|

|

|

Welcome back to What I’m Hearing+, our new streaming-focused companion to Matt Belloni’s beloved franchise. I’m Julia Alexander, an entertainment journalist turned analyst, Puck correspondent, and director of strategy at Parrott Analytics. Thanks again to everyone who has been sending feedback on what we’re building here. Please keep the notes coming by responding directly to this email.

|

|

|

| —Zaslav’s gaming gamble: I’m surprised more people aren’t talking about MultiVersus, the new video game from Warner Bros. Interactive Entertainment that’s basically Super Smash Bros.—Nintendo’s blockbuster crossover gaming franchise—for Warner Bros. characters. Super Smash Bros., after all, allowed Nintendo to enter a different gaming genre (expanding its audience) while re-establishing love for its various characters, like Mario, to help sell new consoles (retaining its audience). Ideally MultiVersus can do the same thing, bringing in characters from, say, the DC Universe, that can lead to cross-platform programming and expanded business.

Batgirl, for instance, was a $90 million bet that C.E.O. David Zaslav didn’t want. But could a less expensive project, tied into a character launch on MultiVersus (maybe with an additional spot in another DC film), help to create character longevity that simultaneously benefits multiple Warner Bros. Discovery businesses? That would be my hypothesis. And it helps with that all encompassing “metaverse” prophecy, too.

—YouTube vs. Apple?: YouTube is a platform designed for indulging obsessions. It’s where Cocomelon found its audience, and where the creator economy was established; it’s the reason why Netflix invests more than any other streamer in its various YouTube channels. Offering customers access to their favorite streaming services is the logical next step. Indeed, according to the Wall Street Journal, YouTube will soon begin to offer those add-ons in its own channel store, allowing customers to sign up for services like HBO Max or Netflix directly through YouTube just as they can through Apple TV or the App Store.

It’s no surprise that YouTube wants to control the top of those distribution channels—plus credit card and user information—just like Amazon, Apple, and Roku. User data, after all, is what informs these platforms’ content strategies and business opportunities. The streamers will have plenty of leverage in the ensuing negotiations over ad inventory and customer data, but they are also under pressure to grow their subscriber base, and YouTube offers another avenue.

|

|

| Bob Chapek’s Funny Math on Streaming |

| No, Disney didn’t just surpass Netflix in total subscribers—unless you can justify 1+1=3. Inside the semantic-financial civil war over the most powerful number in streaming. |

|

|

|

| It’s been a rocky road for Disney C.E.O. Bob Chapek, but he got a real victory lap moment last week after Disney reported that streaming subscriptions totalled 221.7 million, beating Netflix for the first time, exceeding Wall Street’s expectations, and causing Disney stock to jump nearly 10 percent. That milestone would have been unthinkable just a few years ago. Bob Iger, despite his legendary business acumen and M&A masterstrokes, was late to the streaming game, only launching Disney+ in November 2019. Since then, however, Disney+ has grown at a startling rate of 22.1 million subscribers per quarter. That stat is a big reason why Chapek earned a new three-year contract from the Disney board.

But statistics hide all sorts of complexities about Disney’s numbers, and it’s no secret that the way the public narrative surrounding how the company calculates total subscribers to its “Streaming Services”—a business unit that encompasses Disney+, Hulu, ESPN+, Disney+ HotStar, and Star+—is more than a little misleading. I want to be very explicit: I’m not suggesting that Disney’s streaming business is in trouble. If I had to bet on three services that will still be here in a decade, Disney+ would be included without hesitation. But how we talk about streaming is important in how we think about streaming success. Yes, Disney’s collection of services total more subscribers than Netflix, according to headlines everywhere. But that’s also not the whole story.

