Welcome back to Dry Powder. I’m Bill Cohan.

We’re fast

approaching the end of the first quarter, and while it’s still early innings, the investment banking bonanza that was supposed to accompany the second Trump administration has yet to materialize. In tonight’s jam-packed issue, I chat with one longtime M&A banker who explains why C.E.O.s are sitting on their hands, offer a timely update on the quixotic Project Rise Partners bid for Paramount, and explore how Elon Musk’s new perch in D.C. has impacted his

businesses.

|

|

|

A MESSAGE FROM GOLDMAN SACHS

|

Early financial gains from recent tech cycles were captured by hardware companies.

After that initial boom,

infrastructure software usually takes over, bridging hardware innovation with app development – a transition that is fast approaching for AI.

Read more on how AI is re-platforming the economy.

|

|

|

|

Marion Maneker

|

|

- What’s going on

between Sotheby’s and Pace?: Recently, a persistent and long-running rumor finally broke out into the open when ARTnews ran the thinnest of stories claiming that Sotheby’s was negotiating a “significant investment” in Pace. The story also offered the caveat that the deal would not be an acquisition, but rather a “multifaceted

joint venture.” It was significant not for the non-news of talks, but because it finally put some scale and perspective on the past few months’ rumors about a tie-up between Sotheby’s and Pace Gallery, which was founded by the 87-year-old Arne Glimcher—who is still very much on top of his game—and is run by his son, Marc.

The chatter came about partly because Sotheby’s and Pace made a joint bid for the Riggio estate, which meant that a

number of Sotheby’s staffers and some other participants in the process saw the Glimchers attend the pitch meetings. It’s easy to imagine how that metastasized into rumors of an acquisition, especially since Sotheby’s owner Patrick Drahi and C.E.O. Charles Stewart traditionally keep their cards very close to the vest. I’m told the issue came to a head recently when Sotheby’s staffers confronted Stewart, who told them there was no deal to acquire Pace. No one

questioned Stewart’s interest in the primary market, which led him to hire Art Basel’s Noah Horowitz for a yearlong sabbatical. He’s also been looking for ways to scale Sotheby’s business. In this context, that might mean Sotheby’s and Pace collaborating on ways to tap into Sotheby’s client base to sell Pace’s artworks, or Pace giving

Sotheby’s a way to hold exhibitions in Chelsea. Whatever the connection might ultimately look like, it’s still very much in the talking stage.

How Sotheby’s would raise the money to buy Pace was always the real conundrum. In order to secure nearly $1 billion from ADQ, the Emirati sovereign wealth fund, Drahi had to reinvest some of his own cash into the business to maintain control. And while Pace may be the smallest of the four global galleries—behind Zwirner, Hauser, and Gagosian—it’s

still a nine-figure enterprise. A potential acquisition would have required more ADQ cash, inevitably tipped the balance of equity toward the Gulf, and exacerbated the 11 percent dividend that Sotheby’s is already paying. And one can only imagine the further blow to morale if it turned out that the auction house, which recently completed a brutal round of layoffs, was sitting on dry powder. Though, the company did say at the time of ADQ’s investment that some of the money would go toward growth

initiatives.

Also: Why would Pace want to be acquired? For the past year, there’s been a lot of talk that galleries all throughout Chelsea are experiencing cash-flow problems amid the market pullback. No one seriously thinks that the Glimcher family is having financial troubles, but that doesn’t necessarily mean that the gallery wouldn’t enjoy a cash infusion on its balance sheet. “Marc needs cash?” one private dealer texted me after the ARTnews story ran. “That’s the worst kept secret in

the art world right now.”

When I asked Pace about the rumors, a spokesperson responded, “Despite the challenging economic conditions of the last year and a half, which have affected the entire art market, Pace is financially stable. We have navigated the ups and downs of the market successfully for the past 65 years and continue to do so.”

