3 percent from two years ago.

Clark is a true needle-mover, akin to Tiger

Woods and Michael Jordan. And that’s why 41 of the Indiana Fever’s 44 games will be on national television this season. The ratings also reveal that new viewers who sampled last year’s tournament liked what they saw and stuck around. Meanwhile, ratings for regular season WNBA games are still trending up.

- LIV vs. PGA Tour: If there were ever a weekend when LIV Golf could outperform the PGA Tour, it’d be this one. Next

week is the Masters, and many PGA Tour players are taking a breather to prepare. Those who are playing this week, in the tour’s Valero Texas Open, include Jordan Spieth, Patrick Cantlay, and Tony Finau.

While NBC broadcasts from Texas, Fox will be carrying a LIV Golf tournament from Trump National Doral in Florida. So far, LIV hasn’t even come close to the PGA Tour in terms of TV viewership, and I expect that to

continue—unless, of course, the president decides to fly down to Doral for an impromptu visit… it is on Fox after all.

- The SpinCo custody battle: My partner Dylan Byers wrote a terrific piece last night on the talent fallout expected in the wake of MSNBC being spun off from NBCU—and divorced from NBC proper. The breakup’s big winner? Steve Kornacki, whose NBCU deal has him appearing on NFL and Kentucky Derby

programming, but not on MSNBC, where he first made a name for himself 13 years ago. Dylan’s piece focused on NBC News talent, but sports hosts may face similar pressures: SpinCo’s USA Network and Golf Channel will be separated from RemainCo’s well-upholstered NBCU and Peacock.

Here’s Dylan: “The Kornacki move is illustrative of a broader reality: The SpinCo breakup is setting these networks and their employees on alternate courses toward two radically different futures, which

gives the current moment an air of Calvinist predestination—the existential cafeteria crisis where you learn whether or not there’s a seat for you at the cool kids’ table. (There isn’t really a cool kids’ table anymore in this sector, but whatever.)

“From the talent’s perspective, the distinction can be rather stark. NBCUniversal is a veritable symphony of well-financed and sleekly produced enterprises that will furnish Kornacki with five-star treatment at Rockefeller Plaza for

his appearances before millions, then whisk him away to the Super Bowl in San Francisco and the Winter Olympics in Milan. In recent years, MSNBC contributors sometimes had to pay their own Uber fare to 400 North Cap while applying their own powder.”

The whole piece is worth a read.

- Tony Romo’s next deal: CBS

Sports’s decision to pair J.J. Watt with Ian Eagle as the number two booth on NFL games will give the network leverage when Tony Romo’s deal is up in 2030. On yesterday’s Varsity podcast, Marchand explained that CBS didn’t have a backup when the network signed Romo to a 10-year, $180 million contract in 2020. (Of course, ESPN was also a stalking horse in those negotiations, too.) “The mistake CBS made was that they didn’t have a number

two analyst,” Marchand told me. “That left them exposed, because they had no second choice. … CBS went with the strategy of not preparing someone in place of Romo. That changes now with J.J. Watt. He and Ian Eagle will probably be a popular broadcast team.”

|

And now, here’s Julia with the sort of work you can find only at Puck…

|

|

|

This Christmas, the NFL will host three games, further encroaching on the NBA’s

own five-game holiday tradition. Is this the latest tactic in a cold war against the NBA, or is a monster day of sports-streaming and couch-surfing big enough for both leagues?

|

|

|

In an age of algorithms and far too many streaming options, one of the

many questions keeping streaming executives up at night is how to get people to subconsciously and automatically return to their platform week after week. Netflix attempts to do this by releasing new shows on Fridays, but it’s simply not a satisfying substitute for appointment television. (Who can forget NBC’s must-see TV Thursday night juggernaut of Seinfeld, Friends, and ER in the 1990s? What a time…) That said, no one is better at training

audiences than the NFL, whose games are one of the few entertainment experiences that qualify as appointment viewing these days. Whether you watch or not, you know that fall and winter Sundays are for football.

As my Puck partner John Ourand

reported on Monday, the NFL is hoping to turn Christmas Day into the equivalent of a football Sunday by lining up a streaming triple-header this year. Two games will stream on Netflix, and a third on Amazon Prime, as part of its standing Thursday Night Football deal. Last Christmas, Netflix’s

double-header reached more than 30 million views per game, roughly 25 million more viewers than the average audience for the NBA’s five games on Christmas.

