Welcome back to What I’m Hearing+, the bonus round of the WIH game

show. Today’s fabulous prizes are two of my favorite shows, Jeopardy! and Wheel of Fortune (or, in certain syndication markets, Wheel of Fortune and Jeopardy!). At one point, Netflix carried a bunch of old Jeopardy! tournaments, but there’s been no way to watch new episodes like how, say, The Bachelor drops on Hulu the day after it airs on ABC. Sony, which owns the shows, wants to change that—preferably without CBS, which has

syndicated Jeopardy! and Wheel for decades. Hence, litigation. All yours, Eriq…

Discussed in this issue: Keith Le Goy, David Ellison, Kevin Brazile, Merv Griffin, Roger King, Shari Redstone, Scott Trupchak, Greg Guenther, Angela Kucharski, Bill

Paley, Donald Trump, Elon Musk, Marc Toberoff, James Gunn, Blake Lively, Nick Shapiro, Angelina Jolie, Brad Pitt, and many more…

|

|

|

|

Eriq Gardner

|

|

- Trump’s federal

agency overreach may backfire: This week, Elon Musk threw his weight behind a proposal to merge the antitrust units of the Department of Justice and Federal Trade Commission, essentially fulfilling a prophecy I made on Puck’s The Powers That Be podcast after the election. If this actually happens, alongside Donald Trump’s broader

push to curb the independence of agencies like the F.T.C. and F.C.C., the White House would gain even more direct influence over proposed mergers and acquisitions.

However, if that’s actually the objective, the consolidation may have unintended consequences, potentially opening up a new defense strategy for companies facing government antitrust challenges. Namely, companies may soon be on firmer legal ground to accuse regulators of “improper selective enforcement.” AT&T and Time Warner

flirted with this defense in 2018—suspecting their merger was targeted because of Trump’s disdain for CNN—but ended up not pursuing it at trial when the federal judge overseeing the case blocked their request to obtain White House–D.O.J. communications. The judge didn’t see enough evidence that the merger was indeed being singled out to justify such a request.

But does the calculation change when a president exerts more direct control over antitrust enforcement? I think so. After

all, the independence of various executive branch agencies was deliberately strengthened after Watergate, amid concerns that political bias could taint law enforcement. So here’s another prediction: We’re going to see legal battles over White House communications, as the Trump administration finds itself on shakier ground when it comes to shielding internal discussions about corporate dealmaking. Trump might be busy at the moment kicking reporters out of their chairs, but the real question is

whether he’s also making it harder to keep things hidden.

- Will A.I. be Superman’s new kryptonite?: In the battle over whether Warner Bros. has lost certain foreign rights to Superman, perpetual Warners nemesis Marc Toberoff wants an injunction that would block the studio from exploiting the franchise—including James Gunn’s upcoming reboot this July—in Canada, the U.K., Ireland, and Australia. This is a

long shot, as I wrote a few weeks ago, but it’s notable that Toberoff is attempting to weaponize fears around artificial intelligence.

To secure an injunction, a plaintiff must typically show a likelihood of success on the merits of the case, and also prove that they would suffer irreparable harm without court intervention. Judges sometimes

also weigh the broader public interest. On that front, Toberoff is arguing that disregarding foreign laws that allow an author’s estate to reclaim rights 25 years after death could set a dangerous precedent, potentially inviting disrespect for U.S. intellectual property abroad—especially in the A.I. age. Interesting angle. I wonder whether Marc has been consulting with another one of his clients, Elon Musk, on the matter. (Here’s the full

brief.)

- A Brangelina connection to Baldonigate: It’s almost too perfect—Blake Lively’s Willkie Farr legal team has hired crisis P.R. fixer Nick Shapiro to shape their legal communication strategy. Shapiro’s great, but hiring another image consultant in a case

that revolves around P.R. voodoo? Bold move.

Also, let’s talk about the media breathlessly touting Shapiro’s C.I.A. credentials (yes, he once advised John Brennan) but missing the more relevant detail: Shapiro has been working with Angelina Jolie’s lawyers in her ongoing legal war with ex-husband Brad Pitt over the Miraval winery they owned. Now that’s a case study in high-stakes reputation management.

By

the way, Judge Lewis Liman granted a motion by The New York Times today to pause discovery, pending a ruling on its motion to dismiss. He nodded to the “delicate and complicated issues” raised by seeking documents and depositions from a journalistic outfit. Next up is the protective order: The judge will be convening a video conference later this week, complete with media dial-in. Unprecedented fanfare, certainly.

