Welcome back to What I’m Hearing, and welcome to spring. We deserve it.

Anyway, tonight

I’ve got some brief thoughts on the Endeavor take-private and what Patrick Whitesell is up to next, plus a Snow White autopsy and a grim chart that says everything you need to know about the box office.

Programming note: This week on The Town, Lucas Shaw and I looked at the most important ’25 movie for each

studio, Sara Fischer explained all the ways Trump can further screw with Hollywood, and Julia Alexander suggested what Apple TV+ can do to keep its Severance fans.

Subscribe here and here.

Not a Puck subscriber yet? Just click here. Got a news tip or an idea for

me? Just reply to this email or message me on Signal at 310-804-3198.

Discussed in this issue: Patrick Whitesell, Brian Robbins, John Mulaney, Carl Rinsch, J.K. Rowling, Jeremy Zimmer, David Zaslav, Conan O’Brien, Bryan Lourd, Steph Jones, Peter Chernin, Mark Shapiro, Rachel Zegler, Harvey Weinstein, Egon Durban, Ari Emanuel, Richard Weitz, and… Triumph the Insult Comic Dog.

But first…

|

Who

Won the Week: Nobody (Second Week in a Row!)

|

Honorable mention: David Zaslav. Disney’s Snow White flopped so hard

that the media mostly ignored The Alto Knights, the $50 million movie Zaz greenlit to impress his Hamptons buddies, which grossed just $3.2 million on 2,650 screens this weekend.

