Hi you,

It’s me, Baratunde

Thurston, founding partner at Puck, back with the second installment of our quarterly series: The Puck Private Conversation, powered by Orchestra.

Last October, we surveyed you—Puck’s elite audience of dealmakers and trendsetters—and your answers were so interesting, we’ve done it again. In this edition, we broke out our poll into five sections, covering the boardroom, market sentiment, politics, trends in

media and entertainment, and artificial intelligence at the start of the second Trump administration. While our last survey was a preelection snapshot, this one is focused on post-inaugural expectations

and predictions: How have new priorities in Washington changed your company’s business strategy? What will Trump do in his first 100 days? How has A.I. impacted your business? Do you even social media anymore?

We partnered with Orchestra, the premier strategy and communications agency, and 586 of you responded. Let’s break down what we learned, section by section, with some memorable quotes from you along the way.

⏰ P.S.: On March 14 from 2:30

to 3:30 p.m. ET, I’ll be hosting a Zoom call with Orchestra C.E.O. Jonathan Rosen for a deep dive into some of the most interesting findings… and just to chat with you because I like you! RSVP here to join the conversation.

|

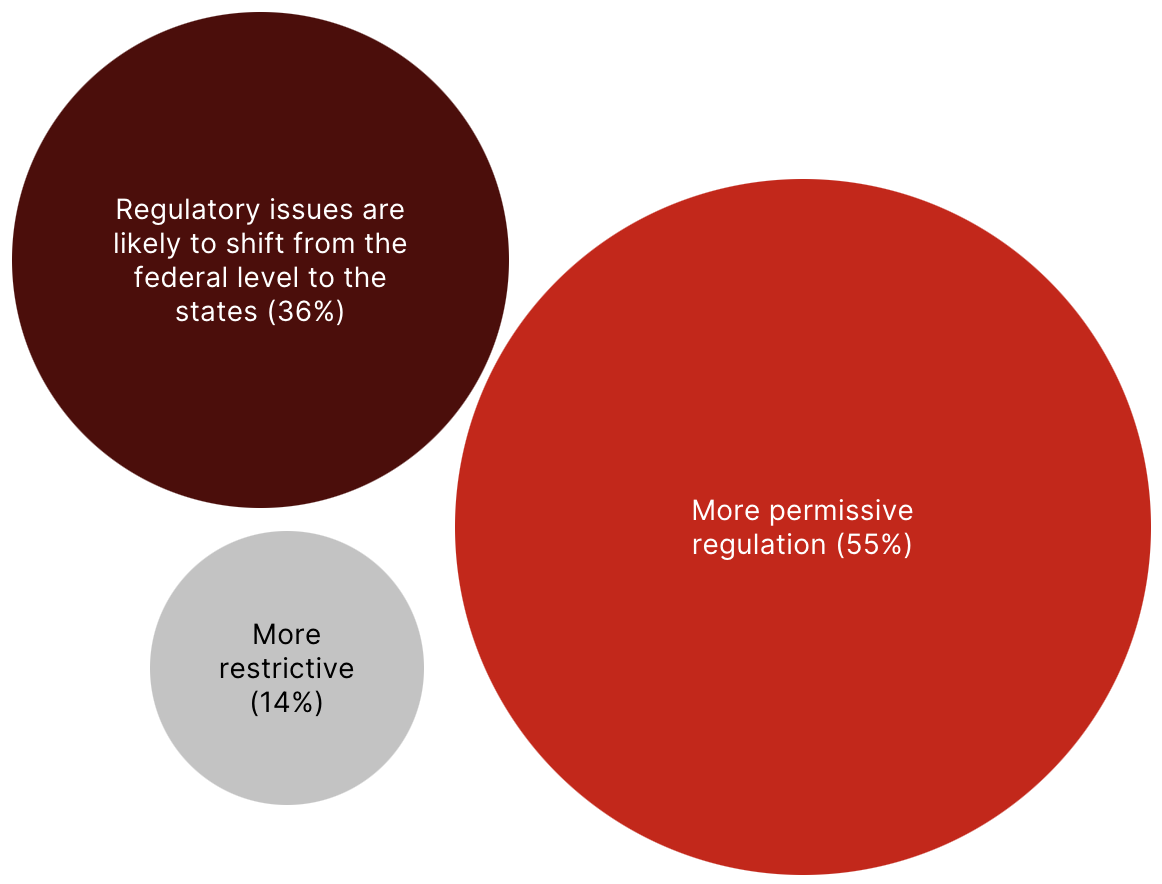

President Trump has promised to roll back regulations and most

boardroom leaders believe him, with 55 percent of our “elites” cohort—Puck readers who are entrepreneurs/founders, in senior management, or in the C-suite and above—expecting regulation to become less restrictive and 36 percent saying regulatory issues will likely shift from the federal level to the states. Only a small minority of total respondents (13 percent) said regulation is likely to become more restrictive. Notably, among respondents in