- Pension

funds try to derail Paramount-Skydance deal: Have you heard about Project Rise Partners? This shadowy group, with equally mysterious investors, surfaced a few months ago with a $19-per-share bid to buy Paramount—a supposedly fully financed offer that appears more lucrative for the company’s Class B shareholders than the Skydance deal that’s been accepted by Shari Redstone. But the whole thing is bizarre and bordering on farce. PRP’s grand vision includes turning the

Paramount lot into a tourist attraction, reviving the “I Want My MTV” slogan, and expanding into hospitality in the Middle East. Not surprisingly, Paramount’s special committee—formed to evaluate bids—rejected it outright.

But that rejection didn’t sit well with a handful of New York pension funds, which hold stakes in Paramount, and they’re taking the fight to the Delaware Court of Chancery. The pension funds, perhaps eyeing a way to drag David Ellison to the

renegotiation table, are seeking a temporary restraining order to block the Paramount-Skydance transaction from closing. A hearing took place yesterday, with a ruling coming tomorrow.

In a sealed briefing, Paramount’s special committee has apparently warned that granting the restraining order could trigger Skydance’s right to walk away from the deal. Given how aggressively Ellison pursued Redstone’s position, there’s no reason to believe he’d actually pull out—but the fact that

Paramount even raised the issue is interesting on its own.

|

|

|

Which brings me to my main story…

|

|

|

The fight over the streaming future of Sony’s long-running quiz show and

Wheel of Fortune represents a full-scale, high-stakes, and final deconstruction of a half-century of TV dealmaking, and an industry model that has been in decline for years.

|

|

|

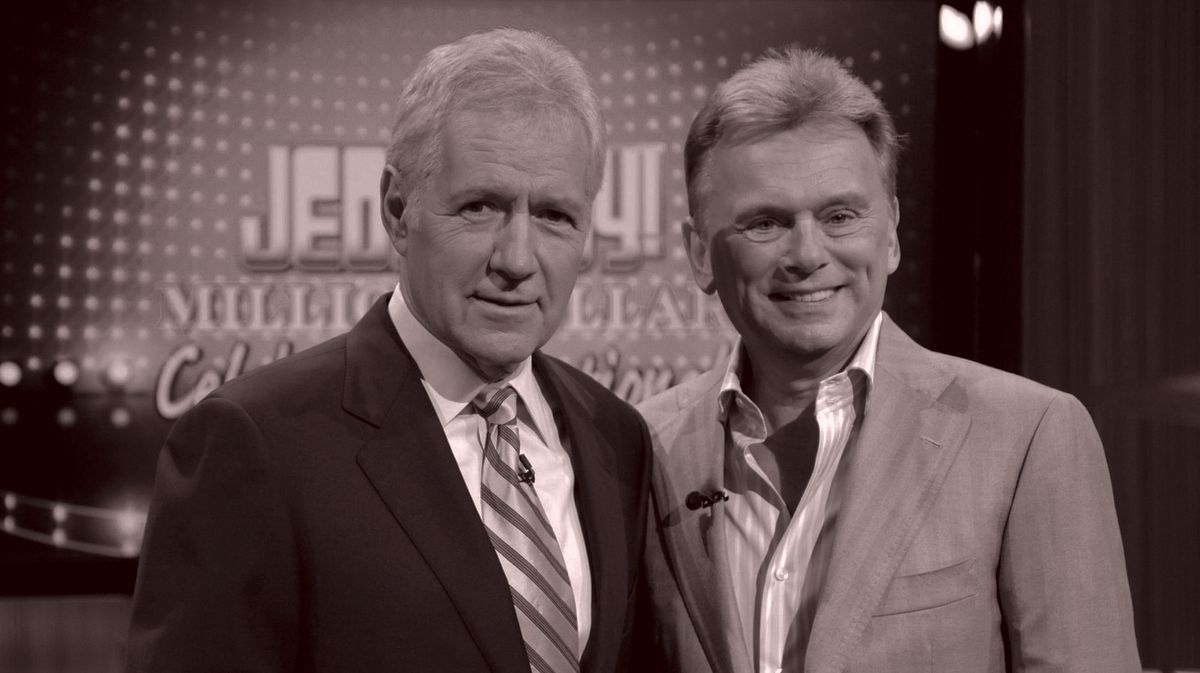

The streaming land grab just claimed two of the last great holdouts:

Jeopardy! and Wheel of Fortune. Sony Pictures Television is officially shopping the digital rights to both game-show juggernauts, a seismic shift for a pair of broadcast syndication staples that, until now, had been precious relics of the linear era. “The world is changing around us,” Sony’s television chairman, Keith Le Goy, told The New York Times.