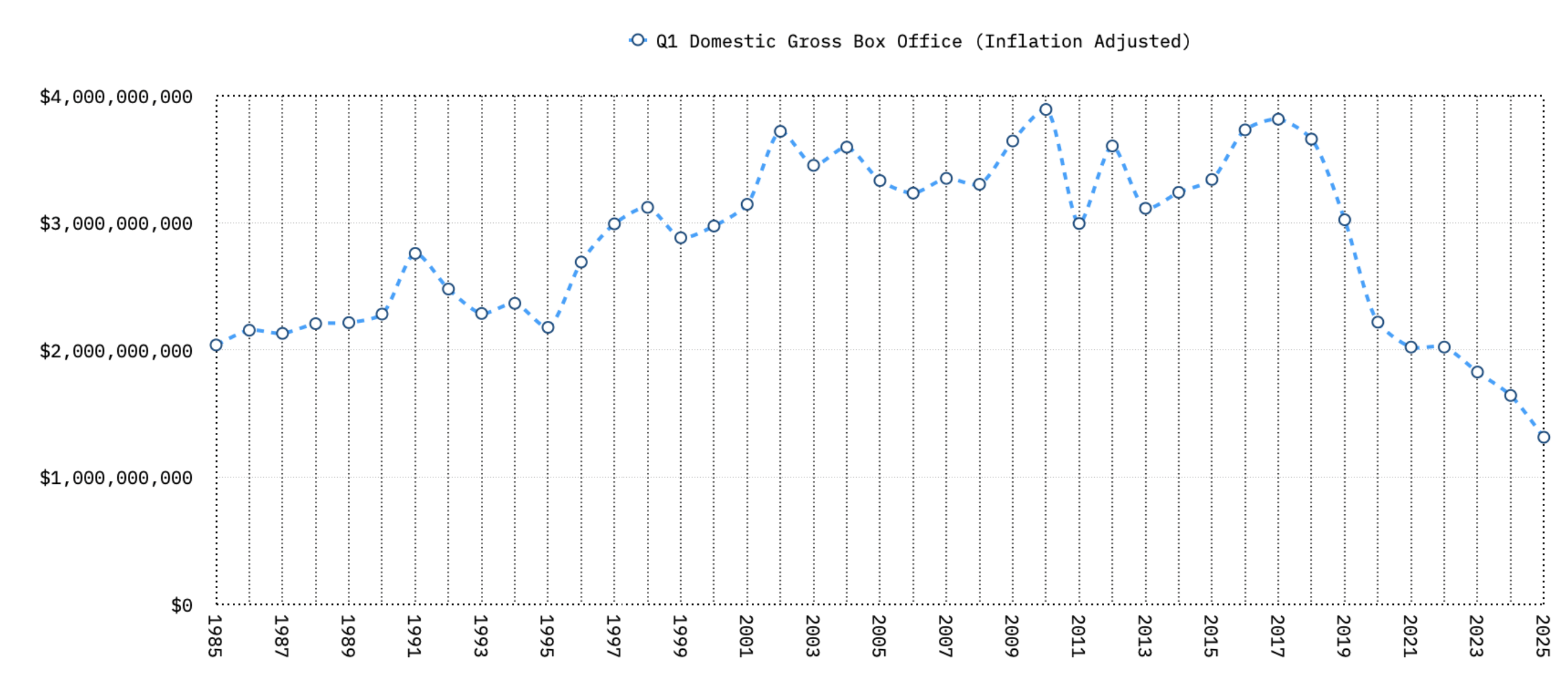

More: Domestic box office is headed for a depressing Q1, which ends this weekend. Worse, if you adjust for inflation, the trajectory looks like this (courtesy of advisor Jon Rogers)…

|

Now to the latest in agency financial shenanigans…

|

Ari Finally Set Patrick Free

|

Ari Emanuel and Patrick Whitesell made a combined $274 million in cash

today. How’s your Monday?

That’s the latest incredible windfall for the Endeavor leaders—not quite as incredible if you’re a typical WME agent, but at least they’re able to cash in equity at $27.50 a share. The Endeavor stock was at $17 a couple years ago, so there are fewer disgruntled sharks today, which is heartwarming for everyone. It’s all part of Endeavor’s $25 billion go-private transaction, engineered by majority owner Silver Lake, which will rebrand the talent

agency/other stuff company as WME Group. And, given that Emanuel and Whitesell had previously taken hundreds of millions of dollars out of this company, the money isn’t even the biggest headline of the day.

More interesting, at least to those of us who have watched the agency business balloon into a private equity-fueled urinal-spying contest led by Emanuel and CAA’s Bryan Lourd, is the exit of both Ari and Patrick from the day-to-day jobs of

overseeing a talent agency. It’s been quite a ride. Emanuel has been kicked upstairs to “executive chairman” of WME Group while he continues as C.E.O. and executive chair of TKO, which houses UFC, WWE, Professional Bull Riders, and other lucrative sports assets. Dwayne Johnson, Pete Berg, Tyler Perry, and others need not worry: Ari will keep screaming on behalf of his talent clients, too, and WME Group’s parent, now privately owned by Silver

Lake, will maintain its 60 percent stake in TKO. So it’s all still basically The Ari Show, with the usual enabling from Silver Lake’s Egon Durban. Not the big, happy, publicly traded entertainment and sports behemoth that Ari once dreamed of, but certainly not a bad place to be.

|

|

|

A MESSAGE FROM OUR SPONSOR

|

|

|

Whitesell, on the other hand, will have no title at either WME or TKO, nor will he stay on the board of

WME. Instead he’s launching a new, still unnamed company with $250 million of Silver Lake’s money and keeping an ownership stake in WME that he’s rolling over from Endeavor. Plus, he’ll still advise his big clients, like Ryan Reynolds, Ben Affleck, and Matt Damon, though I’m told Patrick will take no salary. (I know, start a GoFundMe…) He’s more like a consigliere now, I guess (though

I’m sure that’s not how CAA and UTA will characterize his status), with Christian Muirhead and Richard Weitz running the WME agency, reporting to Mark Shapiro, who will be president of both WME and TKO. Got that? As usual with Endeavor stuff, it’s all financial and executive jujitsu—with Ari and Patrick making the lion’s share of money. (Usual disclosure: WME represents Puck but not me personally.)

And now, after years of

personally and professionally drifting away from Ari, Patrick is finally out. (You can stop sending me emails reporting they “don’t speak” and “hate each other.” I’m good.) In a brief chat today, Whitesell acknowledged but downplayed that rift, and told me his new business will function less like Endeavor and more like investor Peter Chernin’s post-Fox endeavors. He’ll leverage his relationships not to take over companies or try to smash them together or operate them personally,

but to identify a portfolio of businesses in entertainment and sports, especially, that could benefit from minority investments. He’s already lined up a couple bets that he’s finalizing, I’m told.