Whatever the case, it seems very unlikely that either Glimcher would choose this moment to write the end of the Pace story by selling the firm

to Sotheby’s. And yet, the rumors kept coming back even after the Riggio estate went to Christie’s. The noise level really started to rise late last week—reports even started coming back to me that Glimcher had been speaking to artists to make sure they’d heard from him first. (Artists, who spend a lot of time working alone, can jump at the chance to share something worth talking about…) I’m told that Glimcher called one artist to say that something was going on but he could not talk about it.

Still, the message was that Pace is Pace, and whatever was in the works wouldn’t change anything. Glimcher also assured the artist that there was no financial issue.

In that context, the ARTnews story reads like an attempt to take the temperature down from a boil to a simmer. That’s a good thing. The announcement of a major transaction could have had a destabilizing effect on the market. People are nervous: The mood has shifted very quickly from a sigh of relief in Los Angeles to

gallows humor in New York. One dealer told me Friday night that he had previously hoped that one silver lining to this year’s political news was that the economy would remain strong, and art buyers might become more bullish. Now he’s grateful for every sale and watching the news through splayed fingers over his eyes.

- Barbara Gladstone’s heirs vs. her artists: Also on Friday, Katya Kazakina dropped a

story on Artnet reporting that the personal collection of dealer Barbara Gladstone, who was fiercely protective of her artists’ markets, was being shopped to both Sotheby’s and Christie’s for this May’s auction season—which is looking smaller and smaller as the belligerent rhetoric from Washington gets louder and louder. That’s the

simple piece of what looks like an estate planning challenge.

Gladstone’s will created a number of different trusts. Her gallery trust contains her ownership position in her namesake business; another trust was set up for her art. Max Falkenstein, senior partner in the gallery, was named trustee for the ownership stake along with lawyer Michael Stout and art advisor Allan Schwartzman. But only Stout and Schwartzman were deemed trustees

for the art.

According to the will, Gladstone wanted the art sold to benefit her heirs, which include her children and grandchildren. The will provides for the fact that Falkenstein and Schwartzman might have conflicts of interest given their roles. But there doesn’t seem to be a provision for the possibility of another conflict of interest between the two trusts. That shouldn’t be a problem: Ideally, Gladstone Gallery would handle the sales of Gladstone’s personal

collection. After all, the gallery knows the markets for these artists better than anyone else, and selling privately would protect against potentially damaging downdrafts in pricing. And, of course, the company would earn fees on those sales, which would benefit the gallery owners and the heirs.

So why are we hearing reports that the art is being dangled in front of the auction houses? It appears that much of the value of the art in the estate lies in works by Richard

Prince that Gladstone owned. Prince’s market has been on an upswing lately. Yet, at least one art advisor casually told me that he thought the gallery undersold Harbor Nurse (2003) at Art Basel in Miami for a reported $4.5 million after other Prince nurses sold at auction for higher

prices—one for $5.6 million in October and another $6.7 million in November. The Gladstone estate also includes a Mike Kelley Memory Ware work, according to Kazakina, which could be very desirable on the open market. It’s been a while since Kelley’s Memory Ware works were auctioned for $3 million or more. But there’s also been a major retrospective of Kelley’s work mounted in London and Paris each year for the past two years.

Of course, we don’t know

which works were being discussed at the auction houses. Was it just the Princes and Kelleys, for which the heirs will very much want to see a fair market price? Or is it all of the art, including the artists the gallery still represents, who might resent seeing their work flogged publicly? With Gladstone herself gone, there’s an obvious tension between the interests of the heirs and those of the artists and gallery. Could the Artnet story have been the result of an internal

struggle?