Ah, but

there’s more to the story. Sony worked hard to frame the move as unrelated to its nasty legal fight with CBS over syndication rights. But in reality, this is all about the hundreds of millions of dollars these shows generate annually, as well as the broader shake-up at CBS’s parent company, Paramount Global, which is in the process of being taken over by David Ellison’s Skydance. Of course streaming would become a flashpoint: Sony’s decision to explore a

digital home for the twin towers of syndication—possibly with Netflix or Peacock—follows its attempt to terminate a 40-plus-year-old agreement, effectively reclaiming full control of the licensing for the shows, which each command about 7 million viewers every night. In short, this has become a full-scale, high-stakes deconstruction of a half-century of TV dealmaking, a final battle over an industry model that, for better or worse, is dying.

CBS has already fired a warning shot, I’ve learned, arguing that Sony’s attempt to shop streaming rights separately is a blatant breach of contract. While Sony believes it can license next-day rights immediately and same-day rights starting in 2028, when Jeopardy! syndication deals with TV stations expire, CBS sees the situation as far murkier. In a November 26 letter from its Weil Gotshal legal team, CBS argued that Sony would effectively be

competing against its own partner, undermining CBS’s ability to maximize TV station licensing fees and ad revenue. The letter states: “The digital rights should be sold together, and Sony will be responsible for any harm that results from any decision Sony makes to the contrary.”

I hear that CBS is not backing down, and plans to take the issue to Los Angeles Superior Court Judge Kevin Brazile, who issued a restraining order several weeks ago meant to

preserve the status quo. Sony, for its part, will counter that none of this should come as a surprise. The shift to streaming has been in the works for years, the studio will contend, with plenty of pitch meetings where the topic was openly discussed. And of course, the 1980s-era syndication agreements say nothing specifically about streaming. As is often the case in these disputes—where both sides are fighting over contracts drafted in the pre-digital world—the silence may or may not be

meaningful. Either way, expect to hear plenty more.

|

The Shari Distraction Theory

|

It’s worth remembering that Jeopardy! and Wheel of Fortune,

along with other iconic game and talk shows, owe much of their success to a 1970s decision by the F.C.C. to rein in the major networks’ stranglehold on content. The rule change cracked open the industry for independent players, such as legendary talk show host Merv Griffin, who created Jeopardy! and Wheel of Fortune, and Roger King, who struck a deal with Griffin’s production company to exclusively syndicate both shows. King

built King World, a distribution empire that also included The Oprah Winfrey Show, Rachael Ray, and Inside Edition. King and his siblings were legendary schmoozers, personally selling Hollywood to station executives across the country.

But nothing stays independent in Hollywood forever. By the late ’90s, those so-called fin-syn rules had been mostly dismantled, paving the way for media giants to swallow up syndication

businesses. In 1999, CBS bought King World for $2.5 billion in stock, just as the studios were hoarding networks and distribution arms. Meanwhile, Merv Griffin Enterprises eventually landed with Sony—after a brief and bizarre stopover at Coca-Cola. (Yes, Coca-Cola once owned Jeopardy!—give me “weird corporate detours” for $1,000.)

That’s why Sony and CBS find themselves in court over a distribution deal that neither company directly

signed. But the bigger question is why now—and that’s where things get stormy. Sony, of course, has become an arms dealer—the one Hollywood major without a general-interest streaming platform of its own—so it lives and dies by licensing. CBS, on the other hand, controls the syndication pipeline for Jeopardy! and Wheel, which makes the Sony play here look like a power grab. According to CBS, Sony made a nine-figure buyout offer early last year, and when that didn’t

work, it started pointing to “garden-variety” accounting violations as an excuse to blow up the old deal.

Sony doesn’t see those violations as minor. The company claims that the Shari Redstone–era cost cuts at Paramount have left CBS’s syndication business weakened, with fewer resources to market the shows and secure top-tier licensing and ad dollars. Sony is also unhappy that CBS let its Nielsen ratings deal

lapse (it recently re-signed), and says it had to step in to help Jeopardy! land continued Procter & Gamble advertisements.