Whitesell is also personally taking on WME’s football representation business, which has about 100 clients (200 with coaches) and about 40 or 50 employees. That’s totally separate from the Silver Lake–backed investment vehicle, because Durban is

buying a piece of the NFL’s Las Vegas Raiders, and the league doesn’t want a team owner to maintain a stake in a company that represents players—even if that company is three times removed from Durban himself. Beyond that, Whitesell is recruiting Jason Lublin, the Endeavor C.F.O., to join the new company, though there’s no deal yet. Others

could follow.

A somewhat remarkable (if long-discussed) turn of events, considering Emanuel and Whitesell have been partners since Ari recruited Patrick from CAA back in 2001. Together, they basically swiped the William Morris Agency out from under Jim Wiatt and spent most of the 2010s leveraging Silver Lake’s money into a multi-limbed sea monster of a corporate entity. The market may have ultimately rejected that monster, but Ari and Patrick’s

accountants haven’t complained. Today’s filing revealed Emanuel converted part of his ownership stake to mint $174 million in cash, and Whitesell took out a cool $100 million—though Ari and Patrick will roll over a combined $555 million of their equity into the private entity.

Remember, this is on top of the hundreds of millions of dollars

they made when Endeavor went public four years ago (though a lot of that was in options). And all this is separate from their salaries from Endeavor and TKO, which in 2023 totalled $89 million for Emanuel alone. Ari, out of the goodness of his heart, waived a $25 million “transaction” bonus. What’s $25 million, at this point?

The colossal windfall for a duo that climbed the Hollywood ladder from the bottom certainly defies logic, and rivals have been fanning any possible flames of outrage

over the profiteering. But if this is indeed a kiss-off from Ari to Patrick, it’s the kind that leaves very few hard feelings.

|

“Thank you all for coming, and shame on you for being here.”

—Triumph the Insult Comic Dog

(Robert Smigel), appearing at Conan O’Brien’s star-studded yet awkward Mark Twain Prize ceremony on Saturday at the recently Trumpified Kennedy Center.

Runner-up: “I have a couple movies left in me.”

—Harvey Weinstein, in a prison interview with Page

Six.

Second runner-up: “Three guesses. Sorry, but that was irresistible.”

—J.K. Rowling, when asked on Twitter/X “What actor/actress instantly ruins a movie for you?” likely referencing Daniel Radcliffe, Emma Watson, and Rupert Grint, her Harry Potter stars and vocal critics of her anti-trans views.

|

Thoughts and prayers to embattled publicist and erratic screamer Steph Jones, who was

formally accused of leaking her former employee’s texts in a new lawsuit from Justin Baldoni and Jen Abel. [People]

47 Ronin director Carl Rinsch took $11 million from Netflix to make a show and instead spent about $2.4 million on five Rolls-Royces and a Ferrari, $652,000 on

watches and clothes, $638,000 on two mattresses (?!), and $3.8 million on furniture and antiques, among other allegations in the indictment. Somehow, this is less offensive than what the Russo brothers did. [Business Insider]

Sesame Workshop generated $271 million in revenue and more than $20 million in profit in

2022, according to financial forms that were leaked as Sesame Street struggles to chart a post-HBO future. [NY Times]

Paramount co-C.E.O. Brian Robbins, who’s been living in Montecito as the Skydance-Redstone drama plays out, has a deal to sell his Beverly Hills property for $20.8 million.

[Real Deal]

You hit up the OpenAI “Sora Selects” film festival last week in L.A.? No? You’d rather die a violent death? [LA Times]

Kathryn

VanArendonk nicely explains why Mulaney’s Netflix talk show is both discordant and very watchable. [Vulture]

The first and last time my name will be in a headline with Olivia Wilde. [IndieWire]

Now here’s Scott with a take on the ‘Snow White’ collapse…

|

|

|

Forget the movie’s controversies about Gaza, little people, and its

leading lady. What doomed the vastly underperforming Snow White is that Disney simply overestimated the value of a live-action remake of a historic, but not exactly beloved, film.

|

|

|

Snow White was not remotely the fairest of them all, but not for the reasons many of us expected.