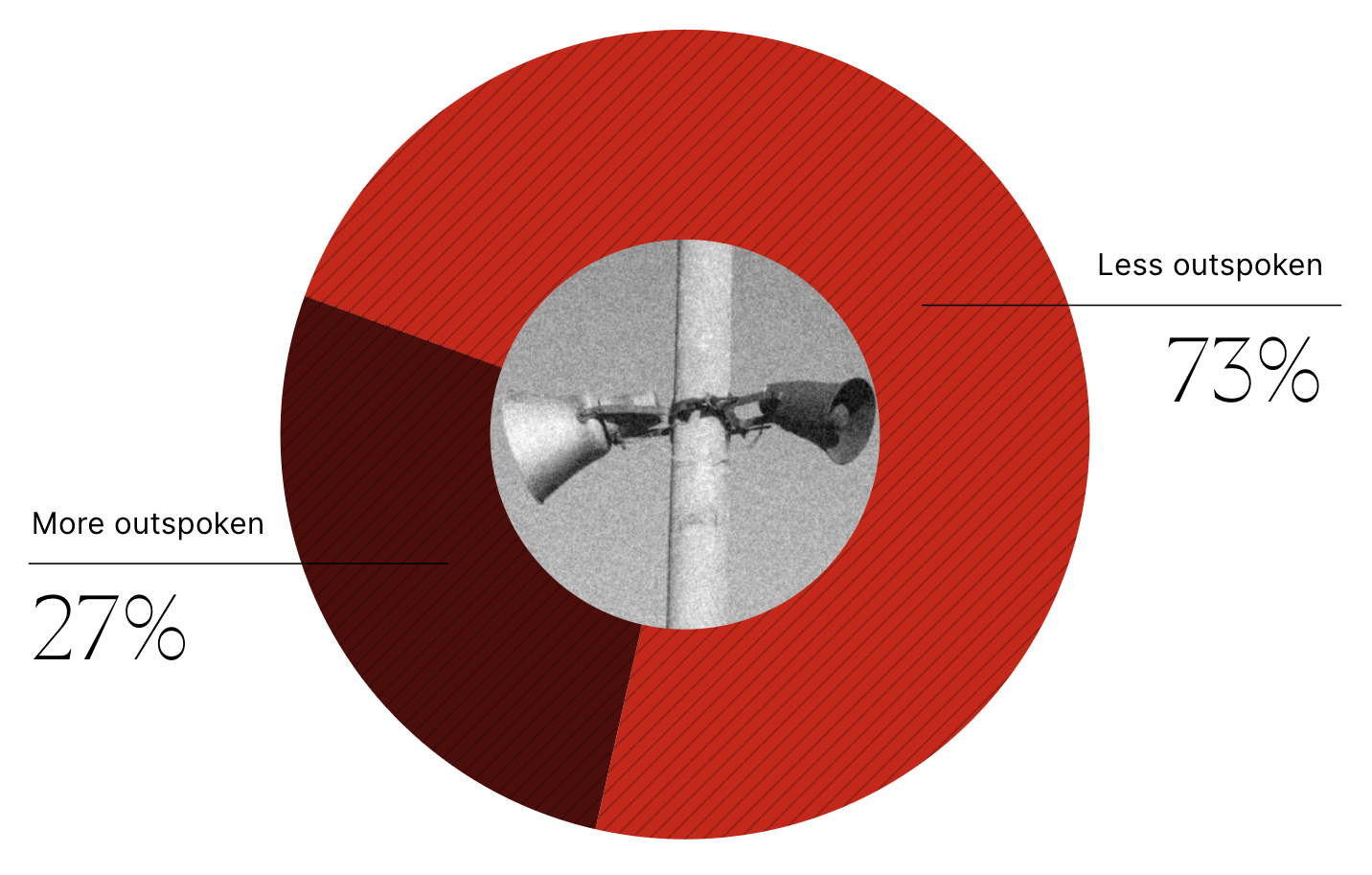

Finance, 73 percent predict less red tape during Trump II. But we weren’t just interested in your expectations of government action. We wanted to know what you expect when it comes to your boardrooms’ willingness to speak out about social and political issues. The short answer: a lot less. A whopping 73 percent of founders, C-level executives, and senior managers said their organizations will become less outspoken, while only 27 percent said

they’d speak out more. A larger share (39 percent) of respondents working in nonprofits and the public sector said their organizations would become more outspoken. But overall, the pivot (or genuflection) by tech leaders onstage during Trump’s inauguration doesn’t appear to be an anomaly, nor is it limited to Silicon Valley.

|

American businesses are loosening up…

|

At a boardroom level, which best represents your evolving

expectations for regulation?

|

…but watching what they say.

|

At a boardroom level, is your organization becoming more or

less outspoken on social and political issues after the 2024 election?

|

With the new administration ordering federal agencies to

eliminate diversity, equity, and inclusion programs, and demanding investigations into private companies and institutions that promote D.E.I., it’s not that surprising to see businesses shift proactively from resistance to compliance.

|

As with our first quarterly survey, we asked how you feel

about the future of your industries. There are a few ways to parse the data: by overall levels of positivity, and by industry. Positive sentiment outweighed negative sentiment across all market segments except for Fashion, and Nonprofit & Public Sector, which both reported a net-negative outlook. As with our previous survey, those of you in Finance had the most positive expectations for your industry, with 73 percent describing their outlook as “very positive” or “generally

positive.” Remarkably, only 4 percent of respondents in Finance reported negative expectations for the immediate future.

There is a bit of a contradiction here. When we asked finance professionals to describe their level of concern about Trump’s tariff policies, 62 percent said they expect those policies to hurt the market rally. Given the president’s Day 1 announcement regarding his intention to place 25 percent tariffs on Canada and Mexico

(i.e., it wasn’t just campaign bluster), as well as an additional 10 percent tariff on goods from China, it will be interesting to see if those positive vibes on Wall Street continue.

|

Which of the following best characterizes your outlook for

your industry?

|

In another notable split, a majority of those in Media

(54 percent) expressed a positive outlook for their industry, but only 37 percent of respondents in Entertainment were similarly upbeat.

|

Meanwhile, among the Hollywood crowd…

|

62 percent believe the market for theatrical

films will improve this year but that it’s still declining in the long run. Their faith in their legacy media peers is also low when looked at from another angle. When asked, “Which company’s stock will perform the best in 2025?” 49 percent chose Netflix. The only other double-digit winners were Disney (16 percent) and Paramount Global (12 percent). All other companies registered single-digit support.

Intriguingly, there was also a

divide between the Art and Fashion camps. A massive majority (83 percent) of respondents in Fashion believe the overall industry trajectory will be mixed depending on the brand—a.k.a. “It depends.” Meanwhile there’s much less ambiguity about the art market, with 48 percent reporting that it’s already bouncing back from last year’s lows.

|

You may recall from our last survey that 84

percent of respondents planned to vote for Vice President Kamala Harris and only 6 percent for Donald Trump. In the face of Harris’s decisive defeat, we wanted to know what you thought about the Democrats—what they should do now, who should lead them, and what went wrong—as well as what you expect from Trump.

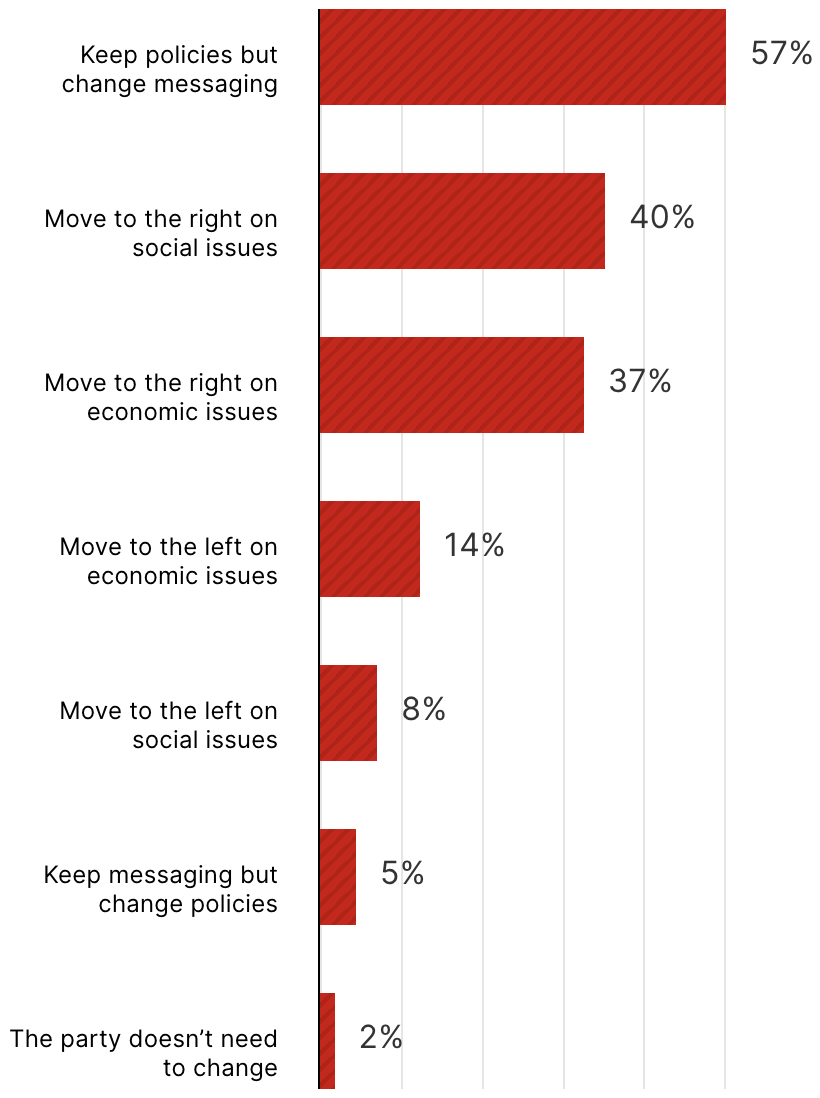

Many more of you think the Democratic Party needs to move to the right on social and economic issues (40 percent and 37

percent respectively) than the left (8 percent and 14 percent), but a majority (57 percent) believe the party has the right policies and just needs to change its messaging. Given the expanding impact of wealth inequality on America’s sense of economic precarity, I’ll admit to some surprise that, on net, there’s a desire for the party to move right on the economy. That said, our poll didn’t break out which conservative economic

principles Democrats should adopt. A question for our next survey, perhaps.