Then there’s the question of whether CBS has been using these cash cows illicitly to prop up the rest of its syndication slate. Sony alleges that Jeopardy! and Wheel of Fortune are being bundled with far-less-popular shows that CBS wholly owns, like Hot Bench and The Drew Barrymore

Show, diverting revenue. Sony is also accusing CBS of selling the game shows to its own stations at below-market rates, in breach of an obligation to secure maximum receipts. In short, Sony sees CBS as coasting on the past.

Notably, this dispute is unfolding just as the Skydance-Paramount merger sits before the F.C.C., which must approve the transfer of CBS’s broadcast licenses. While the government’s review doesn’t directly involve CBS

Media Ventures—its syndication arm—there have been calls for the F.C.C. to impose fin-syn-style conditions on the deal. Sony is arguing that the merger could cost jobs and further erode CBS’s ability to distribute Jeopardy! and Wheel, giving Sony all the more reason to take control itself.

Is there even more going on? I’ve also heard the theory that Sony is taking advantage of Paramount’s regulatory distractions—strategically timing this push

while the company’s incoming and outgoing leaders have their hands full with the merger. Last year, Sony tapped Jill Ratner as its new general counsel, bringing the aggressive attorney over from Disney. And in this case, the involvement of Marc Seltzer and Davida Brook at Susman Godfrey—big names in the legal community, but hardly entertainment specialists—has raised eyebrows. Perhaps Sony decided this was the perfect moment to test whether CBS

was open to renegotiating legacy agreements that make little sense now that the clubby syndication era is just about over, and the economics of television have shifted.

|

This fight could be nothing short of existential for CBS’s syndication

division—once a crown jewel of the Redstone empire with Oprah, Judge Judy, and everyone’s favorite early evening game shows. In declarations that CBS submitted in support of its request for the restraining order, Scott Trupchak, a top CBS advertising executive, said that Sony’s attempted takeover of distribution has rattled clients and agencies, leading them to question CBS’s ability to fulfill its commitments. Greg Guenther, a senior vice

president, said licensees are now doubting CBS’s authority—one network, the BBC, has even asked for indemnification. Angela Kucharski, a CBS marketing executive, said the lawsuit has thrown the company’s credibility into question and created chaos among station groups like Sinclair Broadcast Group, which owns hundreds of Fox and ABC affiliates across the country.

It was this kind of

industry-wide panic—plus the possibility of triggering hundreds of secondary lawsuits from CBS’s partners—that prompted Judge Brazile to step in last month. After Sony started telling the industry that it had officially terminated CBS’s rights to Jeopardy! and Wheel of Fortune—and that stations and advertisers should now deal directly with Sony—Brazile ordered the parties to hit pause.

For

a moment, it seemed possible that the uncertainty might yank the game shows off the air entirely. That didn’t happen, but Brazile’s order was a recognition of the enormity of the stakes. Now, with a more lasting injunction request in front of him, he has to decide who’s likely to prevail—and whether outright termination of a decades-old agreement is really the appropriate remedy for whatever problems have come up.

It’s worth asking why anyone would want to

own CBS right now. Between the inevitable legal showdowns over digital rights, and the ongoing headaches with 60 Minutes and Trump’s election interference lawsuit, Bill Paley’s once-storied Tiffany Network is challenged. I hear Skydance is watching all of this closely—but they’re not walking away.

|

Thanks, Eriq. I’ll be back on Thursday evening.

Matt

|

|

|

Puck founding partner Matt Belloni takes you inside the business of Hollywood, using exclusive reporting and

insight to explain the backstories on everything from Marvel movies to the streaming wars.

|

|

|

Unique and privileged insight into the private conversations taking place inside boardrooms and corner offices up

and down Wall Street, relayed by best-selling author, journalist, and former M&A senior banker William D. Cohan.

|

|

|

Need help? Review our FAQ page or contact us for assistance. For brand partnerships, email ads@puck.news.

You received this email because you signed up to receive emails from Puck, or as part of your Puck account associated with . To stop receiving this newsletter and/or manage all your email preferences, click here.

|

Puck is published by Heat Media LLC. 107 Greenwich St, New York, NY 10006

|

|

|

|