It’s not clear how the NBA will respond to three more hours of football on Christmas, but they’re not necessarily quaking in their Jordans. Last year, the NBA saw a substantial boost in audience despite the NFL games—viewership

was up 84 percent over Christmas 2023, helped partly by the Lakers’ narrow win over the Warriors, a game that peaked at around 8.4 million viewers. More important, though, was how those games were distributed: The NBA and Disney flooded the zone, making all games available on ABC.

For the NFL, these deals are less about scaling their U.S. audience and more about finding new monetization pipelines. But if the NFL is

going to treat Christmas like a bonus streaming treat, the NBA should flood the zone in that ostensibly boring part of the American media ecosystem: broadcast, where audiences are relatively stable compared to the veritable ghost towns that cable channels are quickly becoming. The NBA needs to figure out how to use this hybrid broadcast-and-streaming opportunity to convert cord-cutters and cord-nevers into regular viewers. After all, next season’s NBA games will be widely accessible through ABC,

NBC, and Prime Video—as opposed to decaying cable networks, like TNT, that Gen Z has never heard of.

|

For both Netflix and Amazon, which have the largest advertising tiers globally,

finding new ways to build off the sizable NFL audience presents exciting opportunities. While Netflix’s role in this story is fairly straightforward—a matter of matching audience size with advertisers’ wish lists (hello, Travis Kelce and Beyoncé) and pushing further into live events—Amazon’s position is more interesting.

Sure, Amazon is already home to the NFL on Thursdays, but Seattle’s digital bookseller has never carried a

big NFL game on a real holiday, unless you count its Black Friday games. This year, Amazon has the benefit of being a broadcaster and a retailer on the same day that gift cards are handed out to tens of millions of people. I don’t want to suggest that the NFL is simply a high-velocity ad for Amazon’s Prime shopping business—which, of course, represents the vast majority of its total revenue—but the synergies between Prime Video and Prime are mouthwatering for

executives.

To wit, when Amazon broadcast an NFL game on Black Friday in 2023, the feed was crowded with in-game exclusive shopping moments. And while the shopping experience felt a little janky (scanning a QR code on your TV set…), it demonstrated how Amazon’s senior leadership envisioned its expanding return on the NFL deal. (And the Christmas game won’t cost Amazon an extra $100 million.)

|

Bluntly put, the NBA doesn’t have a fan problem—it has a viewership problem. You

can actually see some of this contradiction play out in the league’s finances: Commissioner Adam Silver secured $76 billion in new media rights deals through 2036, but ratings are down around 5 percent in the current season. Perhaps the most telling statistic is a 14 percent drop in ratings on TNT compared to the prior season, as of February, while ratings for ESPN and ABC were

relatively flat in the same period. Sure, ABC saw a 10 percent increase in overall regular NBA season viewership for the 2024-2025 season, but that figure includes strong help from five Christmas games and two NBA Cup matches. The takeaway remains the same: Flood the zones where audiences are heading and where they remain. Last

Christmas’s NBA success, and ABC’s reported growth, is a perfect lead-up to Comcast’s deal with the league.

Of course, I’m not trying to convince anyone that broadcast TV has a bright future. But broadcasting on networks (21 percent of all TV share in the U.S.) alongside streaming on Disney+ and ESPN+ (a combined 82 million subscribers) will give the NBA a continued stronghold in American homes on a day that might

otherwise be dominated by Netflix and the NFL. The NBA is never going to have NFL numbers, but talk to anyone at the league, and they’ll tell you the problem is getting their viewership to match up to their fandom.

|

Alas, I received a lot of feedback on Monday’s email, including several

vindictive shots at the Terps’ former basketball coach and commentary on the YES Network–Comcast battle. Remember, you can respond directly to this email to hit my inbox.

On the Comcast R.S.N. strategy: “Maybe YES and SNY should be migrated to the Premier Holy Shit Package™️ simultaneously.” —A Varsity subscriber

On Maryland basketball:

“I can’t believe you didn’t comment on Kevin Willard! You scored a better coach with Buzz Williams anyway. So much for SEC schools not losing coaches.” —A Varsity subscriber

|

See you Monday from Vegas,

John

|

|

|

Unique and privileged insight into the private conversations taking place inside boardrooms and corner offices up and

down Wall Street, relayed by best-selling author, journalist, and former M&A senior banker William D. Cohan.

|

|

|

Finally, a media podcast about what’s actually happening in the media—not the oversanitized,

legal-and-standards-approved version you read online. Join Dylan Byers, Puck’s veteran media reporter, as he sits down with TV personalities, moguls, pundits, and industry executives for raw, honest, sometimes salacious conversations about the business of media and its biggest egos. New episodes publish every Tuesday and Friday.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|