|

How should the Democratic Party change to appeal to more

voters in 2028?

|

And the next Democratic savior is…

|

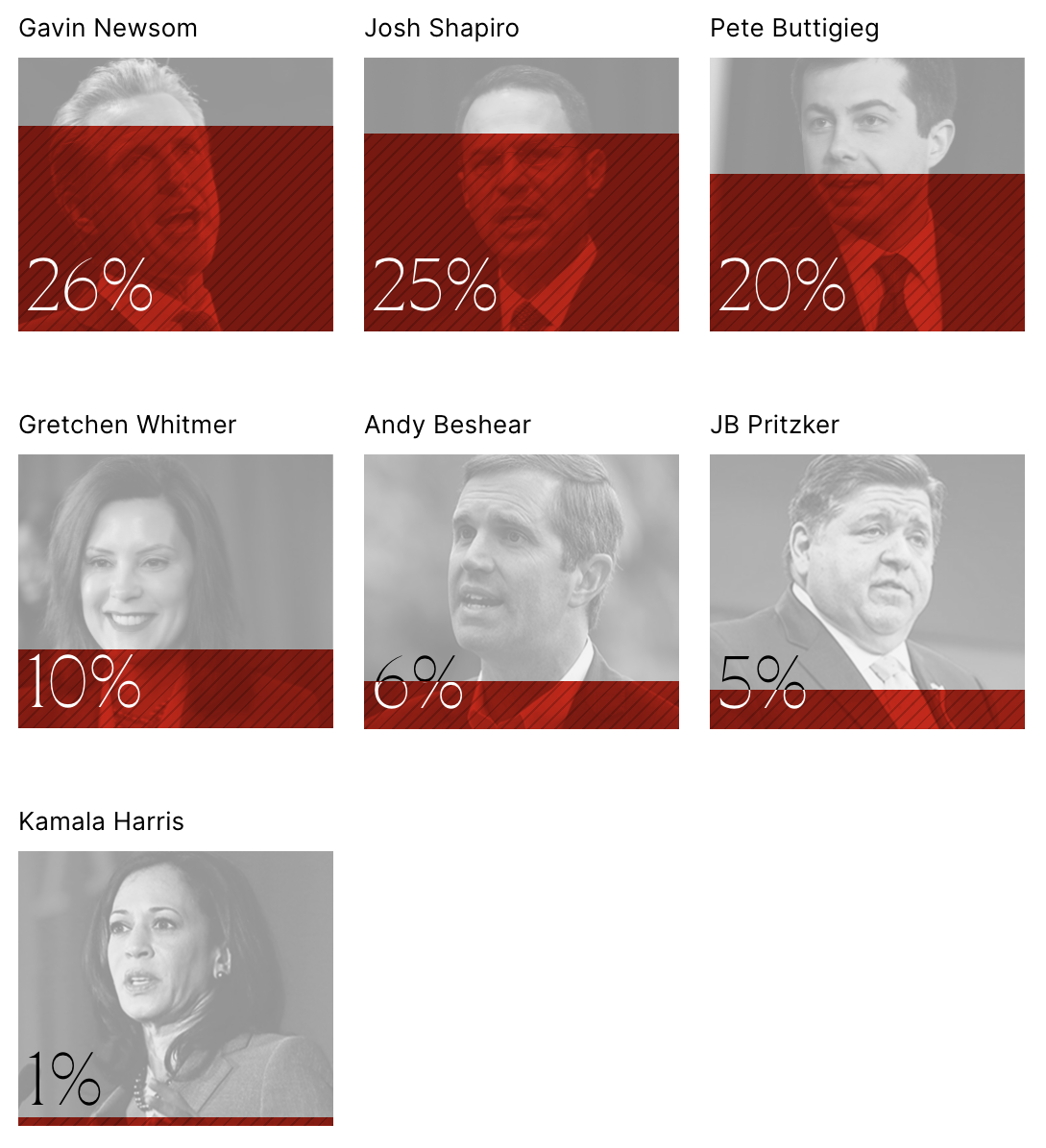

Who is most likely to emerge as the Democratic Party’s

standard-bearer over the next two years?

As for who should lead the Democrats out of the wilderness, you resoundingly agreed that it should not be Kamala Harris, who was named by just 1 percent of respondents. Instead, the top three choices for the party’s next standard-bearer were California Governor Gavin Newsom, Pennsylvania Governor Josh Shapiro, and former Secretary of Transportation Pete Buttigieg.

