Welcome back to What I’m Hearing, home in L.A. after a quick two-day New York

trip and a surprisingly good martini with my Puck colleagues at the P.J. Clarke’s on the Hudson (don’t judge). Tonight, a long-overdue look at Apple TV+ upon the finale of its biggest show since Ted Lasso. Plus, some James Bond news, and the debut (finally!) of The Alto Knights, the greatest gangster movie David Zaslav ever forced his Warner Bros. studio heads to greenlight.

Not a Puck member? Just click here. Got a news tip or an idea for me? Just reply to this email or message me on Signal at 310-804-3198.

Let’s begin…

|

- Amazon

picks its Bond producers: Good luck to David Heyman and Amy Pascal, who are in talks to shepherd the next iteration of James Bond. The veteran producers have been among the names rumored in the British press in the weeks since Amazon shocked the town by acquiring full control of the

Bond franchise from Barbara Broccoli and Michael G. Wilson, but now I’m told reps for Heyman and Pascal are negotiating their deals. Amazon declined to comment, and nothing can be official until the Broccoli transaction closes, which is still a ways off. But they’re the choice of Amazon execs Mike Hopkins, Jen Salke, and Courtenay Valenti, and barring some impasse, the announcement will happen.

This duo

checks a lot of boxes. Heyman is British, for one, and he’s handled big film franchises like Harry Potter, Barbie, and Wonka. Pascal also produced Barbie, but more importantly, she worked on Casino Royale, Skyfall, and Quantum of Solace when she ran Sony Pictures, which distributed several Bond pics. The plan is to make a new movie for theatrical release before any spinoffs or TV extensions, so their first task will be to settle on

writers and/or a filmmaker before picking a new Bond. And just because Heyman and Pascal are lead producers, that wouldn’t prevent them from bringing on, say, Chris Nolan and his wife/partner Emma Thomas to produce, too… if Nolan was interested in directing.

- The Not-so-Electric State?: It’s too early to call the Russo brothers’ $300 million The Electric State a disappointment,

especially since it generated 25 million views in its first weekend, according to Netflix. But a few possibly instructive stats:

|

- The Russo opus generated 30 percent fewer views in its first 72 hours than Damsel, the (much cheaper) 2024 film that also starred Millie Bobby Brown.

- Those 25 million initial viewers are fewer than many Netflix films, including Jessica Alba’s Trigger Warning last year, which also did not cost $300

million.

- The Russos’ previous Netflix movie, The Gray Man, was No. 1 in 84 countries. Electric State was tops in fewer than 50.

|

- Zaz’s

Hamptons vanity project D.O.A.: Want to make someone at Warner Bros. laugh and cry at the same time? Just say the words “Alto Knights.” Yes, it’s finally opening weekend for the $50 million double-the-Robert De Niro gangster drama that Warner Discovery C.E.O. David Zaslav demanded—sorry, lightly suggested—his film chiefs Mike De Luca and Pam Abdy greenlight immediately when

they arrived in 2022. As I reported back then, the project, then with the much better title Wise Guys, had been rejected by Warners and other studios, but it happened to have been written by Zaslav’s Hamptons buddy Nick

Pileggi, now 92, and it had a producer attached, Irwin Winkler, 93, who was also part of the Zaz social circle. The duo appealed personally to the new W.B.D. leader, who had recently purchased Bob Evans’ house and fancied himself a movie guy despite a career in cable television, and—voila!—a coveted greenlight. Hollywood!

You won’t believe this, but the movie rammed through by the C.E.O. on behalf of his elderly cronies, against the best

instincts of the people who make movies for a living, was delayed twice, panned by critics, and is tracking to open to less than $5 million. It’ll almost certainly lose money for a cash-strapped studio that is literally selling off finished movies to the highest bidder. But

at least Zaslav, 65, got to go to an old-fashioned movie premiere in New York on a Saturday night where, standing next to Pileggi, Winkler, De Niro, 81, and director Barry Levinson, 82, he must have felt like the youngest, hippest studio head in the history of Hollywood.