According to the will, Falkenstein has no control over how the art trust disposes of the works, which must be frustrating. It’s not clear whether Schwartzman has a conflict of interest. Presumably, he does if he is taking a fee to represent the art trust as an art advisor in relation to the auction houses, and he does not if he is simply acting as a trustee of the art trust. Curiously, Kazakina’s report mentions neither Falkenstein nor Schwartzman. She does say she tried to

reach Stout for comment. That makes sense: He’s the key to all of this, because it’s looking like he’ll have to be the one who decides what’s best for both sides. When I reached him by email this afternoon, he replied that the estate’s administration remained a confidential matter, but: “No complete strategy decisions have been made as of this writing.”

|

|

|

News and notes from around the financial sector: an update on the

latest pseudo obstacle to the Skydance bid for Paramount Global, a banker’s lament for the frozen M&A pipeline under Trump II, and a close look at how Elon Musk’s businesses have been faring since the election.

|

|

|

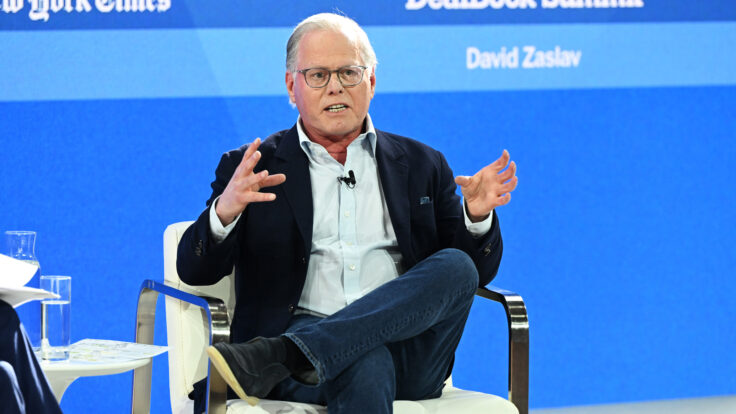

For all those worried that the Skydance deal might get sidetracked by something

called Project Rise Partners and its alleged $13.5 billion bid for Paramount Global, fear not. While Project Rise has made some noise, particularly in the Delaware courts, I’m hearing it’s having little impact with the one group that really matters: the special committee of the Paramount Global board of directors, which is charged with evaluating the proposal and changing its recommendation about the Skydance deal if such a change is warranted. I’m told that, barring some drastic

and unlikely change to the offer, the special committee is not doing anything of the sort.

Naturally, David Ellison’s Skydance has raised questions about the “belated” and “unserious” Project Rise bid and its financing. Others have questioned who, exactly, is behind Project Rise Partners. Its own press releases obscured the composition of the partnership, calling it a special purpose entity created for the purpose of acquiring Paramount Global. (Not helpful,

guys.)

Digging deeper, it turns out that the co-chairmen of Project Rise Partners are Moses Gross, the managing partner of something called the Malka Investment Trust (never heard of it), and Daphna Edwards Ziman, the president of Cinémoi TV Network. (Ziman, according to her LinkedIn page, is a “NY Times Best Selling author and writer/director, children’s advocate, and political activist.”) It’s no wonder that the special committee is not taking Project

Rise seriously.

|

|

|

A MESSAGE FROM GOLDMAN SACHS

|

Demand for gold this year is rising, due to:

1. Central banks increasing their purchases

2. Declining

interest rates making gold ETFs more appealing

3. Policy uncertainty and trade concerns

Read more from Goldman Sachs to understand why gold’s surge is set to continue.

|

|

|

Nor, for that matter, is the Delaware Chancery Court. In a recent ruling, the

court opted to allow Skydance to continue its long march toward closing, which is now expected to occur in May. Still, the court left some room for the Project Rise bid to be explored further if it were somehow to morph into a real and superior deal, in which case the special committee would have to take it seriously. After all, the committee, which is being advised by Centerview Partners and Cravath, is obligated to maximize the consideration for Paramount Global shareholders—and that is

precisely what it has done by accepting the Skydance deal.