|

| ADVERTISEMENT |

|

|

|

| How Many Subscribers Is One Subscriber? |

|

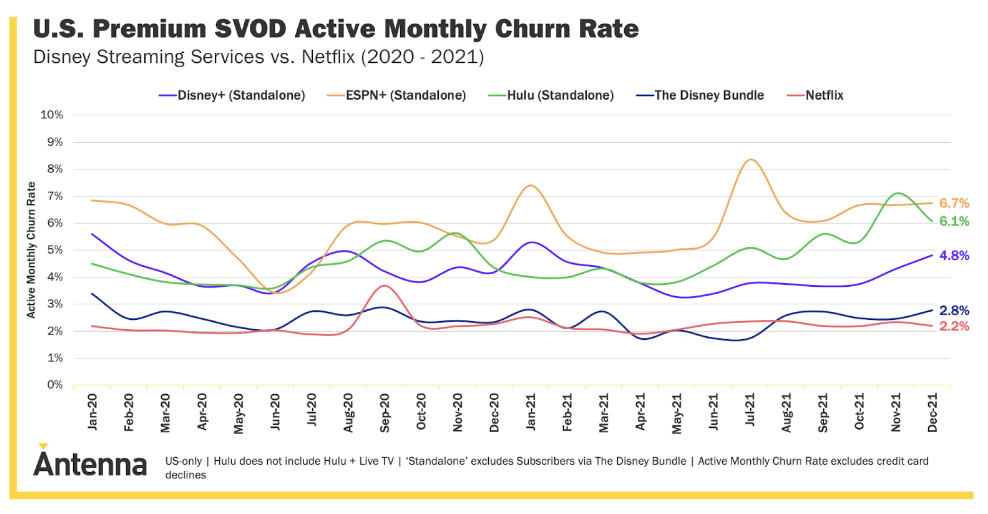

| The key to Chapek’s master plan for growing audiences is the Disney Streaming Bundle, a reduced-cost package that includes Disney+, ESPN+ and Hulu—$14 per month with ads, or for $20 per month without ads. It’s basically a “buy two, get one free” offering—perhaps the best deal in the streaming industry, which is why the Disney bundle also has the lowest overall churn rate (about 2.2 percent, according to Antenna data) of all the major services. |

|

|

| But here’s the trick. If you subscribe to the Disney bundle, the company counts you as three subscribers—an ESPN+ subscriber, a Hulu subscriber, and Disney+ subscriber. That’s true, in a sense, but not exactly fair if you’re trying to make a direct comparison with Netflix or another streamer.

Why does that distinction matter? Streaming, as a business, is wholly dependent on subscriber numbers and revenue, and both are dependent on churn. The math is relatively simple for Netflix, where one customer equals one subscription, generating $15.95 per month in revenue in the U.S. But for a company like Disney, which has multiple products built into one product, the math becomes more nuanced: a single customer spending $14 per month on the lower-priced Disney Streaming Bundle may only use two services, and get the third for free, but they’re counted as three paying, engaged subscribers. Disney breaks out the ARPU (average revenue per user) for both ESPN+ ($4.55) and Hulu ($12.92), but we don’t know the allocated ARPU within the bundle or how many customers to ESPN+ and Hulu are part of the bundle.

Disney reports subscriber numbers each quarter, but they’re still shrouded in mystery. The media framing the subscriber count as “beating Netflix” generates attention. It doesn’t necessarily drive actual business value. Giving away a free subscription (like ESPN+) as part of a bundle increases the perceived value of the product to consumers (hence the low churn) but doesn’t generate more revenue, and neither does counting subscriptions as subscribers. Some may chalk this point up to semantics, but subscriber semantics matter in streaming since it’s a relatively new industry and we’re still learning to talk about it.

The more fundamental question is why someone chooses to pay for a service, which is really a question about the perceived value of a content offering. A customer choosing to buy the Disney Streaming Bundle instead of Disney+ or Hulu on their own presumably sees value in having access to more than one platform, but also views it as one unified product. Therefore, a Disney Streaming Bundle subscriber is really just one subscriber, not three, even if they are technically producing three subscriptions. To count it as three, especially when we don’t know if one of those services is ever being used or has ever been opened, isn’t a fair comparison to Netflix.

|

|

|

| Netflix doesn’t offer an annual subscription plan. Part of the company’s core strategy, built around simplicity, is giving customers the freedom to leave at any point. Annual plans also typically mean discounts, which generate less revenue per customer. While Netflix may explore an annual plan option as it contends with slower growth and major retention woes, it’s a monthly recurring revenue business right now.