Most assumed that the reboot would be doomed by bad press, or the Fox News–led backlash against a so-called “woke” version of the classic fairy tale, or even a star in Rachel Zegler who wasn’t willing to mute her criticism of Israel or of Prince Charming’s “stalker”-like moves in the 1937 classic. But per EntIntelligence, the film slightly overindexed in red counties compared to the average family/animated title.

It wasn’t that audiences had political qualms about the

star, or the supposed lack of sisterly camaraderie between Zegler and co-star Gal Gadot, or even beef about Disney’s decision to cast seven CGI dwarfs (internally at Disney, they were referred to as the “miners”). The problem was that no one cared about a $270 million live-action remake of Disney’s Depression-era Snow White and the Seven Dwarfs.

|

|

|

A MESSAGE FROM OUR SPONSOR

|

|

|

Disney’s decision to make a big-budget, live-action Snow White arguably made some sense,

both commercially and culturally, at one point. Over the past 15 years, the studio has found success with Cinderella ($545 million in 2015), The Jungle Book ($966 million in 2016), and Sleeping Beauty ($760 million for Angelina Jolie’s Maleficent in 2014). And even though the Snow White fairy tales have already gotten plenty of live-action adaptations—including Mirror Mirror and Snow White and the Huntsman, both in

2012—it was still likely worth it for Disney to roll the dice. But that doesn’t mean the judgment wasn’t clouded by the weight of Disney’s heritage.

The original was known for being Disney’s first animated movie, rather than for its popular appeal. Millennial parents didn’t grow up with the VHS of the movie in heavy rotation the way they did with, say, The Little Mermaid, Aladdin, and Beauty and the Beast. And their parents would

likely favor Pinocchio, Fantasia, or Bambi over Snow White. It’s therefore not a big surprise that…

Continue reading online…

|

Lots of opinions on Apple TV+ and the ouster of UTA’s Jeremy Zimmer in response to

my Monday and Thursday columns. Some examples…

“The Medialink/UTA debacle illustrates what happens when dealmakers at the top, like Zimmer, are hermetically sealed from interacting with anyone actually doing the work. Everyone across the business knew what Medialink really was in 2017. It’s insane to have gone through with that deal four years later.” —An executive

“You’re being very nice to Jeremy. He ‘lost the troops’ a long time ago. When I was at

UTA, we knew he was a liability in every client meeting. (A Michael Scott situation.) Plus, he treated people badly and took millions of dollars out of the company without having clients or meaningful relationships. It had to end at some point.” —An agent

“Why do you care if Apple TV+ loses $1 billion or $10 billion or $100 billion? Scaring them out of town with negativity does nobody any good.” —A producer

“With that [brand] name and all those other services,

Apple TV+ should have the lowest churn rate. As someone who subscribes and quits several times a year, here’s my reason: There’s not very much to watch.” —A non-industry reader

[Ed. note: That’s probably why Apple is hiring a head of retention for Apple TV+.]

“You can use the shiny object

originals to get people in the door and then a deep catalog to keep feeding them. Apple Music and news and books and podcasts are all about aggregation, so they’re not allergic to it. Spend a few hundred million of those dollars to license!!” —Another executive