Perhaps the people behind Project Rise are simply trying to finagle some sort of financial payoff to go away, as Elliott Management, the activist hedge fund, recently tried and failed to accomplish. But that won’t work, either, at this point. My sources tell me a stick-up payment to Project Rise is way off the table and is simply not going to happen. It’s pretty clear that, in the end, the Ellisons will own Paramount Global, and

that David Ellison and Jeff Shell, working alongside Gerry Cardinale at RedBird Capital, will soon be running the place. And another thing: I’m reliably told that Shari Redstone’s desire to settle the bogus 60 Minutes lawsuit with Trump won’t hold up the closing, regardless of whether the lawsuit is settled or dismissed or allowed to proceed. This deal is going to close.

|

We’re nearly a quarter into the new year, and the much-anticipated investment banking

bonanza that was supposed to materialize along with the second Trump administration—you know, with the promise of less regulation, lower interest rates, and a booming economy and stock market—has yet to materialize. Yes, there have been a few big acquisitions, including Constellation’s $16.4 billion deal for Calpine, Johnson & Johnson’s $15 billion deal for Intra-Cellular Therapies, and the roughly $10 billion going private deal for Walgreens. But consumer confidence is plunging as tariffs go

up, and Trump’s chaos administration has made dealmaking quite challenging. “Every executive is sitting on his or her hands,” explained one longtime senior M&A banker. “Every executive.”

The tariff shenanigans are just one factor. “What people don’t appreciate [about tariffs],” the banker continued, “is that once he starts this, of course countries will retaliate—nobody is just going to let themselves get bludgeoned. They’ll lose their political standing. Trump just didn’t

account for that.” This banker said he admires some of the things Trump is doing, like the proposal for a 30-day ceasefire in Ukraine, and asking NATO countries to contribute more financially to the alliance, but that the ratio of things he does not admire to those he does is about 20 to 1. Meanwhile, he said, what Trump is doing with the economy “is crazy,” echoing what longtime CNBC economics reporter Steve Liesman said on air the other day, even though he

said he thought it might cost him his job for saying it.

There is a general concern, which is reflected in the falling stock markets, that second-quarter corporate earnings are going to suffer, in large part because of the precipitous drop in consumer confidence—as can be seen in Delta and American Airlines slashing their first-quarter earnings and revenue guidance, and in the downward pressure on many retail stocks. (As usual, this is not investment advice.) Alas, in the banker’s view,

nothing is likely to change for the better until a real recession hits, and not just an economic slowdown. “To the point where somebody goes to Walmart and they can’t afford the basket they used to because they just don’t have money,” he said, “and they’re pissed.” Only then, he surmised, would the market find the bottom.

There are some green shoots, however, for M&A practitioners. First is the simple fact that there are something like 28,000 companies in the portfolios of

private equity firms that have to be sold, merged, etcetera. That alone will drive M&A activity at some point. There is also a fair amount of pent-up demand to do strategic deals, since the regulatory environment in the previous administration made deals harder to do. On the other hand, the promised regulatory reforms haven’t really kicked in yet, since the administration’s focus has been on cutting government jobs, and then there’s this tariff Gordian knot. In order for M&A activity to pick up,

according to the top bankers I chat with, C.E.O.s will need to know whether tariffs will be a thing or not, and if so, how much and for how long. The chaos is just too bewildering. “If they can measure his uncertainty within bounds, they would do stuff,” my M&A friend continued. “They don’t need complete certainty. They need to measure the uncertainty, and right now they can’t.”

|

One person who can measure the general economic uncertainty is Elon

Musk, the world’s richest man, with a net worth these days estimated at $320 billion. Since the first of the year, roughly coincident with his taking on his new role as the face of Trump’s Department of Government Efficiency, his net worth has decreased by $112 billion, an amount that is by itself greater than the total net worths of all but nine other people.