- 4th and 10, you punt: Speaking of Warners, De Luca and Abdy finally reshuffled their risky slate, sliding Paul Thomas Anderson’s $130 million-plus

Leo DiCaprio drama from August to late September, pushing Maggie Gyllenhaal’s The Bride to ’26 and the Anne Hathaway 1980s dinosaur movie Flowervale Street to August of next year. As Kim Masters reported last week, Abdy was attempting to fix the Gyllenhaal movie, and now she’ll have more

time. Will these moves take some heat off Mike and Pam? Maybe a little. Disney essentially did the same thing last year amid its activist shareholder fight, pushing from ’24 to ’25 its “problem” movies, Captain America: Brave New World, Pixar’s Elio, and this weekend’s Snow White. But now those movies are coming out, and…

- Box office over/under: …speaking of Snow White, let’s set the line at $50 million for the $250

million lightning rod. I’ll take the under, not because of the silly media controversies, but because Disney execs overreacted to them, signaling they didn’t really believe in this movie from the get-go.

|

Now, on the night of the ‘Severance’ finale…

|

|

|

As the $3 trillion company’s stock drops and its leadership scrutinizes the money-losing

Apple TV+ service, some around town are asking whether the streaming ambitions become expendable if the share price or overall financials grow more challenged.

|

|

|

At lunch with an agent last week, the first question he asked wasn’t about Disney

succession, or the mysteriously ongoing employment of the Russo brothers, or even whether David Zaslav has soured on Mike and Pam at Warner Bros. Instead: “What are you hearing about Apple?”

His nerves were

understandable. The news from Cupertino these past few weeks has been… concerning. Not just the stock drop—about 13 percent this past month, part of an overall market selloff amid the Trump tariff talk. Worse, new A.I. features for iPhones were pushed until at least 2026, and a key executive admitted the delays were “ugly and embarrassing”—especially since A.I. innovations had been advertised in a splashy campaign before they actually existed. Ooof. Apple was sued today

over the alleged deception, it reorganized its A.I. executives, and superfans have been freaking. “When mediocrity, excuses, and bullshit take root, they take over,” wrote John Gruber, the influential Apple blogger, adding that the world’s largest company “will quickly collapse upon itself with the acceptance of all three.”

That may be a bit much, especially considering Apple’s core business is elegant

hardware, not A.I., and it generated a ridiculous-sounding $70 billion in iPhone sales just last quarter. But the term “vaporware” isn’t often associated with Apple, and the perceived weakness in the next tech revolution, combined with overall economic uncertainty associated with a Trump trade war, raises the specter of a prolonged slowdown. Maybe that’s why Warren Buffett has been offloading his Apple stock lately.