|

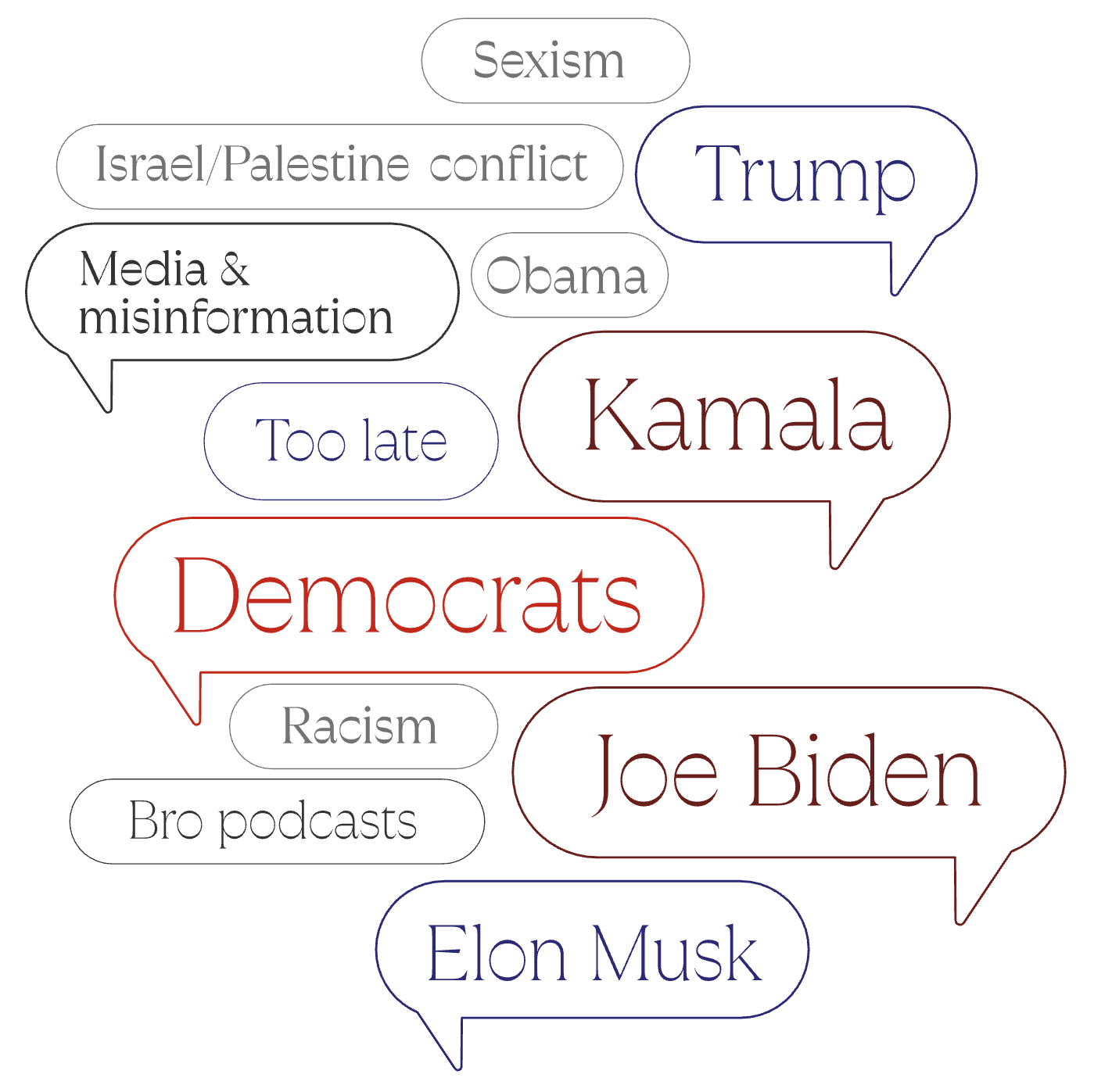

When it comes to who or what is to blame for Harris’s loss…

|

you all came out blazing. Seriously, we left the text field

open for your input and 93 percent of you had something to say! The most frequently stated reason is encapsulated by this simple statement: “Joe should have left sooner.”

Indeed, President Biden’s decision to drop out of the race so late—or even to run for reelection in the first place—was the number one reason cited for Harris’s loss. Number two was Harris herself, or her staff, for being too cautious, too tied to Biden, or just the wrong race and gender for this

country. After Biden and Harris, respondents placed the blame on the Democratic Party for “disorganization and lack of succession planning,” for being “condescending,” and for lacking “connection to the American people.” Algorithms, misinformation, and Fox News came up a fair amount, but nowhere near as much as internal factors. That said, some notable outliers included blaming “the American people’s ignorance,” “not having a super wealthy freak show benefactor like Elon,” and, simply, “men.”

|

Speaking of men and Elon…

|

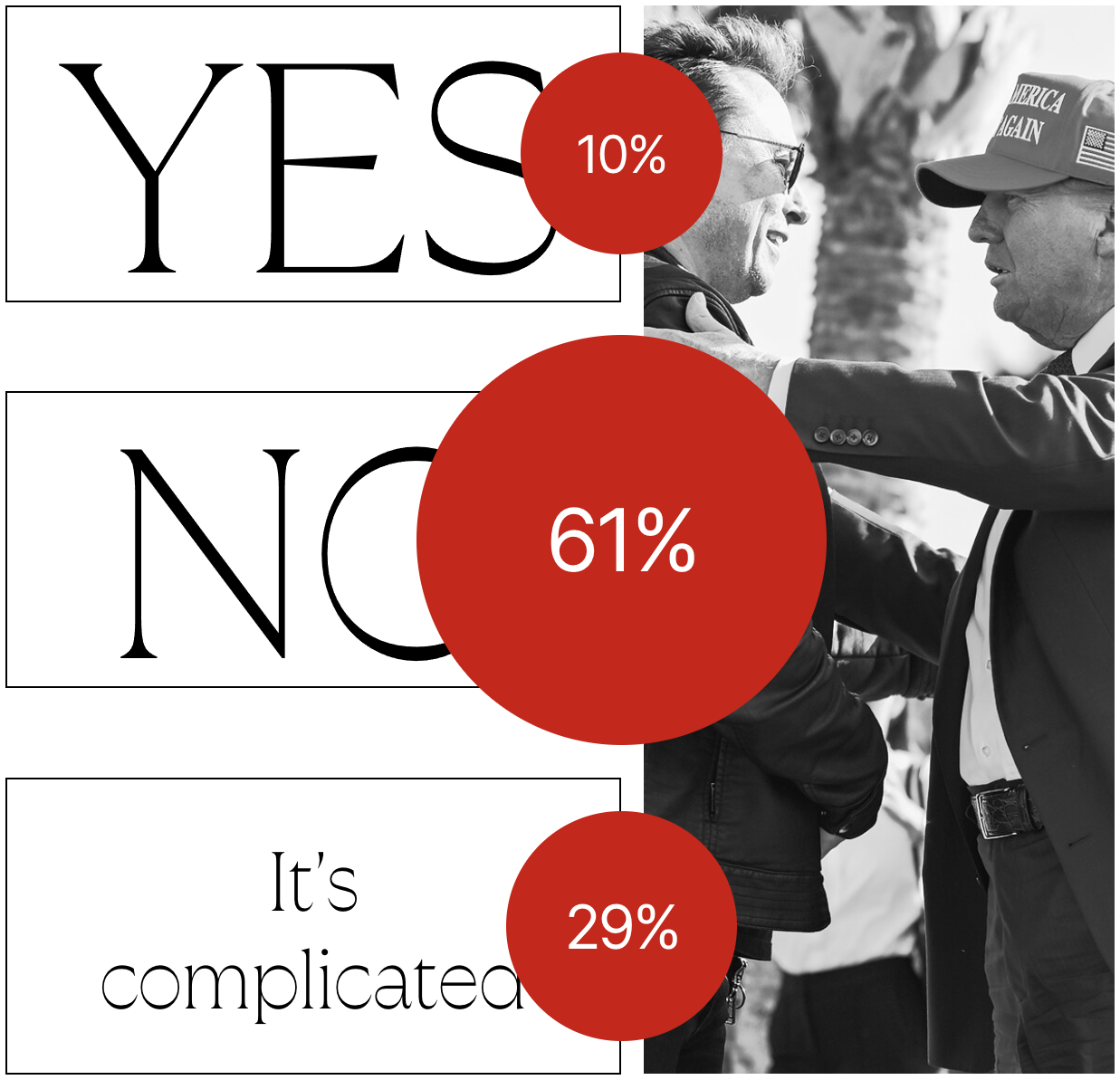

most survey takers predicted an end to the Trump-Elon

bromance, with 61 percent saying it won’t last and only 10 percent saying it will.