Perhaps Elon doesn’t care, even if he did seem on the verge of tears in his Fox Business interview with Larry

Kudlow the other day. (Managing multiple businesses has become “extremely difficult” right now, he said.) But I suspect that other shareholders at Tesla, his sole publicly traded company, are wishing he would drop the DOGE shtick and focus on running the auto manufacturer. Since the first of the year, Tesla’s stock is down 34 percent, having lost close to $400 billion in market value. The company is valued at $783 billion these days, which still strikes me as ridiculous, with a

price-to-earnings ratio of 122x. (By comparison, GM trades at a P/E ratio of 7.5x; Ford at 6.6x. Just saying.) “Musk has lost more in Tesla than he made in DOGE cuts,” one short-seller emailed me the other day.

But, by some minor miracle, several of Elon’s private companies have actually benefited, at least from a valuation perspective, since he joined the Trump bandwagon. I guess we shouldn’t be surprised. Trump is nothing if not transactional, and has proved more than

willing to bestow favors, or government contracts, on his friends and sycophants without one iota of shame or regret. For instance, the F.A.A. is apparently ending its contract with Verizon in favor of a new deal with Starlink, which is part of Elon’s SpaceX. On Friday, Trump personally filmed an advertisement for Tesla with Elon in front of the White House, causing the Tesla stock to rise nearly 4 percent.

The relationship has also benefited X, whose debt was once considered unsellable

at par. More recently, however, the banks that owned the $13 billion in X debt were finally able to unload it onto the marketplace after holding on to it for more than two years. What had been expected to trade for 50 cents on the dollar at best, given how poorly X’s business was performing, has turned into a financial bonanza. A bunch of the debt first traded around 90 cents on the dollar, and a bunch more has continued to trade right up to par, or 100 cents on the dollar.

While sources

tell me that the X business itself has been performing a little better lately, the true driver of the X valuation has been xAI—which was valued a couple months ago at $50 billion—and provides the platform’s A.I. component, known as Grok. X owns a 12 percent stake in xAI, a gift from Elon in exchange for the use of X’s engineers, computers, and Nvidia chips to develop the product. Given the xAI valuation, X’s stake was subsequently valued at $6 billion, which has boosted the overall valuation of

X to a place that made it possible for investors to pay up for the X debt.

Bloomberg, citing a study done by Caplight, a trading platform, has reported that the xAI equity, which is privately held, has been trading on the “secondary markets” at a valuation of nearly $100 billion, making X’s stake in xAI worth nearly $12 billion these days. One investor in the X debt told me that X’s stake in xAI alone covers the value of his X debt, and that he doesn’t even need to think about X anymore.

That’s quite something. What’s more, I’m told that X just raised a fresh $1 billion in equity from new and existing shareholders at the original and still-ludicrous $44 billion valuation from October 2022. (I’m told Elon is going to use the new equity he raised to pay off what’s left of the remaining junior Twitter/X debt that has not been offloaded to investors in the marketplace.)

This is all quite an astounding turn of events—made possible, no doubt, by Elon’s close association with

the president of the United States. Meanwhile, Caplight has also found that shares of SpaceX and Neuralink, two of Elon’s other privately held companies, have also increased in value since the 2024 election: Supposedly, Neuralink is valued around $9 billion these days, and SpaceX, which was valued around $350 billion in December, has seen its valuation double. Only the privately held shares of Musk’s The Boring Company, which digs underground tunnels to supposedly make travel around congested

cities easier, have fallen in price since the election.

No wonder C.E.O.s the world over are lining up to pay Trump obeisance. What better way to reward the loyalty of his oligarchs than with access, favors, and government contracts to help boost the valuation of their companies? The virtuous cycle is complete.

|

|

|

Puck’s daily art market email, anchored by industry expert Marion Maneker, offers unparalleled access to the

mega-auctions and galleries, elite buyers and sellers, and the power players who run this opaque world. Wall Power also features Julie Brener Davich, a veteran of Christie’s and Sotheby’s, who provides unique insights into how the business really works.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click

here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY

10006

|

|

|

|