Disney, on the other hand, did offer a one-time, three-year discounted subscription (about $140) in 2019 ahead of Disney+’s launch. Financially, those subscribers effectively got a free year of Disney+. It was a short-term bet on long-term customer gain, taking advantage of the initial perceived value of a Disney-branded streaming service and giving Disney three years to turn that into actual customer satisfaction and retention. The “winner” in the colloquial “streaming wars” will be the company that can provide satisfaction month after month. Disney was essentially asking for the chance to prove their value over time.

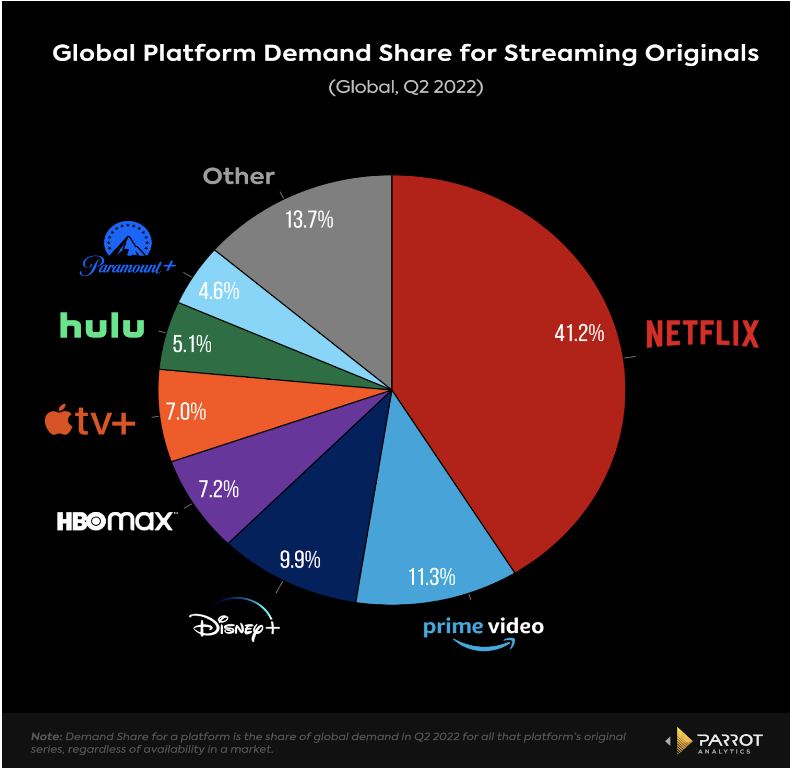

Now, I sincerely doubt Disney+ is going to see massive churn come Dec. 8, when new price changes go into effect ($3 a month more for ad-free Disney+, bringing it to $10.99 a month). Disney’s global demand share, which demonstrates consumers’ interest in subscribing to a platform, jumped to just under 10 percent in Q3, according to Parrot Analytics, where I work as director of strategy. The demand for Disney+ originals has grown 35.6 percent year to date, and 191 percent over the past two years. Consumers aren’t getting tired of Disney+ content. Offering an ad-supported tier at $7.99 a month (the current Disney+ price) for customers who clearly want Disney+ but don’t want to spend $36 more a year will help to stave off churn even more.

|

|

|

| That said, there will be some churn when all those early subscribers come up for renewal. How that impacts Disney’s sub count in the U.S. will be telling. Many three-year subscribers may choose to remain ad-free Disney+ subscribers for an upcharge, or switch to the ad-supported level at the same $7.99 price. Some may roll into the bundle. Some will cancel.