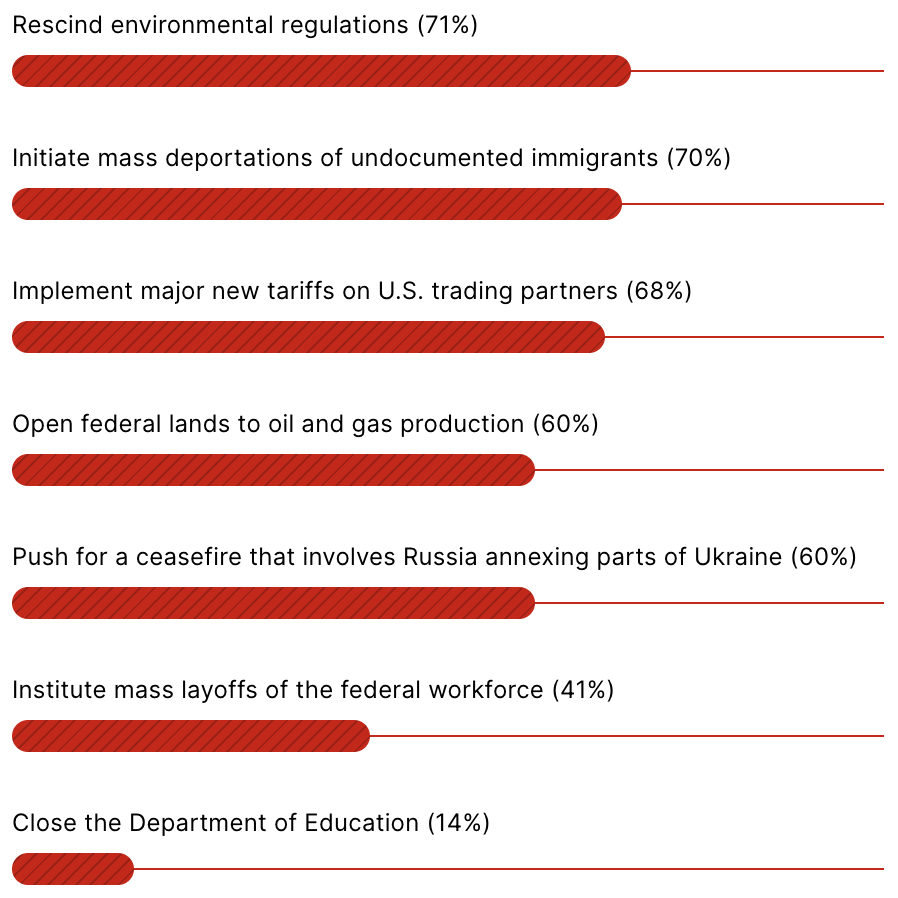

Finally in politics, most of you believe Trump will do most of the things he promised on the campaign trail, with majorities predicting he’ll rescind environment regulations, initiate mass deportations, open federal lands to oil and gas production, and more. Alas, this survey was conducted before Trump’s inauguration, and much of what you were asked about has already come

to pass. About four in 10 people predicted Trump would institute mass layoffs of the federal workforce, which is currently happening. Only 14 percent said they believed Trump would close the Department of Education, which is in the process of being destroyed.

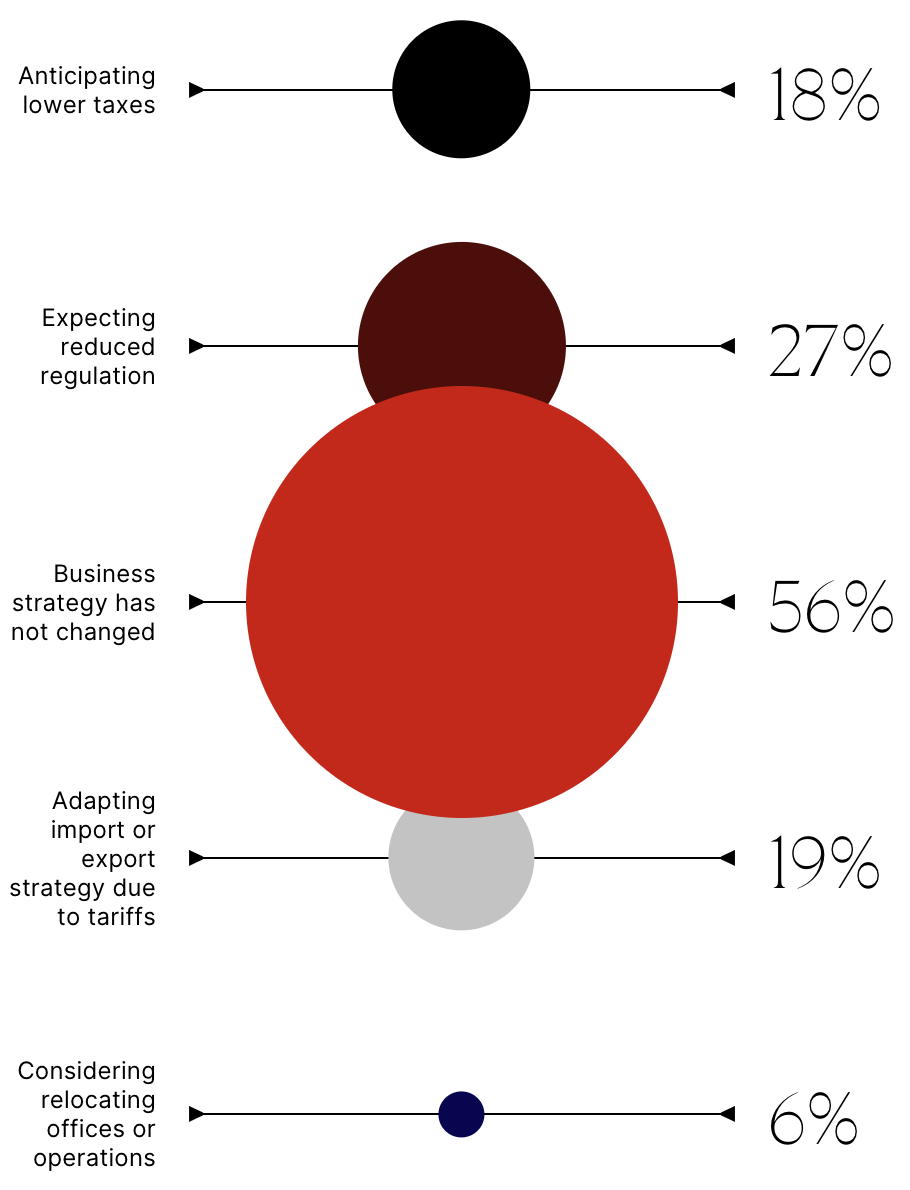

For better or for worse, however, most respondents said the election results have not changed their company’s business strategy, with smaller numbers anticipating lower taxes (18 percent) and reduced

regulations (27 percent). Less than one in five said their businesses were shifting their import or export strategies due to tariffs.

|

Breaking up is hard to do

|

Will the Trump-Elon bromance last?

|

How have the election results changed your company’s business

strategy?

|

Taking Trump literally and seriously

|

Which of the following do you think Trump will actually do in

his first 100 days?