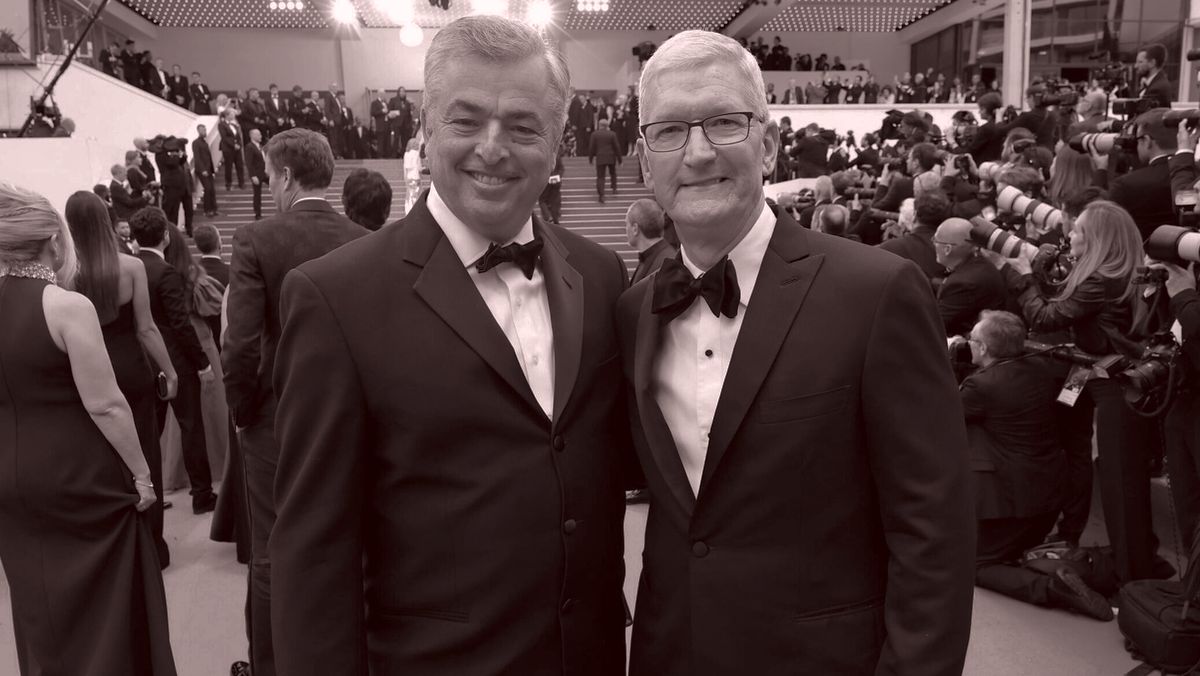

All of which fed into the self-centered fears of my lunch date. What, if anything, does the current state of Apple mean for its entertainment business? After all, more than five years into the Apple TV+ experiment, it’s never been entirely clear what C.E.O. Tim Cook and services chief Eddy Cue are up to in Hollywood. Certainly not making money, at least not in the traditional sense. The Information

reported today that Apple lost $1 billion on Apple TV+ last year, following a Bloomberg report that more than $20 billion has been shoveled into making original

shows and movies since 2019. That’s not nothing, even for a company worth $3 trillion.

The “loss” number is a bit misleading, of course, considering Apple has always said that a key goal is to leverage Leo DiCaprio and Reese Witherspoon to thicken its brand halo and the device “ecosystem,” ultimately boosting its other businesses. But still… for all its billions,

Apple TV+ has accumulated only about 45 million subscribers worldwide, according to today’s Information report and other estimates.

That’s far less than Disney+, Max, and Paramount+, all of which launched around the same time. Those rival services are attached to legacy studios with rich libraries, but they’re not attached to a company with $65 billion in cash on hand and a device in the pockets of 1 billion people that also delivers bundle-friendly

music, news, and games. Apple declined to confirm or comment on any numbers, but a source there suggested the subscriber number is higher than 45 million and that the global nature of the sub base is being undercounted by U.S.-oriented research firms. Maybe. The company reveals zero performance data beyond B.S. “biggest weekend ever!” press releases that the trades accept without skepticism and producers like Ben Stiller and David Ellison post with “blessed”

emojis on their social media. No one outside the company really knows how the Apple TV+ business is performing.

|

Despite its size and capabilities, Apple still pushes the whole boutique-y, We’re

the new HBO angle… to which the HBO people next door in Culver City often joke, Yeah, but people actually watch HBO. Indeed, the Nielsen Gauge report continues to omit Apple TV+, meaning that the service generates less than its reporting threshold of 1 percent of viewership on connected TVs. Hugely expensive, movie star–driven TV shows regularly land with little awareness or, presumably, viewers. Did you know Natalie Portman, Colin Farrell,

Michael Douglas, Billy Crystal, and Warren Beatty all made shows for Apple this past year? They did! Well, except Warren Beatty… I made that one up, but you believed it because it sounds like someone Apple would work with.

For that reason, I wasn’t shocked to report last May that Cook and Cue had

summoned the unit’s content chiefs, Zack Van Amburg and Jamie Erlicht, to Cupertino for a come-to-Jesus discussion about how to reduce costs. Today’s report revealed Apple TV+ spent $500 million less last year after the admonitions. We all know from the Wolfs blowup with George Clooney and Brad Pitt

that they’re backing away from releasing movies theatrically. Cook also cracked down on private jet use by talent, according to the report. (I know. Outrageous.)

Against that backdrop, it’s worth asking whether the streaming service becomes a target if Apple’s share price or overall financials grow more challenged. Maybe the fears of every agent and producer in town—that Cue will one day see an upcoming L.A. trip on his

calendar, shrug and ask, “Why, again, are we doing this?”—will finally be realized. In that case, $4 billion or $5 billion a year would simply disappear from Hollywood. A “disaster” scenario, another agent texted.