|

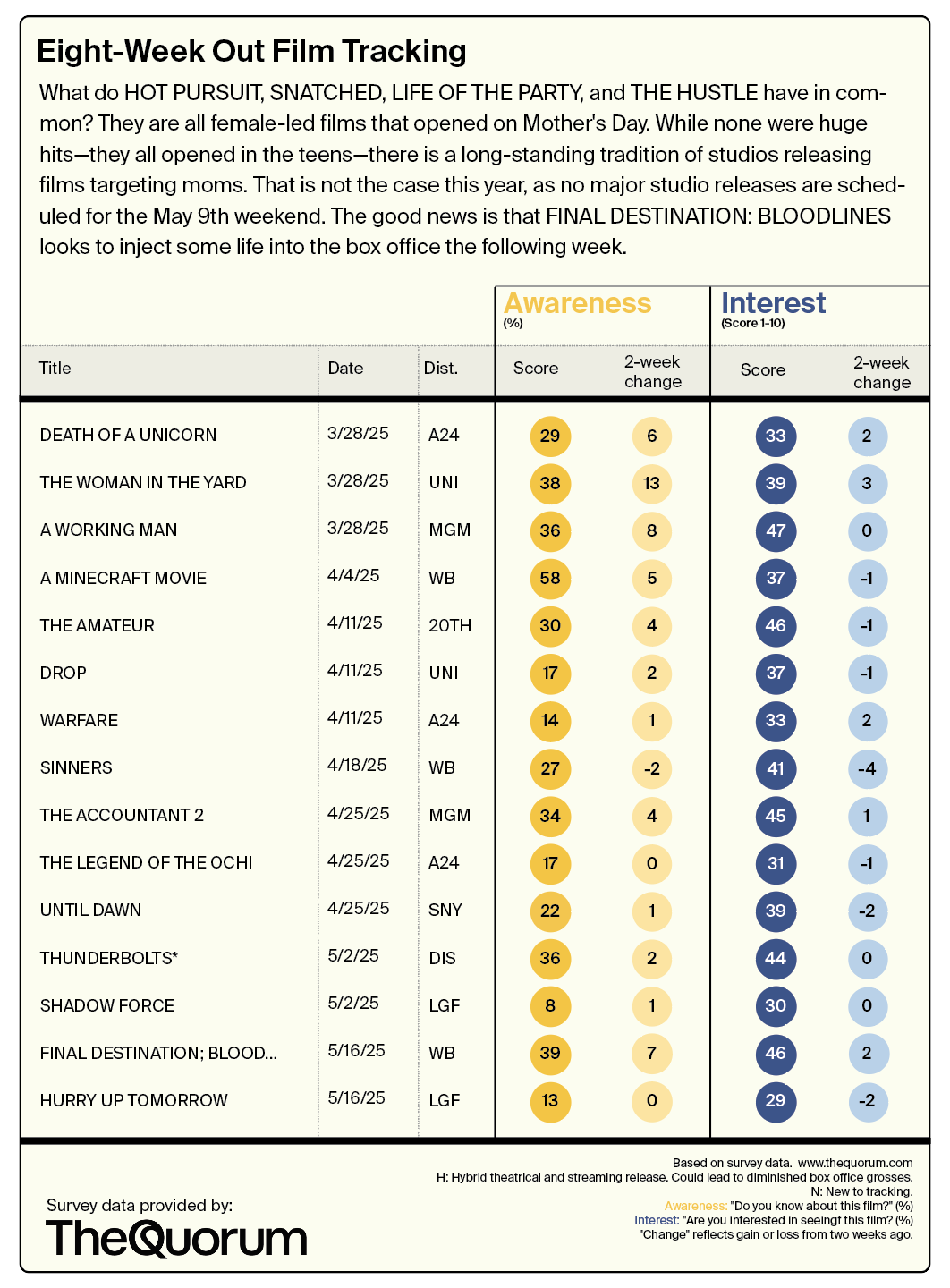

Hollywood officially hates moms, with zero female-targeted movies opening for Mother’s Day in early

May, according to the early tracking chart from The Quorum…

|

Have a great week,

Matt

Corrections: New James Bond producer Amy

Pascal didn’t produce Barbie, as I said on Thursday. (I think I was confusing it with Greta Gerwig’s Little Women, which Pascal did produce.) Also, Christian Muirhead’s former title at Endeavor was C.C.O., not C.O.O. Apologies to both.

Got a question, comment, complaint, or a secret war plan to inadvertently disclose? Email me at Matt@puck.news or call/text me at 310-804-3198.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|

_01JPAEJK65ZR6PZ6AZC6AZW1WR.jpg)

_01JPAEJJX15BJSF2B9GRN8Y7Q4.jpg)

_01JPAEJJKBPZEHQB714AJSEG47.jpg)

_01JPAEJJ9CKZF95D5PD5K1P9HM.jpg)