|

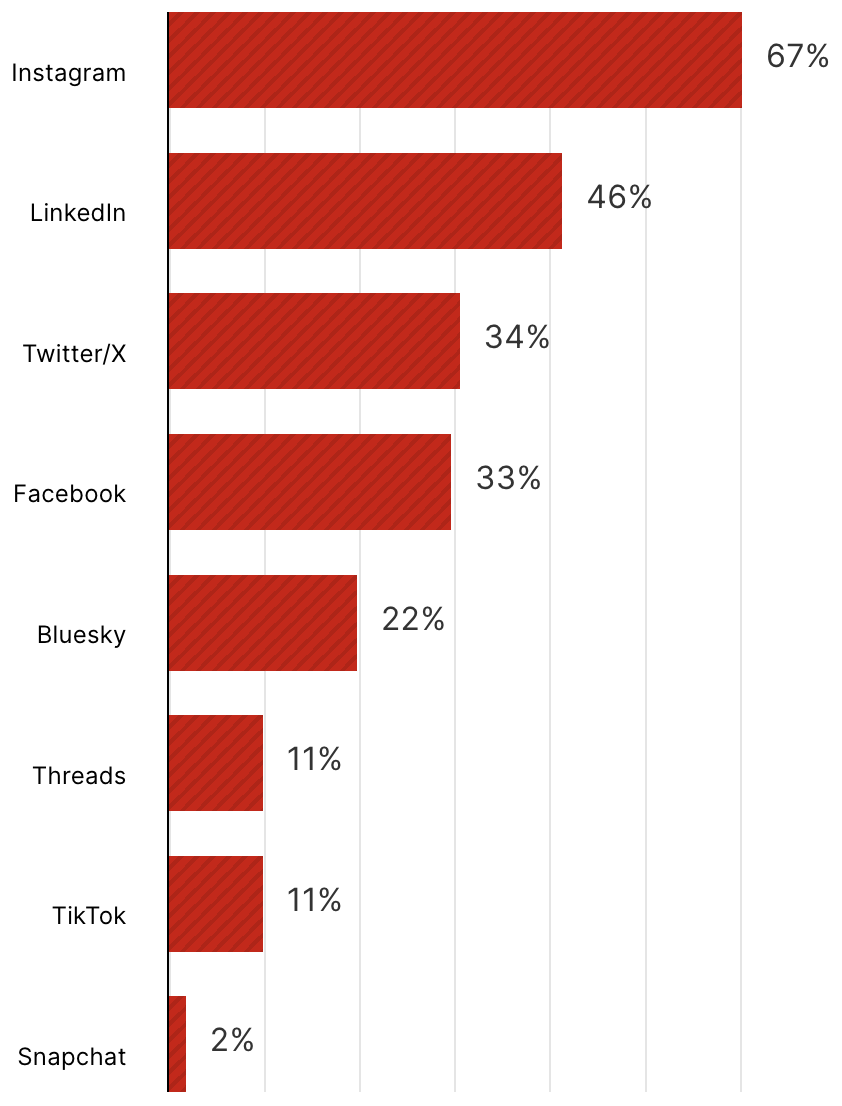

For this quarter’s survey, we asked about both new and old

media. When it comes to daily social media use, there’s one clear winner among Puck subscribers: Instagram, which is used regularly by 67 percent of you, followed by LinkedIn at 46 percent. In a perplexing twist, those of you in Fashion clocked in as the most devoted fans of LinkedIn, with two-thirds of you using the app. Très chic.

Twitter/X and Facebook were nearly tied in our survey, with 34 and 33 percent

respectively, although there was a divergence in usage by age. Facebook is still used by 50 percent of Puck respondents who are retired, but by only 25 percent of people in their early careers. A much larger percentage of youngsters (44 percent) use Twitter/X.

Not surprisingly, Bluesky and Threads both lagged X in overall use among Puck respondents. But it was somewhat shocking to discover that twice as many of you use Bluesky as

Threads—the much bigger and better-funded Meta platform, which is integrated into Instagram. It’s an important reminder that when it comes to social media, adoption is driven by social dynamics much more than marketing budget or parent company backing. If that weren’t the case, we’d all be using Google Wave.

|

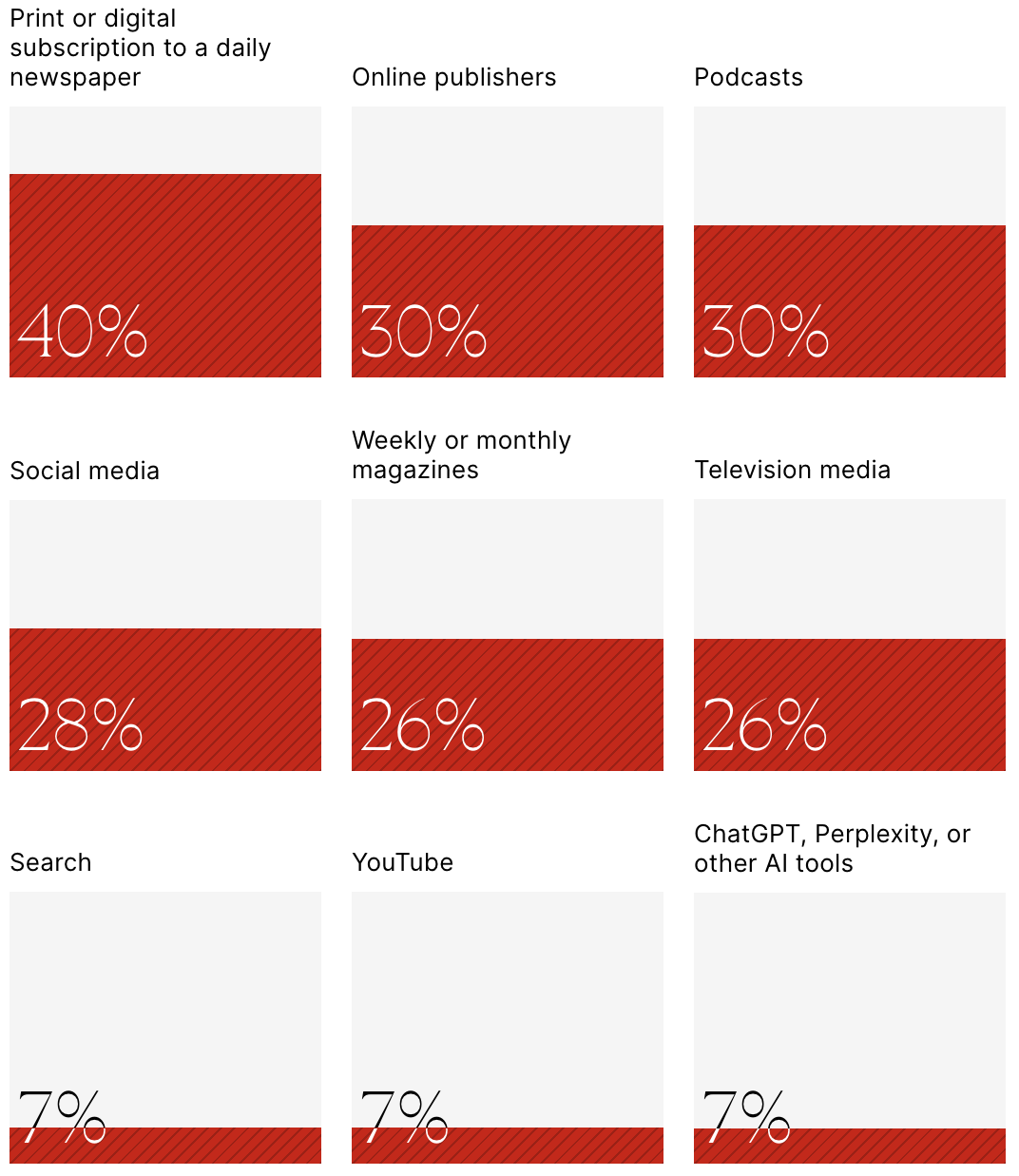

As for their sources of news, Puck respondents are a pretty

conservative bunch, technologically if not politically, with more than 85 percent getting information from a daily newspaper—whether in print or online. Only 22 percent of respondents cited YouTube, likely attributable to the demographic skew of the survey pool. Even less popular among Puck respondents were A.I.-based news tools. (That’s probably for the best, given the embryonic state of the industry: Apple just announced it would stop using A.I. to summarize

news alerts on iPhones because of how often it was fabricating information.)