That seems unlikely, at least for now. It’s still early days, and other than the cost

controls, Apple hasn’t indicated that it’s soured on making originals for streaming, which presents other business opportunities. It’s a boost to its services business, and if Apple ultimately wants to compete with Amazon, Google, Roku, and others to become the “front door” for all digital video consumption—an aspiration that took a hit when it agreed to create an AppleTV+ channel on Prime Video to boost subs—it needs a platform to build out.

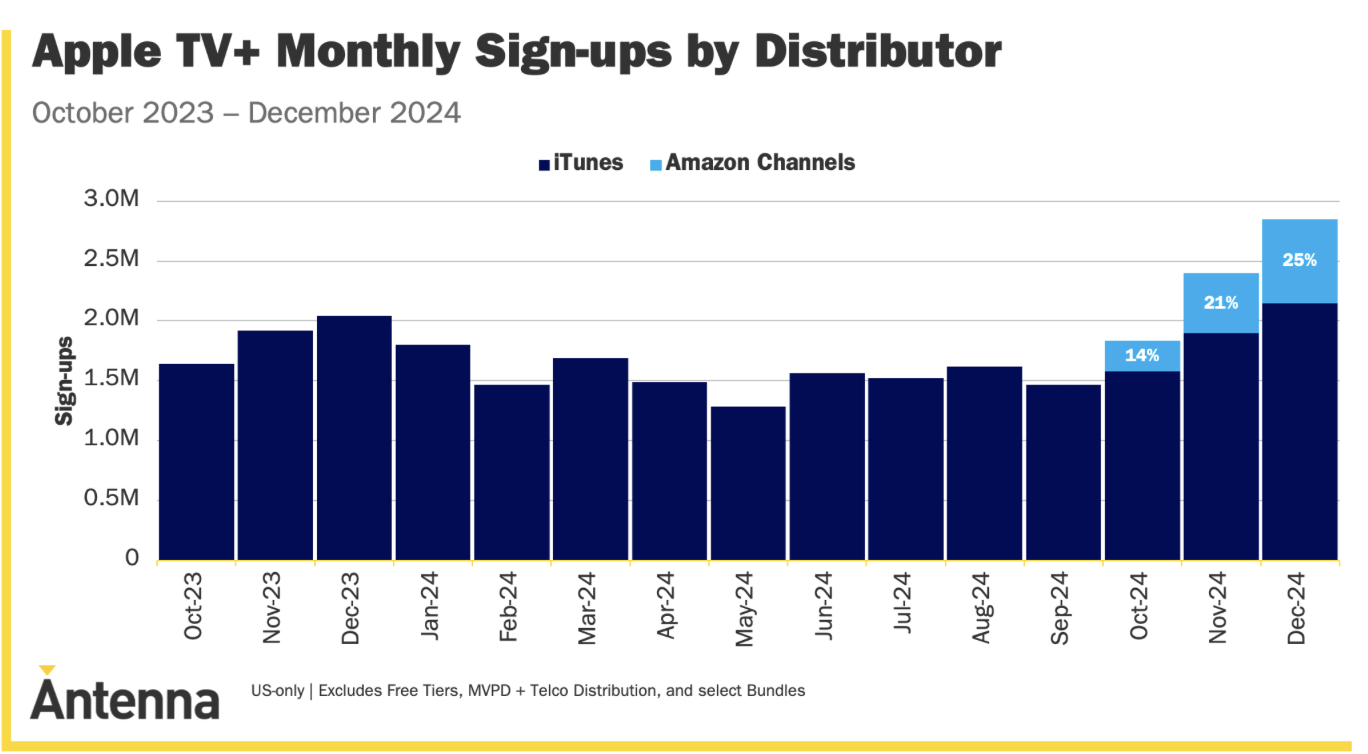

And the funny thing is that, despite the losses, Apple TV+—once known only as the obscure app to find Ted Lasso and maybe The Morning Show—seems to be gaining at least a little traction these days. Severance cost a fortune and Stiller remains a bully, but the show is an old-fashioned, HBO-style hit, appearing on the Nielsen top 10 list for six consecutive weeks and entering the larger cultural conversation. Between January and

February, more than 5.8 million customers signed up for Apple TV+ in the U.S. alone, according to Antenna, behind only Paramount+ in share of gross adds in the period.