An annual subscription option makes sense. Disney hasn’t announced a new three-year deal, but the $80 annual plan is still available. Netflix should implement something similar to improve its retention (while not discounting too much and hurting revenue per user). Still it’s hard to make apples-to-apples comparisons between Disney and Netflix numbers when a portion of the Disney+ base hasn’t had to decide whether to keep paying for the service until now. Netflix has contended with the “churn and return” group, something even co-C.E.O. Reed Hastings pointed out during an earnings call, noting that he understands customers will leave from time to time, but hopes to be the place where they return when a new show drops. Once those Disney+ plans come up for renewal, customers will have to decide if they want to keep paying for Disney+ or go elsewhere.

|

| ADVERTISEMENT |

|

|

|

|

|

| I noted last week that it’s been a rough ride for just about every other streaming service this last quarter in the domestic region. Peacock stayed flat. Netflix lost a million subscribers. HBO Max lost 300,000 subs. Even Disney, which added 14.4 million Disney+ users worldwide, gained its lowest number yet domestically with just 100,000 customers. These are the numbers that have investors concerned about streaming’s viability, especially when considering the mounting costs.

There are a few essential numbers to streaming, including average revenue per user (ARPU), segment revenues, operating losses, customer acquisition costs, and churn rates. And perhaps it’s these numbers that truly dispel the notion that Disney and Netflix are shoulder to shoulder. In the U.S. and Canada, for example, Disney+ generates $6.27 in ARPU (down 5 percent from the year before) compared to Netflix’s $15.95 (up 10 percent from the year prior). Netflix makes 2.5x more per customer in revenue than Disney does in a market where Netflix has 1.6x as many customers. This also, of course, means Netflix’s customer loss in the region is felt more severely. Netflix lost $20.7 million on customer revenue in its second quarter, while Disney gained $625,000 in the same quarter.

Now, that’s just comparing Disney+ ARPU to Netflix, and the discrepancy is in part due to pricing differences. Disney+ is significantly cheaper than Netflix and HBO Max, which is why Disney is raising its price by $3 in December. With increased prices, however, comes the elevated risk of churn. Enough churn creates a material impact on Disney+’s top line, but not increasing prices leaves stagnant ARPU. The trick is finding the best time to increase prices (dependent on demand for programming) to avoid massive churn. The company’s decision to do so around the holidays, around the introduction of a cheaper, ad-supported tier, is key. The point is that it’ll take some time before the Disney+ ARPU, as a single platform, reaches Netflix.

Disney has a self-reported 221 million subscriptions across its streaming services. That, on paper, is more than Netflix’s 220.6 million. It’s also not the full story and, although it’s a game of semantics to impress the Street, it’s also a key reminder of how complicated the streaming races have become.

|

|

|

This week, let’s look at the most in-demand original series on Hulu between Aug. 7 and Aug. 13, according to Parrot Analytics. (This data is gauged by looking at consumption, social interaction, and search traffic.)

- The Orville

- Only Murders in the Building

- The Handmaid’s Tale

- The Bear

- Dopesick

- Animaniacs

- Solar Opposites

- The Dropout

- Pam & Tommy

- Under the Banner of Heaven

I was mentioning to a colleague earlier this week that Hulu’s original series are having a real moment in the culture, as seen by the number of Emmy nominations the platform picked up. It’s also a testament to the diversity of genres at the top of this list, which ranges from sci-fi like Seth MacFarlane’s The Orville, which has steadily built a devoted audience, and the surprise comedy hit Only Murders in the Building, in addition to animated titles like Animaniacs and Solar Opposites. My personal recommendation is the “FX on Hulu” original Under the Banner of Heaven, which has a True Detective vibe (because everyone is trying to make a True Detective), and features one of Andrew Garfield’s most captivating performances.

|

|

|

|

| FOUR STORIES WE’RE TALKING ABOUT |

|

| Should Disney Sell ESPN? |

| Matt and Lucas Shaw to discuss whether Disney should shop the worldwide leader in sports. |

| MATTHEW BELLONI |

|

|

|

|

|

|

| The Brangelina Bombshell |

| Jolie is demanding more info after discovering the F.B.I. drew up a case against her ex-husband. |

| ERIQ GARDNER |

|

|

|

|

|

|

| You received this message because you signed up to receive emails from Puck

Was this email forwarded to you?

Sign up for Puck here

Interested in exploring our newsletter offerings?

Manage your preferences

Puck is published by Heat Media LLC

227 W 17th St

New York, NY 10011

For support, just reply to this e-mail

For brand partnerships, email ads@puck.news

|

|

|