We also asked for your prognostications about future M&A activity in the media industry in 2025—a topic we have covered voraciously at Puck. Not surprisingly, a healthy majority (72 percent) of Puck readers expect Warner Bros. Discovery to follow Comcast’s lead and spin off cable assets this year, while 52 percent think Paramount Global will do the same.

|

Weapons of mass distraction

|

Which social media platforms do you use everyday?

|

Which of the following do you get information from on a

daily/weekly basis?

|

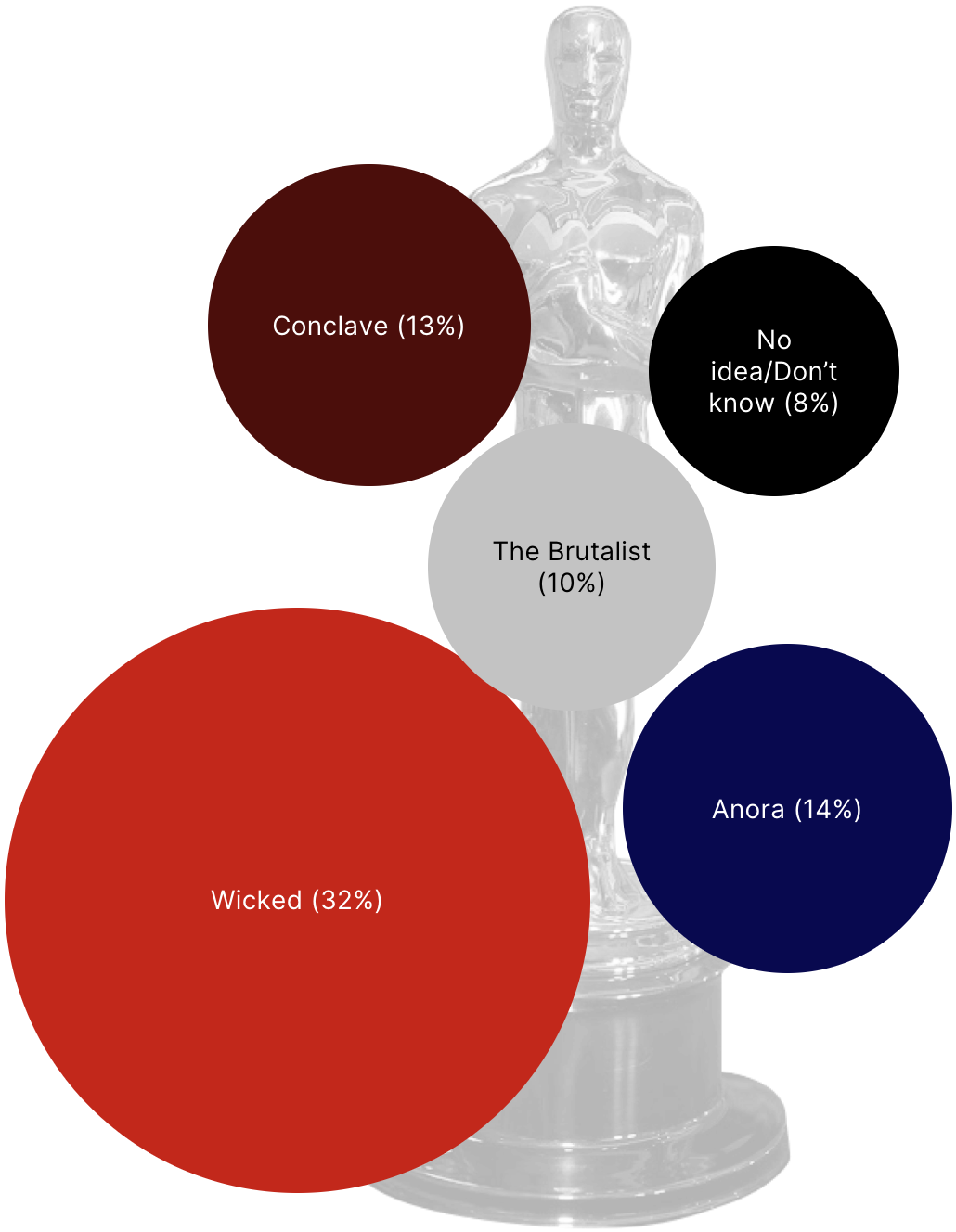

Who will win best picture?

|

Another obsession of ours…

|

is the future of awards shows—a cornerstone of the Hollywood

industrial complex that have nonetheless seen declining TV ratings over the past decade. Notably, only 52 percent of respondents said they watch the Oscars, while a near-majority said they don’t watch any awards shows at all. (Of course, 80 percent of respondents in Entertainment watch the show, but then again, it’s your job!)

As for which movie you think will win best picture this year, we offered another open-ended question, and about 70

percent of you responded. The winner, according to you, will be Wicked, with Anora and Conclave a distant second and third. I experimented with Google’s NotebookLM to help me process all your text inputs, and its take on your responses was that they “indicate a notable lack of enthusiasm for the Oscars as a whole.” Ouch! One direct quote from you supporting this synthesis: “I am in the film and TV business and honestly couldn’t care less.”

|

Do you still watch award shows?