A Severance bump, sure, but Silo, the expensive sci-fi drama, also made the Nielsen list. Also on the movie side, both Wolfs and The Gorge were ravaged by critics but have popped up in the top 10. Apple TV+ becoming

available on Prime drove strong sign-ups as well. And F1, Apple’s $300 million-plus car-racing movie, has decent buzz ahead of its June release in theaters.

|

Plus, after getting shut out at this year’s Oscars and watching execs from Disney, Max,

and Netflix clean up at last year’s Emmys, Zack and Jamie should be big players in TV this year with Severance, Shrinking, Seth Rogen’s The Studio (Disclosure: I appear briefly in that show), maybe Jon Hamm’s Your Friends and Neighbors, and Cate Blanchett’s Disclaimer, among other contenders. Emmys don’t appear on a P&L, but when you’re trying to be HBO and lure big stars and projects to a

smaller-reach service, they do matter.

Still, the Apple TV+ churn rate, meaning how many people cancel every month, is still around 6 to 7 percent—well above the weighted average of all platforms in the past year. We’re about to see a big test of churn now that Severance is ending. “Apple has some of the fewest committed subscribers of all the major services,” the streaming analyst and my

Puck colleague Julia Alexander told me today. “Fewer than 35 percent of all subscribers keep the service for longer than six months.”

Not great. And we know why. Sporadic hits. No meaningful library of movies and shows to keep subscribers entertained. No significant family programming. No A-level sports rights, despite multiple opportunities to outbid rivals. (F1 rights are coming up, will

Apple even try? If it doesn’t, we will kinda know how serious Cue is about sports.) No experienced film executive greenlighting and shepherding major movies. A possible full retreat from theatrical releases if F1 doesn’t work. And a corporate structure that divides the creative units from some of the business and marketing aspects of the service. The result is a platform filled almost exclusively with high-end original TV shows, mostly featuring movie stars, and mostly watched by very

few people. Is that a long-term strategy?

In short, Apple is still dabbling. Sure, Zack and Jamie overpay when they want something (like, say a fourth season of Ted Lasso). But one producer I recently spoke to questioned whether he would take an in-demand project to Apple. He simply wondered whether Apple TV+ will still be around in a few years. Pressure at the parent company could make

that decision a lot easier…

Or not. Challenged companies looking for growth often turn to acquisitions, which maybe could lead Apple to the often-speculated purchase of Netflix or Warner Bros. Discovery or even Disney—once-impossibilities that might be possible in the supposedly deregulation-friendly Trump administration. Services, the division that houses Apple TV+, is a growth spot for Apple, with

revenue up to $26.3 billion in the past quarter, about a 14 percent year-over-year increase, though that’s mostly from its cloud business, not media. Investing in the Hollywood project could help juice those numbers. Plus, while a full-service video platform will never replace iPhone sales, a new season of Ted Lasso or Severance serves as a nice smokescreen for other problems. Cook got good press for his Severance ad, and Cue’s SXSW panel with Stiller was better than

having to talk about supply chain issues or the businesses that actually matter to Apple.

Apple wouldn’t be the first tech powerhouse to dabble in professionally produced content only to retreat. Google tried a couple times to make scripted and unscripted originals for YouTube. (It’s still weird that Cobra Kai, one of Netflix’s biggest comedies, began there.) Facebook jerked around producers and news publishers

with the whole “pivot to video.” Neither Cook nor Cue has suggested anything like that, and Apple, in just over five years, has become a reliable partner and a high-quality buyer for Hollywood shows and movies. In some ways, it’s remarkable how fast Apple TV+ became part of the entertainment community. Whether that lasts is the question.

|

See you Monday,

Matt

Got a question, comment, complaint, or a strongly worded letter to the editor? Email me at Matt@puck.news or call/text me at 310-804-3198.

|

|

|

Puck founding partner Matt Belloni takes you inside the business of Hollywood, using exclusive reporting and insight to

explain the backstories on everything from Marvel movies to the streaming wars.

|

|

|

Ace media reporter Dylan Byers brings readers into the C-suite as he chronicles the biggest stories in the industry: the

future of cable news in the streaming era, the transformation of legacy publishers, the tech giants remaking the market, and all the egos involved.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|