|

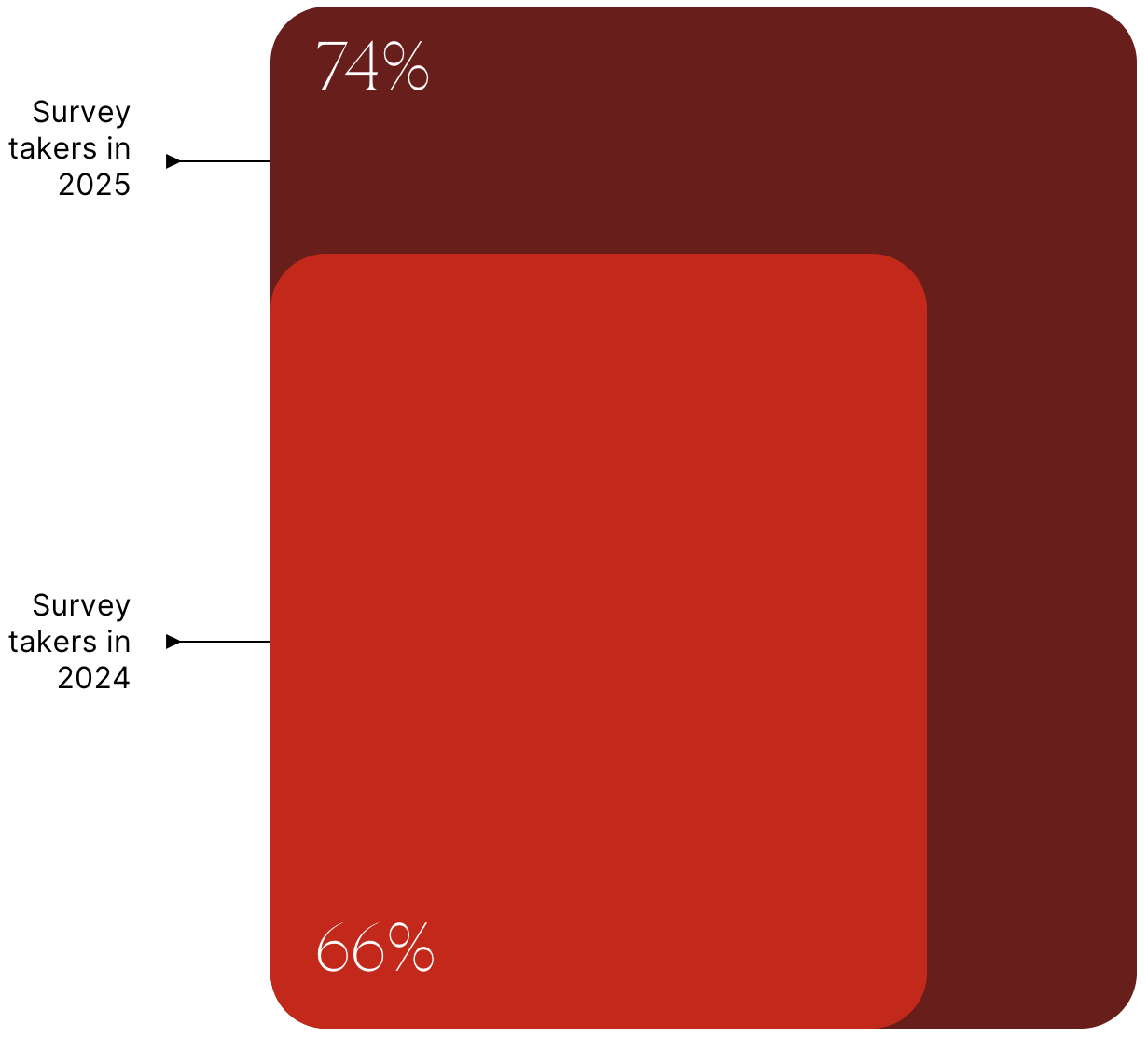

Finally, as in our first survey, we asked about A.I. The

first thing I noticed was a sizable drop in the percentage of you saying you’re not using any A.I. tools, from 35 percent down to 23 percent. I wouldn’t assume it’s because you’ve actively chosen this path, but rather because nearly every software platform is now shoving A.I. nonconsensually in your face so often you’ve just lost the will to resist. (If you’re reading this report in Gmail, it’s probably asking you if you’d prefer an A.I. summary right

now.)

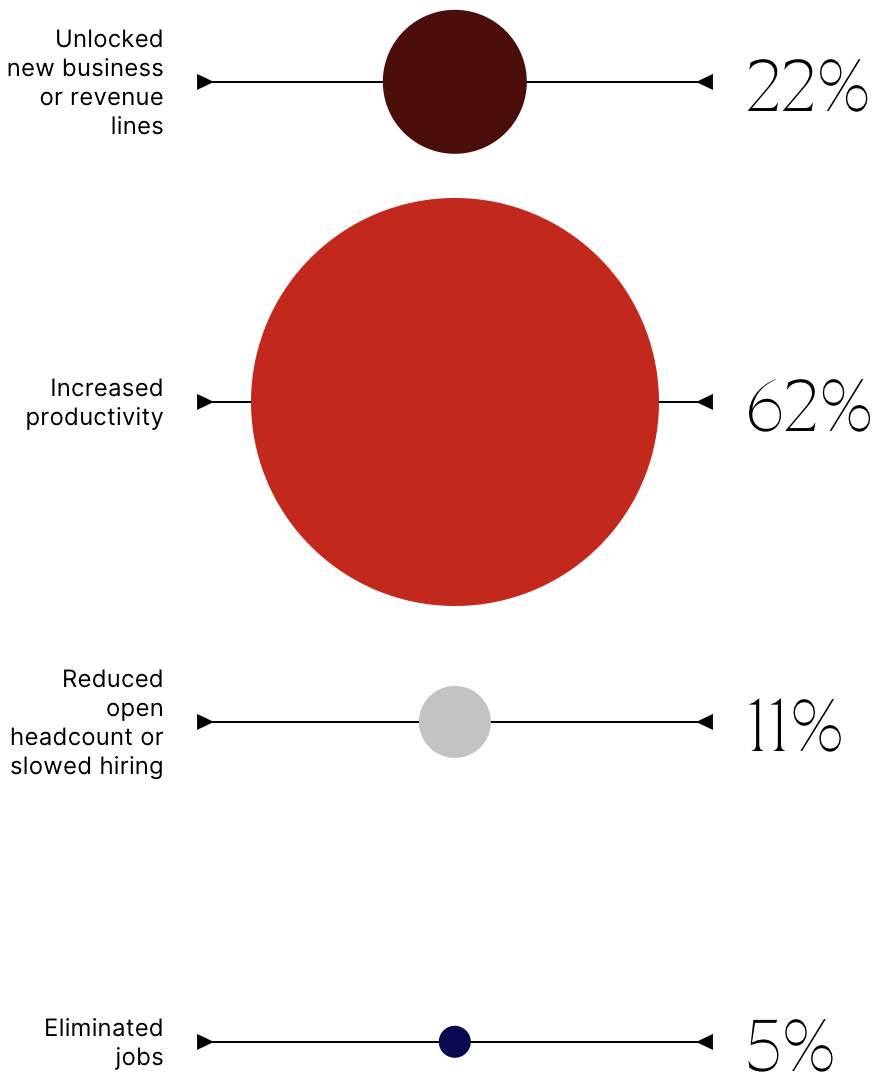

Beyond the aggressive marketing, 62 percent of all Puck respondents said A.I. is increasing their business’s productivity—a percentage that surged to 73 percent among survey takers in the media industry. Thankfully, so far only 11 percent of respondents reported A.I. having a negative impact on the size of their workforce or the pace of hiring. And just 5 percent said A.I. had led to the elimination of jobs at their

place of business.

|

Is your business using A.I. tools?

|

How has A.I. affected your industry?

|

Of course, the growth trajectory of A.I. …

|

will depend on its adoption curve—itself driven by whether

consumers believe it is delivering them real value. And there are early indicators that we may be further along the adoption curve than it appears. While 56 percent of Puck respondents told us they still use Google search “too often to count,” nearly a third (32 percent) said they use it “a lot but not as much as I used to.” Chatbots aren’t yet picking up the slack: Only 3 percent answered that they’re using A.I. alternatives all the time. But

increasingly, the line between the two has become blurred: If you ask Google a question right now, more often than not the top response will be from Gemini, the company’s large language model.

The other factor in A.I.’s future is how much money is pouring into the sector—and whether the market is overheated. Interestingly, 57 percent of respondents in our Finance cohort said they believe the A.I. market is a bubble, but that these investments will be justified in the long

run. 37 percent said the market euphoria is outpacing fundamentals. And only 7 percent said investors were accurately pricing future cash flows right now. In other words: Wall Street is largely in agreement that this technology will be critically important in the future, but how quickly we get there is up for debate.

Indeed, the speed at which A.I. capabilities grow, and the volume of investment in the sector, could have major consequences for the U.S.

economy and the Trump administration, which has wrapped its arms firmly around the billionaires and tech companies placing the biggest bets on A.I., data centers, and chip manufacturing. We’ll have much more on this topic in the third installment of this survey, launching next quarter. Stay tuned.

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St,

New York, NY 10006

|

|

|

|